You should upgrade or use an alternative browser.

Repaints B4 Balanced BB Breakout For ThinkOrSwim

- Thread starter useThinkScript

- Start date

- Status

- Not open for further replies.

In the long run, I think we need to combine all options into a cohesive selections. This includes the scanner additions as well. I'll try to organize and present.

You and I are on the exact same page!!!MACD_BB is the lines with dots and bollinger band. So, I think we are saying the same thing. There can be an option with entries and exit arrows are selectable, just like we have it for PnL calculation.

In the long run, I think we need to combine all options into a cohesive selections. This includes the scanner additions as well. I'll try to organize and present.

For some reason I was calling that the RSI....? Anyway we are in total agreement!You and I are on the exact same page!!!

@AspaTrader let me know when you finalize the scanner code so we can integrate all together and possibly not have multiple versions posted around. Unexperienced trades reading the history may get confused.MACD_BB is the lines with dots and bollinger band. So, I think we are saying the same thing. There can be an option with entries and exit arrows are selectable, just like we have it for PnL calculation.

In the long run, I think we need to combine all options into a cohesive selections. This includes the scanner additions as well. I'll try to organize and present.

I agree totally and perhaps once we get some of this worked out I’ll go back and make a master page and try to delete some of these entries to cut down on any confusion@AspaTrader let me know when you finalize the scanner code so we can integrate all together and possibly not have multiple versions posted around. Unexperienced trades reading the history may get confused.Trying to help everyone.

Good idea.I agree totally and perhaps once we get some of this worked out I’ll go back and make a master page and try to delete some of these entries to cut down on any confusion

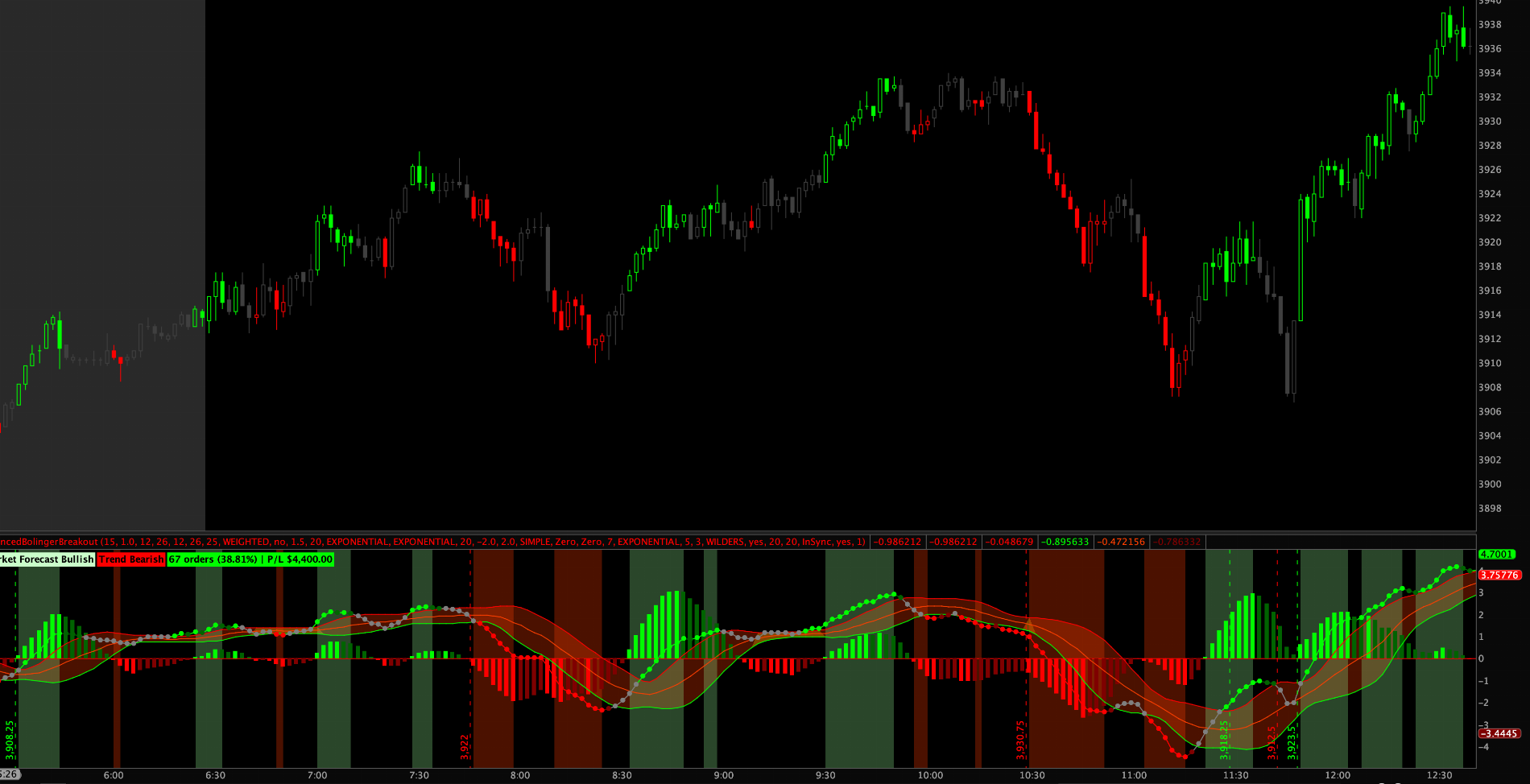

Here is ES, and experimental integration of the indicator with InSync.

Joseph Patrick 18

Active member

Looks amazing!!Well, further improvement with InSync. Check it out from today. Look at the vertical buy and sell levels.

v2.3 is inbound. I'm reviewing the changes.Looks amazing!!

Hey, That’s awesome, I personally like slim ribbons as well. The more withought bogging down the performance the more flexible it is.

Insync is one of my newest favorites. I tested it a few weeks back and loved it. Have so many indicators that I lost it. I have been looking for it for a week. I just realized what it was. I was looking off my phone and did not notice. This is going to be AWS in of you included that. Man you are awesome!!!!!!v2.3 is inbound. I'm reviewing the changes.

I created a scan for it , See if this helps, this is only for bullish.

Ruby:# Balanced BB Breakout Indicator # Free for use. Header credits must be included when any form of the code included in this package is used. # User assumes all risk. Author not responsible for errors or use of tool. # v1.2 - Assembled by Chuck Edwards # v2.0 - Barbaros - cleanup # v2.1 - Barbaros - added RSI IFT, NumberOfShares, BB crossing options # v2.2 - Barbaros - fixed PnL issues and removed intraDay filter #v2.3 - AspaTrader - added Scan code for bullish # Market Forecast def pIntermediate = MarketForecast().Intermediate; def signal_Forecasat = if (pIntermediate > pIntermediate[1] or pIntermediate >= 80) then 1 else 0; # MACD_BB input BBlength = 15; input BBNum_Dev = 1.0; input MACDfastLength = 12; input MACDslowLength = 26; input fastLengthMACD = 12; input slowLengthMACD = 26; input MACDLength = 25; input averageTypeMACD = AverageType.WEIGHTED; input showBreakoutSignals = no; def MACD_Data = MACD(fastLength = MACDfastLength, slowLength = MACDslowLength, MACDLength = MACDLength); def BB_Upper = reference BollingerBands(price = MACD_Data, length = BBlength, Num_Dev_Dn = -BBNum_Dev, Num_Dev_Up = BBNum_Dev).UpperBand; def BB_Lower = reference BollingerBands(price = MACD_Data, length = BBlength, Num_Dev_Dn = -BBNum_Dev, Num_Dev_Up = BBNum_Dev).Lowerband; def BB_Midline = reference BollingerBands(price = MACD_Data, length = BBlength, Num_Dev_Dn = -BBNum_Dev, Num_Dev_Up = BBNum_Dev).MidLine; def signal_MACD = if MACD_Data > MACD_Data[1] and MACD_Data >= BB_Upper or MACD_Data < MACD_Data[1] and MACD_Data >= BB_Upper then 1 else 0; # Keltner Channels input factor = 1.5; input length = 20; input averageType = AverageType.EXPONENTIAL; input trueRangeAverageType = AverageType.EXPONENTIAL; def shift = factor * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), length); def average = MovingAverage(averageType, close, length); def Upper_Band = average + shift; def Lower_Band = average - shift; # Bollinger Bands input BBLength2 = 20; input Num_Dev_Dn = -2.0; input Num_Dev_up = 2.0; input bb_averageType = AverageType.SIMPLE; def sDev = StDev(data = close, length = BBLength2); def MidLine = MovingAverage(bb_averageType, data = close, length = BBLength2); def LowerBand = MidLine + Num_Dev_Dn * sDev; def UpperBand = MidLine + Num_Dev_up * sDev; # BB Alert input BBCrossFromAboveAlert = {default "Zero", "Lower", "Middle", "Upper"}; input BBCrossFromBelowAlert = {default "Zero", "Lower", "Middle", "Upper"}; def BBCrossFromAboveVal = if BBCrossFromAboveAlert == BBCrossFromAboveAlert.Lower then BB_Lower else if BBCrossFromAboveAlert == BBCrossFromAboveAlert.Upper then BB_Upper else 0; def BBCrossFromBelowVal = if BBCrossFromBelowAlert == BBCrossFromBelowAlert.Lower then BB_Lower else if BBCrossFromBelowAlert == BBCrossFromBelowAlert.Upper then BB_Upper else 0; def signal_BB = if MACD_Data crosses above BBCrossFromBelowVal then 1 else 0; # RSI/STOCASTIC/MACD CONFLUENCE COMBO def Value = MovingAverage(averageTypeMACD, close, fastLengthMACD) - MovingAverage(averageTypeMACD, close, slowLengthMACD); def Avg = MovingAverage(averageTypeMACD, Value, MACDLength); def Diff = Value - Avg; def signal_RSI = if Diff >= 0 and Diff > Diff[1] then 1 else 0; def ZeroLine = 0; def UpSignalMACD = if Diff crosses above ZeroLine then ZeroLine else Double.NaN; input lengthRSI = 7; input averageTypeRSI = AverageType.EXPONENTIAL; def NetChgAvg = MovingAverage(averageTypeRSI, close - close[1], lengthRSI); def TotChgAvg = MovingAverage(averageTypeRSI, AbsValue(close - close[1]), lengthRSI); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); input KPeriod = 5; input DPeriod = 3; input averageTypeStoch = AverageType.WILDERS; def SlowK = reference StochasticFull(80, 20, KPeriod, DPeriod, high, low, close, 3, averageTypeStoch).FullK; def SlowD = reference StochasticFull(80, 20, KPeriod, DPeriod, high, low, close, 3, averageTypeStoch).FullD; def rsiGreen = if RSI >= 50 then 1 else Double.NaN; def rsiRed = if RSI < 50 then 1 else Double.NaN; def stochGreen = if SlowK >= 50 then 1 else Double.NaN; def stochRed = if SlowK < 50 then 1 else Double.NaN; def macdGreen = if Value > Avg then 1 else Double.NaN; def macdRed = if Value < Avg then 1 else Double.NaN; def signal_Stoch = if RSI >= 50 and SlowK >= 50 and Value > Avg then 1 else if RSI < 50 and SlowK < 50 and Value < Avg then 0 else 0; # Balance of Power input EMA = 20; input TEMA = 20; def THL = If(high != low, high - low, 0.01); def BullOpen = (high - open) / THL; def BearOpen = (open - low) / THL; def BullClose = (close - low) / THL; def BearClose = (high - close) / THL; def BullOC = If(close > open, (close - open) / THL, 0); def BearOC = If(open > close, (open - close) / THL, 0); def BullReward = (BullOpen + BullClose + BullOC) / 1; def BearReward = (BearOpen + BearClose + BearOC) / 1; def BOP = BullReward - BearReward; def SmoothBOP = ExpAverage(BOP, EMA); def xPrice = SmoothBOP; def xEMA1 = ExpAverage(SmoothBOP, TEMA); def xEMA2 = ExpAverage(xEMA1, TEMA); def xEMA3 = ExpAverage(xEMA2, TEMA); def nRes = 3 * xEMA1 - 3 * xEMA2 + xEMA3; def SmootherBOP = nRes; def s1 = SmoothBOP; def s2 = SmootherBOP; def s3 = SmootherBOP[2]; def BOPshort = s2 < s3 and s2[1] > s3[1]; def BOPlong = s2 > s3 and s2[1] < s3[1]; # RSI IFT def over_Bought = .5; def over_Sold = -.5; def R = reference RSI(5, close) - 50; def AvgRSI = MovingAverage(AverageType.Exponential,R,9); def inverseRSI = (Power(Double.E, 2 * AvgRSI) - 1) / (Power(Double.E, 2 * AvgRSI) + 1); def RSI_IFT_Buy = (inverseRSI > 0) and (inverseRSI[1] < 0); def RSI_IFT_Sell = (inverseRSI[1] > 0) and (inverseRSI < 0); plot signal = if signal_Forecasat and signal_BB and signal_MACD and signal_RSI and signal_Stoch then 1 else 0;

Good job sir! Can you give more explaining for which plot we scan for? Signal?

Green dots are Bullish trend, Red dots are Bearish trend. It works on mobile with limitations......the alerts, dots, P/L and candle color do not work on mobile. The latest update is “......v2.2 on post #70”....(edited) Barbaros is working on the latest improvements and will be posting soon. We are also working on some examples to show how we live to trade this indicator. I will try and update that next week as well as cleaning up this post a bit to have the latest version available on the first page. We are still making improvements to this. It is a work in progress. If while monitoring it you notice any improvements or notice any way to execute better trades using this indicator, please don't hesitate to let us know.Thank you very much. Looks like a great one I ever seen!

I have so many questions please if you have time:

Green dots mean long and red short?

Works on mobile?

Which version is the updated one? Can you guys update the first post?

Guys, latest indicator is v2.2 and it is on post #70. I'll be releasing v2.3 to make it continue from the latest release.Green dots are Bullish trend, Red dots are Bearish trend. It works on mobile with limitations......the alerts, dots, P/L and candle color do not work on mobile. The latest update is v2.3 on post #114. Barbaros is working on the latest improvements and will be posting soon. We are also working on some examples to show how we live to trade this indicator. I will try and update that next week as well as cleaning up this post a bit to have the latest version available on the first page. We are still making improvements to this. It is a work in progress. If while monitoring it you notice any improvements or notice any way to execute better trades using this indicator, please don't hesitate to let us know.

v2.3 on post #114 is scanner only. It is barebones to make scanner work quickly.

@AspaTrader do you mind editing your post and change "v2.3" to "scanner"? I'm currently thinking that we'll have 2 scripts. One for scanner and another for the indicator. I can maintain the indicator and may be you can maintain the scanner. Then, @Chuck can update the original post to include latest version of both scripts.

Sure ... I will work on it...Guys, latest indicator is v2.2 and it is on post #70. I'll be releasing v2.3 to make it continue from the latest release.

v2.3 on post #114 is scanner only. It is barebones to make scanner work quickly.

@AspaTrader do you mind editing your post and change "v2.3" to "scanner"? I'm currently thinking that we'll have 2 scripts. One for scanner and another for the indicator. I can maintain the indicator and may be you can maintain the scanner. Then, @Chuck can update the original post to include latest version of both scripts.

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

RedK Chop & Breakout Scout V2.0 for ThinkOrSwim | Indicators | 20 | |

| G | Potential Breakout (PBO) Indicator for ThinkorSwim | Indicators | 8 | |

|

|

ThinkorSwim Stock Breakout Scanner | Indicators | 11 | |

|

|

Potential Breakout Arrow Plots Indicator for ThinkorSwim | Indicators | 85 | |

| H | TOP Ultimate Breakout Indicator for ThinkorSwim | Indicators | 128 |

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/