@BenTen Good day could you assist me in coding this Linda Raschke indicator in TOS:

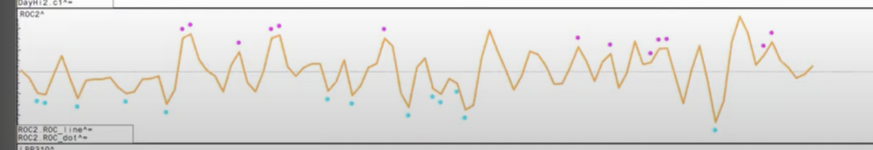

Indicator: 2 Period ROC with LBR 310 creating DOTS

Indicator Process: The line is the 2 period ROC. The dots are generated as follows - If the slope of the LBR 3/10 slow line, fast line, and the ROC are up, then you get a pink dot at the top of the ROC- If all three slopes are down, you get the blue dot at the bottom of the ROC line

** Note: The LBR 3/10 is Linda's Raschke oscillator. The fast line is just the SMA 3 minus the SMA 10. The slow line is the 16-period average of the fast line.

That should be everything you need to recreate it ! -- Attached is how this indicator should look:

Any help would be greatly appreciated.

Thanks

Indicator: 2 Period ROC with LBR 310 creating DOTS

Indicator Process: The line is the 2 period ROC. The dots are generated as follows - If the slope of the LBR 3/10 slow line, fast line, and the ROC are up, then you get a pink dot at the top of the ROC- If all three slopes are down, you get the blue dot at the bottom of the ROC line

** Note: The LBR 3/10 is Linda's Raschke oscillator. The fast line is just the SMA 3 minus the SMA 10. The slow line is the 16-period average of the fast line.

That should be everything you need to recreate it ! -- Attached is how this indicator should look:

Any help would be greatly appreciated.

Thanks