HAHAHA. I've been doing this long enough to no there isn't any magic indicator. But , I have to say, using TOS and your charts are , well, as good as it gets. Need to be going with the flow, but as far as having an "assistant" that watches everything, this is top notch. Thank you for all your efforts . Warm regards, Mike

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Thread starter csricksdds

- Start date

-

- Tags

- agaig

Repaints

A tablespoon of humor helps the losing trades go down!HAHAHA. I've been doing this long enough to no there isn't any magic indicator. But , I have to say, using TOS and your charts are , well, as good as it gets. Need to be going with the flow, but as far as having an "assistant" that watches everything, this is top notch. Thank you for all your efforts . Warm regards, Mike

Some time ago a couple of you asked how I use this chart (or any of my charts for that matter).Second this comment. Can you please provide more clarity on how you are using this and if it applies to all time frames or just 5m? And what do you mean 'only place trades when two or more indicators are in agreement?' . Which two indicators are you referring to?

One thing I look for is the first and second changes in direction a stock (ETF) takes after the ORB (Opening Range Breakout) of the market (usually the first 15-30 minutes after open).

There is a lot of pent-up energy at market open which needs to play out (options are usually more costly during this ORB period).

It has been my experience that the first and second changes in direction after this ORB period may frequently represent the most profitable trades of the day?

The first trade then will be at, or after 10:00 a.m., with the second trade taking place after the first trade plays itself out. Frequently these first two trades will be completed before noon and, if profitable, end my trading day?

Take time and look back at some of your favorite stocks (ETFs) for the past few days and see what happened after the ORB when looking at the next two changes in direction?

Last edited by a moderator:

Thanks, that worked. I just hope it doesn't change it on the 5 min chart as well. I am looking at incorporating these with another chart I am working on. They look like they could work well together, but going to take some time. I wish we could put powerpoint presentations together to explain an entry/exit and some examples of false signals.Go to the beaker to the left of the time frame you are using - click on it for dropdown to added studies and strategies...look to the right of the Traffic Light, click on the wheel and change the aggregation period to 10 minutes. If still having problems let me know?

If you have any issues let me know and I will try to answer and help?Thanks, that worked. I just hope it doesn't change it on the 5 min chart as well. I am looking at incorporating these with another chart I am working on. They look like they could work well together, but going to take some time. I wish we could put powerpoint presentations together to explain an entry/exit and some examples of false signals.

After watching this chart for a while it would be nice to have the 4/8 line on the chart - can you do that?

I mean the 4/8 Murray Math line - how do I get that? the AGAIG Murray math indicator on the chart does not have a 4/8 line on it.

I guess I should of said the level 4 line?

I mean the 4/8 Murray Math line - how do I get that? the AGAIG Murray math indicator on the chart does not have a 4/8 line on it.

I guess I should of said the level 4 line?

Last edited by a moderator:

These are the lines on the code which I think you are referencing:I guess I should of said the level 4 line?

def MMLevel8 = 8 / 8;

def MMLevel7 = 7 / 8;

def MMLevel1 = 1 / 8;

def MMLevel0 = 0 / 8;

Are you looking for a midline? If so my standard deviation lines will give you the midline as well as a 1 SD deviation either way: This is the link for that which could be added to your chart: http://tos.mx/!BhUmOttN

If this is not what you're looking for please let me know?

Great, I see it now 1 SDThese are the lines on the code which I think you are referencing:

def MMLevel8 = 8 / 8;

def MMLevel7 = 7 / 8;

def MMLevel1 = 1 / 8;

def MMLevel0 = 0 / 8;

Are you looking for a midline? If so my standard deviation lines will give you the midline as well as a 1 SD deviation either way: This is the link for that which could be added to your chart: http://tos.mx/!BhUmOttN

If this is not what you're looking for please let me know?

Thanks

Always feel free to ask questions...thanksGreat, I see it now 1 SD

Thanks

Is there a way to keep everything visible on the chart with automatic instead of manual? I've been able to do it on other charts, but when I do it on this one it flattens everything into a few horizontal lines.

Is there a way to keep everything visible on the chart with automatic instead of manual? I've been able to do it on other charts, but when I do it on this one it flattens everything into a few horizontal lines.

Now I'm at my computer.

On the upper right of a chart are two lines that look like they have a sideways S inside.

This is the Price Axis Setting.

Click on that and the dropdown will open.

If any of the boxes are checked it will probably compress your chart.

The only thing I want active is to click on the little wheel between your time setting and the beaker and click on Price Axis

(I like to check and keep Price Zoom. Click on that and hit Apply and then OK.

This should help your chart expand and not flatten.

After this if price get out of area I got to that chart Price Axis Setting and click Auto.

You can also put your pointer on the black area that shows price (on chart right sideline), right click and you can lengthen or shorten the chart view.

Last edited by a moderator:

RicRams

New member

would a IV+IVR+IV% label be possible? TIAThank you for your nice list of questions. I have developed several AGAIG indicators with different variations. As a visual trader I try to make indicators that might be appealing to some and others that might be appealing to others. It's like car shopping, some models are more appealing to some and not to others.

My charting goal is to have the least amount of indicators that give the information a person desires.

If you will tell me the ones you would like on your personal charting and let me know I will try to put them in place for you.

If you like this chart and would like for me to delete, or add something for you, I will be happy to help? Let me know.

Thanks to @rad14733 who is an options expert this might be the label you're looking for?would a IV+IVR+IV% label be possible? TIA

AddLabel(yes, "ImpVol: " + (Imp_Volatility * 100) + "%", Color.CYAN);

Last edited by a moderator:

Hello Charles,AGAIG As Good As It Gets

High Profit Options Trading Chart for TOS

This may be my best trading chart thus far!

UPDATED: moved murrey bubbles to the right

LABELS:

ATR D/W (Daily Weekly); PSAR; Stacked EMAs; ORB LABEL; TI MTFs; TRAFFIC LIGHT (Green, Yellow, Red);

CHART:

Includes the Date Time Line Vertical; Murrey Math Pivots; AsGoodAsItGetsIndicator; PRICE POINTER; PSAR Transition Line; SD (Standard Deviation) Pivots; Europe Closing Vertical Line; Profit Maximizer Arrows; Power Hour Heads Up;

COMMENTARY:

Any questions feel free to ask?

Hopefully the upper labels are self-explanatory.

The THICK RED/GREEN Upper/Lower lines are MAJOR MURREY MATH PIVOTS (Overbought/Oversold and may move (repaint) until high/low pivots are established). The Yellow dashed lines UNDER/OVER the HEAVY LINES are where Overbought/Oversold Direction is probably Weakening.

The Short/Long Bubbles are my As Good As It Gets Indicator Trend Direction Bubbles.

The Heavy Chart WAVY Line with direction arrows is the Profit Maximizer Arrows. Also included is the 20 EMA White Line showing if the moving average is above/below the 20 EMA.

Also are Vertical lines showing just before Europe Market Closing and just before the Power Hour (last hour of trading).

ONLY PLACE TRADES WHEN TWO OR MORE INDICATORS ARE IN AGREEMENT!Links: (5min Charts) MUST follow these instructions for loading shared links.

Single Chart: http://tos.mx/!yowprDUc

Double Chart: http://tos.mx/!MbS6BvHd

Chart View Single: Chart View Double:

First and foremost thank you so much for taking the time to share your knowledge, experience and scripts with this incredible community. It is appreciated in more ways than I can describe.

I noticed that your single chart shows the murrey bubbles update (8.29.24) in the code. Looking at the double chart it seems it is the previous version (8.26.24) as it does not seem to show the murrey bubbles update in the code. I just wanted to confirm if that is accurate or whether you might not have uploaded the updated double chart.

Last edited:

@csricksdds Please forgive me I am in process of learning ins and outs of TOS application. One of the other things I noticed when I load your double chart upon initial load I don't see all the lines (Hi AlgoPivot, Ob Pivot, OB Weakening, OS Pivot etc...) as shown on your screenshots. Each time it loads I am forced to manually left click on prices on the far right side (for both left & right chart) and drag mouse down/up to adjust the screen after which the lines show up. Is this normal? Or do I need to adjust some sort of settings so that it loads automatically on display exactly as you designed? In addition when I start making adjustment the red price bubble on right side disappears from view please see my second screen shot. Finally please see my other post earlier perhaps I noticed double chart does not seem to have the updated murrey bubble code wasn't sure if that was accurate or not. I've attached some screenshots so you can see how it looks when I first load your charts as well as after making manual adjustments. Thank you in advance.

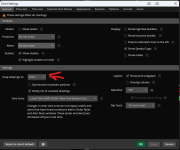

EDIT --> After I posted I found another users post that raised similar question and saw your response. I click on my price axis, scale was set to AUTO. I assume I need to change to MANUAL and check off keep price zoom? I've added screenshot with my current settings for one of your charts. When I make the change in the price side I no longer see the RED/GREEN bubble and when I change to other tickers I am forced to adjust settings again. Finally if I adjust enough I also see red bubble show up that says HiAlgoPivot but no cut lines, (assume was designed that way). Not sure if this is standard TOS behaviour or whether there is means to adjust it so that it automatically shows all necessary lines and not require adjusting for each ticker which appears to be the case if using manual instead of auto in price axis.

EDIT --> After I posted I found another users post that raised similar question and saw your response. I click on my price axis, scale was set to AUTO. I assume I need to change to MANUAL and check off keep price zoom? I've added screenshot with my current settings for one of your charts. When I make the change in the price side I no longer see the RED/GREEN bubble and when I change to other tickers I am forced to adjust settings again. Finally if I adjust enough I also see red bubble show up that says HiAlgoPivot but no cut lines, (assume was designed that way). Not sure if this is standard TOS behaviour or whether there is means to adjust it so that it automatically shows all necessary lines and not require adjusting for each ticker which appears to be the case if using manual instead of auto in price axis.

Attachments

Last edited:

They are future time frames from the one you are looking at and they show RED/GREEN if that time frame is moving down/up.Could you explain the TI MTFs - I see they are red/green and have different times on them but not totally sure I understand it.

Gon Fishin

New member

These are some awesome collections of indicators. Thank you.Go to the beaker to the left of the time frame you are using - click on it for dropdown to added studies and strategies...look to the right of the Traffic Light, click on the wheel and change the aggregation period to 10 minutes. If still having problems let me know?

For those several indicators that aggregate a timeline can't you just set the default to GetAggregationPeriod() and ELSE/IF it to allow people to choose higher timeframes if they want. Then it auto adjusts to the chart yet still remains flexible?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 26

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 19

-

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

5737

Online

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 26

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 19

-

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 26

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 19

-

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.