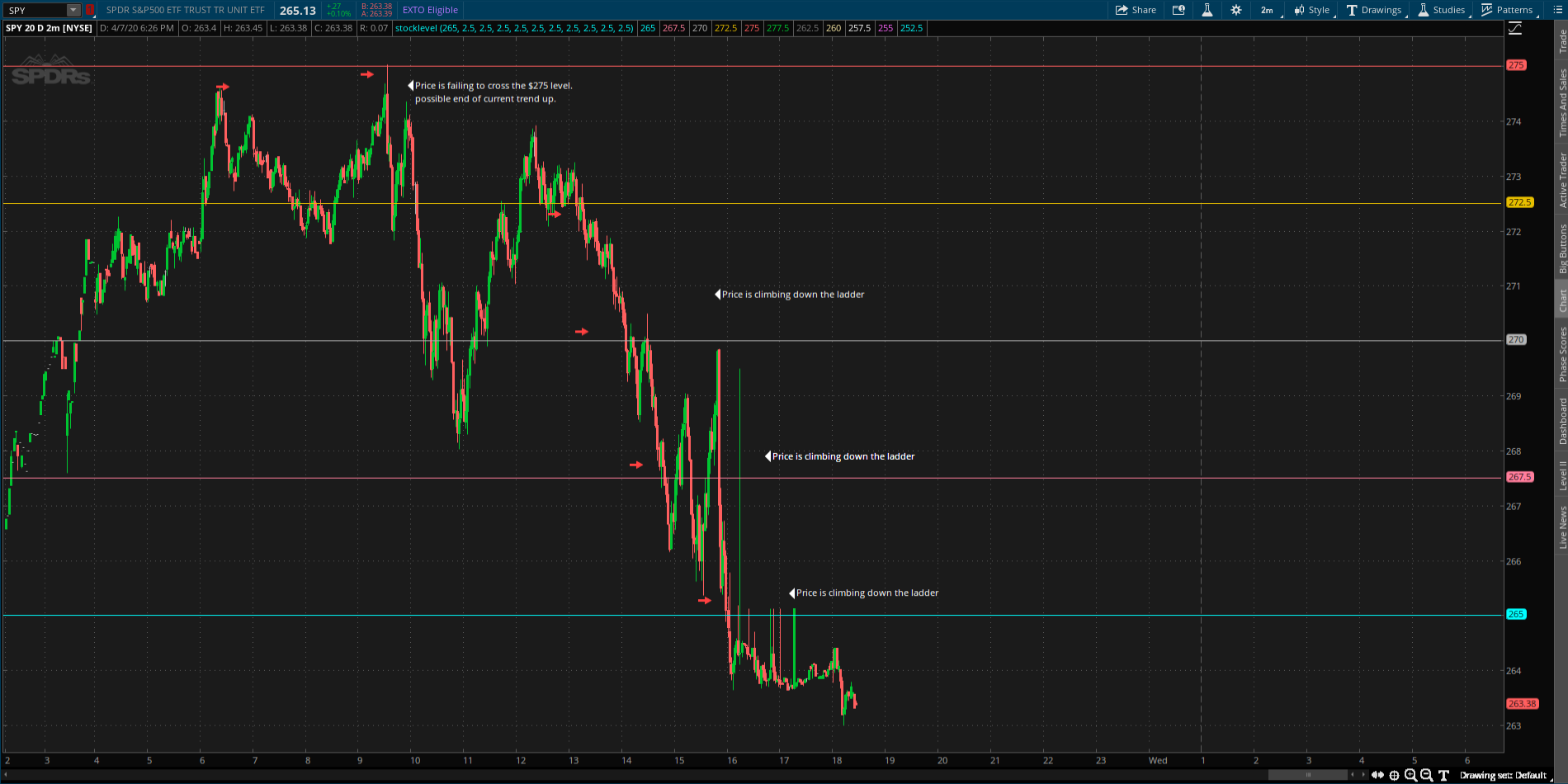

So I'm back with another strategy that's super simple. It is a play on basic level fundamentals that try to tap in on market sentiment on price.

To clear confusion. The levels are not used for support and resistance, they are used to define price action. The ability to see what price is doing at each line i.e. is price being halted at this price, is it bursting through at this price point, or is it consolidating at this price? The ability to exit a trade early or stay in a trade longer is what goal is here.

* I am not a code writer and pieced this together from searching the net. The code is very redundant because I have not figured out how to get lines that stretch across the chart as I wanted. If anyone can come along and clean it up and make it more efficient I would appreciate it.

*Please note to change the level you go into the study settings and change the price for each symbol you are looking at. I am not sophisticated enough to have it auto plot. I have defined each level or "rung" of the ladder to be $2.5. For this market volatility its appropriate but as the market goes you will have to adjust by going into the code itself and replace 2.5 with whatever you deem appropriate. (for indicies I find for /es to use every 10 points, /nq use every 25 points, and /ym use every 100 points)

So the strategy is that you define a price based on the ticker symbol you are watching. I like to use the previous day close or recent high or low. Once defined you determine the trend and then follow the lines like a ladder. Climb up or down based on price action and trend. I am trying to move away from a ton of indicators on the chart and follow pure price.

code:

Examples:

^^^ The last image is multiple levels put on @ 10 points between. 1 min chart catches price action nicely on /es

That's about it. Feel free to ask questions, I will try to answer them the best I can.

To clear confusion. The levels are not used for support and resistance, they are used to define price action. The ability to see what price is doing at each line i.e. is price being halted at this price, is it bursting through at this price point, or is it consolidating at this price? The ability to exit a trade early or stay in a trade longer is what goal is here.

* I am not a code writer and pieced this together from searching the net. The code is very redundant because I have not figured out how to get lines that stretch across the chart as I wanted. If anyone can come along and clean it up and make it more efficient I would appreciate it.

*Please note to change the level you go into the study settings and change the price for each symbol you are looking at. I am not sophisticated enough to have it auto plot. I have defined each level or "rung" of the ladder to be $2.5. For this market volatility its appropriate but as the market goes you will have to adjust by going into the code itself and replace 2.5 with whatever you deem appropriate. (for indicies I find for /es to use every 10 points, /nq use every 25 points, and /ym use every 100 points)

So the strategy is that you define a price based on the ticker symbol you are watching. I like to use the previous day close or recent high or low. Once defined you determine the trend and then follow the lines like a ladder. Climb up or down based on price action and trend. I am trying to move away from a ton of indicators on the chart and follow pure price.

code:

Code:

input MyLevel = 10;

input Above = 2.5;

input Above2 = 2.5;

input Above3 = 2.5;

input Above4 = 2.5;

input Above5 = 2.5;

input Below = 2.5;

input Below2 = 2.5;

input Below3 = 2.5;

input Below4 = 2.5;

input Below5 = 2.5;

plot Level = MyLevel;

plot AboveLevel = MyLevel + Above;

plot AboveLevel2 = MyLevel + Above + Above2;

plot AboveLevel3 = MyLevel + Above + Above2 + Above3;

plot AboveLevel4 = MyLevel + Above + Above2 + Above3 + Above4;

plot AboveLevel5 = MyLevel + Above + Above2 + Above3 + Above4 + Above5;

plot BelowLevel = MyLevel - Below;

plot Belowlevel2 = MyLevel - Below - Below2;

plot Belowlevel3 = MyLevel - Below - Below2 - Below3;

plot Belowlevel4 = MyLevel - Below - Below2 - Below3 - Below4;

plot Belowlevel5 = MyLevel - Below - Below2 - Below3 - Below4 - Below5;Examples:

^^^ The last image is multiple levels put on @ 10 points between. 1 min chart catches price action nicely on /es

That's about it. Feel free to ask questions, I will try to answer them the best I can.

Last edited: