This indicator uses historical volatility of the last 10 and 100 days.

Some research points to combining the 10 and 100 day historical volatility (HV) indicators can help identify HV signals.

Volatility measures the extent of price changes, but doesn't indicate the direction of the change.

Some suggest imbuing direction with the use of 20 bar moving average.

Suggestion:

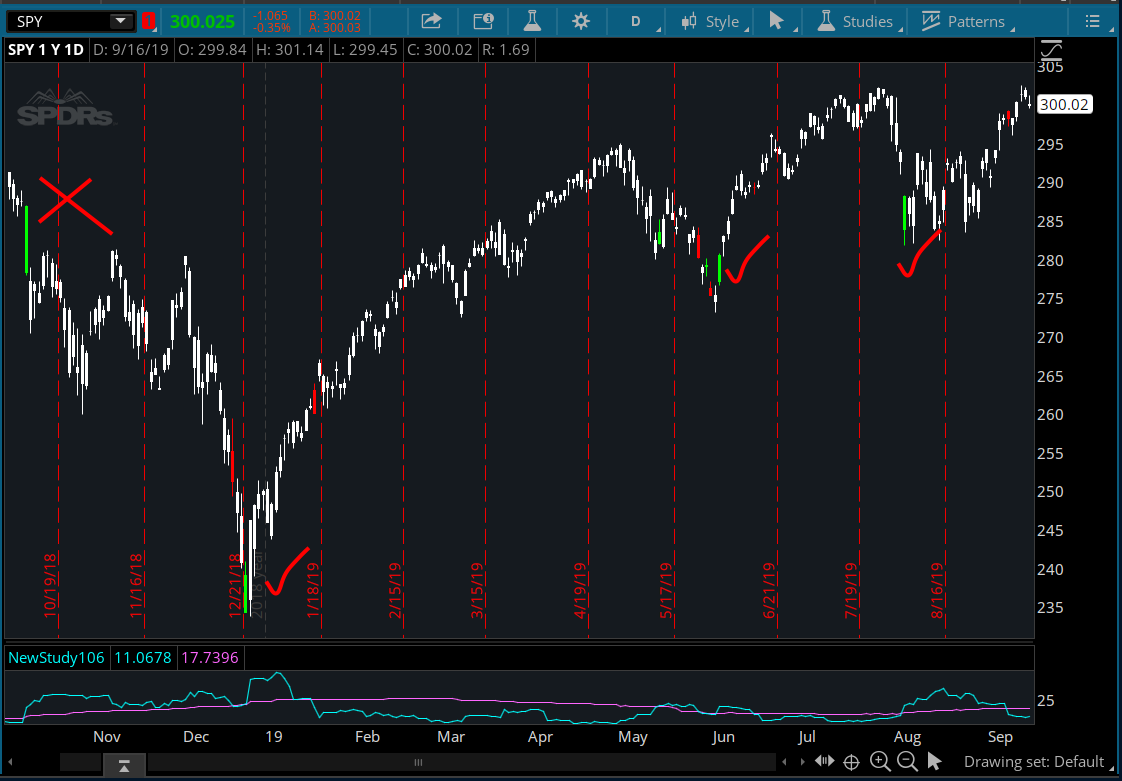

Look for an entry zone when the close has crossed above its 20 day moving average, and when Historical Volatility Indicator was .5 or lower within the last 10 days.

Exit Zones when close crosses below its 20 day moving average, and when Historical Volatility Indicator was .5 or lower within the last 10 days.

I think you should look at the daily chart first for this particular indicator. On $SPY it definitely spotted some nice bullish reversal signals.

It doesn't hurt to test on lower timeframes either

Some research points to combining the 10 and 100 day historical volatility (HV) indicators can help identify HV signals.

Volatility measures the extent of price changes, but doesn't indicate the direction of the change.

Some suggest imbuing direction with the use of 20 bar moving average.

Suggestion:

Look for an entry zone when the close has crossed above its 20 day moving average, and when Historical Volatility Indicator was .5 or lower within the last 10 days.

Exit Zones when close crosses below its 20 day moving average, and when Historical Volatility Indicator was .5 or lower within the last 10 days.

thinkScript Code

Code:

# Actionable Daily Historical Volatility

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/141g43Qm/

declare lower;

# Historical Volatility 10 day

def HV = stdev(log(close / close[1]), 10) * sqrt(365) * 100;

# Historical Volatility 100 day

def HV1 = stdev(log(close / close[1]), 100) * sqrt(365) * 100;

assignPriceColor(if HV>HV1 and HV[1]<HV1[1] then Color.Green else if HV<HV1 and HV[1]> HV1[1] then Color.Red else Color.White);

plot tenHV = HV;

plot HundredHV = HV1;

tenHV.SetDefaultColor(GetColor(1));

HundredHV.SetDefaultColor(GetColor(0));I think you should look at the daily chart first for this particular indicator. On $SPY it definitely spotted some nice bullish reversal signals.

It doesn't hurt to test on lower timeframes either

Attachments

Last edited by a moderator: