Hi everyone

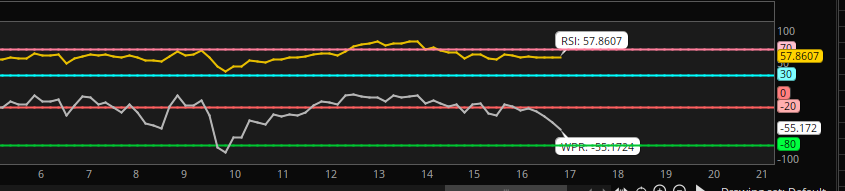

I am trying to write a basic indicator code that implement William% and RSI to find deep and top of the market this is the code that I was able to write, but it does not work so It is clearly wrong.

can anyone be so nice to check it and help me out?

thanks

I am trying to write a basic indicator code that implement William% and RSI to find deep and top of the market this is the code that I was able to write, but it does not work so It is clearly wrong.

can anyone be so nice to check it and help me out?

thanks

Code:

# buy the deep

input length = 14;

input oversold = 30;

input overbought = 70;

input WprPeriod = 24;

# WPR Indicator

def HH = highest(high, WprPeriod);

def LL = lowest(low, WprPeriod);

def WPR = (HH - close) / (HH - LL) * -100;

# RSI Indicator

def NetChgAvg = WildersAverage(close - close[1], length);

def TotChgAvg = WildersAverage(AbsValue(close - close[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

# Buy/Sell Signals

def buySignal = if RSI crosses above oversold and WPR > -20 then 1 else 0;

def sellSignal = if RSI crosses below overbought and WPR < -80 then 1 else 0;

# Plot Signals

plot buy = if buySignal then low - 2.5 else Double.NaN;

Buy.setdefaultColor(color.dark_GREEN);

Buy.hidetitle();

plot sell = if sellSignal then high + 2.5 else Double.NaN;

sell.setDefaultColor(color.red);

Sell.hidetitle();

buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);