Thanks to everyone for their work as I would not have gotten this far without your contribution. I have referenced members of the community as you have either commented or contributed to the HA forums/discussions.

After conducting research on indicators/studies that would aid in my entry and exits as well as keeping me in the trend longer than usual, I came upon Sylvan Vervoort and his work. ( I have previously used the TrendPainter, Supertrend etc.) After reading “Trading with the Heikin-Ashi Candlestick Oscillator" and “Trading Medium-Term Divergences” I began searching the site for script that emulates his work.

@BenTen, @zkm, @mc01439, @HighBredCloud, @JBTrades, @markos, @tomsk @horserider @YungTraderFromMontana @diazlaz @J007RMC

Key components

TEMA, Reversal bubbles and/or arrows, MTF indicator, Addchart script used to create the HA , does not repaint.

Strategy – long and/or short. Enter and/or exit based on reversals (however, I utilize other indicators and signals such as the RSI, MTF, increased volume, stocks with strong catalyst, RV above 2.0 and Fib retracement.

Scan

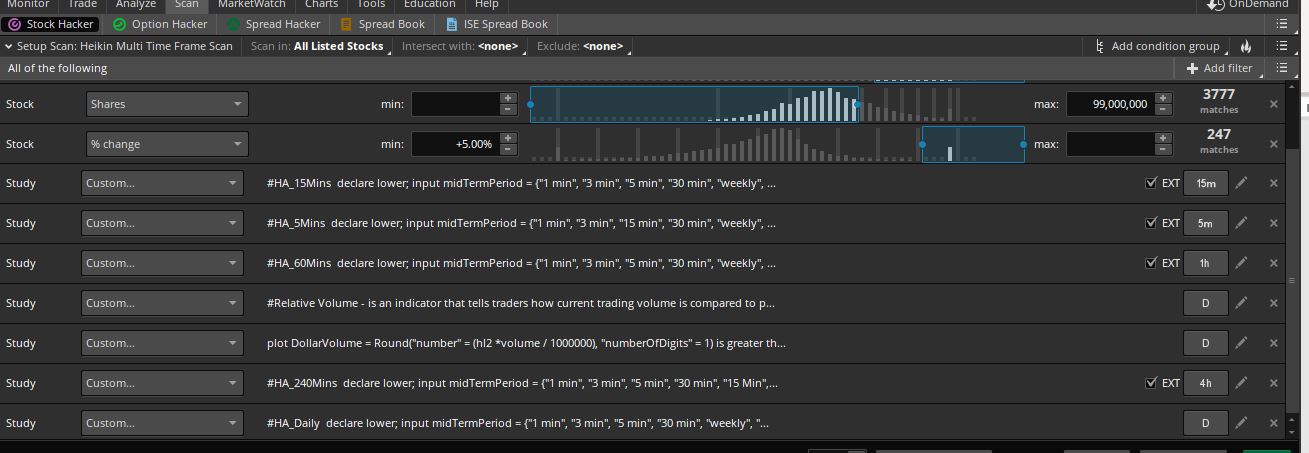

The scan comprises of the MTF script along with the script for liquidity, relative volume and/or stocks that are near (2-5%) to their 52wk high and short interest. I scan for stocks that are low float.

Watchlist

The watchlist is based on the buy and sell signals.

Feedback from members

I would like feedback from members regarding changing those candles that are “in the trend” but have a different color. (see chart). This would eliminate the number of signals that appear. (especially where there is only one red or green candle in the middle of the current trend. I have tried using strategies such as increasing the lookback period, using the previous candle(s) script but with no success. Please see notes within the chart.

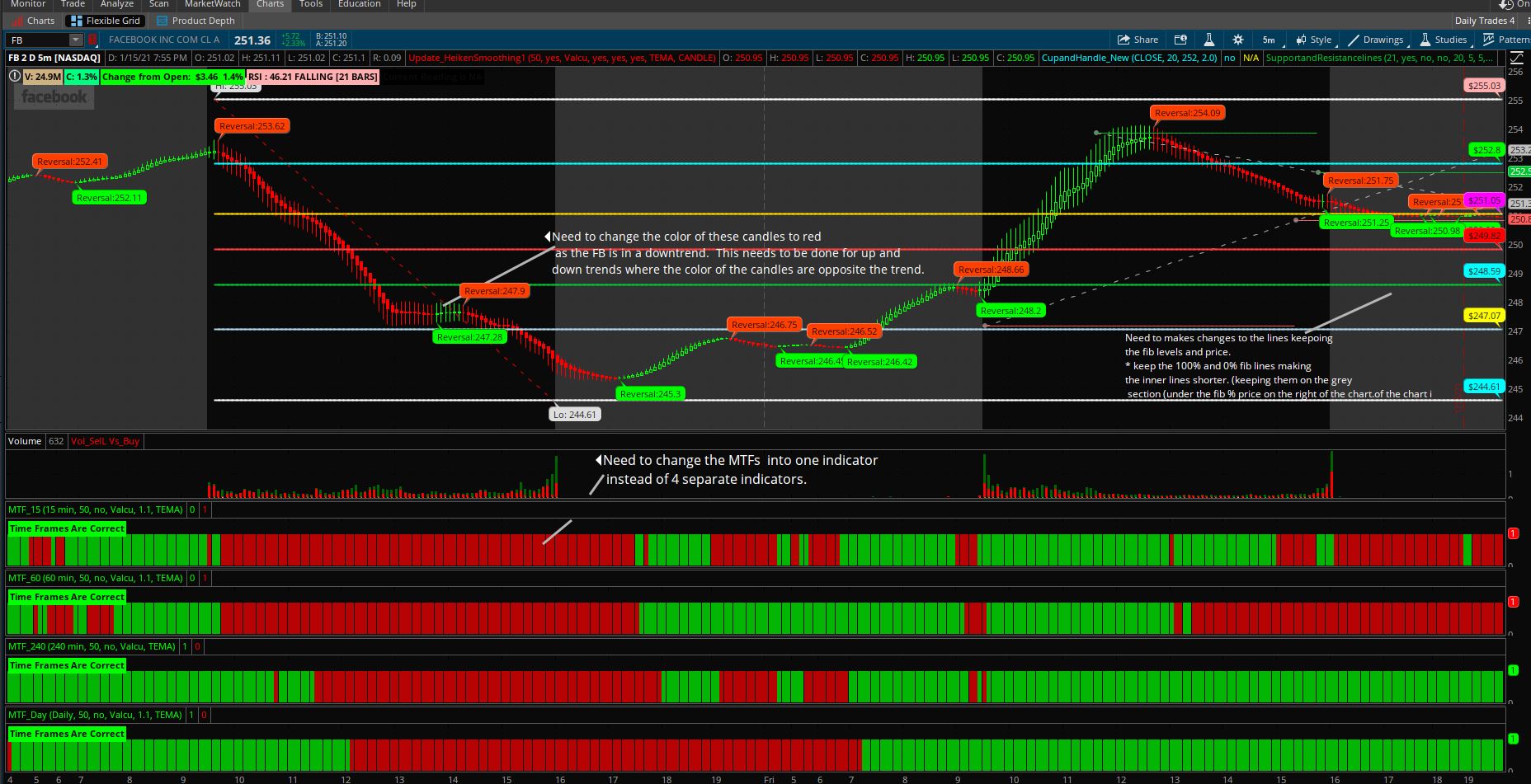

Also, can someone please provide the information for making the Fib lines shorter. Please see notes within the chart.

It is a work in progress. I have made profitable trades and this indicator has allowed me to find setups before major breakouts etc. (this is in combination with the Buy-the Dip).

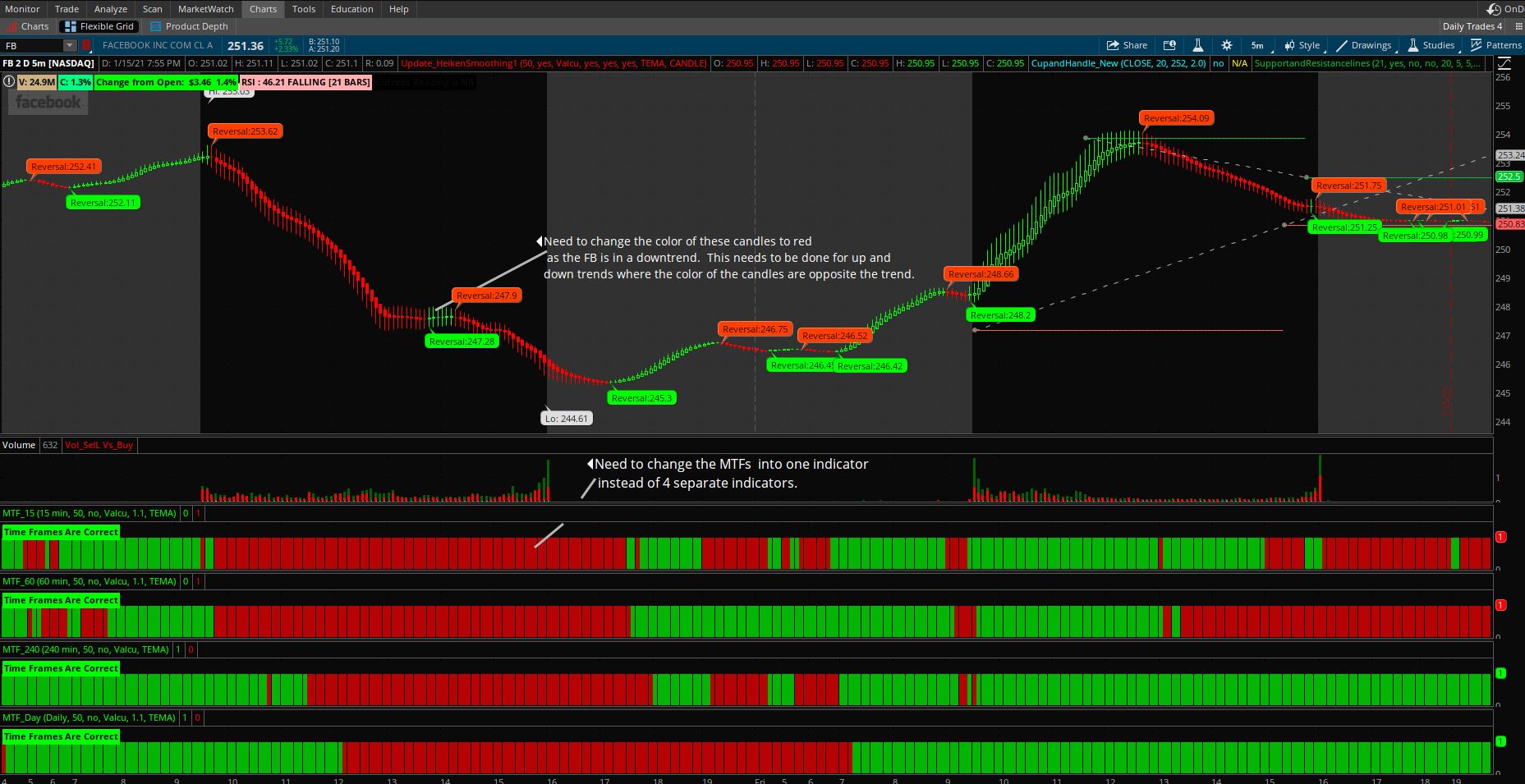

This is a chart without the regular candles. This shows the HA with the buy and sell signals and the Multi Time Frames. This is the main trading chart. The chart with the candlesticks is used for reference during trading. (I use two monitors when trading)

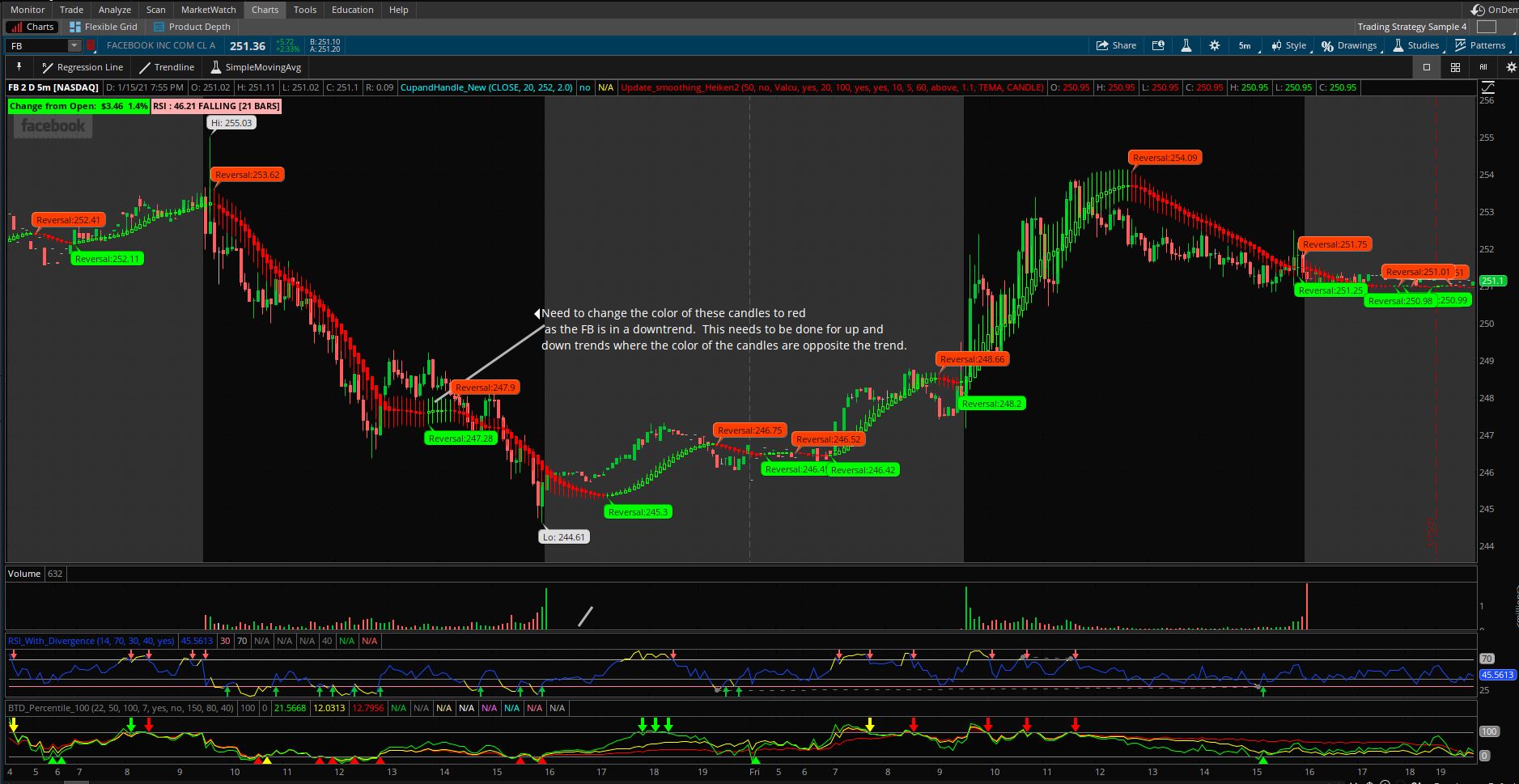

This is the above chart with the regular candles.

This chart shows the Fib Lines and notes on the feedback needed.

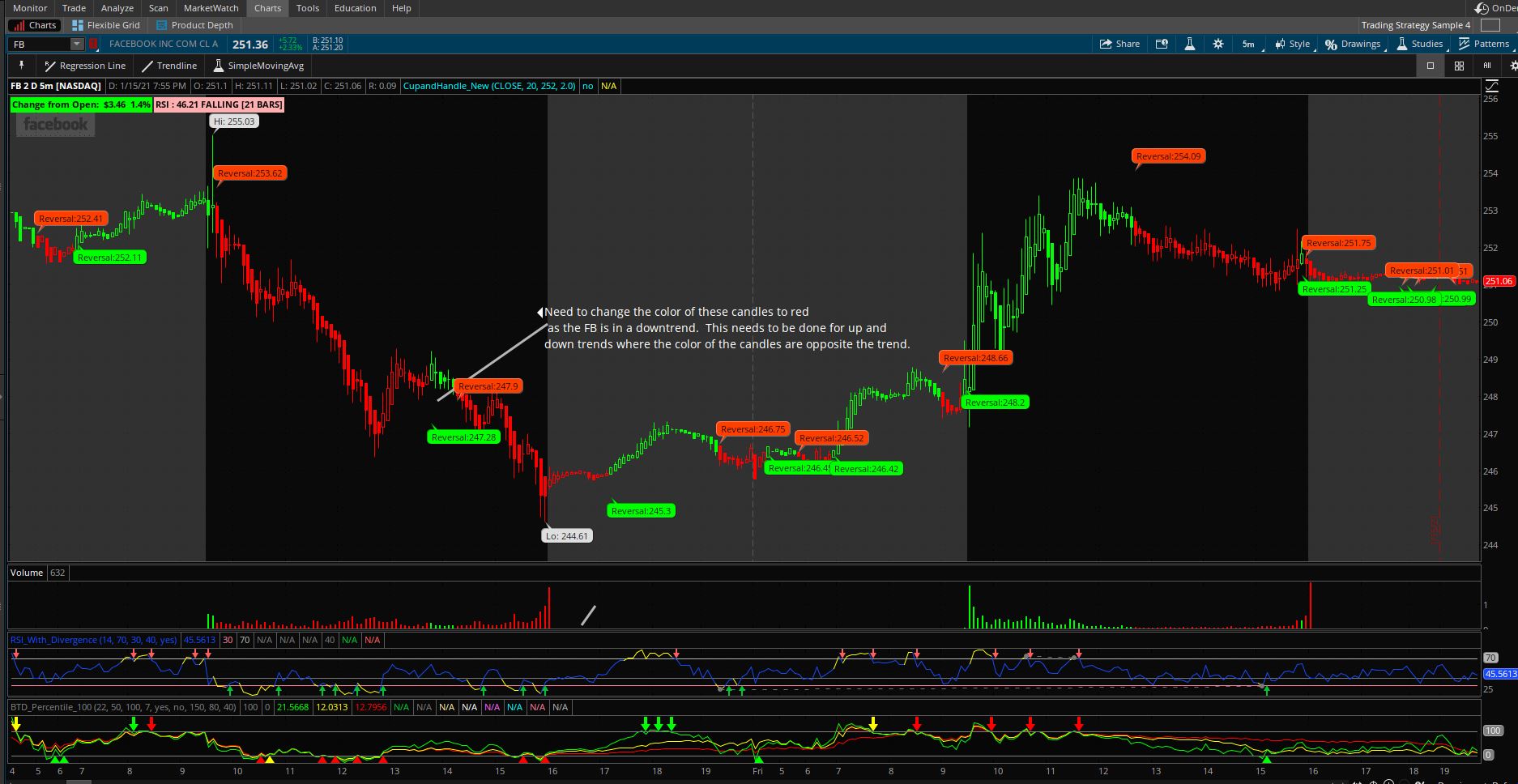

This chart shows the HA candles without the new HA_smoothing chart

This chart shows the scan criteria

Code

I am looking forward to your feedback. Thanks.

After conducting research on indicators/studies that would aid in my entry and exits as well as keeping me in the trend longer than usual, I came upon Sylvan Vervoort and his work. ( I have previously used the TrendPainter, Supertrend etc.) After reading “Trading with the Heikin-Ashi Candlestick Oscillator" and “Trading Medium-Term Divergences” I began searching the site for script that emulates his work.

@BenTen, @zkm, @mc01439, @HighBredCloud, @JBTrades, @markos, @tomsk @horserider @YungTraderFromMontana @diazlaz @J007RMC

Key components

TEMA, Reversal bubbles and/or arrows, MTF indicator, Addchart script used to create the HA , does not repaint.

Strategy – long and/or short. Enter and/or exit based on reversals (however, I utilize other indicators and signals such as the RSI, MTF, increased volume, stocks with strong catalyst, RV above 2.0 and Fib retracement.

Scan

The scan comprises of the MTF script along with the script for liquidity, relative volume and/or stocks that are near (2-5%) to their 52wk high and short interest. I scan for stocks that are low float.

Watchlist

The watchlist is based on the buy and sell signals.

Feedback from members

I would like feedback from members regarding changing those candles that are “in the trend” but have a different color. (see chart). This would eliminate the number of signals that appear. (especially where there is only one red or green candle in the middle of the current trend. I have tried using strategies such as increasing the lookback period, using the previous candle(s) script but with no success. Please see notes within the chart.

Also, can someone please provide the information for making the Fib lines shorter. Please see notes within the chart.

It is a work in progress. I have made profitable trades and this indicator has allowed me to find setups before major breakouts etc. (this is in combination with the Buy-the Dip).

This is a chart without the regular candles. This shows the HA with the buy and sell signals and the Multi Time Frames. This is the main trading chart. The chart with the candlesticks is used for reference during trading. (I use two monitors when trading)

This is the above chart with the regular candles.

This chart shows the Fib Lines and notes on the feedback needed.

This chart shows the HA candles without the new HA_smoothing chart

This chart shows the scan criteria

Code

Code:

#Heiken_Ashi based on Sylvan Verboort's Trading with HA Candlestick Oscillator

#Bon Bon _last update Jan 17th 2021

#Influenced by script from HoboTheClown / blt,http://www.thinkscripter.com, TD Hacolt etc.

#MTF based on HannTech's MTF_MACD script

#update 1/2/21 - changed the default moving average to TEMA. Changed the period to 35.

#update changed reversal arrows to reversal bubbles with price

### YOU MUST HAVE THE STYLE SETTING FIT STUDIES ENABLED ###

#hint: The style setting Fit Studies must be enabled to use these bars.

input period = 50;

input hideCandles = yes;

input candleSmoothing = {default Valcu, Vervoort};

input show_bubble_labels = yes;

input bubbles = yes;

input arrows = yes;

#input smoothingLength = 3;

input movingAverageType = {default TEMA, Exponential, Hull };

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Exponential:

openMA = CompoundValue(1, ExpAverage(open, period), open);

closeMA = CompoundValue(1, ExpAverage(close, period), close);

highMA = CompoundValue(1, ExpAverage(high, period), high);

lowMA = CompoundValue(1, ExpAverage(low, period), low);

case Hull:

openMA = CompoundValue(1, HullMovingAvg(open, period), open);

closeMA = CompoundValue(1, HullMovingAvg(close, period), close);

highMA = CompoundValue(1, HullMovingAvg(high, period), high);

lowMA = CompoundValue(1, HullMovingAvg(low, period), low);

case TEMA:

openMA = CompoundValue(1, TEMA(open, period), open);

closeMA = CompoundValue(1, TEMA(close, period), close);

highMA = CompoundValue(1, TEMA(high, period), high);

lowMA = CompoundValue(1, TEMA(low, period), low);

}

HidePricePlot(hideCandles);

def haOpen;

def haClose;

switch (candleSmoothing){

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0 ) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

}

plot o = haOpen;

o.Hide();

def haLow = Min(lowMA, haOpen);

def haHigh = Max(highMA, haOpen);

#Zero Lag System - MetaStock Crossover Formula

#zero-lagging principle

#Zero-lagging TEMA average on closing prices

#Medium-term price reversals - upward trend

def avg = 34;

def TMA1 = reference TEMA(haClose, avg); # triple exponential moving average (TEMA) of 34 bars

def TMA2 = reference TEMA(TMA1, avg);

def Diff = TMA1 - TMA2;

def ZlHa = TMA1 + Diff; #Zero-lagging TEMA average on closing prices - medium term uptrend;

#Medium-term price reversals - downward trend

def TMA1_ = reference TEMA((high + low) / 2, avg);

def Diff2 = TMA1_ - TMA2;

def ZlCl = TMA1_ + Diff2; #Zero-lagging TEMA average on closing prices - medium term doenwardtrend;

def ZlDif = ZlCl - ZlHa; # Zero-Lag close - Zero-Lag HA(green candle) Uptrend when ZlDif is equal to or greater than zero

#uptrend {green candle}

def keep1 = if (haClose >= haOpen and haClose[1] >= haOpen[1]) then 1 else 0;

def keep2 = if ZlDif >= 0 then 1 else 0;

def keep3 = if (AbsValue(close - open) < ((high - low) * 0.35)) and high >= low[1] then 1 else 0;

def keeping = if (keep1 or keep2) then 1 else 0;

def keepall = if keeping or (keeping[1]) and close >= open or close >= (close[1]) then 1 else 0;

def utr = if keepall or (keepall[1]) and keep3 then 1 else 0;

#downtrend red candle

def keep1_ = if (haClose < haOpen and haClose[1] < haOpen[1]) then 1 else 0;

def keep2_ = if ZlDif < 0 then 1 else 0;

def keep3_ = if (AbsValue(close - open) < ((high - low) * 0.35)) and low <= high[1] then 1 else 0;

def keeping_ = if (keep1_ or keep2_) then 1 else 0;

def dkeepall_ = if keeping_ or (keeping_[1]) and close < open or close < (close[1]) then 1 else 0;

def dtr = if dkeepall_ or (dkeepall_[1] - 1) and keep3_ == 1 then 1 else 0; #downtrend

def upw = if dtr and (dtr[1]) and utr then 1 else 0;

def dnw = if !utr and (utr[1] ) and dtr then 1 else 0;

def results = if upw then 1 else if dnw then 0 else results[1];

#Change the color of HA and Japanese Candles - turn off to show only HA on chart

AssignPriceColor(if haClose >= haOpen

then Color.GREEN else

if haClose < haOpen

then Color.RED else Color.WHITE);

#Heiken_A script

#####################################################################################################

input charttype = ChartType.CANDLE;

def haopen_ = if haClose <= haOpen

then haOpen + 0

else Double.NaN;

def HAhi = if haClose <= haOpen

then haHigh

else Double.NaN;

def HAlo = if haClose <= haOpen

then haLow

else Double.NaN;

AddChart(growColor = Color.RED, neutralColor = Color.CURRENT, high = HAhi, low = HAlo, open = haopen_, close = haClose, type = ChartType.CANDLE);

def HAclose1 = ohlc4;

def HAopen1 = if haClose >= haOpen

then CompoundValue(1, (haOpen[1] + haClose[1]) / 2, (open[1] + close[1]) / 2)

else Double.NaN;

def haopen_1 = if haOpen <= haClose

then HAopen1 + 0 else Double.NaN;

def HAhigh1 = haHigh;

def HAlow1 = haLow;

AddChart(growColor = Color.GREEN, neutralColor = Color.CURRENT, high = HAhigh1, low = HAlow1, open = haopen_1, close = haClose, type = ChartType.CANDLE);

#####################################################################################################

#Buy and sell signals

def trend = haClose >= haOpen;

def trendup = trend and !trend[1];

def trendd = haClose < haOpen;

def trendDown = trendd and !trendd[1];

AddChartBubble(bubbles and trendup and trendup, HAlow1, ("Reversal:" + round(HAlow1, 2)), Color.GREEN, no);

AddChartBubble(bubbles and trendDown and trendDown, HAhigh1, ("Reversal:" + round(HAhigh1,2)), Color.LIGHT_RED, yes);

#Arrows instead of bubbles

#def trend = haClose >= haOpen ;

#plot trendup = trend and !trend[1];

#trendup.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#trendup.SetDefaultColor(Color.CYAN);

#def trendd = haClose <= haOpen ;

#plot trendDown = trendd and !trendd[1];

#trendDown.SetDefaultColor(Color.MAGENTA);

#trendDown.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);I am looking forward to your feedback. Thanks.

Last edited: