All-in-oneBuySell Volume w/ Labels, PreMarket OBV & Cumulative Premarket Vol, etc.

My first post. I hope it's useful to someone. Any critiques are helpful.

Includes:

How Labels are read:

[ Vol: Current Volume (Previous Volume) Percent Change From Previous ]

My first post. I hope it's useful to someone. Any critiques are helpful.

Includes:

- More InDepth Buy/Sell Volume Labels

- Cumulative Premarket Volume

- Premarket OnBalance Volume

- Volume Simple 9 Period Moving Average

- Midpoint to help gauge

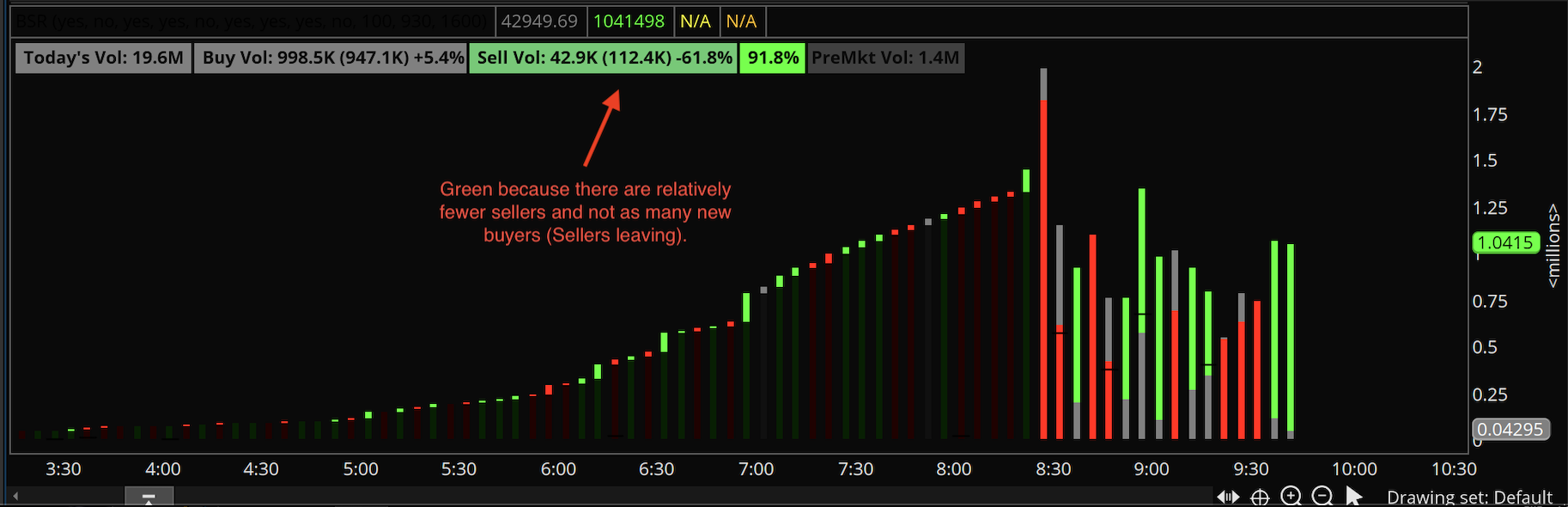

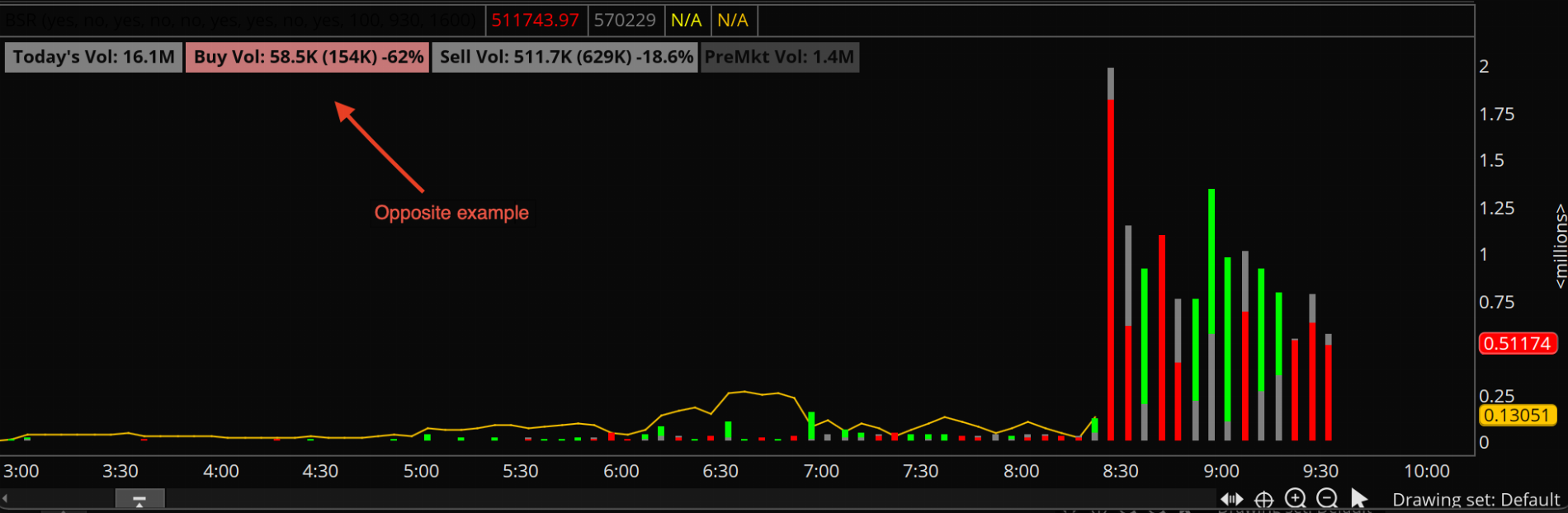

- Dynamic Coloring

How Labels are read:

[ Vol: Current Volume (Previous Volume) Percent Change From Previous ]

Code:

# All-in-oneBuySell Volume w/ Labels, PreMarket OBV, Cumulative Premarket Vol

# @walkr 3/6/2022

#hint showVol9MovAvg: Simple 9 period moving average for volume

#hint showBarPercent: Shows current bar's buyers vs sellers as percent \n <li>Green = Current buyers</li><li>Red = Current sellers</li>

#hint showBarVisual: Represents current bar's buyer to seller percent with a horizontal positive/negative bar

#hint showPrevVol: Shows previous buy or sell volume in parenthesis

#hint showPreMktOBV: Shows pre-market on-balane volume

#hint PreMkt: Time pre-market starts

#hint MktOpen: Time regular trading starts

#hint AfterMkt: Time regular trading ends

input showTodaysVol = yes;

input showVolMovAvg = yes;

input showBuyAndSellVolLabels = yes;

input showBarPercent = yes;

input showBarVisual = no;

input showPrevVol = yes;

input showPercentChg = yes;

input showPreMktCmlVol = no;

input showPreMktOBV = yes;

input PreMkt = 0100;

input MktOpen = 930;

input AfterMkt = 1600;

def v = volume;

def h = high;

def o = open;

def c = close;

def l = low;

# Calculations

def tv = volume(period = AggregationPeriod.DAY);

def bv = RoundUp(v * (c - l) / (h - l));

def sv = RoundDown(v * (h - c) / (h - l));

def br = bv / v;

def sr = sv / v;

def bp = br * 100;

def sp = sr * 100;

def bvpc = ((bv - bv[1]) / bv[1]);

def svpc = ((sv - sv[1]) / sv[1]);

def bsr = Round((bv - (if v == 0 then 0.5 else (v / 2))) / ((if v == 0 then 1 else v) - 0) * 100, 1);

# Conditions & Parameters

def u = br > 1 / 2;

def d = sr > 1 / 2;

def ut = br > br[1];

def dt = sr > sr[1];

def isPm = SecondsFromTime(PreMkt) >= 0 and SecondsTillTime(MktOpen) > 0;

def pmStart = isPm and !isPm[1];

def isDay = SecondsFromTime(MktOpen) >= 0 and SecondsTillTime(AfterMkt) > 0;

def dayStart = isDay and !isDay[1];

# Self-referring Variables

def n = n[1] + if pmStart then 1 else 0;

def nDay = if dayStart then 1 else nDay[1] + 1;

def cmVol = if dayStart then v else if isDay then if nDay > 9 then v + v[1] + v[2] + v[3] + v[4] + v[5] + v[6] + v[7] + v[8] else cmVol[1] + v else cmVol[1];

def cmlPmVol = if pmStart then v else if isPm then cmlPmVol[1] + v else cmlPmVol[1];

def pmOBV = if pmStart then if c > o then v else if c < o then - v else 0 else if isPm then if c > o then pmOBV[1] + v else if c < o then pmOBV[1] - v else pmOBV[1] else pmOBV[1];

# AvgPreMktVol

def ONV1;

def ONV2;

def ONV3;

def ONV4;

def ONV5;

if (pmStart and n > 1) {

ONV1 = cmlPmVol[1];

ONV2 = ONV1[1];

ONV3 = ONV2[1];

ONV4 = ONV3[1];

ONV5 = ONV4[1];

} else {

ONV1 = ONV1[1];

ONV2 = ONV2[1];

ONV3 = ONV3[1];

ONV4 = ONV4[1];

ONV5 = ONV5[1];

}

def avgPMV = if n > 5 then (ONV1 + ONV2 + ONV3 + ONV4 + ONV5) / 5 else Double.NaN;

# Plots

plot PrevCmlVol = if !showPreMktCmlVol then Double.NaN else if isPm then cmlPmVol - v else Double.NaN;

plot NegVolume = if showPreMktCmlVol then if isPm then Double.NaN else sv else sv;

plot PosVolume = if showPreMktCmlVol then if isPm then cmlPmVol else bv + sv else bv + sv;

plot Mid = if !(bp > 60 or bp < 40 or bv == sv) then v / 2 else Double.NaN;

plot AvgVol = if showVolMovAvg then if isDay then if nDay < 9 then cmVol / nDay else cmVol / 9 else Double.NaN else Double.NaN;

plot PreMktOBV = if showPreMktOBV then if isPm then pmOBV else Double.NaN else Double.NaN;

# Today Volume Label

AddLabel(!IsNaN(tv) and showTodaysVol, " Today's Vol: " + (if tv >= 1000000 then Round(tv / 1000000, 1) else if tv >= 1000 then Round(tv / 1000, 1) else Round(tv / 100) * 100) + (if tv >= 1000000 then "M " else if tv >= 1000 then "K " else "") + " ", Color.GRAY);

# Buy Label

AddLabel(showBuyAndSellVolLabels,

" Buy Vol: " + (if IsNaN(bv) then 0 else (if bv >= 1000000 then Round(bv / 1000000, 1) else if bv >= 1000 then Round(bv / 1000, 1) else Round(bv / 100) * 100)) + (if bv >= 1000000 then "M " else if bv >= 1000 then "K " else " ") +

(if showPrevVol then "(" + (if IsNaN(bv[1]) then 0 else if AbsValue(bv[1]) >= 1000000 then Round(bv[1] / 1000000, 1) else if AbsValue(bv[1]) >= 1000 then Round(bv[1] / 1000, 1) else bv[1]) + (if AbsValue(bv[1]) >= 1000000 then "M) " else if AbsValue(bv[1]) >= 1000 then "K) " else ") ") else " ") +

if !showPercentChg then " " else ((if bvpc > 0 then "+" else "") + (if IsNaN(bvpc) then "----" else if bvpc > 999999 then "" + 999999 else Round(bvpc * 100, 1) + "") + "% "),

if IsNaN(bvpc) or IsNaN(svpc) then Color.DARK_GRAY else if (AbsValue(bvpc) > AbsValue(svpc)) then if (bvpc > 0) then CreateColor(0, 50 + (205 * br), 0) else if (bvpc < 0) then CreateColor(200, 120, 120) else Color.GRAY else if (svpc > bvpc) then Color.GRAY else Color.GRAY);

# Sell Label

AddLabel(showBuyAndSellVolLabels,

" Sell Vol: " + (if IsNaN(sv) then 0 else (if sv >= 1000000 then Round(sv / 1000000, 1) else if sv >= 1000 then Round(sv / 1000, 1) else Round(sv / 100) * 100)) + (if sv >= 1000000 then "M " else if sv >= 1000 then "K " else " ") +

( if showPrevVol then "(" + (if IsNaN(sv[1]) then 0 else if AbsValue(sv[1]) >= 1000000 then Round(sv[1] / 1000000, 1) else if AbsValue(sv[1]) >= 1000 then Round(sv[1] / 1000, 1) else sv[1]) + (if AbsValue(sv[1]) >= 1000000 then "M) " else if AbsValue(sv[1]) >= 1000 then "K) " else ") ") else " ") +

if !showPercentChg then " " else ((if svpc > 0 then "+" else "") + (if IsNaN(svpc) then "----" else if svpc > 999999 then "" + 999999 else Round(svpc * 100, 1) + "") + "% "),

if IsNaN(svpc) or IsNaN(bvpc) then Color.DARK_GRAY else if (AbsValue(bvpc) < AbsValue(svpc)) then if (svpc < 0) then CreateColor(120, 200, 120) else if (svpc > 0) then CreateColor(50 + (205 * sr), 0, 0) else Color.GRAY else if (svpc < bvpc) then Color.GRAY else Color.GRAY);

# Current Bar Percent Label

AddLabel(!IsNaN(v) and showBarPercent,

(if showBarVisual then "{" + (if bsr < 0 then (if AbsValue(bsr) >= 50 then "\" else if AbsValue(bsr) >= 47.5 then "`" else "_") + (if AbsValue(bsr) >= 45 then "\" else if AbsValue(bsr) >= 42.5 then "`" else "_") + (if AbsValue(bsr) >= 40 then "\" else if AbsValue(bsr) >= 37.5 then "`" else "_") + (if AbsValue(bsr) >= 35 then "\" else if AbsValue(bsr) >= 32.5 then "`" else "_") + (if AbsValue(bsr) >= 30 then "\" else if AbsValue(bsr) >= 27.5 then "`" else "_") + (if AbsValue(bsr) >= 25 then "\" else if AbsValue(bsr) >= 22.5 then "`" else "_") + (if AbsValue(bsr) >= 20 then "\" else if AbsValue(bsr) >= 17.5 then "`" else "_") + (if AbsValue(bsr) >= 15 then "\" else if AbsValue(bsr) >= 12.5 then "`" else "_") + (if AbsValue(bsr) >= 10 then "\" else if AbsValue(bsr) >= 7.5 then "`" else "_") + (if AbsValue(bsr) >= 5 then "\|" else if AbsValue(bsr) >= 2.5 then "`|" else "_|") else "__________|") + (if bsr >= 5 then "\" else if bsr >= 2.5 then "`" else "_") + (if bsr >= 10 then "\" else if bsr >= 7.5 then "`" else "_") + (if bsr >= 15 then "\" else if bsr >= 12.5 then "`" else "_") + (if bsr >= 20 then "\" else if bsr >= 17.5 then "`" else "_") + (if bsr >= 25 then "\" else if bsr >= 22.5 then "`" else "_") + (if bsr >= 30 then "\" else if bsr >= 27.5 then "`" else "_") + (if bsr >= 35 then "\" else if bsr >= 32.5 then "`" else "_") + (if bsr >= 40 then "\" else if bsr >= 37.5 then "`" else "_") + (if bsr >= 45 then "\" else if bsr >= 42.5 then "`" else "_") + (if bsr >= 50 then "\" else if bsr >= 47.5 then "`" else "_") + "} " else "") + " " +

(if IsNaN(bsr) then "----" else bsr * 2 + "") + "% ", if IsNaN(br) or IsNaN(sr) then Color.DARK_GRAY else if br == 0 then Color.RED else if sr == 0 then Color.GREEN else if u && ut then CreateColor((255 * sr), 255, (255 * sr)) else if d && dt then CreateColor(255, (255 * br), (255 * br)) else Color.ORANGE);

# Cumulative PreMkt Volume Label

AddLabel(yes, "PreMkt Vol: " + (if cmlPmVol >= 1000000 then Round(cmlPmVol / 1000000, 1) else if cmlPmVol >= 1000 then Round(cmlPmVol / 1000, 1) else Round(cmlPmVol / 100) * 100) + (if cmlPmVol >= 1000000 then "M " else if cmlPmVol >= 1000 then "K " else ""), if isPm then if cmlPmVol > avgPMV then Color.GREEN else Color.ORANGE else Color.DARK_GRAY);

# Appearance

DefineGlobalColor("PosVolume", Color.GREEN);

DefineGlobalColor("NegVolume", Color.RED);

DefineGlobalColor("NeutVolume", Color.GRAY);

DefineGlobalColor("CmlVol", Color.BLACK);

AvgVol.SetDefaultColor(Color.YELLOW);

Mid.SetDefaultColor(Color.BLACK);

PreMktOBV.SetDefaultColor(Color.ORANGE);

PosVolume.AssignValueColor(if showPreMktCmlVol && isPm then if u then GlobalColor("PosVolume") else if d then GlobalColor("NegVolume") else GlobalColor("NeutVolume") else (if u then GlobalColor("PosVolume") else if d then GlobalColor("NeutVolume") else GlobalColor("NeutVolume")));

NegVolume.AssignValueColor(if d then GlobalColor("NegVolume") else if u then GlobalColor("NeutVolume") else GlobalColor("NeutVolume"));

PrevCmlVol.AssignValueColor(GlobalColor("CmlVol"));

PosVolume.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

NegVolume.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

PrevCmlVol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Mid.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);Attachments

Last edited by a moderator: