I have a BB Watchlist on TC2000 I would like to replicate on ToS for a Strategy of Volatility Rising

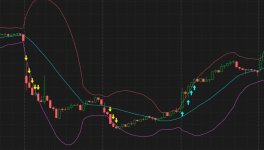

When Upper BB and Lower BB are both widening at a certain rate, it triggers a Tickle, and it is very very useful when applied to several Timefframes, eg, i have it for 1m, 15m, Hr and Day. when 3 or 4 are lit, things are really moving!

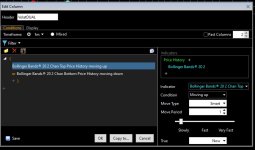

I Share here the coding for TC2000, as well as an image of the Watchlist (it may be useful and profitable for many)

Maybe in ToS it wont show a tickle, but change to white background above certain level might be useful

I hope someone could help me to code it for ToS, it is a very simple, yet useful and powerful indicator

thanks Folks!!

When Upper BB and Lower BB are both widening at a certain rate, it triggers a Tickle, and it is very very useful when applied to several Timefframes, eg, i have it for 1m, 15m, Hr and Day. when 3 or 4 are lit, things are really moving!

I Share here the coding for TC2000, as well as an image of the Watchlist (it may be useful and profitable for many)

Maybe in ToS it wont show a tickle, but change to white background above certain level might be useful

I hope someone could help me to code it for ToS, it is a very simple, yet useful and powerful indicator

thanks Folks!!