The code in this thread is for the lower chart indicator.

The author states:

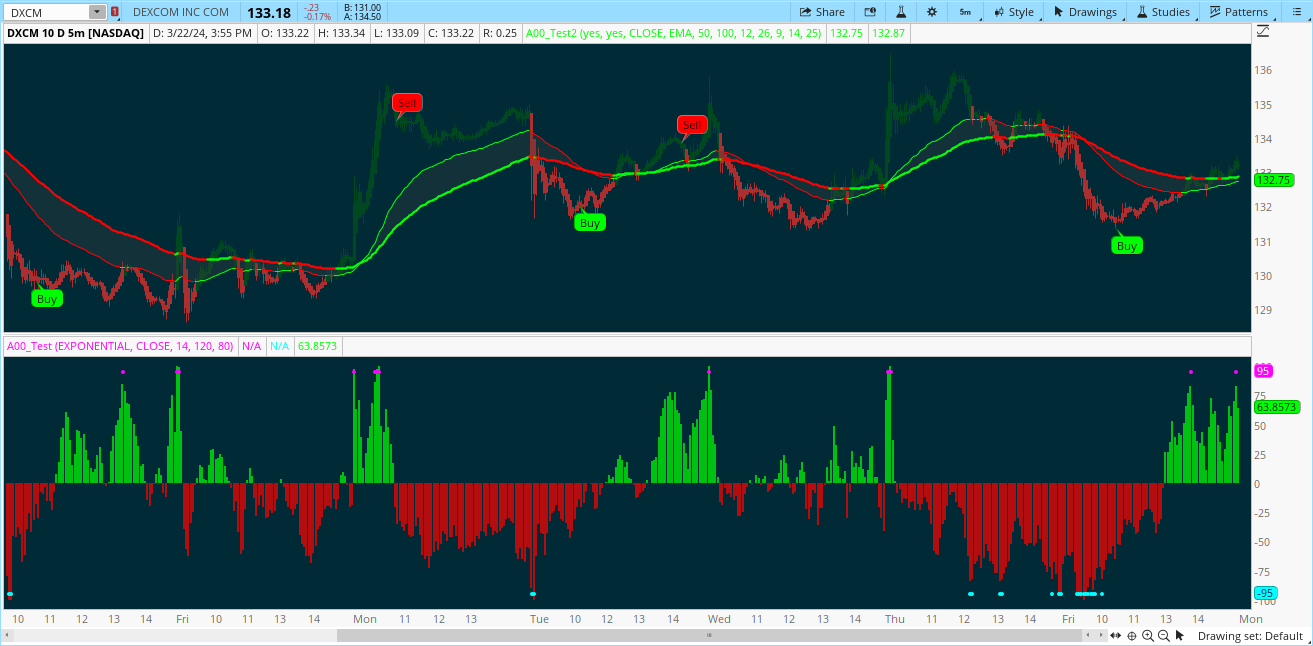

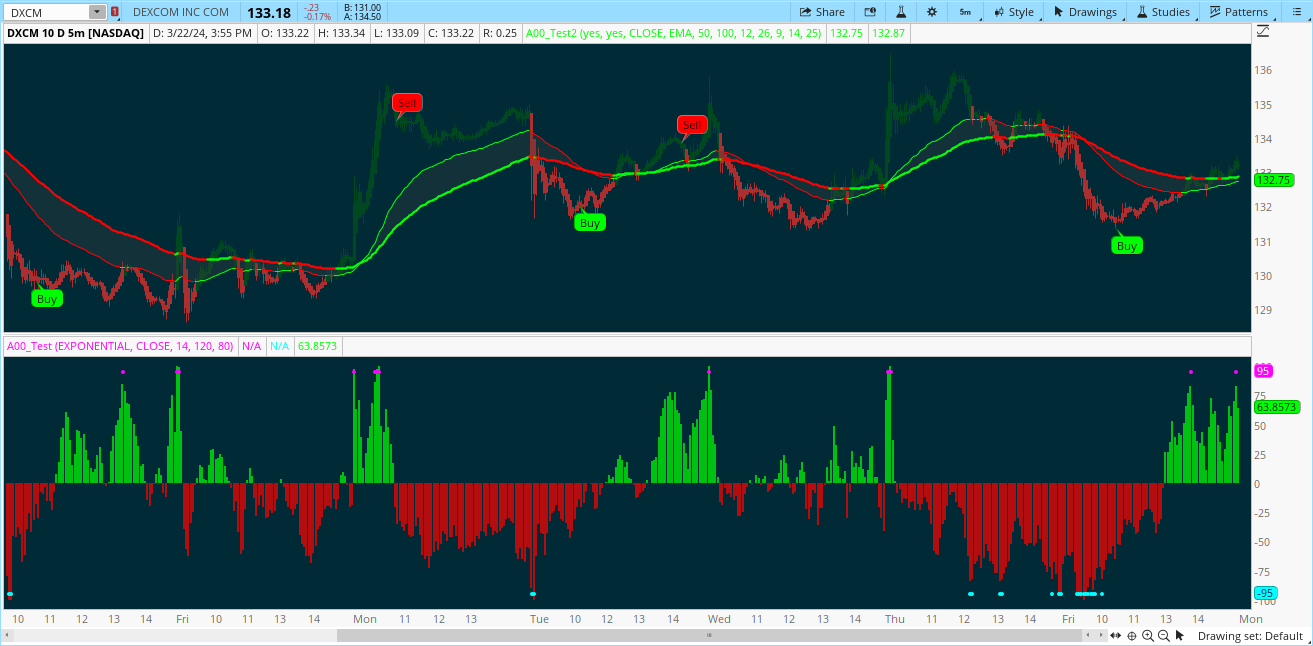

This script helps you identify the relative strength of bulls and bears in the market. It calculates the difference between the high and the moving average for bulls, and the difference between the moving average and the low for bears. Then it normalizes the values between -100 and 100 using the highest and lowest values of the last "bars back" periods. This allows you to compare the current strength of bulls and bears relative to their historical strength.

The output of the script is a colored column chart that represents the difference between the normalized bulls and bears values. If the chart is mostly green, it means the bulls are currently stronger than the bears, and vice versa for a mostly red chart. Additionally, the script provides bullish and bearish signals based on when the normalized bulls cross above or below the user-defined "Line Height" value.

You can use this script to help you identify potential trend changes in the market, as well as to confirm existing trends.

OP states:

https://www.tradingview.com/script/Ap9HknuH-Bulls-v-Bears/).

Appreciate if this is converted as well. Thanks in advance.

The author states:

This script helps you identify the relative strength of bulls and bears in the market. It calculates the difference between the high and the moving average for bulls, and the difference between the moving average and the low for bears. Then it normalizes the values between -100 and 100 using the highest and lowest values of the last "bars back" periods. This allows you to compare the current strength of bulls and bears relative to their historical strength.

The output of the script is a colored column chart that represents the difference between the normalized bulls and bears values. If the chart is mostly green, it means the bulls are currently stronger than the bears, and vice versa for a mostly red chart. Additionally, the script provides bullish and bearish signals based on when the normalized bulls cross above or below the user-defined "Line Height" value.

You can use this script to help you identify potential trend changes in the market, as well as to confirm existing trends.

OP states:

The combination of this lower chart indicator with the upper chart study of Trend Trader https://usethinkscript.com/threads/trend-trader-buy-sell-signals-for-thinkorswim.18271/#post-139736 works really well.

https://www.tradingview.com/script/Ap9HknuH-Bulls-v-Bears/).

Appreciate if this is converted as well. Thanks in advance.

Last edited by a moderator: