You should upgrade or use an alternative browser.

Repaints B4 Balanced BB Breakout For ThinkOrSwim

- Thread starter useThinkScript

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

HuskeyTN

Member

I came across this fancy indicator pulled together by @Chuck and fancified by @barbaros. It has literally given me an awesome tool to work on my strategy and make money instead of bag holding a bunch of healthcare stocks. The creation you all have put together has really helped and made it so much easier to see exactly what is going on with each stock I looked at. I batted 1000 today because of it.

And then I got to take a ride on the RAIL

Just wanted to thank you all for your brains and kindness. I've truly learned so much in this forum. Special thanks to @BenTen (He's everywhere), @mashume (nice work man), @henry1224 (thanks for the knowledge), @XeoNoX (thank you as well), and @Pelonsax (Nice work on the STRAT and use your Finite Volume Element). There are several more thank you's as I've gained so much knowledge here. Just wanted everyone know I greatly appreciate the kindness and selflessness everyone here has. I love this game and will continue to learn and grow so one day I really will become an Investor instead of a Gambler!

Wait... It's not the Redit Support Index?!? What?... I even know what RSI stand for now!...

Seriously, thanks!

-mashume

HuskeyTN

Member

Bwahaha!Wait... It's not the Redit Support Index?!? What?

Seriously, thanks!

-mashume

Sorry to hear about your injury, but it's awesome that, like the rest of us, you are a professional gambler nowFirst off a little back story, if you're already bored you can skip to the next paragraph. I'm a new investor/gambler I guess. I have owned my own businesses for 29 years and was an Assistant Chief and Firefighter for a volunteer department surrounding Dollywood and butting up to the Great Smokey Mountains for 17 years. After a sever back injury involving a ladder and a house fire last year I've found myself at 50 plus, injured, and needing something to motivate me once again. And boy have I found it! I came across an interesting article about GME and going to the Moon and something about a Squeeze. Well who doesn't want to be rich! Then I saw the price of GME and decided to take the ride to the moon on AMC. We know how that has played out. Being a competitive person, that major investing mistake has honestly changed my life. For the last 7 weeks I have studied like it's a final. I even know what RSI stand for now!I have experimented with just about every indicator I can find. And from that realized a few days ago my chart looked like the Matrix threw up spaghetti! That's when...

I came across this fancy indicator pulled together by @Chuck and fancified by @barbaros. It has literally given me an awesome tool to work on my strategy and make money instead of bag holding a bunch of healthcare stocks. The creation you all have put together has really helped and made it so much easier to see exactly what is going on with each stock I looked at. I batted 1000 today because of it.

And then I got to take a ride on the RAIL

Just wanted to thank you all for your brains and kindness. I've truly learned so much in this forum. Special thanks to @BenTen (He's everywhere), @mashume (nice work man), @henry1224 (thanks for the knowledge), @XeoNoX (thank you as well), and @Pelonsax (Nice work on the STRAT and use your Finite Volume Element). There are several more thank you's as I've gained so much knowledge here. Just wanted everyone know I greatly appreciate the kindness and selflessness everyone here has. I love this game and will continue to learn and grow so one day I really will become an Investor instead of a Gambler!Cheers

It's very interesting how you are using @mashume's hull moving average and concavity. Do you find that it has helped you make your entries today?

HuskeyTN

Member

Thanks for the reply. And yes I did, and have, used it for entries/exits. It works great on any time frame. I use it like @Chuck (along with the Balanced BB) and view several times frames. The concavity doesn't lie. I've been trying to combine a scan, using the one for this indicator, and the scan for concavity. Not much success yet, but it found me $RAIL today. This is really great work... May not be holy but it is the grail I'm riding now.Sorry to hear about your injury, but it's awesome that, like the rest of us, you are a professional gambler now

It's very interesting how you are using @mashume's hull moving average and concavity. Do you find that it has helped you make your entries today?

HuskeyTN

Member

I also use it on mobile... The 3 minute chart has worked well. Don't know if there's a way to make the Ballanced BB usable on mobile. From what I've read that can be tricky.Thanks for the reply. And yes I did, and have, used it for entries/exits. It works great on any time frame. I use it like @Chuck (along with the Balanced BB) and view several times frames. The concavity doesn't lie. I've been trying to combine a scan, using the one for this indicator, and the scan for concavity. Not much success yet, but it found me $RAIL today. This is really great work... May not be holy but it is the grail I'm riding now.

Unfortunately, a lot of the thinkscript and rendering functionality are missing in the mobile platform. Some features of this indicator are impossible to support.I also use it on mobile... The 3 minute chart has worked well. Don't know if there's a way to make the Ballanced BB usable on mobile. From what I've read that can be tricky.

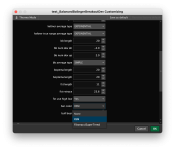

Thank you @barbaros and @Chuck for putting this together. How did it go today with your new updates? Waiting for your updated codeSneak peak shown with /ES...Arrows for entries that combines all methods in this indicator.

So, I added Fibonacci based Super Trend. Lets see how you guys like this.

Bar Colors and Bull/Bear direction have it as an added option.

Also, alerts for entries...no exits yet, but soon.

Attachments

First off a little back story, if you're already bored you can skip to the next paragraph. I'm a new investor/gambler I guess. I have owned my own businesses for 29 years and was an Assistant Chief and Firefighter for a volunteer department surrounding Dollywood and butting up to the Great Smokey Mountains for 17 years. After a sever back injury involving a ladder and a house fire last year I've found myself at 50 plus, injured, and needing something to motivate me once again. And boy have I found it! I came across an interesting article about GME and going to the Moon and something about a Squeeze. Well who doesn't want to be rich! Then I saw the price of GME and decided to take the ride to the moon on AMC. We know how that has played out. Being a competitive person, that major investing mistake has honestly changed my life. For the last 7 weeks I have studied like it's a final. I even know what RSI stand for now!I have experimented with just about every indicator I can find. And from that realized a few days ago my chart looked like the Matrix threw up spaghetti! That's when...

I came across this fancy indicator pulled together by @Chuck and fancified by @barbaros. It has literally given me an awesome tool to work on my strategy and make money instead of bag holding a bunch of healthcare stocks. The creation you all have put together has really helped and made it so much easier to see exactly what is going on with each stock I looked at. I batted 1000 today because of it.

And then I got to take a ride on the RAIL

Just wanted to thank you all for your brains and kindness. I've truly learned so much in this forum. Special thanks to @BenTen (He's everywhere), @mashume (nice work man), @henry1224 (thanks for the knowledge), @XeoNoX (thank you as well), and @Pelonsax (Nice work on the STRAT and use your Finite Volume Element). There are several more thank you's as I've gained so much knowledge here. Just wanted everyone know I greatly appreciate the kindness and selflessness everyone here has. I love this game and will continue to learn and grow so one day I really will become an Investor instead of a Gambler!Cheers

Do

Glad that you recovered back and found this amazing community.what are the red and blue lines?First off a little back story, if you're already bored you can skip to the next paragraph. I'm a new investor/gambler I guess. I have owned my own businesses for 29 years and was an Assistant Chief and Firefighter for a volunteer department surrounding Dollywood and butting up to the Great Smokey Mountains for 17 years. After a sever back injury involving a ladder and a house fire last year I've found myself at 50 plus, injured, and needing something to motivate me once again. And boy have I found it! I came across an interesting article about GME and going to the Moon and something about a Squeeze. Well who doesn't want to be rich! Then I saw the price of GME and decided to take the ride to the moon on AMC. We know how that has played out. Being a competitive person, that major investing mistake has honestly changed my life. For the last 7 weeks I have studied like it's a final. I even know what RSI stand for now!I have experimented with just about every indicator I can find. And from that realized a few days ago my chart looked like the Matrix threw up spaghetti! That's when...

I came across this fancy indicator pulled together by @Chuck and fancified by @barbaros. It has literally given me an awesome tool to work on my strategy and make money instead of bag holding a bunch of healthcare stocks. The creation you all have put together has really helped and made it so much easier to see exactly what is going on with each stock I looked at. I batted 1000 today because of it.

And then I got to take a ride on the RAIL

Just wanted to thank you all for your brains and kindness. I've truly learned so much in this forum. Special thanks to @BenTen (He's everywhere), @mashume (nice work man), @henry1224 (thanks for the knowledge), @XeoNoX (thank you as well), and @Pelonsax (Nice work on the STRAT and use your Finite Volume Element). There are several more thank you's as I've gained so much knowledge here. Just wanted everyone know I greatly appreciate the kindness and selflessness everyone here has. I love this game and will continue to learn and grow so one day I really will become an Investor instead of a Gambler!Cheers

HuskeyTN

Member

Thanks for the reply... The red and blue lines are from the Auto Pivots Support & Resistance Indicator posted by @BenTenDo

Glad that you recovered back and found this amazing community.what are the red and blue lines?

Looking at the code I'm not sure which study this is from the link as there are a few throughout the thread... But it woks for me.

declare upper;

input LookbackPeriod = 5;

input HideCurrentTF = no;

input HideTimeFrame2 = no;

input HideTimeFrame3 = no;

input TimeFrame2 = {"15 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "20 MIN", "30 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", default WEEK, MONTH, "OPT EXP"};

input TimeFrame3 = {"30 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "15 MIN", "20 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", WEEK, default MONTH, "OPT EXP"};

input HideSwings = no;

input SwingsLagBar = 1;

#--------------------------------------------------------------

def _highInPeriod1 = Highest(high, LookbackPeriod);

def _lowInPeriod1 = Lowest(low, LookbackPeriod);

#--------------------------------------------------------------

def marketLow1 = if _lowInPeriod1 < _lowInPeriod1[-LookbackPeriod] then _lowInPeriod1 else _lowInPeriod1[-LookbackPeriod];

def _markedLow1 = low == marketLow1;

rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedLow1) then _lastMarkedLow1[1] else if _markedLow1 then low else _lastMarkedLow1[1], low);

#--------------------------------------------------------------

def marketHigh1 = if _highInPeriod1 > _highInPeriod1[-LookbackPeriod] then _highInPeriod1 else _highInPeriod1[-LookbackPeriod];

def _markedHigh1 = high == marketHigh1;

rec _lastMarkedHigh1 = CompoundValue(1, if IsNaN(_markedHigh1) then _lastMarkedHigh1[1] else if _markedHigh1 then high else _lastMarkedHigh1[1], high);

#--------------------------------------------------------------

plot Resistance1 = _lastMarkedHigh1;

plot Support1 = _lastMarkedLow1;

#--------------------------------------------------------------

Resistance1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Resistance1.SetDefaultColor(Color.MAGENTA);

Resistance1.SetHiding(HideCurrentTF);

#--------------------------------------------------------------

Support1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Support1.SetDefaultColor(Color.YELLOW);

Support1.SetHiding(HideCurrentTF);

#--------------------------------------------------------------

def LowSwingForw = Lowest(low, SwingsLagBar)[-SwingsLagBar];

def LowSwingBack = Lowest(low, LookbackPeriod)[1];

def SwingLow = if low < LowSwingForw and low <= LowSwingBack then 1 else 0;

plot LowSwing = if SwingLow then low else Double.NaN;

LowSwing.hide();

#--------------------------------------------------------------

def HighSwingForw = Highest(high, SwingsLagBar)[-SwingsLagBar];

def HighSwingBack = Highest(high, LookbackPeriod)[1];

def SwingHigh = if high > HighSwingForw and high >= HighSwingBack then 1 else 0;

plot HighSwing = if SwingHigh then high else Double.NaN;

HighSwing.hide();

#--------------------------------------------------------------

HighSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

HighSwing.SetLineWeight(5);

HighSwing.SetDefaultColor(Color.MAGENTA);

HighSwing.SetHiding(HideSwings);

LowSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

LowSwing.SetLineWeight(5);

LowSwing.SetDefaultColor(Color.YELLOW);

LowSwing.SetHiding(HideSwings);

#--------------------------------------------------------------

Alert(HighSwing, "SupRes : Swing High", Alert.BAR, Sound.Bell);

Alert(LowSwing, "SupRes : Swing Low", Alert.BAR, Sound.Bell);

#--------------------------------------------------------------

AddLabel(HighSwing, "SupRes : Swing High", Color.MAGENTA);

AddLabel(LowSwing, "SupRes : Swing Low", Color.YELLOW);

#--------------------------------------------------------------

def _highInPeriod2 = Highest(high(period = TimeFrame2), LookbackPeriod);

def _lowInPeriod2 = Lowest(low(period = TimeFrame2), LookbackPeriod);

#--------------------------------------------------------------

def marketLow2 = if _lowInPeriod2 < _lowInPeriod2[-LookbackPeriod] then _lowInPeriod2 else _lowInPeriod2[-LookbackPeriod];

def _markedLow2 = low(period = TimeFrame2) == marketLow2;

rec _lastMarkedLow2 = CompoundValue(1, if IsNaN(_markedLow2) then _lastMarkedLow2[1] else if _markedLow2 then low(period = TimeFrame2) else _lastMarkedLow2[1], low(period = TimeFrame2));

#--------------------------------------------------------------

def marketHigh2 = if _highInPeriod2 > _highInPeriod2[-LookbackPeriod] then _highInPeriod2 else _highInPeriod2[-LookbackPeriod];

def _markedHigh2 = high(period = TimeFrame2) == marketHigh2;

rec _lastMarkedHigh2 = CompoundValue(1, if IsNaN(_markedHigh2) then _lastMarkedHigh2[1] else if _markedHigh2 then high(period = TimeFrame2) else _lastMarkedHigh2[1], high(period = TimeFrame2));

#--------------------------------------------------------------

plot Resistance2 = _lastMarkedHigh2;

Resistance2.hide();

plot Support2 = _lastMarkedLow2;

Support2.hide();

#--------------------------------------------------------------

Resistance2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Resistance2.SetDefaultColor(Color.MAGENTA);

Resistance2.SetHiding(HideTimeFrame2);

#--------------------------------------------------------------

Support2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Support2.SetDefaultColor(Color.YELLOW);

Support2.SetHiding(HideTimeFrame2);

#--------------------------------------------------------------

def _highInPeriod3 = Highest(high(period = TimeFrame3), LookbackPeriod);

def _lowInPeriod3 = Lowest(low(period = TimeFrame3), LookbackPeriod);

#--------------------------------------------------------------

def marketLow3 = if _lowInPeriod3 < _lowInPeriod3[-LookbackPeriod] then _lowInPeriod3 else _lowInPeriod3[-LookbackPeriod];

def _markedLow3 = low(period = TimeFrame3) == marketLow3;

rec _lastMarkedLow3 = CompoundValue(1, if IsNaN(_markedLow3) then _lastMarkedLow3[1] else if _markedLow3 then low(period = TimeFrame3) else _lastMarkedLow3[1], low(period = TimeFrame3));

#--------------------------------------------------------------

def marketHigh3 = if _highInPeriod3 > _highInPeriod3[-LookbackPeriod] then _highInPeriod3 else _highInPeriod3[-LookbackPeriod];

def _markedHigh3 = high(period = TimeFrame3) == marketHigh3;

rec _lastMarkedHigh3 = CompoundValue(1, if IsNaN(_markedHigh3) then _lastMarkedHigh3[1] else if _markedHigh3 then high(period = TimeFrame3) else _lastMarkedHigh3[1], high(period = TimeFrame3));

#--------------------------------------------------------------

plot Resistance3 = _lastMarkedHigh3;

Resistance3.hide();

plot Support3 = _lastMarkedLow3;

Support3.hide();

#--------------------------------------------------------------

Resistance3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Resistance3.SetDefaultColor(Color.MAGENTA);

Resistance3.SetHiding(HideTimeFrame3);

#--------------------------------------------------------------

Support3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Support3.SetDefaultColor(Color.YELLOW);

Support3.SetHiding(HideTimeFrame3);plot Data = close;agorena123

Member

@barbaros Yes and no, lol. I use the 30m for swing trades and the 5m for day trades. I prefer to have everything aligned but one of my 5m trades was counter trend to the 30m uptrend. Price was below WVAP, the EMAs, and the MACD BB was below the zero line so I took the trade - lasted about 8 bars and profitable.Are you running the 5m and 30m side by side? Are you guys finding that MTF analysis works well?

I have traded it on 2m and recently started looking at 10m.

HuskeyTN

Member

I'm mainly looking for morning gap ups as that's what I'm comfortable with at this point. I start with the 1 minute chart to watch for signals from the Balanced BB and the Hull Concavity indicators. Once I get agreement there I'll move to the 2 minute chart, then the 3. I've waited a couple of times for the 5 minute to align as well. But for some reason the 3 minute has been the closest to good entries/exits it seems. That brings me to a question I have about the default settings in the Balanced BB. I'm becoming familiar with the different moving averages but am having trouble figuring out the perfect combo with what I'm trying to do. The default settings work well for the shorter time frames but wonder if it can do better. I'm backtesting and wading through it but looking for any suggestions anyone might have on tweeking the settings for better signals. Anyone else have any insight or advise on the perfect mix?Are you running the 5m and 30m side by side? Are you guys finding that MTF analysis works well?

I have traded it on 2m and recently started looking at 10m.

Thanks for backtesting. Testing is what we need. I don't have any guidance on longer term trades. Like you, I like to scalp in short time frames.I'm mainly looking for morning gap ups as that's what I'm comfortable with at this point. I start with the 1 minute chart to watch for signals from the Balanced BB and the Hull Concavity indicators. Once I get agreement there I'll move to the 2 minute chart, then the 3. I've waited a couple of times for the 5 minute to align as well. But for some reason the 3 minute has been the closest to good entries/exits it seems. That brings me to a question I have about the default settings in the Balanced BB. I'm becoming familiar with the different moving averages but am having trouble figuring out the perfect combo with what I'm trying to do. The default settings work well for the shorter time frames but wonder if it can do better. I'm backtesting and wading through it but looking for any suggestions anyone might have on tweeking the settings for better signals. Anyone else have any insight or advise on the perfect mix?

I noticed that when trending Rising appears on your label it is dark red, Shouldn't it turn a shade of green when rising? Also I am testing a version I built with the additions of fractal energy and divergence to identify strong trends. I am very excited about how it is performing. I would like you to take a look at it. You will not regret it. bro.chuck.edwards[?]gmail.?

Emailing you right after this.@barbaros,

I noticed that when trending Rising appears on your label it is dark red, Shouldn't it turn a shade of green when rising? Also I am testing a version I built with the additions of fractal energy and divergence to identify strong trends. I am very excited about how it is performing. I would like you to take a look at it. You will not regret it. bro.chuck.edwards[?]gmail.?

There are 2 labels on the left top. One is the "Market Forecast". I reformatted this but didn't change the logic. Market forecast can be rising, but it can be still below 20. If it is, then it will be red. "Trend" label is for MACDBB. Same for that too. It could be below the band and raising but still down trend.

Could we utilize a five color system? Like the MACDBB. Look forward to your email.Emailing you right after this.

There are 2 labels on the left top. One is the "Market Forecast". I reformatted this but didn't change the logic. Market forecast can be rising, but it can be still below 20. If it is, then it will be red. "Trend" label is for MACDBB. Same for that too. It could be below the band and raising but still down trend.

@HuskeyTN is the above code that you are currently using for you charts?Thanks for the reply... The red and blue lines are from the Auto Pivots Support & Resistance Indicator posted by @BenTen

Looking at the code I'm not sure which study this is from the link as there are a few throughout the thread... But it woks for me.

Code:declare upper; input LookbackPeriod = 5; input HideCurrentTF = no; input HideTimeFrame2 = no; input HideTimeFrame3 = no; input TimeFrame2 = {"15 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "20 MIN", "30 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", default WEEK, MONTH, "OPT EXP"}; input TimeFrame3 = {"30 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "15 MIN", "20 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", WEEK, default MONTH, "OPT EXP"}; input HideSwings = no; input SwingsLagBar = 1; #-------------------------------------------------------------- def _highInPeriod1 = Highest(high, LookbackPeriod); def _lowInPeriod1 = Lowest(low, LookbackPeriod); #-------------------------------------------------------------- def marketLow1 = if _lowInPeriod1 < _lowInPeriod1[-LookbackPeriod] then _lowInPeriod1 else _lowInPeriod1[-LookbackPeriod]; def _markedLow1 = low == marketLow1; rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedLow1) then _lastMarkedLow1[1] else if _markedLow1 then low else _lastMarkedLow1[1], low); #-------------------------------------------------------------- def marketHigh1 = if _highInPeriod1 > _highInPeriod1[-LookbackPeriod] then _highInPeriod1 else _highInPeriod1[-LookbackPeriod]; def _markedHigh1 = high == marketHigh1; rec _lastMarkedHigh1 = CompoundValue(1, if IsNaN(_markedHigh1) then _lastMarkedHigh1[1] else if _markedHigh1 then high else _lastMarkedHigh1[1], high); #-------------------------------------------------------------- plot Resistance1 = _lastMarkedHigh1; plot Support1 = _lastMarkedLow1; #-------------------------------------------------------------- Resistance1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance1.SetDefaultColor(Color.MAGENTA); Resistance1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- Support1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support1.SetDefaultColor(Color.YELLOW); Support1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- def LowSwingForw = Lowest(low, SwingsLagBar)[-SwingsLagBar]; def LowSwingBack = Lowest(low, LookbackPeriod)[1]; def SwingLow = if low < LowSwingForw and low <= LowSwingBack then 1 else 0; plot LowSwing = if SwingLow then low else Double.NaN; LowSwing.hide(); #-------------------------------------------------------------- def HighSwingForw = Highest(high, SwingsLagBar)[-SwingsLagBar]; def HighSwingBack = Highest(high, LookbackPeriod)[1]; def SwingHigh = if high > HighSwingForw and high >= HighSwingBack then 1 else 0; plot HighSwing = if SwingHigh then high else Double.NaN; HighSwing.hide(); #-------------------------------------------------------------- HighSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); HighSwing.SetLineWeight(5); HighSwing.SetDefaultColor(Color.MAGENTA); HighSwing.SetHiding(HideSwings); LowSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); LowSwing.SetLineWeight(5); LowSwing.SetDefaultColor(Color.YELLOW); LowSwing.SetHiding(HideSwings); #-------------------------------------------------------------- Alert(HighSwing, "SupRes : Swing High", Alert.BAR, Sound.Bell); Alert(LowSwing, "SupRes : Swing Low", Alert.BAR, Sound.Bell); #-------------------------------------------------------------- AddLabel(HighSwing, "SupRes : Swing High", Color.MAGENTA); AddLabel(LowSwing, "SupRes : Swing Low", Color.YELLOW); #-------------------------------------------------------------- def _highInPeriod2 = Highest(high(period = TimeFrame2), LookbackPeriod); def _lowInPeriod2 = Lowest(low(period = TimeFrame2), LookbackPeriod); #-------------------------------------------------------------- def marketLow2 = if _lowInPeriod2 < _lowInPeriod2[-LookbackPeriod] then _lowInPeriod2 else _lowInPeriod2[-LookbackPeriod]; def _markedLow2 = low(period = TimeFrame2) == marketLow2; rec _lastMarkedLow2 = CompoundValue(1, if IsNaN(_markedLow2) then _lastMarkedLow2[1] else if _markedLow2 then low(period = TimeFrame2) else _lastMarkedLow2[1], low(period = TimeFrame2)); #-------------------------------------------------------------- def marketHigh2 = if _highInPeriod2 > _highInPeriod2[-LookbackPeriod] then _highInPeriod2 else _highInPeriod2[-LookbackPeriod]; def _markedHigh2 = high(period = TimeFrame2) == marketHigh2; rec _lastMarkedHigh2 = CompoundValue(1, if IsNaN(_markedHigh2) then _lastMarkedHigh2[1] else if _markedHigh2 then high(period = TimeFrame2) else _lastMarkedHigh2[1], high(period = TimeFrame2)); #-------------------------------------------------------------- plot Resistance2 = _lastMarkedHigh2; Resistance2.hide(); plot Support2 = _lastMarkedLow2; Support2.hide(); #-------------------------------------------------------------- Resistance2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance2.SetDefaultColor(Color.MAGENTA); Resistance2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- Support2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support2.SetDefaultColor(Color.YELLOW); Support2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- def _highInPeriod3 = Highest(high(period = TimeFrame3), LookbackPeriod); def _lowInPeriod3 = Lowest(low(period = TimeFrame3), LookbackPeriod); #-------------------------------------------------------------- def marketLow3 = if _lowInPeriod3 < _lowInPeriod3[-LookbackPeriod] then _lowInPeriod3 else _lowInPeriod3[-LookbackPeriod]; def _markedLow3 = low(period = TimeFrame3) == marketLow3; rec _lastMarkedLow3 = CompoundValue(1, if IsNaN(_markedLow3) then _lastMarkedLow3[1] else if _markedLow3 then low(period = TimeFrame3) else _lastMarkedLow3[1], low(period = TimeFrame3)); #-------------------------------------------------------------- def marketHigh3 = if _highInPeriod3 > _highInPeriod3[-LookbackPeriod] then _highInPeriod3 else _highInPeriod3[-LookbackPeriod]; def _markedHigh3 = high(period = TimeFrame3) == marketHigh3; rec _lastMarkedHigh3 = CompoundValue(1, if IsNaN(_markedHigh3) then _lastMarkedHigh3[1] else if _markedHigh3 then high(period = TimeFrame3) else _lastMarkedHigh3[1], high(period = TimeFrame3)); #-------------------------------------------------------------- plot Resistance3 = _lastMarkedHigh3; Resistance3.hide(); plot Support3 = _lastMarkedLow3; Support3.hide(); #-------------------------------------------------------------- Resistance3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance3.SetDefaultColor(Color.MAGENTA); Resistance3.SetHiding(HideTimeFrame3); #-------------------------------------------------------------- Support3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support3.SetDefaultColor(Color.YELLOW); Support3.SetHiding(HideTimeFrame3);plot Data = close;

Thank you! I'm not surThanks for the reply... The red and blue lines are from the Auto Pivots Support & Resistance Indicator posted by @BenTen

Looking at the code I'm not sure which study this is from the link as there are a few throughout the thread... But it woks for me.

Code:declare upper; input LookbackPeriod = 5; input HideCurrentTF = no; input HideTimeFrame2 = no; input HideTimeFrame3 = no; input TimeFrame2 = {"15 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "20 MIN", "30 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", default WEEK, MONTH, "OPT EXP"}; input TimeFrame3 = {"30 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "15 MIN", "20 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", WEEK, default MONTH, "OPT EXP"}; input HideSwings = no; input SwingsLagBar = 1; #-------------------------------------------------------------- def _highInPeriod1 = Highest(high, LookbackPeriod); def _lowInPeriod1 = Lowest(low, LookbackPeriod); #-------------------------------------------------------------- def marketLow1 = if _lowInPeriod1 < _lowInPeriod1[-LookbackPeriod] then _lowInPeriod1 else _lowInPeriod1[-LookbackPeriod]; def _markedLow1 = low == marketLow1; rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedLow1) then _lastMarkedLow1[1] else if _markedLow1 then low else _lastMarkedLow1[1], low); #-------------------------------------------------------------- def marketHigh1 = if _highInPeriod1 > _highInPeriod1[-LookbackPeriod] then _highInPeriod1 else _highInPeriod1[-LookbackPeriod]; def _markedHigh1 = high == marketHigh1; rec _lastMarkedHigh1 = CompoundValue(1, if IsNaN(_markedHigh1) then _lastMarkedHigh1[1] else if _markedHigh1 then high else _lastMarkedHigh1[1], high); #-------------------------------------------------------------- plot Resistance1 = _lastMarkedHigh1; plot Support1 = _lastMarkedLow1; #-------------------------------------------------------------- Resistance1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance1.SetDefaultColor(Color.MAGENTA); Resistance1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- Support1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support1.SetDefaultColor(Color.YELLOW); Support1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- def LowSwingForw = Lowest(low, SwingsLagBar)[-SwingsLagBar]; def LowSwingBack = Lowest(low, LookbackPeriod)[1]; def SwingLow = if low < LowSwingForw and low <= LowSwingBack then 1 else 0; plot LowSwing = if SwingLow then low else Double.NaN; LowSwing.hide(); #-------------------------------------------------------------- def HighSwingForw = Highest(high, SwingsLagBar)[-SwingsLagBar]; def HighSwingBack = Highest(high, LookbackPeriod)[1]; def SwingHigh = if high > HighSwingForw and high >= HighSwingBack then 1 else 0; plot HighSwing = if SwingHigh then high else Double.NaN; HighSwing.hide(); #-------------------------------------------------------------- HighSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); HighSwing.SetLineWeight(5); HighSwing.SetDefaultColor(Color.MAGENTA); HighSwing.SetHiding(HideSwings); LowSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); LowSwing.SetLineWeight(5); LowSwing.SetDefaultColor(Color.YELLOW); LowSwing.SetHiding(HideSwings); #-------------------------------------------------------------- Alert(HighSwing, "SupRes : Swing High", Alert.BAR, Sound.Bell); Alert(LowSwing, "SupRes : Swing Low", Alert.BAR, Sound.Bell); #-------------------------------------------------------------- AddLabel(HighSwing, "SupRes : Swing High", Color.MAGENTA); AddLabel(LowSwing, "SupRes : Swing Low", Color.YELLOW); #-------------------------------------------------------------- def _highInPeriod2 = Highest(high(period = TimeFrame2), LookbackPeriod); def _lowInPeriod2 = Lowest(low(period = TimeFrame2), LookbackPeriod); #-------------------------------------------------------------- def marketLow2 = if _lowInPeriod2 < _lowInPeriod2[-LookbackPeriod] then _lowInPeriod2 else _lowInPeriod2[-LookbackPeriod]; def _markedLow2 = low(period = TimeFrame2) == marketLow2; rec _lastMarkedLow2 = CompoundValue(1, if IsNaN(_markedLow2) then _lastMarkedLow2[1] else if _markedLow2 then low(period = TimeFrame2) else _lastMarkedLow2[1], low(period = TimeFrame2)); #-------------------------------------------------------------- def marketHigh2 = if _highInPeriod2 > _highInPeriod2[-LookbackPeriod] then _highInPeriod2 else _highInPeriod2[-LookbackPeriod]; def _markedHigh2 = high(period = TimeFrame2) == marketHigh2; rec _lastMarkedHigh2 = CompoundValue(1, if IsNaN(_markedHigh2) then _lastMarkedHigh2[1] else if _markedHigh2 then high(period = TimeFrame2) else _lastMarkedHigh2[1], high(period = TimeFrame2)); #-------------------------------------------------------------- plot Resistance2 = _lastMarkedHigh2; Resistance2.hide(); plot Support2 = _lastMarkedLow2; Support2.hide(); #-------------------------------------------------------------- Resistance2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance2.SetDefaultColor(Color.MAGENTA); Resistance2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- Support2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support2.SetDefaultColor(Color.YELLOW); Support2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- def _highInPeriod3 = Highest(high(period = TimeFrame3), LookbackPeriod); def _lowInPeriod3 = Lowest(low(period = TimeFrame3), LookbackPeriod); #-------------------------------------------------------------- def marketLow3 = if _lowInPeriod3 < _lowInPeriod3[-LookbackPeriod] then _lowInPeriod3 else _lowInPeriod3[-LookbackPeriod]; def _markedLow3 = low(period = TimeFrame3) == marketLow3; rec _lastMarkedLow3 = CompoundValue(1, if IsNaN(_markedLow3) then _lastMarkedLow3[1] else if _markedLow3 then low(period = TimeFrame3) else _lastMarkedLow3[1], low(period = TimeFrame3)); #-------------------------------------------------------------- def marketHigh3 = if _highInPeriod3 > _highInPeriod3[-LookbackPeriod] then _highInPeriod3 else _highInPeriod3[-LookbackPeriod]; def _markedHigh3 = high(period = TimeFrame3) == marketHigh3; rec _lastMarkedHigh3 = CompoundValue(1, if IsNaN(_markedHigh3) then _lastMarkedHigh3[1] else if _markedHigh3 then high(period = TimeFrame3) else _lastMarkedHigh3[1], high(period = TimeFrame3)); #-------------------------------------------------------------- plot Resistance3 = _lastMarkedHigh3; Resistance3.hide(); plot Support3 = _lastMarkedLow3; Support3.hide(); #-------------------------------------------------------------- Resistance3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance3.SetDefaultColor(Color.MAGENTA); Resistance3.SetHiding(HideTimeFrame3); #-------------------------------------------------------------- Support3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support3.SetDefaultColor(Color.YELLOW); Support3.SetHiding(HideTimeFrame3);plot Data = close;

Thank you! Hull Concavity - i'm still having hard time in understanding thisThanks for the reply... The red and blue lines are from the Auto Pivots Support & Resistance Indicator posted by @BenTen

Looking at the code I'm not sure which study this is from the link as there are a few throughout the thread... But it woks for me.

Code:declare upper; input LookbackPeriod = 5; input HideCurrentTF = no; input HideTimeFrame2 = no; input HideTimeFrame3 = no; input TimeFrame2 = {"15 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "20 MIN", "30 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", default WEEK, MONTH, "OPT EXP"}; input TimeFrame3 = {"30 MIN", "1 MIN", "2 MIN", "3 MIN", "4 MIN", "5 MIN", "10 MIN", "15 MIN", "20 MIN", "1 HOUR", "2 HOURS", "4 HOURS", DAY, "2 DAYS", "3 DAYS", "4 DAYS", WEEK, default MONTH, "OPT EXP"}; input HideSwings = no; input SwingsLagBar = 1; #-------------------------------------------------------------- def _highInPeriod1 = Highest(high, LookbackPeriod); def _lowInPeriod1 = Lowest(low, LookbackPeriod); #-------------------------------------------------------------- def marketLow1 = if _lowInPeriod1 < _lowInPeriod1[-LookbackPeriod] then _lowInPeriod1 else _lowInPeriod1[-LookbackPeriod]; def _markedLow1 = low == marketLow1; rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedLow1) then _lastMarkedLow1[1] else if _markedLow1 then low else _lastMarkedLow1[1], low); #-------------------------------------------------------------- def marketHigh1 = if _highInPeriod1 > _highInPeriod1[-LookbackPeriod] then _highInPeriod1 else _highInPeriod1[-LookbackPeriod]; def _markedHigh1 = high == marketHigh1; rec _lastMarkedHigh1 = CompoundValue(1, if IsNaN(_markedHigh1) then _lastMarkedHigh1[1] else if _markedHigh1 then high else _lastMarkedHigh1[1], high); #-------------------------------------------------------------- plot Resistance1 = _lastMarkedHigh1; plot Support1 = _lastMarkedLow1; #-------------------------------------------------------------- Resistance1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance1.SetDefaultColor(Color.MAGENTA); Resistance1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- Support1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support1.SetDefaultColor(Color.YELLOW); Support1.SetHiding(HideCurrentTF); #-------------------------------------------------------------- def LowSwingForw = Lowest(low, SwingsLagBar)[-SwingsLagBar]; def LowSwingBack = Lowest(low, LookbackPeriod)[1]; def SwingLow = if low < LowSwingForw and low <= LowSwingBack then 1 else 0; plot LowSwing = if SwingLow then low else Double.NaN; LowSwing.hide(); #-------------------------------------------------------------- def HighSwingForw = Highest(high, SwingsLagBar)[-SwingsLagBar]; def HighSwingBack = Highest(high, LookbackPeriod)[1]; def SwingHigh = if high > HighSwingForw and high >= HighSwingBack then 1 else 0; plot HighSwing = if SwingHigh then high else Double.NaN; HighSwing.hide(); #-------------------------------------------------------------- HighSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); HighSwing.SetLineWeight(5); HighSwing.SetDefaultColor(Color.MAGENTA); HighSwing.SetHiding(HideSwings); LowSwing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); LowSwing.SetLineWeight(5); LowSwing.SetDefaultColor(Color.YELLOW); LowSwing.SetHiding(HideSwings); #-------------------------------------------------------------- Alert(HighSwing, "SupRes : Swing High", Alert.BAR, Sound.Bell); Alert(LowSwing, "SupRes : Swing Low", Alert.BAR, Sound.Bell); #-------------------------------------------------------------- AddLabel(HighSwing, "SupRes : Swing High", Color.MAGENTA); AddLabel(LowSwing, "SupRes : Swing Low", Color.YELLOW); #-------------------------------------------------------------- def _highInPeriod2 = Highest(high(period = TimeFrame2), LookbackPeriod); def _lowInPeriod2 = Lowest(low(period = TimeFrame2), LookbackPeriod); #-------------------------------------------------------------- def marketLow2 = if _lowInPeriod2 < _lowInPeriod2[-LookbackPeriod] then _lowInPeriod2 else _lowInPeriod2[-LookbackPeriod]; def _markedLow2 = low(period = TimeFrame2) == marketLow2; rec _lastMarkedLow2 = CompoundValue(1, if IsNaN(_markedLow2) then _lastMarkedLow2[1] else if _markedLow2 then low(period = TimeFrame2) else _lastMarkedLow2[1], low(period = TimeFrame2)); #-------------------------------------------------------------- def marketHigh2 = if _highInPeriod2 > _highInPeriod2[-LookbackPeriod] then _highInPeriod2 else _highInPeriod2[-LookbackPeriod]; def _markedHigh2 = high(period = TimeFrame2) == marketHigh2; rec _lastMarkedHigh2 = CompoundValue(1, if IsNaN(_markedHigh2) then _lastMarkedHigh2[1] else if _markedHigh2 then high(period = TimeFrame2) else _lastMarkedHigh2[1], high(period = TimeFrame2)); #-------------------------------------------------------------- plot Resistance2 = _lastMarkedHigh2; Resistance2.hide(); plot Support2 = _lastMarkedLow2; Support2.hide(); #-------------------------------------------------------------- Resistance2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance2.SetDefaultColor(Color.MAGENTA); Resistance2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- Support2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support2.SetDefaultColor(Color.YELLOW); Support2.SetHiding(HideTimeFrame2); #-------------------------------------------------------------- def _highInPeriod3 = Highest(high(period = TimeFrame3), LookbackPeriod); def _lowInPeriod3 = Lowest(low(period = TimeFrame3), LookbackPeriod); #-------------------------------------------------------------- def marketLow3 = if _lowInPeriod3 < _lowInPeriod3[-LookbackPeriod] then _lowInPeriod3 else _lowInPeriod3[-LookbackPeriod]; def _markedLow3 = low(period = TimeFrame3) == marketLow3; rec _lastMarkedLow3 = CompoundValue(1, if IsNaN(_markedLow3) then _lastMarkedLow3[1] else if _markedLow3 then low(period = TimeFrame3) else _lastMarkedLow3[1], low(period = TimeFrame3)); #-------------------------------------------------------------- def marketHigh3 = if _highInPeriod3 > _highInPeriod3[-LookbackPeriod] then _highInPeriod3 else _highInPeriod3[-LookbackPeriod]; def _markedHigh3 = high(period = TimeFrame3) == marketHigh3; rec _lastMarkedHigh3 = CompoundValue(1, if IsNaN(_markedHigh3) then _lastMarkedHigh3[1] else if _markedHigh3 then high(period = TimeFrame3) else _lastMarkedHigh3[1], high(period = TimeFrame3)); #-------------------------------------------------------------- plot Resistance3 = _lastMarkedHigh3; Resistance3.hide(); plot Support3 = _lastMarkedLow3; Support3.hide(); #-------------------------------------------------------------- Resistance3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Resistance3.SetDefaultColor(Color.MAGENTA); Resistance3.SetHiding(HideTimeFrame3); #-------------------------------------------------------------- Support3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); Support3.SetDefaultColor(Color.YELLOW); Support3.SetHiding(HideTimeFrame3);plot Data = close;

- Status

- Not open for further replies.

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

RedK Chop & Breakout Scout V2.0 for ThinkOrSwim | Indicators | 20 | |

| G | Potential Breakout (PBO) Indicator for ThinkorSwim | Indicators | 8 | |

|

|

ThinkorSwim Stock Breakout Scanner | Indicators | 11 | |

|

|

Potential Breakout Arrow Plots Indicator for ThinkorSwim | Indicators | 85 | |

| H | TOP Ultimate Breakout Indicator for ThinkorSwim | Indicators | 128 |

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

Similar threads

-

-

-

-

Potential Breakout Arrow Plots Indicator for ThinkorSwim

- Started by YungTraderFromMontana

- Replies: 85

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/