RedToGreen

Active member

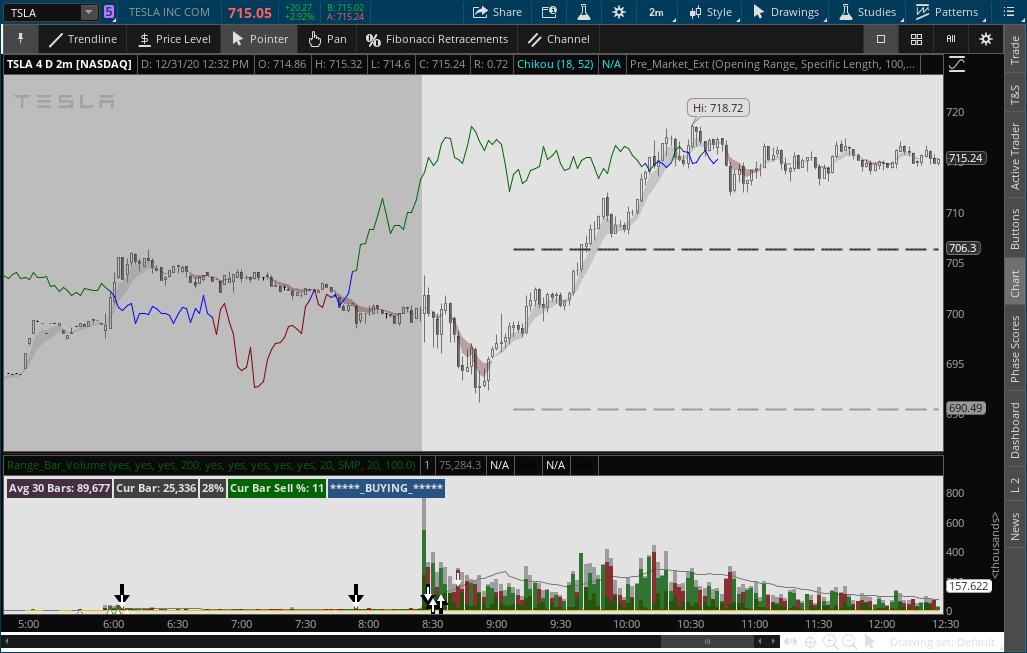

That's it...that's all you get

No other elements of the Ichimoku included...GL

TSLA 2 min chart 12/31/2020

Have a good new year

Should note that I'm using a 18/52 TK period

No other elements of the Ichimoku included...GL

TSLA 2 min chart 12/31/2020

Have a good new year

Should note that I'm using a 18/52 TK period

Code:

#

# TD Ameritrade IP Company, Inc. (c) 2007-2020

#

input tenkan_period = 18;

input kijun_period = 52;

def Tenkan = (Highest(high, tenkan_period) + Lowest(low, tenkan_period)) / 2;

def Kijun = (Highest(high, kijun_period) + Lowest(low, kijun_period)) / 2;

plot Chikou = close[-kijun_period];

def DownChik = Chikou < High from 26 bars ago and Chikou < Close;

def UpChik = Chikou > High from 26 bars ago and Chikou > Close;

Chikou.assignValueColor( if UpChik then color.DARK_GREEN else if DownChik then color.DARK_RED else color.BLUE);

Last edited: