Goingdark365

Member

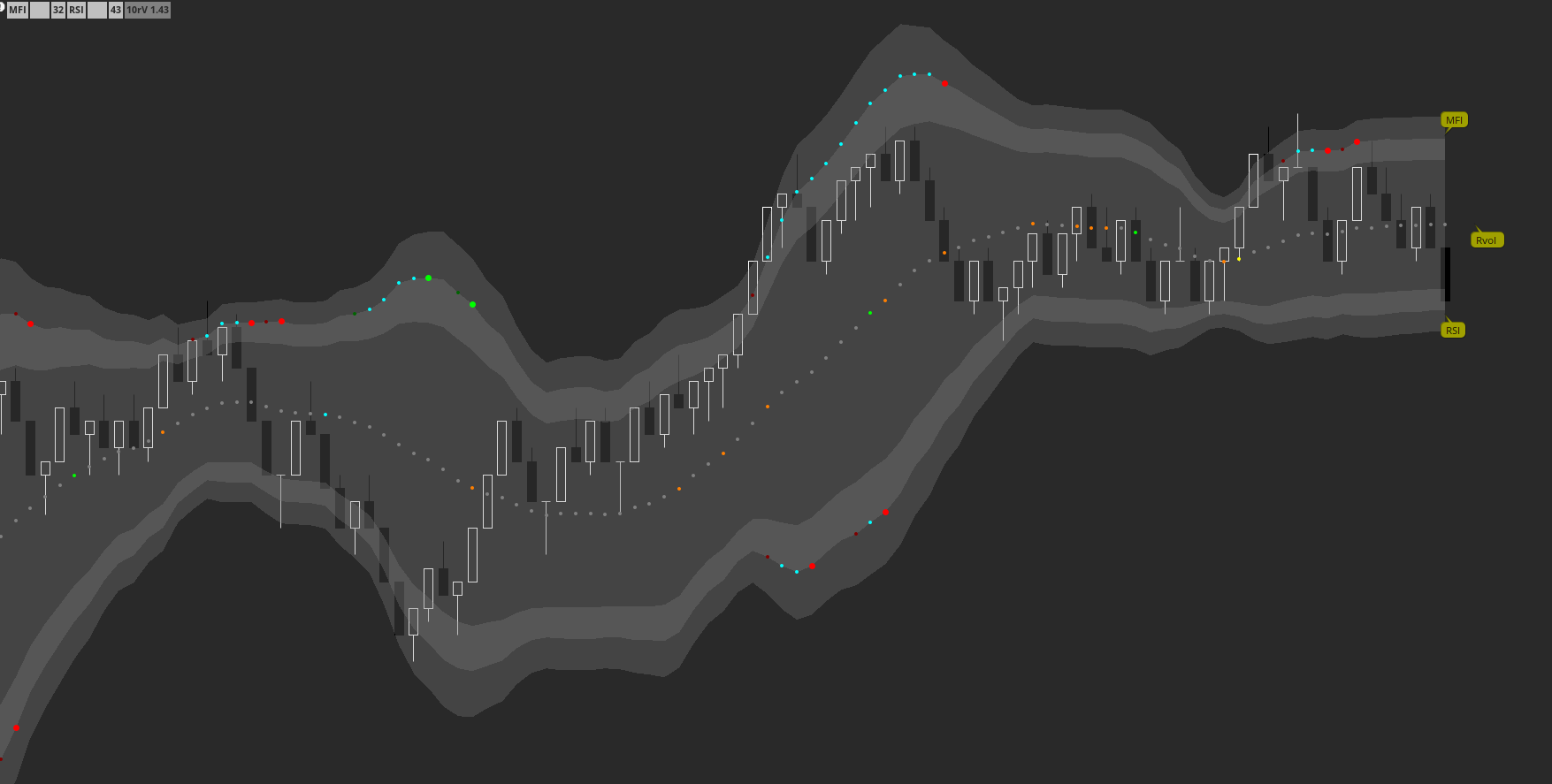

Made this cuple of weeks ago thought i share Bolinger band with Rsi Mfi and rvol all in one

Code:

# created by expertnoob365 aka ziz

# Bollinger Bands WITH

# RSI ENTERING AND EXITING OVER BOUGHT AND OVER SOLD (lower band )

# MFI ENTERING AND EXITING OVER BOUGHT AND OVER SOLD (upper band)

# Dark green points entering over sold

# dark red points entering over bought

# cyan points in over bought ot oversold

# Green larger points EXITING OVER BOUGHT

# Red larger points EXITING OVER Sold

# rvol points vol_To_Avg greater then 3 cyan, greater the 2.6 yellow, greater then 2.0 green, gteater then 1.6 dark orange (Mid Line)

#Added cussion cloudes

#= = = = = Rvol = = = = =

input Rvol_Type = AverageType.SIMPLE;

input RVol_Length = 10 ;

def rvolpaint = yes;

def rvol_color_id = yes;

def rvpoint = no;

def AvgVol = MovingAverage(rvol_Type, volume, RVol_length);

def vol_To_Avg = Round(volume / AvgVol);

def rv1 = 1.6;

def rv2 = 2.0;

def rv3 = 2.6;

def rv4 = 3.0;

def rv1x = vol_To_Avg > rv1 ;

def rv2x = vol_To_Avg > rv2 ;

def rv3x = vol_To_Avg > rv3;

def rv4x = vol_To_Avg > rv4;

#= = = = = Bolinger-Bands = = = = =

input BB_Type = AverageType.Simple;

input BB_Length = 20;

input BB_Price = close;

def displace = 0;

def bbsDev = stdev(data = close[-displace], length = BB_length);

plot MidLine = MovingAverage(BB_Type, data = BB_Price[-displace], length = BB_length);

defineGlobalColor("MIDLINE" , (CreateColor(128,128,128)));

defineGlobalColor("cloud" , (CreateColor(128,128,128)));

defineGlobalColor("upper_cloud" , (CreateColor(128,128,128)));

defineGlobalColor("lower_cloud" , (CreateColor(128,128,128)));

MidLine.AssignValueColor(if rv4x then Color.cyan else if rv3x then Color.YELLOW else if rv2x then Color.GREEN else if rv1x then Color.DARK_ORANGE else GlobalColor("MIDLINE"));

MidLine.HideBubble();

MidLine.SetStyle(Curve.POINTS);

def LowerBand = MidLine - 2 * bbsDev;

def UpperBand = MidLine + 2 * bbsDev;

INPUT Cussion_Clouds = YES;

addCloud(LowerBand, UpperBand, GlobalColor("cloud"), GlobalColor("cloud"));

def upper_up_cloud = IF CUSSION_CLOUDS THEN MidLine + 1.5 * bbsDev ELSE 0;

def upper_lo_cloud = IF CUSSION_CLOUDS THEN MidLine + 2.5 * bbsDev ELSE 0;

addCloud(upper_up_cloud, upper_lo_cloud, GlobalColor("upper_cloud"), GlobalColor("upper_cloud"));

def lower_up_cloud = IF CUSSION_CLOUDS THEN MidLine - 1.5 * bbsDev ELSE 0;

def lower_lo_cloud = IF CUSSION_CLOUDS THEN MidLine - 2.5 * bbsDev ELSE 0;

addCloud(lower_up_cloud, lower_lo_cloud, GlobalColor("upper_cloud"), GlobalColor("upper_cloud"));

#MidLine.AssignValueColor (if Low <= LowerBand AND HL2 > LowerBand or High >= UpperBand AND HL2 < UpperBand then COLOR.CYAN ELSE IF HL2 <= LowerBand or HL2 >= UpperBand THEN COLOR.MAGENTA ELSE GlobalColor("MIDLINE"));

#= = = = = MFI = = = = =

input Mfi_Length = 10;

input Mfi_Over_Sold = 20;

input Mfi_Over_Bought = 80;

def mifmovingAvgLength = 1;

def mfi = Average(moneyflow(high, close, low, volume, Mfi_Length), mifmovingAvgLength);

DEF MIFCROSS_BElow20 = MFI CROSSES BElow Mfi_Over_Sold;#color.CYAN

DEF MFICROSS_above20 = MFI CROSSES above Mfi_Over_Sold;#color.GREEN

DEF MFICROSS_above80 = MFI CROSSES above Mfi_Over_Bought;#color.CYAN

DEF MFICROSS_BElow80 = MFI CROSSES BElow Mfi_Over_Bought;#color.red

defineGlobalColor("MFI" , (CreateColor(41,41,41)));#this hase to be transparrent

plot mfiUPPBand = MidLine + 2.0* bbsDev;

mfiUPPBand.SetStyle(Curve.POINTS);

mfiUPPBand.SETLineWeight(4);

mfiUPPBand.AssignValueColor ( if MFICROSS_above20 then color.GREEN else if MFICROSS_BElow80 then color.red else

GlobalColor("MFI"));

plot mfiUPPBandX = MidLine + 2.0* bbsDev;

mfiUPPBandX.SetStyle(Curve.POINTS);

mfiUPPBandX.SETLineWeight(1);

mfiUPPBandX.AssignValueColor (

if MFICROSS_above80 then color.DARK_red else

IF MIFCROSS_BElow20 then color.DARK_GREEN else

IF mfi > Mfi_Over_Bought then color.CYAN else

if mfi < Mfi_Over_Sold then color.CYAN else

GlobalColor("MFI"));

addLabel(yes, "MFI" , (if

MIFCROSS_BElow20 then color.DARK_GREEN else if

MFICROSS_above80 then color.DARK_red else

color.light_gray));

addLabel(yes, " " , (

IF mfi > Mfi_Over_Bought then color.CYAN else

if mfi < Mfi_Over_Sold then color.CYAN else

color.light_gray));

addLabel(yes, round( mfi,0 ),(if

MFICROSS_above20 then color.GREEN else if

MFICROSS_BElow80 then color.red else

color.light_gray));

#= = = = = RSI = = = = =

input Rsi_Type = AverageType.WILDERS;

input Rsi_Length = 14;

input Rsi_Over_Bought = 70;

input Rsi_Over_Sold = 30;

def NetChgAvg = MovingAverage(Rsi_Type, close - close[1], RSI_length);

def TotChgAvg = MovingAverage(Rsi_Type, AbsValue(close - close[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

DEF RSI = 50 * (ChgRatio + 1);

DEF RSICROSS_BElow30 = IF RSI CROSSES BElow RSI_Over_Sold THEN 1 ELSE 0;#color.CYAN

DEF RSICROSS_above30 = IF RSI CROSSES above RSI_Over_Sold THEN 1 ELSE 0 ;#color.GREEN

DEF RSICROSS_above70 = IF RSI CROSSES above RSI_over_Bought THEN 1 ELSE 0 ;#color.CYAN

DEF RSICROSS_BElow70 = IF RSI CROSSES BElow RSI_over_Bought THEN 1 ELSE 0 ;#color.red

plot RSIUPPBand = MidLine -2.0* bbsDev;

RSIUPPBand.SetStyle(Curve.POINTS);

RSIUPPBand.SETLineWeight(4);

RSIUPPBand.AssignValueColor (

if RSICROSS_above30 then color.GREEN else

if RSICROSS_BElow70 then color.red else

GlobalColor("MFI"));

plot RSIUPPBandX = MidLine - 2.0* bbsDev;

RSIUPPBandX.SetStyle(Curve.POINTS);

RSIUPPBandX.SETLineWeight(1);

RSIUPPBandX.AssignValueColor (

if RSICROSS_above70 then color.DARK_red else

IF RSICROSS_BElow30 then color.DARK_GREEN else

IF RSI > RSI_over_Bought then color.CYAN else

if RSI < RSI_Over_Sold then color.CYAN

else GlobalColor("MFI"));

DEF RSI_BULL = RSICROSS_above30;

DEF RSI_BEAR = RSICROSS_BElow70;

DEF MFI_BULL = MFICROSS_ABOVE20;

DEF MFI_BEAR = MFICROSS_BElow80;

#= = = = = lables = = = = =

addLabel(yes, "RSI" , (if

RSICROSS_BElow30 then color.DARK_GREEN else if

RSICROSS_ABove70 then color.DARK_red else

color.light_gray));

addLabel(yes, " " , (

IF RSI > RSI_over_Bought then color.CYAN else

if RSI < RSI_Over_Sold then color.CYAN else

color.light_gray));

addLabel(yes, round( RSI,0 ),(if

RSICROSS_above30 then color.GREEN else if

RSICROSS_BElow70 then color.red else

color.light_gray));

AddLabel(rvol_color_id, RVol_length + "rV " + vol_To_Avg,

if vol_To_Avg > rv4 then Color.cyan else

if vol_To_Avg > rv3 then Color.YELLOW else

if vol_To_Avg > rv2 then Color.LIGHT_GREEN else

if vol_To_Avg > rv1 then Color.DARK_ORANGE

else Color.GRAY) ;

#= = = = = Bubbles = = = = =

input Bubbles = YES;

input Bubble_Mover = -1;

DEF n1 = Bubble_Mover + 1;

input Rvol_Bubble_Mover = 1;

def Rn1 = Rvol_Bubble_Mover + 1;

DEF RSIBand = MidLine - 2.1 * bbsDev;

DEF MFIBand = MidLine + 2.1 * bbsDev;

DEF RVOLbAND = MIDLINE;

AddChartBubble(bubbles and !IsNaN(close[n1]) and IsNaN(close[bubble_mover]) , RSIBand[N1], "RSI", CreateColor(160,160,0), NO);

AddChartBubble(bubbles and !IsNaN(close[RN1]) and IsNaN(close[Rvol_Bubble_Mover]) , RVOLbAND[RN1], "Rvol " , CreateColor(160,160,0), NO);

AddChartBubble(bubbles and !IsNaN(close[n1]) and IsNaN(close[bubble_mover]) , MFIBand[N1], "MFI", CreateColor(160,160,0), YES);

Last edited: