@BenTen @horserider Do you guys mind looking at the below code when you get a chance and provide some feedback if the below code satisfies the above conditions for each MA's( 18/50/100). I was hoping to have these as Indicators, currently i use this as Scans but it very much of a hit and miss sometime i get a hit but most time hardly anything gets picked up through these scans. Please advise.

I have below code placed into three different scans which eventually saves into three different watchlist, i think it would be better if i can get this to work as an Indicator.

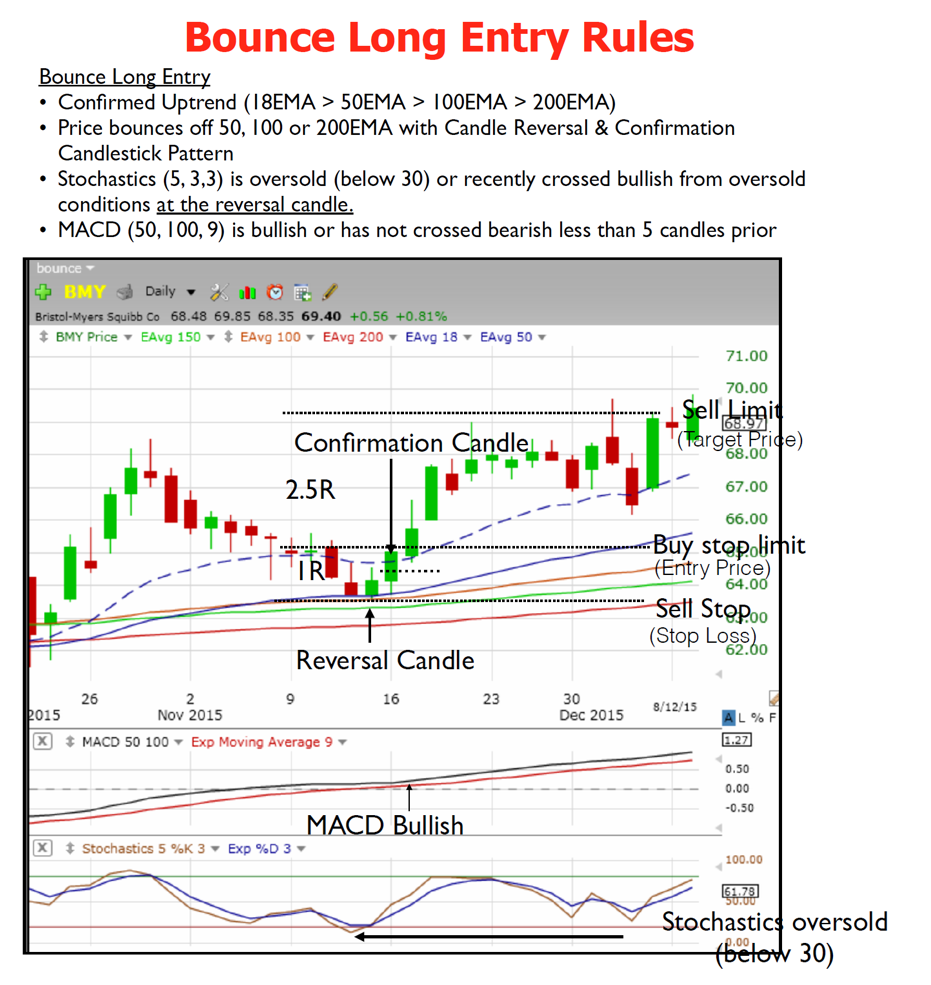

18 Bounce Long

MovAvgExponential("length" = 18) is greater than MovAvgExponential("length" = 50) and MovAvgExponential("length" = 50) is greater than MovAvgExponential("length" = 100) and MovAvgExponential("length" = 100) is greater than MovAvgExponential("length" = 200) and low from 1 bars ago crosses below MovAvgExponential("length" = 18) and MACDHistogramCrossover("fast length" = 18, "slow length" = 50, "crossing type" = "Negative to Positive") is true within 15 bars and MACDHistogramCrossover("fast length" = 50, "slow length" = 100, "crossing type" = "Negative to Positive") is true within 15 bars and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3, "average type" = "EXPONENTIAL")."FullK" is less than or equal to 30 within 3 bars and open from 1 bars ago is greater than MovAvgExponential("length" = 18) and close from 1 bars ago is greater than MovAvgExponential("length" = 18) and close is greater than high from 1 bars ago and close is greater than open

50 Bounce Long

MovAvgExponential("length" = 18) is greater than MovAvgExponential("length" = 50) and MovAvgExponential("length" = 50) is greater than MovAvgExponential("length" = 100) and MovAvgExponential("length" = 100) is greater than MovAvgExponential("length" = 200) and low from 1 bars ago crosses below MovAvgExponential("length" = 50) and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3, "average type" = "EXPONENTIAL")."FullK" is less than or equal to 30 within 3 bars and open from 1 bars ago is greater than MovAvgExponential("length" = 50) and close from 1 bars ago is greater than MovAvgExponential("length" = 50) and close is greater than high from 1 bars ago and close is greater than open

100 Bounce Long

MovAvgExponential("length" = 18) is greater than MovAvgExponential("length" = 50) and MovAvgExponential("length" = 50) is greater than MovAvgExponential("length" = 100) and MovAvgExponential("length" = 100) is greater than MovAvgExponential("length" = 200) and low from 1 bars ago crosses below MovAvgExponential("length" = 100) and StochasticFull("over bought" = 70, "over sold" = 30, "k period" = 5, "d period" = 3, "average type" = "EXPONENTIAL")."FullK" is less than or equal to 30 within 3 bars and open from 1 bars ago is greater than MovAvgExponential("length" = 100) and close from 1 bars ago is greater than MovAvgExponential("length" = 100) and close is greater than high from 1 bars ago and close is greater than open