RickK

Active member

Warning: This is a repainting indicator/strategy. Proceed with caution.

So I keep coming back to the AccDist (with Stochastic) and the AccDist (with Linear Regression) and I'm starting to really like it.

The original idea came from a post thread that begins here: https://usethinkscript.com/threads/a-wonderful-simple-top-and-bottom-intraday-signal.1981/ and

I posted something awhile back here: https://usethinkscript.com/threads/a-wonderful-simple-top-and-bottom-intraday-signal.1981/post-39357

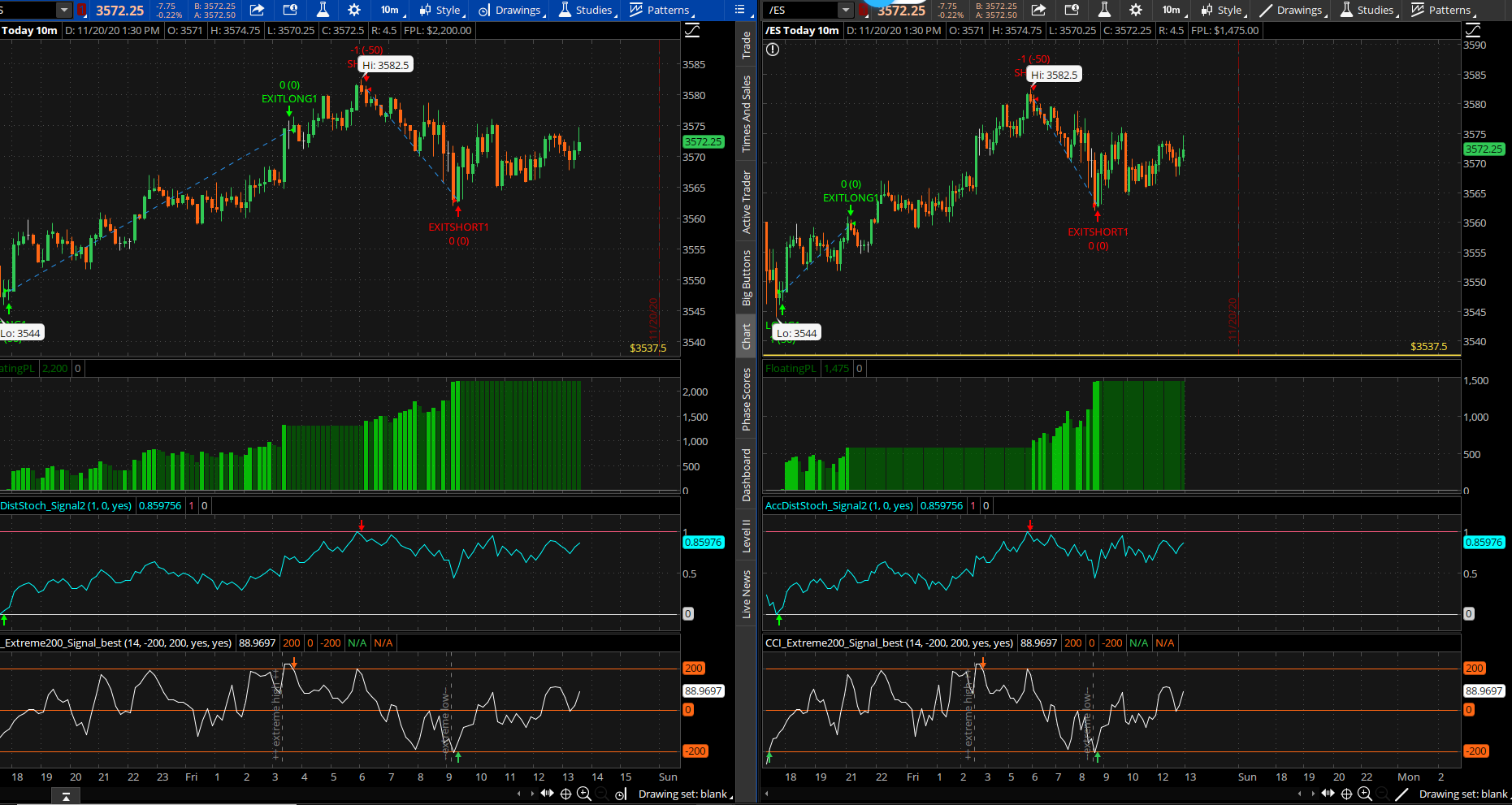

So I've patched together a little strategy that finds excellent entries and definitely successful exits... but not optimal exits. I'm hoping that others might jump in and start a dialog about how to optimize exits. What I did was combine the AccDist_Stochastic indicator with a CCI_Extremes indicator (which basically just signals when CCI has hit +200 or -200....which are often reversal or retracement points).

Note: I've come to the conclusion that with either of the AccDist indicators, displaying them on charts with multiple days can be deceiving. Meaning that the indicator may display wonderful tops and bottoms on, let's say, a 5min/10 day chart, but when those days were happening in real time, the signals may not have been there. The indicator is fickle that way. So, my conclusion is this: use this only on a "today" chart, meaning 3min:Today, 5min:Today, 10min:Today, 15min:Today and so on.

A lot of the entries happen after market closes/reopens, overnight and quite often 1-2 hrs before market open.

I didn't note original authors in the script, so let me say that all credit goes to @BillMurray , @Playstation @horserider , @BenTen , @mashume , @we29125 and others. I was just monkeying around tossing snippets into someone elses code.

I have included a chart layout that has the strategy (2 slightly differerent versions) in side by side charts like the image below. That chart is located here: http://tos.mx/VRj7S2b

Thanks to any and all that jump in.

So I keep coming back to the AccDist (with Stochastic) and the AccDist (with Linear Regression) and I'm starting to really like it.

The original idea came from a post thread that begins here: https://usethinkscript.com/threads/a-wonderful-simple-top-and-bottom-intraday-signal.1981/ and

I posted something awhile back here: https://usethinkscript.com/threads/a-wonderful-simple-top-and-bottom-intraday-signal.1981/post-39357

So I've patched together a little strategy that finds excellent entries and definitely successful exits... but not optimal exits. I'm hoping that others might jump in and start a dialog about how to optimize exits. What I did was combine the AccDist_Stochastic indicator with a CCI_Extremes indicator (which basically just signals when CCI has hit +200 or -200....which are often reversal or retracement points).

Note: I've come to the conclusion that with either of the AccDist indicators, displaying them on charts with multiple days can be deceiving. Meaning that the indicator may display wonderful tops and bottoms on, let's say, a 5min/10 day chart, but when those days were happening in real time, the signals may not have been there. The indicator is fickle that way. So, my conclusion is this: use this only on a "today" chart, meaning 3min:Today, 5min:Today, 10min:Today, 15min:Today and so on.

A lot of the entries happen after market closes/reopens, overnight and quite often 1-2 hrs before market open.

I didn't note original authors in the script, so let me say that all credit goes to @BillMurray , @Playstation @horserider , @BenTen , @mashume , @we29125 and others. I was just monkeying around tossing snippets into someone elses code.

I have included a chart layout that has the strategy (2 slightly differerent versions) in side by side charts like the image below. That chart is located here: http://tos.mx/VRj7S2b

Thanks to any and all that jump in.

Last edited by a moderator: