Hello, my strategy is a basic ema cross but with Emma's stacked in the direction of the trade.

9 ema above 13 ema above 100 ema then go long, if they are all stacked on the short side, then go short.

can someone combine these 2 scripts that would then produce the arrow when the above lines up. Now the arrow and trade zone happens with a 9 and 100 cross over, it is missing the ema stacked part with the third ema.

Thank you

#

# Trade Lines

# v1.0 by @mark.917

#

# Trade Lines will plot lines with and optional cloud showing where you entered your

# position and the location of your stop loss and profit target.

#

# To use, your code will need to set "your_buy_signal" or "your_sell_signal" to true.

# The profit target and stop loss are based on an ATR multplier. You may modify this

# to be whatever you would like.

declare upper;

#######################

# YOUR CODE STARTS HERE

#######################

# sample using moving average crossover for signals

Input FastMaLength = 5;

Input SlowMaLength = 50;

def FastMA = MovingAverage(AverageType.EXPONENTIAL, close, FastMaLength);

def SlowMA = MovingAverage(AverageType.EXPONENTIAL, close, SlowMaLength);

plot fastMAPlot = FastMA;

fastMAPlot.SetDefaultColor(GetColor(1));

plot slowMAPlot = SlowMA;

slowMAPlot.SetDefaultColor(GetColor(2));

def buy_signal = FastMA crosses above SlowMA;

def sell_signal = FastMA crosses below SlowMA;

###################

# BEGIN TRADE LINES

###################

input show_trade_zone = yes;

input calc_mode = {default fixed, atr}; #hint mode: Select fixed values or atr values for target and stop levels.

input ATRTargetMultiple = 2.5;

input ATRStopMultiple = 1.5;

input FixedTarget = 1.50;

input FixedStop = .75;

def atr = ATR(14, AverageType.EXPONENTIAL);

def target;

def stop;

switch (calc_mode) {

case atr:

target = atr * ATRTargetMultiple;

stop = atr * ATRStopMultiple;

case fixed:

target = FixedTarget;

stop = FixedStop;

}

def long_signal = if buy_signal then 1 else 0;

def long_target = if long_signal == 1 then target else long_target[1];

def long_stop = if long_signal == 1 then stop else long_stop[1];

def long_entry = if long_signal == 1 then open else if (high[1] > long_entry[1] + long_target or low[1] < long_entry[1] - long_stop) then Double.NaN else long_entry[1];

def long_exit = if long_entry > 0 then 0 else 1;

plot long_pt = if show_trade_zone and !long_exit then long_entry + long_target else Double.NaN;

long_pt.SetDefaultColor(Color.GREEN);

plot long_ep = if show_trade_zone and !long_exit then long_entry else Double.NaN;

long_ep.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

long_ep.SetDefaultColor(Color.WHITE);

plot long_sl = if show_trade_zone and !long_exit then long_ep - long_stop else Double.NaN;

long_sl.SetDefaultColor(Color.RED);

#AddCloud(if show_trade_zone then long_pt else Double.NaN, long_ep, Color.GREEN);

#AddCloud(if show_trade_zone then long_sl else Double.NaN, long_ep, Color.RED);

def short_signal = if sell_signal then 1 else 0;

def short_target = if short_signal == 1 then target else short_target[1];

def short_stop = if short_signal == 1 then stop else short_stop[1];

def short_entry = if short_signal == 1 then open else if (low[1] < short_entry[1] - short_target or high[1] > short_entry[1] + short_stop) then Double.NaN else short_entry[1];

def short_exit = if short_entry > 0 then 0 else 1;

plot short_pt = if show_trade_zone and !short_exit then short_entry - short_target else Double.NaN;

short_pt.SetDefaultColor(Color.GREEN);

plot short_ep = if show_trade_zone and !short_exit then short_entry else Double.NaN;

short_ep.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

short_ep.SetDefaultColor(Color.WHITE);

plot short_sl = if show_trade_zone and !short_exit then short_ep + short_stop else Double.NaN;

short_sl.SetDefaultColor(Color.RED);

#AddCloud(if show_trade_zone then short_pt else Double.NaN, short_ep, Color.GREEN);

#AddCloud(if show_trade_zone then short_sl else Double.NaN, short_ep, Color.RED);

#################

# END TRADE LINES

#################

#AddOrder(OrderType.BUY_AUTO, FastMA crosses above SlowMA[1]);

#AddOrder(OrderType.SELL_AUTO, FastMA crosses below SlowMA[1]);;

--------------------------------------------------------------------------------------------------------------------------------------------------

# Multi-Timeframe ElvisTrend

# Copyright (C) 2023 darkelvis twitter.com/TheOGdarkelvis

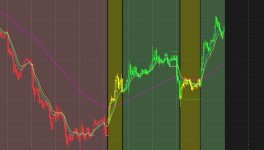

# Indicator uses a set of stacked moving averages to identify trend. Stacked low to high should indicate an uptrend, stacked high to low should indicate a downtrend, when moving averages are not stacked there is no trend. Green indicates bullish, red for bearish, and yellow for no trend.

declare lower;

##Settings

input AvgType = averageType.EXPONENTIAL;

input Fast_MA = 8;

input Mid_MA = 13;

input Slow_MA = 21;

input Show_Labels = yes;

input Timeframe = aggregationPeriod.HOUR;

##Calculations

def price = close;

def FastValue = MovingAverage(AvgType, close(period=Timeframe),Fast_MA);

def MidValue = MovingAverage(AvgType, close(period=Timeframe), Mid_MA);

def SlowValue = MovingAverage(AvgType, close(period=Timeframe), Slow_MA);

def bullish = FastValue >= MidValue AND MidValue >= SlowValue;

def bearish = FastValue <= MidValue AND MidValue <= SlowValue;

def no_trend = FastValue >= MidValue and MidValue <= SlowValue or FastValue <= MidValue and MidValue >= SlowValue;

##Label

#AddLabel(Show_Labels, If bullish then "LONG ONLY" else "", if bullish then color.green else color.black);

#AddLabel(Show_Labels, If bearish then "SHORT ONLY" else "", if bearish then color.red else color.black);

#AddLabel(Show_Labels, If no_trend then "SIT ON YOUR HANDS" else "", if no_trend then color.yellow else color.black);

##Background cloud

AddCloud(if bullish then Double.POSITIVE_INFINITY else Double.NaN,if bullish then Double.NEGATIVE_INFINITY else Double.NaN, Color.LIGHT_GREEN);

AddCloud(if bearish then Double.POSITIVE_INFINITY else Double.NaN,if bearish then Double.NEGATIVE_INFINITY else Double.NaN, Color.PINK);

AddCloud(if no_trend then Double.POSITIVE_INFINITY else Double.NaN,if no_trend then Double.NEGATIVE_INFINITY else Double.NaN, Color.YELLOW);

##Color Candles

AssignPriceColor(if bullish then color.GREEN else if bearish then color.RED else color.yellow);

9 ema above 13 ema above 100 ema then go long, if they are all stacked on the short side, then go short.

can someone combine these 2 scripts that would then produce the arrow when the above lines up. Now the arrow and trade zone happens with a 9 and 100 cross over, it is missing the ema stacked part with the third ema.

Thank you

#

# Trade Lines

# v1.0 by @mark.917

#

# Trade Lines will plot lines with and optional cloud showing where you entered your

# position and the location of your stop loss and profit target.

#

# To use, your code will need to set "your_buy_signal" or "your_sell_signal" to true.

# The profit target and stop loss are based on an ATR multplier. You may modify this

# to be whatever you would like.

declare upper;

#######################

# YOUR CODE STARTS HERE

#######################

# sample using moving average crossover for signals

Input FastMaLength = 5;

Input SlowMaLength = 50;

def FastMA = MovingAverage(AverageType.EXPONENTIAL, close, FastMaLength);

def SlowMA = MovingAverage(AverageType.EXPONENTIAL, close, SlowMaLength);

plot fastMAPlot = FastMA;

fastMAPlot.SetDefaultColor(GetColor(1));

plot slowMAPlot = SlowMA;

slowMAPlot.SetDefaultColor(GetColor(2));

def buy_signal = FastMA crosses above SlowMA;

def sell_signal = FastMA crosses below SlowMA;

###################

# BEGIN TRADE LINES

###################

input show_trade_zone = yes;

input calc_mode = {default fixed, atr}; #hint mode: Select fixed values or atr values for target and stop levels.

input ATRTargetMultiple = 2.5;

input ATRStopMultiple = 1.5;

input FixedTarget = 1.50;

input FixedStop = .75;

def atr = ATR(14, AverageType.EXPONENTIAL);

def target;

def stop;

switch (calc_mode) {

case atr:

target = atr * ATRTargetMultiple;

stop = atr * ATRStopMultiple;

case fixed:

target = FixedTarget;

stop = FixedStop;

}

def long_signal = if buy_signal then 1 else 0;

def long_target = if long_signal == 1 then target else long_target[1];

def long_stop = if long_signal == 1 then stop else long_stop[1];

def long_entry = if long_signal == 1 then open else if (high[1] > long_entry[1] + long_target or low[1] < long_entry[1] - long_stop) then Double.NaN else long_entry[1];

def long_exit = if long_entry > 0 then 0 else 1;

plot long_pt = if show_trade_zone and !long_exit then long_entry + long_target else Double.NaN;

long_pt.SetDefaultColor(Color.GREEN);

plot long_ep = if show_trade_zone and !long_exit then long_entry else Double.NaN;

long_ep.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

long_ep.SetDefaultColor(Color.WHITE);

plot long_sl = if show_trade_zone and !long_exit then long_ep - long_stop else Double.NaN;

long_sl.SetDefaultColor(Color.RED);

#AddCloud(if show_trade_zone then long_pt else Double.NaN, long_ep, Color.GREEN);

#AddCloud(if show_trade_zone then long_sl else Double.NaN, long_ep, Color.RED);

def short_signal = if sell_signal then 1 else 0;

def short_target = if short_signal == 1 then target else short_target[1];

def short_stop = if short_signal == 1 then stop else short_stop[1];

def short_entry = if short_signal == 1 then open else if (low[1] < short_entry[1] - short_target or high[1] > short_entry[1] + short_stop) then Double.NaN else short_entry[1];

def short_exit = if short_entry > 0 then 0 else 1;

plot short_pt = if show_trade_zone and !short_exit then short_entry - short_target else Double.NaN;

short_pt.SetDefaultColor(Color.GREEN);

plot short_ep = if show_trade_zone and !short_exit then short_entry else Double.NaN;

short_ep.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

short_ep.SetDefaultColor(Color.WHITE);

plot short_sl = if show_trade_zone and !short_exit then short_ep + short_stop else Double.NaN;

short_sl.SetDefaultColor(Color.RED);

#AddCloud(if show_trade_zone then short_pt else Double.NaN, short_ep, Color.GREEN);

#AddCloud(if show_trade_zone then short_sl else Double.NaN, short_ep, Color.RED);

#################

# END TRADE LINES

#################

#AddOrder(OrderType.BUY_AUTO, FastMA crosses above SlowMA[1]);

#AddOrder(OrderType.SELL_AUTO, FastMA crosses below SlowMA[1]);;

--------------------------------------------------------------------------------------------------------------------------------------------------

# Multi-Timeframe ElvisTrend

# Copyright (C) 2023 darkelvis twitter.com/TheOGdarkelvis

# Indicator uses a set of stacked moving averages to identify trend. Stacked low to high should indicate an uptrend, stacked high to low should indicate a downtrend, when moving averages are not stacked there is no trend. Green indicates bullish, red for bearish, and yellow for no trend.

declare lower;

##Settings

input AvgType = averageType.EXPONENTIAL;

input Fast_MA = 8;

input Mid_MA = 13;

input Slow_MA = 21;

input Show_Labels = yes;

input Timeframe = aggregationPeriod.HOUR;

##Calculations

def price = close;

def FastValue = MovingAverage(AvgType, close(period=Timeframe),Fast_MA);

def MidValue = MovingAverage(AvgType, close(period=Timeframe), Mid_MA);

def SlowValue = MovingAverage(AvgType, close(period=Timeframe), Slow_MA);

def bullish = FastValue >= MidValue AND MidValue >= SlowValue;

def bearish = FastValue <= MidValue AND MidValue <= SlowValue;

def no_trend = FastValue >= MidValue and MidValue <= SlowValue or FastValue <= MidValue and MidValue >= SlowValue;

##Label

#AddLabel(Show_Labels, If bullish then "LONG ONLY" else "", if bullish then color.green else color.black);

#AddLabel(Show_Labels, If bearish then "SHORT ONLY" else "", if bearish then color.red else color.black);

#AddLabel(Show_Labels, If no_trend then "SIT ON YOUR HANDS" else "", if no_trend then color.yellow else color.black);

##Background cloud

AddCloud(if bullish then Double.POSITIVE_INFINITY else Double.NaN,if bullish then Double.NEGATIVE_INFINITY else Double.NaN, Color.LIGHT_GREEN);

AddCloud(if bearish then Double.POSITIVE_INFINITY else Double.NaN,if bearish then Double.NEGATIVE_INFINITY else Double.NaN, Color.PINK);

AddCloud(if no_trend then Double.POSITIVE_INFINITY else Double.NaN,if no_trend then Double.NEGATIVE_INFINITY else Double.NaN, Color.YELLOW);

##Color Candles

AssignPriceColor(if bullish then color.GREEN else if bearish then color.RED else color.yellow);