You should upgrade or use an alternative browser.

Tweezer candlestick pattern in ThinkorSwim

- Thread starter Buckbull

- Start date

-

- Tags

- candlestick patterns

Just go to the TOS platform, click on charts. Then on the top right, there is a button called "Patterns"

There is a drop down menu, so you can go and explore that area. Many examples of chart of candlestick patterns there

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Tweezer Top

# Generation time: 2020-12-09T00:55:57.031Z

def IsUp = close > open;

def IsDown = close < open;

def IsDoji = IsDoji();

def avgRange = 0.05 * Average(high - low, 20);

plot PatternPlot =

IsUp[1] and

IsDown[0] and

Between(open[1] - close[0], -avgRange, avgRange) and

close[1] == open[0];

PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

PatternPlot.SetDefaultColor(GetColor(0));Tweezer Bottom

# Generation time: 2020-12-09T00:56:49.012Z

def IsUp = close > open;

def IsDown = close < open;

def IsDoji = IsDoji();

def avgRange = 0.05 * Average(high - low, 20);

plot PatternPlot =

IsDown[1] and

IsUp[0] and

Between(open[1] - close[0], -avgRange, avgRange) and

close[1] == open[0];

PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

PatternPlot.SetDefaultColor(GetColor(0));@tomsk Could you by any chance help me out , with the pinbar study ben posted i would like to do a scan where the pinbar closes within the body of the previous days candle . Thanks

@Buckbull - I assume you're referring to the Pinbar indicator that @BenTen posted in the following thread

https://usethinkscript.com/threads/pin-bar-reversal-indicator-for-thinkorswim.156/

Here is your COMPLETED scan. Load the following code directly into the scanner. It scans for a bullish/bearish pinbar that closes within the body of the previous days candle. Please note that I have NOT changed any of the definitions of the pinbar definition that came with the original study

I just added your requirement for closes within the body of the previous candle and some minor clean up to enable the scan.

I have tested the scan on the S&P 500. At the present time, a bullish scan yields 2 results while a bearish scan yields 1 result.

# Pinbar Scan

# tomsk

# 11.23.2019

# https://usethinkscript.com/threads/create-your-own-candlestick-pattern-in-thinkorswim.1103/#post-10213

# This scans for a bullish/bearish pinbar that closes within the body

# of the previous candle. The conditions for the logic for the pinbar

# conditions were extracted from the following study as posted by BenTen

# in May 2019

#

# https://usethinkscript.com/threads/pin-bar-reversal-indicator-for-thinkorswim.156/

input LastBars = 0;

input MaxNoseBodySize = 0.33; #(default = 0.33) — maximum allowed body/length ratio for the Nose bar.

input NoseBodyPosition = 0.4; #(default = 0.4) — Nose body should be position in top (bottom for bearish pattern) part of the Nose bar.

input LeftEyeOppositeDirection = yes; #(default = true) — tells the indicator that the Left Eye bar should be bearish for bullish Pinbar, and bullish for bearish Pinbar.

input NoseSameDirection = yes; #(default = true) — tells the indicator that the Nose bar should be of the same direction as the pattern itself.

input NoseBodyInsideLeftEyeBody = no; #(default = false) — tells the indicator that the Nose body should be inside the Left Eye body.

input LeftEyeMinBodySize = 0.1; #(default = 0.1) — minimum size of the Left Eye body relative to the bar length.

input NoseProtruding = 0.5; #(default = 0.5) — minimum protrusion of the Nose bar relative to the bar length.

input NoseBodyToLeftEyeBody = 1; #(default = 1) — maximum size of the Nose body relative to the Left eye body.

input NoseLengthToLeftEyeLength = 0; #(default = 0) — minimum Nose length relative to the Left Eye length.

input LeftEyeDepth = 0.2; #(default = 0.2) — minimum depth of the Left Eye relative to its length. Depth is length of the part of the bar behind the Nose.

# Left Eye and Nose bars's paramaters

def NoseLength = High - Low;

def LeftEyeLength = High[1] - Low[1];

def NoseBody = Absvalue(Open - Close);

def LeftEyeBody = Absvalue(Open[1] - Close[1]);

# Bearish Pinbar

def BearSignalDown = if (High - High[1] >= NoseLength * NoseProtruding) and

(NoseBody / NoseLength <= MaxNoseBodySize) and

(1 - (High - Max(Open, Close)) / NoseLength < NoseBodyPosition) and

if LeftEyeOppositeDirection then (Close[1] > Open[1]) else 1 and

if NoseSameDirection then (Close < Open) else 1 and

(LeftEyeBody / LeftEyeLength >= LeftEyeMinBodySize) and

((Max(Open, Close) <= High[1]) && (Min(Open, Close) >= Low[1])) and

(NoseBody / LeftEyeBody <= NoseBodyToLeftEyeBody) and

(NoseLength / LeftEyeLength >= NoseLengthToLeftEyeLength) and

(Low - Low[1] >= LeftEyeLength * LeftEyeDepth) and

if NoseBodyInsideLeftEyeBody then ((Max(Open, Close) <= Max(Open[1], Close[1]))

&& (Min(Open, Close) >= Min(Open[1], Close[1]))) else 1

then yes

else no ;

def BullSignalUp = if (Low[1] - Low >= NoseLength * NoseProtruding) and

(NoseBody / NoseLength <= MaxNoseBodySize) and

(1 - (Min(Open, Close) - Low) / NoseLength < NoseBodyPosition) and

if LeftEyeOppositeDirection then (Close[1] < Open[1]) else 1 and

if NoseSameDirection then (Close > Open) else 1 and

(LeftEyeBody / LeftEyeLength >= LeftEyeMinBodySize) and

((Max(Open, Close) <= High[1]) && (Min(Open, Close) >= Low[1])) and

(NoseBody / LeftEyeBody <= NoseBodyToLeftEyeBody) and

(NoseLength / LeftEyeLength >= NoseLengthToLeftEyeLength) and

(High[1] - High >= LeftEyeLength * LeftEyeDepth) and

if NoseBodyInsideLeftEyeBody then ((Max(Open, Close) <= Max(Open[1], Close[1]))

&& (Min(Open, Close) >= Min(Open[1], Close[1]))) else 1

then yes

else no;

# Scan specific logic. Look for a close within previous bar's body

# Add this to the original scan condition from a user request

def condition = between(close, min(open[1],close[1]),max(open[1],close[1]));

# Comment out (#) the ONE not needed

plot bullish_signal = BullSignalup and condition;

# plot bearish_signal = BearSignalDown and condition;

# End Pinbar Scan# Comment out (#) the ONE not needed

plot bullish_signal = BullSignalup and condition;

# plot bearish_signal = BearSignalDown and condition;

# End Pinbar Scan

Bearish Scan

# Comment out (#) the ONE not needed

# plot bullish_signal = BullSignalup and condition;

plot bearish_signal = BearSignalDown and condition;

# End Pinbar Scan

I would just save as different scans.

Awesome thanks as usual , But Im a little confused if im saving it right when I copied the script you made in I got 2 stocks like you did

$REG

$MKC

How do I switch it to a Bearish Scan ?

You seem to be new to scans - please note that the scanner only accepts one plot statement

I have listed two in the code, one commented out. Just switch those round for theopposite case

You should get 1 result for the bearish case if you ran the scan today

@tomsk I am new, but i will learn it . I refuse to be beat!

Not to worry, with practice you'll get the hang of it in no time!

Hi, looking for two consecutive green candles script & two consecutive red candles script.

Can someone help?

Thank you

Daniel.

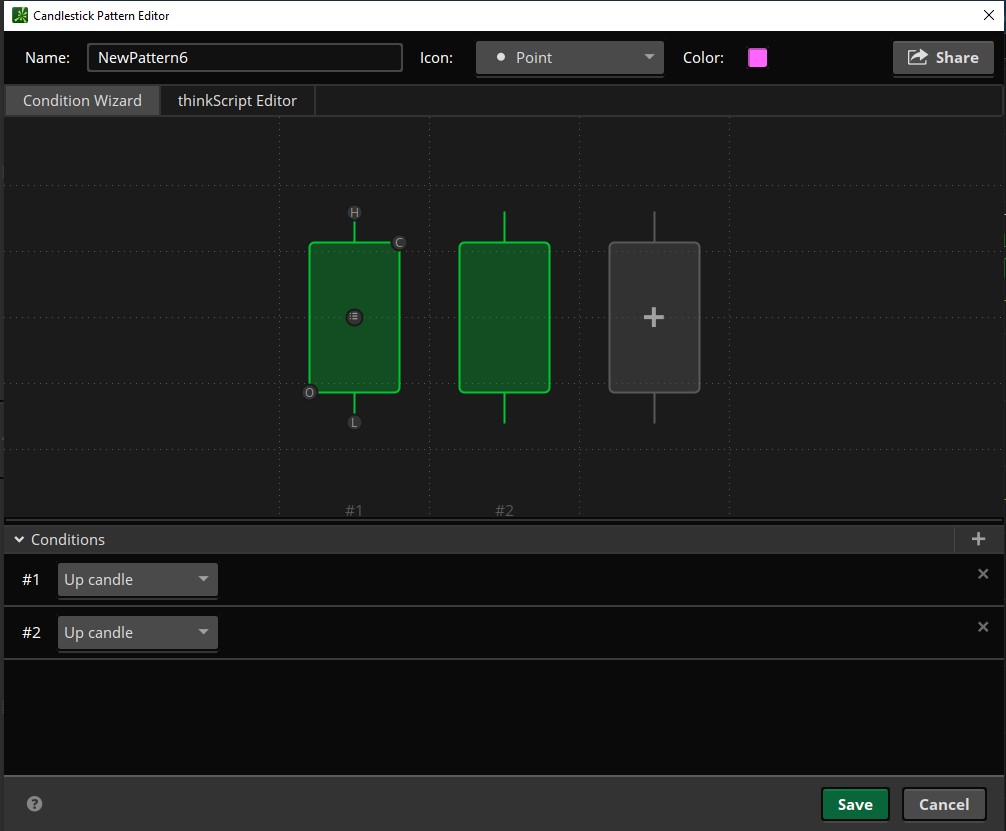

Very easy to do using the TOS candlestick pattern editor.

Here is an example:

Two consecutive green candles.

# Generation time: 2021-05-06T02:20:32.449444600Z

def IsUp = close > open;

def IsDown = close < open;

def IsDoji = IsDoji();

def avgRange = 0.05 * Average(high - low, 20);

plot PatternPlot =

IsUp[1] and

IsUp[0];

PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

PatternPlot.SetDefaultColor(GetColor(0));finespun1

New member

Can you post a picture of what this is supposed to look like when it finds one please?Tweezer Top

Code:# Generation time: 2020-12-09T00:55:57.031Z def IsUp = close > open; def IsDown = close < open; def IsDoji = IsDoji(); def avgRange = 0.05 * Average(high - low, 20); plot PatternPlot = IsUp[1] and IsDown[0] and Between(open[1] - close[0], -avgRange, avgRange) and close[1] == open[0]; PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN); PatternPlot.SetDefaultColor(GetColor(0));

Tweezer Bottom

Code:# Generation time: 2020-12-09T00:56:49.012Z def IsUp = close > open; def IsDown = close < open; def IsDoji = IsDoji(); def avgRange = 0.05 * Average(high - low, 20); plot PatternPlot = IsDown[1] and IsUp[0] and Between(open[1] - close[0], -avgRange, avgRange) and close[1] == open[0]; PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP); PatternPlot.SetDefaultColor(GetColor(0));

Thanks so much!!!Very easy to do using the TOS candlestick pattern editor.

Here is an example:

Two consecutive green candles.

Code:# Generation time: 2021-05-06T02:20:32.449444600Z def IsUp = close > open; def IsDown = close < open; def IsDoji = IsDoji(); def avgRange = 0.05 * Average(high - low, 20); plot PatternPlot = IsUp[1] and IsUp[0]; PatternPlot.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); PatternPlot.SetDefaultColor(GetColor(0));

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Candlestick Pattern Code For Scan | Questions | 3 | |

| C | Creating custom candlestick patterns study, low wick and relative break out | Questions | 2 | |

|

|

Candlestick Body Strength/Height | Questions | 2 | |

| K | Candlestick body to range percentage | Questions | 1 | |

| T | 8ema candlestick pattern | Questions | 4 |

Similar threads

-

-

Creating custom candlestick patterns study, low wick and relative break out

- Started by conorh

- Replies: 2

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Creating custom candlestick patterns study, low wick and relative break out

- Started by conorh

- Replies: 2

-

-

-

Similar threads

-

-

Creating custom candlestick patterns study, low wick and relative break out

- Started by conorh

- Replies: 2

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/