Hi,

Can someone who's really skilled at Thinkscript create an indicator to label setups like Al Brooks describes? I believe there's an EasyLanguage version of it out there, or a NinjaTrader version, but I can't seem to find the code online to replicate it.

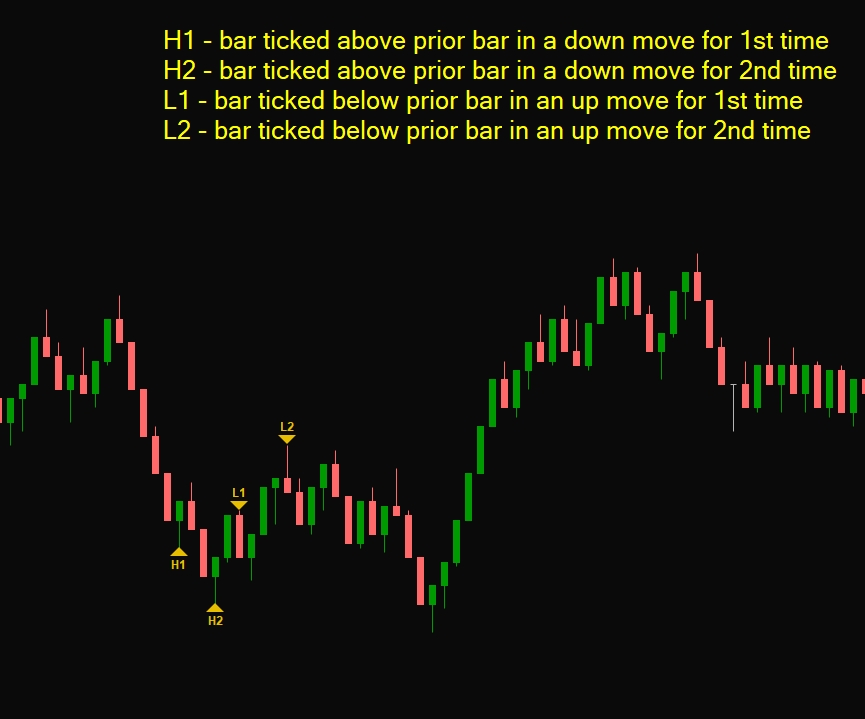

I've tried several times to create an indicator to label H1 / H2 and L1 / L2 setups as Al brooks describes. I've come close, but get into trouble with things like double tops / bottoms.

Here are the rules. I'll discuss "H" setups (new attempt to reverse in a downtrend), although they apply for "L" setups, just in the opposite direction. The study should handle both.

1. From a high point, when the price moves down, the first attempt to go higher is labeled a H1.

2. As the price continues downward below that (i.e. a series of lower swing lows) each subsequent attempt to reverse is labeled H2... H3... and so on.

3. The reversal attempt only needs to be a single tick above (H > H[1]) but it can be many ticks too.

4. A double top of swing highs "resets" the count back to zero.

5. A higher high of a swing hi also "resets" the count back to zero.

6. Because these patterns can happen in just a few bars, it's important to not make it a "swing" style indicator with a look forward / look back process - that would very clearly not work when a H2 setup occurs within 4 bars. This is one of the major challenges I've run into.

Here's a picture below with some of the setups labeled. My thought was to have it display numbers below with the count (H1, H2, H3...)

here are some comments and questions,

i just say things like i see it. read it as factual, with no emotion. i'm just trying to ask questions that will help me (and others) understand your request.

please rewrite your rules after reading this.

it seems you want to find big and small, peaks and valleys. ( or maybe just big ones, i'm a little confused)

you don't mention a price parameter(open,high,low,close) very often, so i'm not sure what i am supposed to compare to what.

1. From a high point, when the price moves down, the first attempt to go higher is labeled a H1.

high point of what? close? , high ? low?

what is attemping to go higher than what? close and high? close and close?

why are your H labels pointing at the bar with the lowest low and not the bar after it that has a higher high? which bar do you want the bubble on?

2. As the price continues downward below that (i.e. a series of lower swing lows) each subsequent attempt to reverse is labeled H2... H3... and so on.

below what? the low of the higher high?

what is a lower swing lows? just say lower low

how many lower lows have to happen for a low to be considered a possible H ( a valley)

so look for small peaks and valleys... what defines them?

3. The reversal attempt only needs to be a single tick above (H > H[1]) but it can be many ticks too.

what is above what? close > high[1]? close > close[1]? high > high[1]?

4. A double top of swing highs "resets" the count back to zero.

what is a swing high? is that a big peak or a small peak? a higher high, within x bars before and after it? swing is a confusing word to me, it doesn't tell me anything.

a double top(words) and a higher top(in picture) are 2 different things. which do you want. a double implies 2 peaks in a row, 1 not nesesarily higher/lower then the previous one.

5. A higher high of a swing hi also "resets" the count back to zero.

doesn't rule #4, 2 peaks, make #5 unessesary? have to have 2 peaks for one to be higher than the previous one.

6. Because these patterns can happen in just a few bars, it's important to not make it a "swing" style indicator with a look forward / look back process - that would very clearly not work when a H2 setup occurs within 4 bars. This is one of the major challenges I've run into.

so what is the range of bars you want to look back and forward, for big peaks ( and small peaks)?

i think some counting formulas can be created to do what you want. just need to clarify the rules.