rloftinbiz

New member

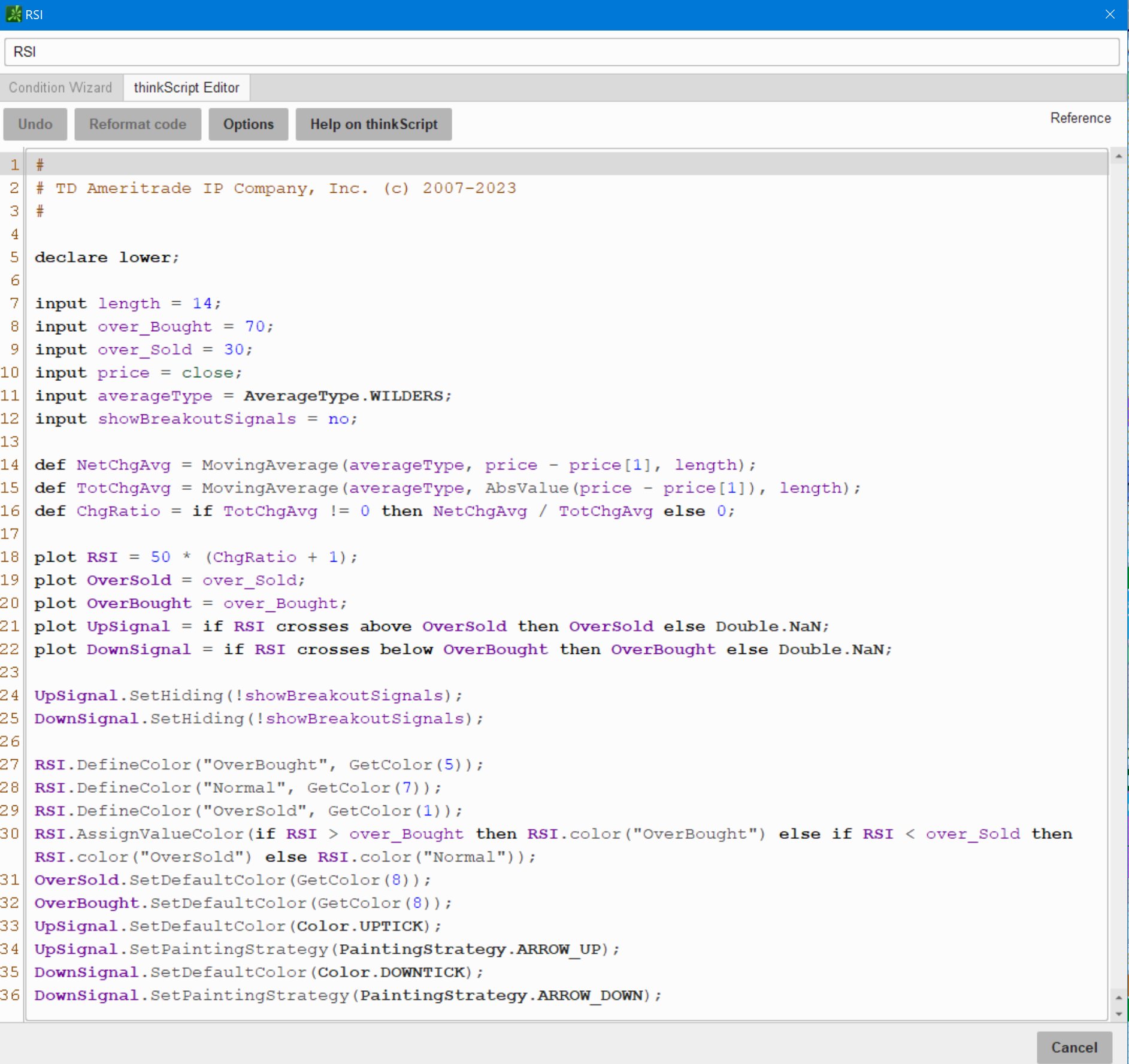

I want to recreate ThinkorSwim’s RSI function using AverageType.WILDERS on a different platform that matches ThinkorSwim’s results. As far as I can tell the close prices of both match historically for any instrument.

Current TOS code:

input RSI_len = 2;

input averageType = AverageType.WILDERS;

def RSI = RSI(length = RSI_len, averageType = averageType);

I can find pieces of the formula/code in TOS. From what I can tell TOS uses a look back period of 7 days for AverageType.WILDERS with ‘1’ as the dividend for Wilder in place of ‘2’ for a standard EMA.

Quotes from learning Center: --------------------------------------------------------------------------------------

“WildersSmoothing

Description

The Wilder's Smoothing study is similar to the Exponential Moving Average with the difference that Wilder's Smoothing uses a smoothing factor of 1/length which makes it respond more slowly to price changes compared to other moving averages.” --------------------

“MovAvgExponential

Description

The Exponential Moving Average (EMA) is a type of moving average that assigns greater weight to the most recent price data. Unlike the simple moving average where all data points have the same weight, the EMA's weighting factors to price data decrease exponentially.

The recursive representation of the EMA formula is the following:

EMA1 = price1;

EMA2 = α*price2 + (1 - α)*EMA1;

EMA3 = α*price3 + (1 - α)*EMA2;

EMAN = α*priceN + (1 - α)*EMAN-1;

where:

• N is the bar number;

• α is a smoothing coefficient equal to 2/(length + 1).”

-------------------------------------------------------------------------------------------------------------------

The is a simple scripting language from ProRealTime and my code to duplicate TOS:

‘[…]’ brackets indicate previous days, increasing numbers increase backwards in days.

-------------------------------------------------------------------------------------------------------------------

price1 = close

LookBack = 7

n0 = price1[0] - price1[1] //1st iteration today minus yesterday's price

if n0 > 0 then

u0 = n0

elsif n0 < 0 then

d0 = n0 * -1

else

u0 = 0

d0 = 0

endif

n1 = price1[1] - price1[2] //2nd iteration yesterday minus day-before-yesterday's price

if n1 > 0 then

u1 = n1

elsif n1 < 0 then

d1 = n1 * -1

else

u1 = 0

d1 = 0

endif

AvgPD = (u0 + u1) / 2 // simple average two-day gain

AvgND = (d0 + d1) / 2 // simple average two-day loss

a = 1/length + 1

// subtract yesterday from today for positive and negative price changes.

for i = 0 to LookBack do

diff = price1[length + i] - price1[length + 1 + i]

if diff > 0 then

diffP = diff

elsif diff < 0 then

diffN = diff * -1 // absolute value

else

diffP = 0

diffN = 0

endif

if i = 0 then // first averaging step

AvgP = AvgPD

AvgN = AvgND

else // subsequent averaging steps

AvgP = a * diffP + (1 - a) * AvgP

AvgN = a * diffN + (1 - a) * AvgN

endif

next

RS = AvgP/AvgN

xRSI = 100-(100/(1+RS))

return xRSI

Unfortunately, the above code does not work. Adjusting the ‘LookBack’ period seems to shift the entire calculation in time with zero ‘LookBack’ (meaning no look-back at all) the closet to TSO. I don’t think what I’m doing is near correct. Unsure why it is so difficult for find out the math or code used. Any help is sincerely appreciated.

Current TOS code:

input RSI_len = 2;

input averageType = AverageType.WILDERS;

def RSI = RSI(length = RSI_len, averageType = averageType);

I can find pieces of the formula/code in TOS. From what I can tell TOS uses a look back period of 7 days for AverageType.WILDERS with ‘1’ as the dividend for Wilder in place of ‘2’ for a standard EMA.

Quotes from learning Center: --------------------------------------------------------------------------------------

“WildersSmoothing

Description

The Wilder's Smoothing study is similar to the Exponential Moving Average with the difference that Wilder's Smoothing uses a smoothing factor of 1/length which makes it respond more slowly to price changes compared to other moving averages.” --------------------

“MovAvgExponential

Description

The Exponential Moving Average (EMA) is a type of moving average that assigns greater weight to the most recent price data. Unlike the simple moving average where all data points have the same weight, the EMA's weighting factors to price data decrease exponentially.

The recursive representation of the EMA formula is the following:

EMA1 = price1;

EMA2 = α*price2 + (1 - α)*EMA1;

EMA3 = α*price3 + (1 - α)*EMA2;

EMAN = α*priceN + (1 - α)*EMAN-1;

where:

• N is the bar number;

• α is a smoothing coefficient equal to 2/(length + 1).”

-------------------------------------------------------------------------------------------------------------------

The is a simple scripting language from ProRealTime and my code to duplicate TOS:

‘[…]’ brackets indicate previous days, increasing numbers increase backwards in days.

-------------------------------------------------------------------------------------------------------------------

price1 = close

LookBack = 7

n0 = price1[0] - price1[1] //1st iteration today minus yesterday's price

if n0 > 0 then

u0 = n0

elsif n0 < 0 then

d0 = n0 * -1

else

u0 = 0

d0 = 0

endif

n1 = price1[1] - price1[2] //2nd iteration yesterday minus day-before-yesterday's price

if n1 > 0 then

u1 = n1

elsif n1 < 0 then

d1 = n1 * -1

else

u1 = 0

d1 = 0

endif

AvgPD = (u0 + u1) / 2 // simple average two-day gain

AvgND = (d0 + d1) / 2 // simple average two-day loss

a = 1/length + 1

// subtract yesterday from today for positive and negative price changes.

for i = 0 to LookBack do

diff = price1[length + i] - price1[length + 1 + i]

if diff > 0 then

diffP = diff

elsif diff < 0 then

diffN = diff * -1 // absolute value

else

diffP = 0

diffN = 0

endif

if i = 0 then // first averaging step

AvgP = AvgPD

AvgN = AvgND

else // subsequent averaging steps

AvgP = a * diffP + (1 - a) * AvgP

AvgN = a * diffN + (1 - a) * AvgN

endif

next

RS = AvgP/AvgN

xRSI = 100-(100/(1+RS))

return xRSI

Unfortunately, the above code does not work. Adjusting the ‘LookBack’ period seems to shift the entire calculation in time with zero ‘LookBack’ (meaning no look-back at all) the closet to TSO. I don’t think what I’m doing is near correct. Unsure why it is so difficult for find out the math or code used. Any help is sincerely appreciated.