All other Automatic Fib indicators look at the past, measure a previous high and previous low and give you levels. This indicator looks into the future and gives you possible high and low price levels. The Automatic Fibonacci Levels are two indicators, one for long positions and one for short positions. Up and Down arrows show entry signals when price crosses the 78.6% level. Entry signal alerts are included. This can be used for both swing trading and day trading based on the timeframe of your chart.

If price continues and breaks the 100% level, a new set of lines will be automatically drawn. Note, no guarantee price will hit the target.

Here are some examples.

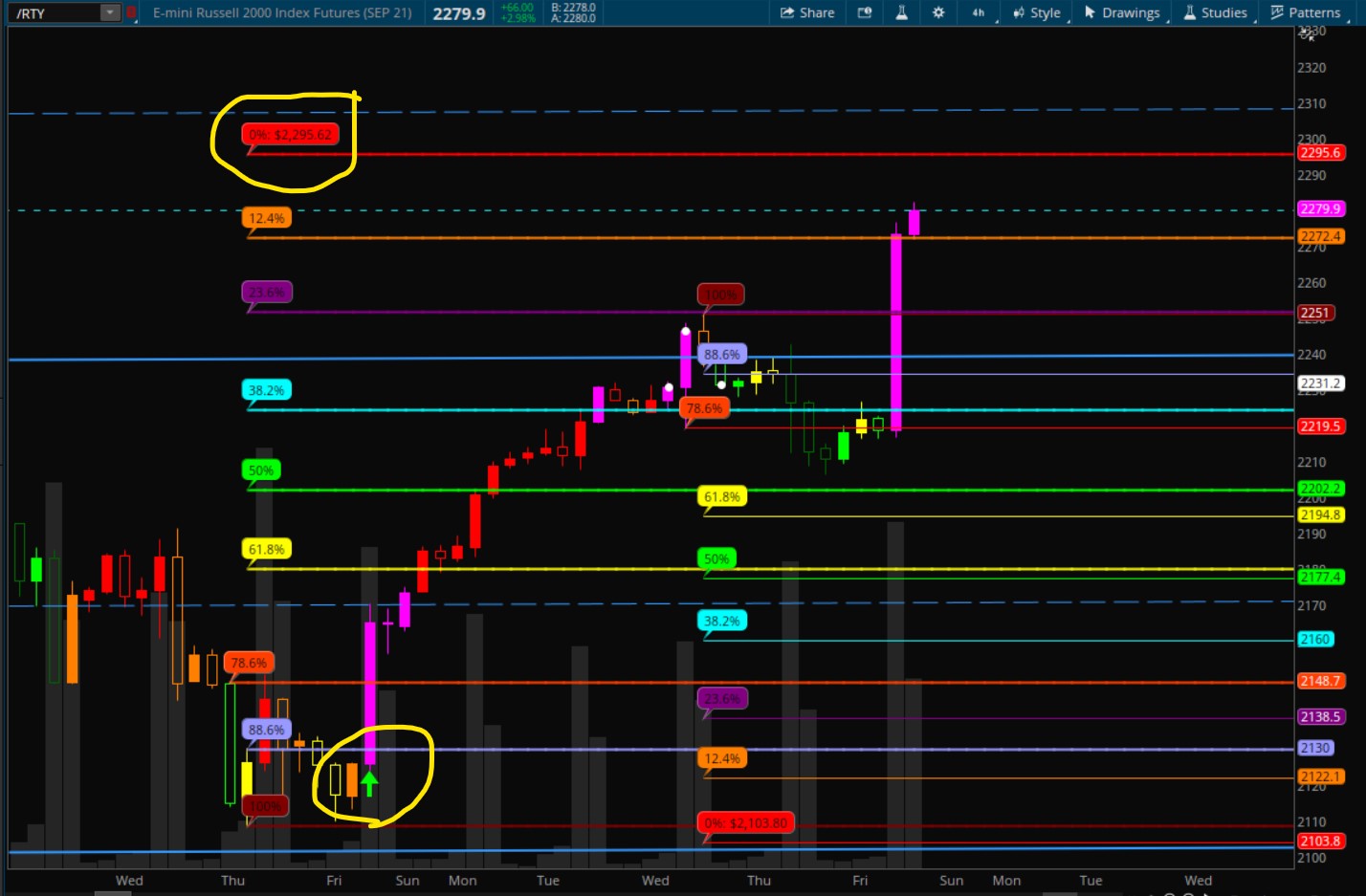

Long position in /RTY 4 hr.

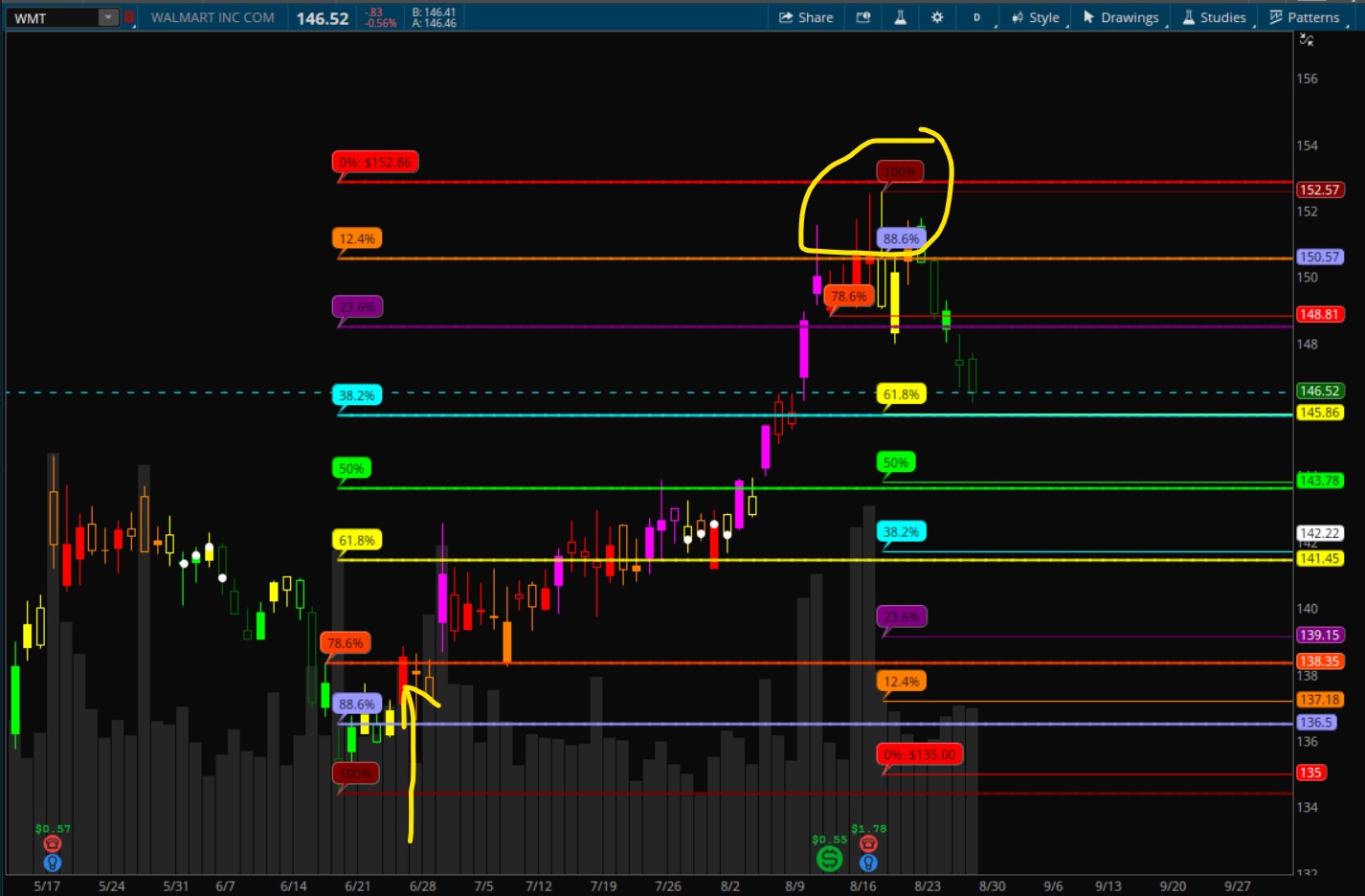

Long position in WMT daily.

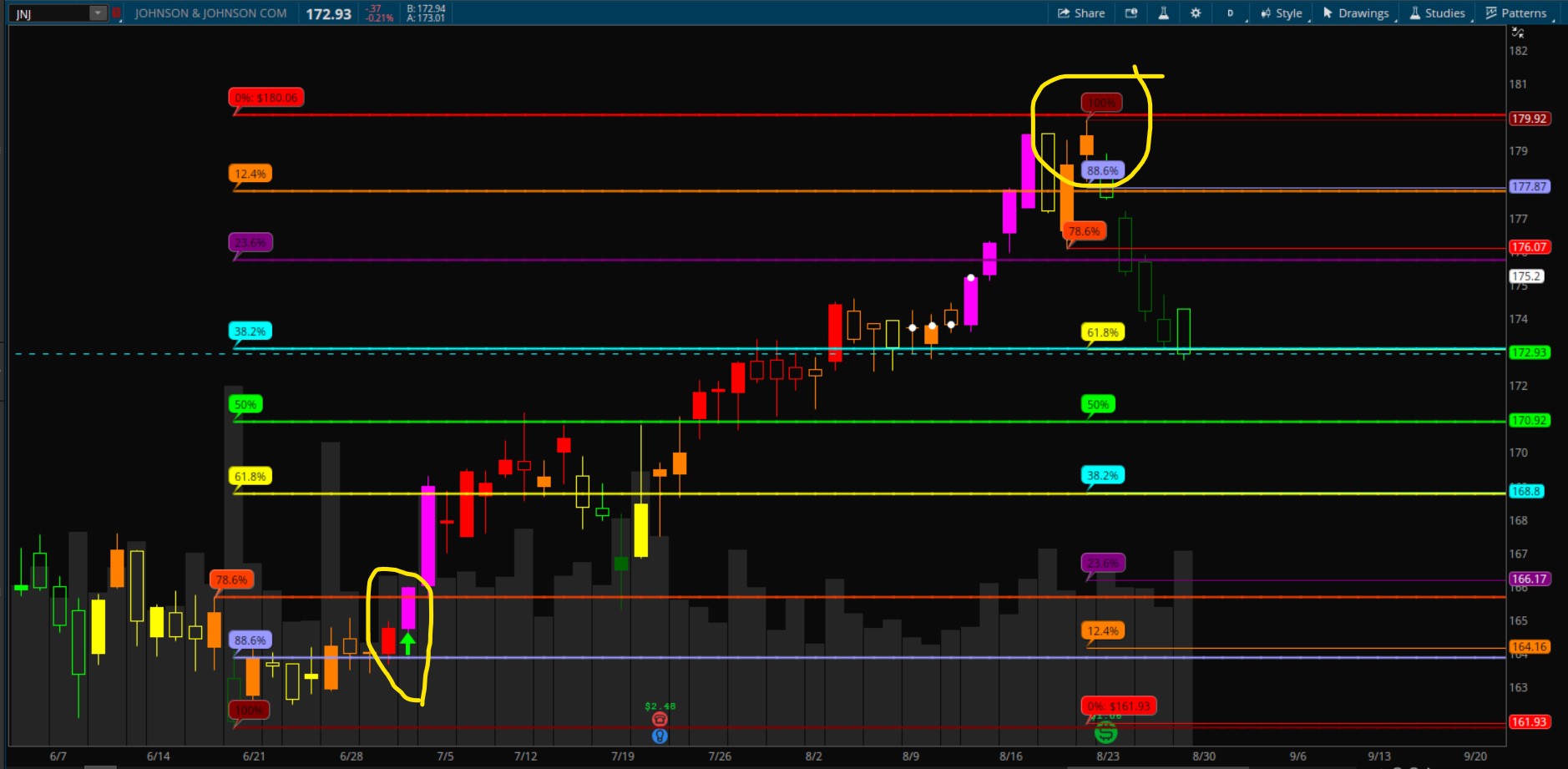

Long position in JNJ daily.

Short position in /SI daily.

Short position in HRZN 4 hr.

Shareable Link:

Long position:

http://tos.mx/AyuB4pQ

Short position:

http://tos.mx/1IJ4a4L

Long Position Code:

Short Position Code:

If price continues and breaks the 100% level, a new set of lines will be automatically drawn. Note, no guarantee price will hit the target.

Here are some examples.

Long position in /RTY 4 hr.

Long position in WMT daily.

Long position in JNJ daily.

Short position in /SI daily.

Short position in HRZN 4 hr.

Shareable Link:

Long position:

http://tos.mx/AyuB4pQ

Short position:

http://tos.mx/1IJ4a4L

Long Position Code:

Code:

#Automatic Fibonacci Long Levels

#based on Mobius's Fractal Pivot Strategy

#developed by Chewie76 on 8/27/2021

# User Inputs

input n = 20;

input FractalEnergyLength = 8;

input FractalEnergyThreshold = .68;

input AtrMult = .70;

input nATR = 4;

input AvgType = AverageType.HULL;

input LabelsOn = yes;

input AlertsOn = yes;

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def TS = TickSize();

def nan = double.nan;

def ATR = Round((MovingAverage(AvgType, TrueRange(h, c, l), nATR)) / TS, 0) * TS;

def risk = if Between(c, 0, 1500)

then ATR

else if Between(c, 1500, 3500)

then 2

else if Between(c, 3500, 5500)

then 4

else 6;

def FE = Log(Sum((Max(h, c[1]) - Min(l, c[1])), FractalEnergyLength) /

(Highest(h, FractalEnergyLength) - Lowest(l, FractalEnergyLength)))

/ Log(FractalEnergyLength);

# Parent Aggregation Pivot High

# Pivot High Variables

def p_hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -1);

def p_PivotH = if (bar > n and

h == Highest(h, n) and

p_hh)

then h

else NaN;

def p_PHValue = if !IsNaN(p_PivotH)

then p_PivotH

else p_PHValue[1];

def p_PHBar = if !IsNaN(p_PivotH)

then bar

else nan;

# Pivot High and Pivot High Exit Variables

# Pivot High Variables

def hh = fold ii = 1 to n + 1

with pp = 1

while pp

do h > GetValue(h, -1);

def PivotH = if (bar > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBar = if !IsNaN(PivotH)

then bar

else nan;

# Pivot High Exit Variables

def PHExit = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then l[1]

else fold r = 0 to 20

with a = NaN

while IsNaN(a)

do if GetValue(l[1], r) < l

then GetValue(l[1], r)

else NaN

else Double.NaN;

def PHExitValue = if !IsNaN(PHExit)

then PHExit

else PHExitValue[1];

def PHExitBar = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then bar - 1

else fold d = 0 to 20

with y = NaN

while IsNaN(y)

do if GetValue(l[1], d) < l

then GetValue(bar - 1, d)

else NaN

else NaN;

# Pivot Low and Pivot Low Entry Variables

# Parent Pivot Low Variables

def p_ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -1);

def p_PivotL = if (bar > n and

l == Lowest(l, n) and

p_ll)

then l

else NaN;

def p_PLValue = if !IsNaN(p_PivotL)

then p_PivotL

else p_PLValue[1];

def p_PLBar = if !IsNaN(p_PivotL)

then bar

else nan;

# Pivot Low Variables

def ll = fold jj = 1 to n + 1

with qq = 1

while qq

do l < GetValue(l, -1);

def PivotL = if (bar > n and

l == Lowest(l, n) and

ll)

then l

else NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBar = if !IsNaN(PivotL)

then bar

else nan;

# Pivot Low Entry Variables

def PLEntry = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then h[1]

else fold t = 0 to 20

with w = NaN

while IsNaN(w)

do if GetValue(h[1], t) > h

then GetValue(h[1], t)

else NaN

else NaN;

def PLEntryValue = if !IsNaN(PLEntry)

then PLEntry

else PLEntryValue[1];

def PLEntryBar = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then bar - 1

else fold u = 0 to 20

with z = NaN

while IsNaN(z)

do if GetValue(h[1], u) > h

then GetValue(bar - 1, u)

else NaN

else NaN;

# Plots

plot F_100 = if bar >= HighestAll(PLBar)

then HighestAll(if isNaN(c[-1])

then PLValue

else nan)

else nan;

F_100.SetDefaultColor(Color.dark_red);

F_100.SetLineWeight(2);

def F_0100 =(if isNaN(F_100[1]) then F_100 else Double.NaN);

addchartBubble(LabelsOn and F_100, F_0100,"100%",color.dark_red);

plot F_786 = if bar >= HighestAll(PLEntryBar)

then HighestAll(if isNaN(c[-1])

then PLEntryValue

else nan)

else nan;

F_786.SetDefaultColor(Color.light_red);

F_786.SetLineWeight(2);

def F_0786 =(if isNaN(F_786[1]) then F_786 else Double.NaN);

addchartBubble(LabelsOn and F_786, F_0786,"78.6%",color.light_red);

plot priceLine = HighestAll(if IsNaN(c[-1])

then c

else Double.NaN);

priceLine.SetStyle(Curve.SHORT_DASH);

priceLine.SetLineWeight(1);

priceLine.SetDefaultColor(Color.CYAN);

plot UpArrow = if c crosses above F_786 and FE > .5

then l

else Double.NaN;

UpArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

UpArrow.SetLineWeight(5);

UpArrow.SetDefaultColor(Color.GREEN);

#Fib levels

plot F_0 = (F_786-F_100) * 4.673 + F_100;

F_0.setdefaultcolor(color.red);

F_0.setlineweight(2);

def F_00 =(if isNaN(F_0[1]) then F_0 else Double.NaN);

addchartBubble(LabelsOn and F_0, F_00,"0%: " + asDollars(F_00),color.red);

plot F_124 = (F_0 - F_100)/1.14155+ F_100;

F_124.setdefaultcolor(color.dark_orange);

F_124.setlineweight(2);

def F_0124 =(if isNaN(F_124[1]) then F_124 else Double.NaN);

addchartBubble(LabelsOn and F_124, F_0124,"12.4%",color.dark_orange);

plot F_236 = (F_0 - F_100)/1.3089+ F_100;

F_236.setdefaultcolor(color.plum);

F_236.setlineweight(2);

def F_0236 = (if isNaN(F_236[1]) then F_236 else Double.NaN);

addchartBubble(LabelsOn and F_236, F_0236,"23.6%",color.plum);

plot F_382 = (F_0 - F_100)/1.618+ F_100;

F_382.setdefaultcolor(color.cyan);

F_382.setlineweight(2);

def F_0382 =(if isNaN(F_382[1]) then F_382 else Double.NaN);

addchartBubble(LabelsOn and F_382, F_0382,"38.2%",color.cyan);

plot F_50 = (F_0 - F_100)/2 + F_100;

F_50.setdefaultcolor(color.green);

F_50.setlineweight(2);

def F_050 =(if isNaN(F_50[1]) then F_50 else Double.NaN);

addchartBubble(LabelsOn and F_50, F_050,"50%",color.green);

plot F_618 = (F_0 - F_100)/2.618+ F_100;

F_618.setdefaultcolor(color.yellow);

F_618.setlineweight(2);

def F_0618 =(if isNaN(F_618[1]) then F_618 else Double.NaN);

addchartBubble(LabelsOn and F_618, F_0618,"61.8%",color.yellow);

plot F_886 = (F_786 - F_100)/1.88+ F_100;

F_886.setdefaultcolor(color.violet);

F_886.setlineweight(2);

def F_0886 =(if isNaN(F_886[1]) then F_886 else Double.NaN);

addchartBubble(LabelsOn and F_886, F_0886,"88.6%",color.violet);

plot FE_272 = (F_0 - F_100)*1.272 + F_100;

FE_272.setdefaultcolor(color.yellow);

FE_272.SetStyle(Curve.LONG_DASH);

FE_272.setlineweight(2);

def F_0272 =(if isNaN(FE_272[1]) then FE_272 else Double.NaN);

addchartBubble(LabelsOn and FE_272, F_0272,"-27.2%",color.yellow);

plot FE_50 = (F_0 - F_100)*1.5 + F_100;

FE_50.setdefaultcolor(color.GREEN);

FE_50.SetStyle(Curve.LONG_DASH);

FE_50.setlineweight(2);

def FE_050 =(if isNaN(FE_50[1]) then FE_50 else Double.NaN);

addchartBubble(LabelsOn and FE_50, FE_050,"-50%",color.GREEN);

# Alerts

Alert(AlertsOn and UpArrow, " ", Alert.Bar, Sound.ding);Short Position Code:

Code:

#Automatic Fibonacci Short Levels

#based on Mobius's Fractal Pivot Strategy

#developed by Chewie76 on 8/27/2021

# User Inputs

input n = 20;

input FractalEnergyLength = 8;

input FractalEnergyThreshold = .68;

input AtrMult = .70;

input nATR = 4;

input AvgType = AverageType.HULL;

input LabelsOn = yes;

input AlertsOn = yes;

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def TS = TickSize();

def nan = double.nan;

def ATR = Round((MovingAverage(AvgType, TrueRange(h, c, l), nATR)) / TS, 0) * TS;

def risk = if Between(c, 0, 1500)

then ATR

else if Between(c, 1500, 3500)

then 2

else if Between(c, 3500, 5500)

then 4

else 6;

def FE = Log(Sum((Max(h, c[1]) - Min(l, c[1])), FractalEnergyLength) /

(Highest(h, FractalEnergyLength) - Lowest(l, FractalEnergyLength)))

/ Log(FractalEnergyLength);

# Parent Aggregation Pivot High

# Pivot High Variables

def p_hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -1);

def p_PivotH = if (bar > n and

h == Highest(h, n) and

p_hh)

then h

else NaN;

def p_PHValue = if !IsNaN(p_PivotH)

then p_PivotH

else p_PHValue[1];

def p_PHBar = if !IsNaN(p_PivotH)

then bar

else nan;

# Pivot High and Pivot High Exit Variables

# Pivot High Variables

def hh = fold ii = 1 to n + 1

with pp = 1

while pp

do h > GetValue(h, -1);

def PivotH = if (bar > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBar = if !IsNaN(PivotH)

then bar

else nan;

# Pivot High Exit Variables

def PHExit = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then l[1]

else fold r = 0 to 20

with a = NaN

while IsNaN(a)

do if GetValue(l[1], r) < l

then GetValue(l[1], r)

else NaN

else Double.NaN;

def PHExitValue = if !IsNaN(PHExit)

then PHExit

else PHExitValue[1];

def PHExitBar = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then bar - 1

else fold d = 0 to 20

with y = NaN

while IsNaN(y)

do if GetValue(l[1], d) < l

then GetValue(bar - 1, d)

else NaN

else NaN;

# Pivot Low and Pivot Low Entry Variables

# Parent Pivot Low Variables

def p_ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -1);

def p_PivotL = if (bar > n and

l == Lowest(l, n) and

p_ll)

then l

else NaN;

def p_PLValue = if !IsNaN(p_PivotL)

then p_PivotL

else p_PLValue[1];

def p_PLBar = if !IsNaN(p_PivotL)

then bar

else nan;

# Pivot Low Variables

def ll = fold jj = 1 to n + 1

with qq = 1

while qq

do l < GetValue(l, -1);

def PivotL = if (bar > n and

l == Lowest(l, n) and

ll)

then l

else NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBar = if !IsNaN(PivotL)

then bar

else nan;

# Pivot Low Entry Variables

def PLEntry = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then h[1]

else fold t = 0 to 20

with w = NaN

while IsNaN(w)

do if GetValue(h[1], t) > h

then GetValue(h[1], t)

else NaN

else NaN;

def PLEntryValue = if !IsNaN(PLEntry)

then PLEntry

else PLEntryValue[1];

def PLEntryBar = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then bar - 1

else fold u = 0 to 20

with z = NaN

while IsNaN(z)

do if GetValue(h[1], u) > h

then GetValue(bar - 1, u)

else NaN

else NaN;

# Plots

plot S_100 = if bar >= HighestAll(PHBar) then HighestAll(if isNaN(close[-1]) then PHValue else nan) else nan;

S_100.SetDefaultColor(Color.dark_red);

S_100.SetLineWeight(1);

def S_0100 =(if isNaN(S_100[1]) then S_100 else Double.NaN);

addchartBubble(LabelsOn and S_100, S_0100,"100%",color.dark_red);

plot S_786 = if bar >= HighestAll(PHexitBar) then HighestAll(if isNaN(close[-1]) then PHExitValue else nan) else nan;

S_786.SetDefaultColor(Color.red);

def S_0786 =(if isNaN(S_786[1]) then S_786 else Double.NaN);

addchartBubble(LabelsOn and S_786, S_0786,"78.6%",color.light_red);

plot priceLine = HighestAll(if IsNaN(c[-1])

then c

else Double.NaN);

priceLine.SetStyle(Curve.SHORT_DASH);

priceLine.SetLineWeight(1);

priceLine.SetDefaultColor(Color.CYAN);

plot DnArrow = if c crosses below S_786 and ((FE > .618)

or (FE < .382))

then h

else Double.NaN;

DnArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

DnArrow.SetLineWeight(5);

DnArrow.SetDefaultColor(Color.RED);

#Fib levels

plot S_0 = (S_100-S_786) * -4.673 + S_100;

S_0.setdefaultcolor(color.red);

S_0.setlineweight(1);

def S_00 =(if isNaN(S_0[1]) then S_0 else Double.NaN);

addchartBubble(LabelsOn and S_0, S_00,"0%: " + asDollars(S_00),color.red);

plot S_124 = (S_100-S_0)/-1.14155 + S_100;

S_124.setdefaultcolor(color.dark_orange);

S_124.setlineweight(1);

def S_0124 =(if isNaN(S_124[1]) then S_124 else Double.NaN);

addchartBubble(LabelsOn and S_124, S_0124,"12.4%",color.dark_orange);

plot S_236 = (S_100-S_0)/-1.3089+ S_100;

S_236.setdefaultcolor(color.plum);

S_236.setlineweight(1);

def S_0236 = (if isNaN(S_236[1]) then S_236 else Double.NaN);

addchartBubble(LabelsOn and S_236, S_0236,"23.6%",color.plum);

plot S_382 = (S_100-S_0)/-1.618+ S_100;

S_382.setdefaultcolor(color.cyan);

S_382.setlineweight(1);

def S_0382 =(if isNaN(S_382[1]) then S_382 else Double.NaN);

addchartBubble(LabelsOn and S_382, S_0382,"38.2%",color.cyan);

plot S_50 = (S_100-S_0)/-2 + S_100;

S_50.setdefaultcolor(color.green);

S_50.setlineweight(1);

def S_050 =(if isNaN(S_50[1]) then S_50 else Double.NaN);

addchartBubble(LabelsOn and S_50, S_050,"50%",color.green);

plot S_618 = (S_100-S_0)/-2.618+ S_100;

S_618.setdefaultcolor(color.yellow);

S_618.setlineweight(1);

def S_0618 =(if isNaN(S_618[1]) then S_618 else Double.NaN);

addchartBubble(LabelsOn and S_618, S_0618,"61.8%",color.yellow);

plot S_886 = (S_100-S_786)/-1.88+ S_100;

S_886.setdefaultcolor(color.violet);

S_886.setlineweight(1);

def S_0886 =(if isNaN(S_886[1]) then S_886 else Double.NaN);

addchartBubble(LabelsOn and S_886, S_0886,"88.6%",color.violet);

plot SE_272 = (S_100-S_0)*-1.272 + S_100;

SE_272.setdefaultcolor(color.yellow);

SE_272.SetStyle(Curve.LONG_DASH);

SE_272.setlineweight(2);

def S_0272 =(if isNaN(SE_272[1]) then SE_272 else Double.NaN);

addchartBubble(LabelsOn and SE_272, S_0272,"-27.2%",color.yellow);

plot SE_50 = (S_100-S_0)*-1.5 + S_100;

SE_50.setdefaultcolor(color.GREEN);

SE_50.SetStyle(Curve.LONG_DASH);

SE_50.setlineweight(1);

def SE_050 =(if isNaN(SE_50[1]) then SE_50 else Double.NaN);

addchartBubble(LabelsOn and SE_50, SE_050,"-50%",color.GREEN);

# Alerts

Alert(AlertsOn and DnArrow, " ", Alert.Bar, Sound.ding);

Last edited: