armybender

Active member

This is an indicator I have used for some time to help me conduct after-the-fact analysis on entries. The same thing can be accomplished with Fibonacci extensions, or other tools, but this simplifies the process.

It will either draw arrows or recolor bars that meet certain criteria.

The basic assumptions are as follows:

The reason for this methodology is to ensure the "trader's equation" is followed, which is: profit must be equal or greater to the risk * the probability of the success of the trade. Probability is an estimate, but the general thesis is that you shouldn't risk more on a probability adjusted basis than you're going to earn, or you'll just slowly bleed yourself dry.

Lastly, you'll notice that my license notes are pretty lax. I wrote it, but I don't care what you do with it. Modify it, share it, sell it. Frankly, I don't care. Here's the thing, I use it as a tool. If you don't like it, don't use it. If it helps you, great... use it. If you want to modify it, go ahead. My only hope is that this will help educate people about the trader's equation (Al brooks writes some great stuff on it) and that they'll learn to read the charts instead of using indicators (which are just chart data and math) to make good trades.

NOTE: I believe TOS's update today has broken the processing of nested if/then/else statements, so there seems to be an issue with bar coloring under certain conditions.

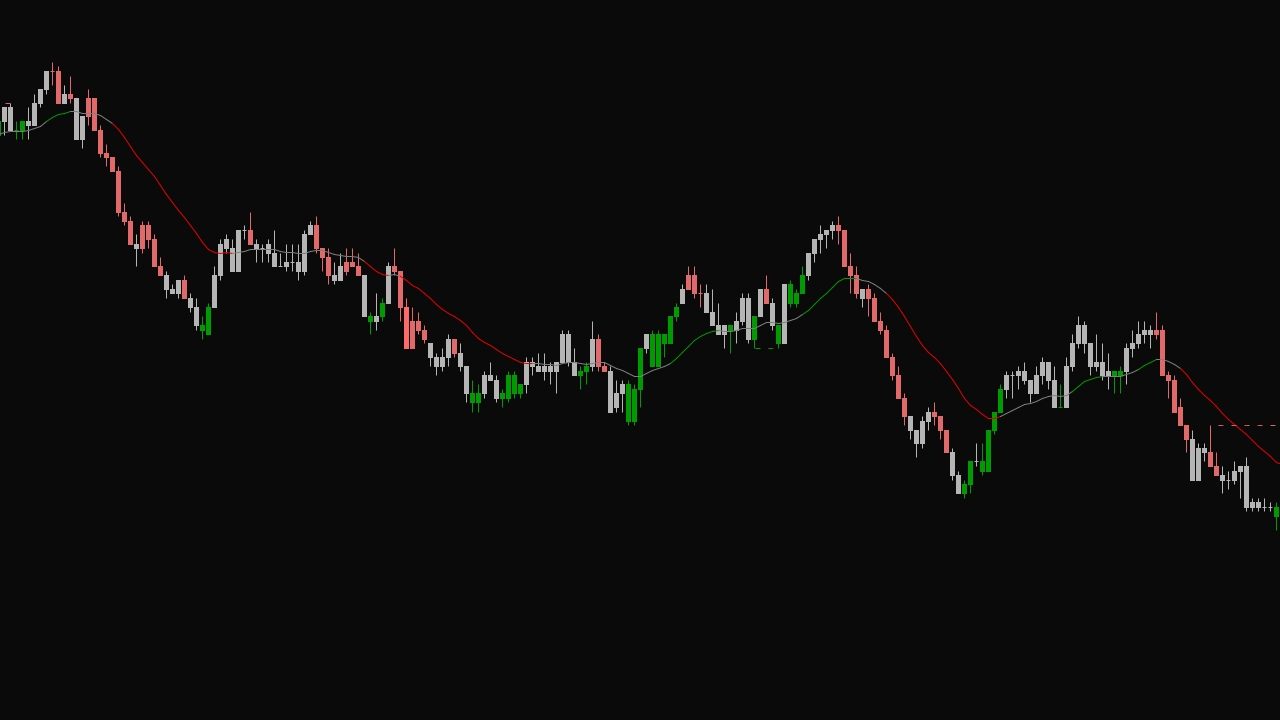

Study screenshot with bar coloring turned off and arrows off.

It will either draw arrows or recolor bars that meet certain criteria.

The basic assumptions are as follows:

- A trade is entered either one tick above or below a bar (above for long / below for short) using a stop entry.

- A stop order is placed one tick below the bar to exit the trade if the market goes the opposite direction.

- A limit order is placed 1x the bar height + 2 ticks above or below the entry price to exit the trade with a profit if the limit is met.

- Arrows or colored bars occur when the profit target is met and the stop exit target is NOT met.

- Because this is analyzing trades on a bar-by-bar basis (i.e. not based on movement as bars form) it cannot determine if outside bars (bars that go above and below) would have been profitable or not, so it assumes they would not have been.

The reason for this methodology is to ensure the "trader's equation" is followed, which is: profit must be equal or greater to the risk * the probability of the success of the trade. Probability is an estimate, but the general thesis is that you shouldn't risk more on a probability adjusted basis than you're going to earn, or you'll just slowly bleed yourself dry.

Lastly, you'll notice that my license notes are pretty lax. I wrote it, but I don't care what you do with it. Modify it, share it, sell it. Frankly, I don't care. Here's the thing, I use it as a tool. If you don't like it, don't use it. If it helps you, great... use it. If you want to modify it, go ahead. My only hope is that this will help educate people about the trader's equation (Al brooks writes some great stuff on it) and that they'll learn to read the charts instead of using indicators (which are just chart data and math) to make good trades.

NOTE: I believe TOS's update today has broken the processing of nested if/then/else statements, so there seems to be an issue with bar coloring under certain conditions.

Study screenshot with bar coloring turned off and arrows off.

Ruby:

### ACHIEVED_PROFIT_TARGET --- 2023-03-11 BY ARMYBENDER

### License: I don't care - do what you want with it.

### Determines whether a trade would have achieved a profit target before being stopped out.

### Risk is based on the bar height + 2 ticks (1 tick for a stop entry price above/below the bar, and

### 1 tick for a stop exit price below the bar. The study uses future bars, so it cannot be used in

### realtime to make trade decisions, however, it is helpful for quick analysis or measurement

### after the fact. This will work with all bar types.

### DECLARATIONS

declare upper;

declare once_per_bar;

### GLOBAL COLOR DEFINITIONS

DefineGlobalColor("Green", CreateColor(0, 155, 0));

DefineGlobalColor("Red", CreateColor(225, 105, 105));

DefineGlobalColor("Gray", CreateColor(181, 181, 181));

### INPUTS

input requireSignalBar = no;

input colorBars = yes;

input showArrows = no;

input requireTickThrough = yes;

input rewardMode = {default "Risk Reward Ratio", "Number of Ticks"};

input riskTargetRatio = 1.0;

input rewardNumberOfTicks = 4;

input numberOfBarsForward = 30;

input offsetBarsPlot = 0;

input arrowTickOffset = 2;

input arrowSize = 1;

input showHammer2EBars = no;

### DEFINITIONS

def rtRatio = riskTargetRatio;

def barsFwd = numberOfBarsForward;

def longEntry = high + TickSize();

def shortEntry = low - TickSize();

def riskAmount = if requireTickThrough then high - low + (3 * TickSize()) else high - low + (2 * TickSize());

def longStop = low - TickSize();

def shortStop = high + TickSize();

def longTarget =

if rewardMode == rewardMode."Risk Reward Ratio" then

longEntry + (rtRatio * riskAmount)

else if rewardMode == rewardMode."Number of Ticks" then

longEntry + rewardNumberOfTicks * TickSize()

else

Double.NaN

;

def shortTarget =

if rewardMode == rewardMode."Risk Reward Ratio" then

shortEntry - (rtRatio * riskAmount)

else if rewardMode == rewardMode."Number of Ticks" then

shortEntry - rewardNumberOfTicks * TickSize()

else

Double.NaN

;

def isUp = close > open;

def isDown = close < open;

def isBullDoji = IsDoji() and high == close;

def isBearDoji = IsDoji() and low == close;

def isBullSignalBar = if (isUp or isBullDoji) and low < low[1] and high[-1] > high then yes else no;

def isBearSignalBar = if (isDown or isBearDoji) and high > high[1] and low[-1] < low then yes else no;

def longRiskTargetMet =

if !requireSignalBar or isBullSignalBar then

fold l = 1 to barsFwd

with long = Double.NaN

while IsNaN(long)

do

if GetValue(low, -l) <= longStop then

no

else if GetValue(high, -l) >= longTarget then

yes

else

Double.NaN

else

Double.NaN;

def shortRiskTargetMet =

if !requireSignalBar or isBearSignalBar then

fold s = 1 to barsFwd

with short = Double.NaN

while IsNaN(short)

do

if GetValue(high, -s) >= shortStop then

no

else if GetValue(low, -s) <= shortTarget then

yes

else

Double.NaN

else

Double.NaN;

def longPlotData =

if longRiskTargetMet then

low - (arrowTickOffset * TickSize())

else

Double.NaN;

def shortPlotData =

if shortRiskTargetMet then

high + (arrowTickOffset * TickSize())

else

Double.NaN;

### PLOTS

plot longPlot = if showArrows then if longPlotData[offsetBarsPlot] then low - (arrowTickOffset * TickSize()) else Double.NaN else Double.NaN;

plot shortPlot = if showArrows then if shortPlotData[offsetBarsPlot] then high + (arrowTickOffset * TickSize()) else Double.NaN else Double.NaN;

### BAR COLORING

AssignPriceColor(

if colorBars then

if longRiskTargetMet then GlobalColor("Green")

else if shortRiskTargetMet then GlobalColor("Red")

else GlobalColor("Gray")

else Color.Current

);

### FORMATTING

longPlot.DefineColor("Long", CreateColor(0, 205, 0)); ### Custom green color

longPlot.SetDefaultColor(longPlot.Color("Long"));

longPlot.HideBubble();

longPlot.HideTitle();

longPlot.SetLineWeight(arrowSize);

longPlot.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

shortPlot.DefineColor("Short", CreateColor(205, 0, 0)); ### Custom red color

shortPlot.SetDefaultColor(shortPlot.Color("Short"));

shortPlot.HideBubble();

shortPlot.HideTitle();

shortPlot.SetLineWeight(arrowSize);

shortPlot.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);