Yes, it works at times & doesn't at times - it's not consistent is what I am trying to say. If you look at LEV at 11:54am today, you'd see 2 spikes but uptrend never followed after the following candle. Chart timeframe is 1D2M. Not crtisizing your work at all. Trying to figure out how to understand it better. thats allLOOK at DUST on a 1D 2M chart. What do you see? P.S I use a black background myself. Set this under APPEARANCE in the setup for your charts. There is a background option and I changed the color

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DEEPWATER_THE ONE For ThinkOrSwim

- Thread starter Deepwater

- Start date

OK so when I pull up LEV 1D 2Min chart I see at 10:30 EST a Large Red Sell signal followed by RSI Compounding magenta Sell signals telling you to Consider selling. LEV is heavy overbought at that point as is likely to go down from there. How far it goes down is unknown.Yes, it works at times & doesn't at times - it's not consistent is what I am trying to say. If you look at LEV at 11:54am today, you'd see 2 spikes but uptrend never followed after the following candle. Chart timeframe is 1D2M. Not crtisizing your work at all. Trying to figure out how to understand it better. thats all

so the uptrend spikes at 11:54am est do not show up on your chart?OK so when I pull up LEV 1D 2Min chart I see at 10:30 EST a Large Red Sell signal followed by RSI Compounding magenta Sell signals telling you to Consider selling. LEV is heavy overbought at that point as is likely to go down from there. How far it goes down is unknown.

for today I see a small red spike after market opening (this indicated overbought and you can sell on these if your conservative), a second small red spike a bit later and then a larger Red Spike from the top was a strong sell. Then there is a bunch of RSI Magenta signals also screaming sell and buried in the magenta is another small red spike. Then it is quiet for a while. That's what i see for today. The last buy signal I see was yesterday Premarket onlyso the uptrend spikes at 11:54am est do not show up on your chart?

Yesterday there were 3 small red overbought spikes during regular market hours

G

greenalert20

Guest

So below is what has been really working for me for day-trading and scalping. I am using the original Deepwater indicator (05.07) and the ImKidKid version (see post 35). I combine it with Waddah Attar Exp. and Top Ultimate. I'm also using squeezePro on top chart and auto_fib.

My main cue is when Deepwater Original and DeepwaterImKidKid buy spikes line up and both the 2min and 5 min TMO are at zero. Then i wait for the TopUltimate buy bubble and i buy on the 1st or 2nd dark green Waddah Attar spike.

The new Deepwater (05.20) hardly gives me buy signals on 1min and 2min charts. I have it installed at the bottom with TrueMomentumOscillator and it misses out on some really good spikes.

My main cue is when Deepwater Original and DeepwaterImKidKid buy spikes line up and both the 2min and 5 min TMO are at zero. Then i wait for the TopUltimate buy bubble and i buy on the 1st or 2nd dark green Waddah Attar spike.

The new Deepwater (05.20) hardly gives me buy signals on 1min and 2min charts. I have it installed at the bottom with TrueMomentumOscillator and it misses out on some really good spikes.

I would really like to see what the new code misses out on. Cause I ran them one on top of the other and the only thing it discriminates against is if there is a spurious spike down lasting 1 candle, it ignores it as noise. Other than that looking at 100s of charts they were the same. But keep what is working for you. it looks goodSo below is what has been really working for me for day-trading and scalping. I am using the original Deepwater indicator (05.07) and the ImKidKid version (see post 35). I combine it with Waddah Attar Exp. and Top Ultimate. I'm also using squeezePro on top chart and auto_fib.

My main cue is when Deepwater Original and DeepwaterImKidKid buy spikes line up and both the 2min and 5 min TMO are at zero. Then i wait for the TopUltimate buy bubble and i buy on the 1st or 2nd dark green Waddah Attar spike.

The new Deepwater (05.20) hardly gives me buy signals on 1min and 2min charts. I have it installed at the bottom with TrueMomentumOscillator and it misses out on some really good spikes.

Yes it is there.so the uptrend spikes at 11:54am est do not show up on your chart?

good idea to use both versions (original & kids') simultaneously as a reconfirmation.So below is what has been really working for me for day-trading and scalping. I am using the original Deepwater indicator (05.07) and the ImKidKid version (see post 35). I combine it with Waddah Attar Exp. and Top Ultimate. I'm also using squeezePro on top chart and auto_fib.

My main cue is when Deepwater Original and DeepwaterImKidKid buy spikes line up and both the 2min and 5 min TMO are at zero. Then i wait for the TopUltimate buy bubble and i buy on the 1st or 2nd dark green Waddah Attar spike.

The new Deepwater (05.20) hardly gives me buy signals on 1min and 2min charts. I have it installed at the bottom with TrueMomentumOscillator and it misses out on some really good spikes.

Is the trend confirmed at opening of the spike or at close of spike? ThanksSo below is what has been really working for me for day-trading and scalping. I am using the original Deepwater indicator (05.07) and the ImKidKid version (see post 35). I combine it with Waddah Attar Exp. and Top Ultimate. I'm also using squeezePro on top chart and auto_fib.

My main cue is when Deepwater Original and DeepwaterImKidKid buy spikes line up and both the 2min and 5 min TMO are at zero. Then i wait for the TopUltimate buy bubble and i buy on the 1st or 2nd dark green Waddah Attar spike.

The new Deepwater (05.20) hardly gives me buy signals on 1min and 2min charts. I have it installed at the bottom with TrueMomentumOscillator and it misses out on some really good spikes.

fingerlakes

New member

Do you have a copy of the changed code? I couldnt seem to find it in the thread.5/20/2021 Added a stronger buy signal (taller) if a second buy comes within 14 candles of a previous strong buy. Changed Line Width to 2 or 3 to sharpen signal visibility. Reordered plot of yellow line to be after plot of stronger Green buys therefore you should only see Yellow Spike for over sold and only a larger Green Spike for the Strong Buy. No more yellow/Green Spikes.

Hope you like the changes. Page 1 code updated.

The code on Page 1 that started the thread is always the latest version.Do you have a copy of the changed code? I couldnt seem to find it in the thread.

The signal is set once the candle finalizes. It will not repaintIs the trend confirmed at opening of the spike or at close of spike? Thanks

fingerlakes

New member

How can we scan for strong buy and strong sell signals?The code on Page 1 that started the thread is always the latest version.

The signal is set once the candle finalizes. It will not repaint

I specialize by charting 30 stocks I learn their patterns and moves and use my indicator to buy and sell directly off the chart If Someone has made a scan version maybe they can post it. Also it should work in a custom watchlist column. If I have time I will work on those. Think it's a good ideaHow can we scan for strong buy and strong sell signals?

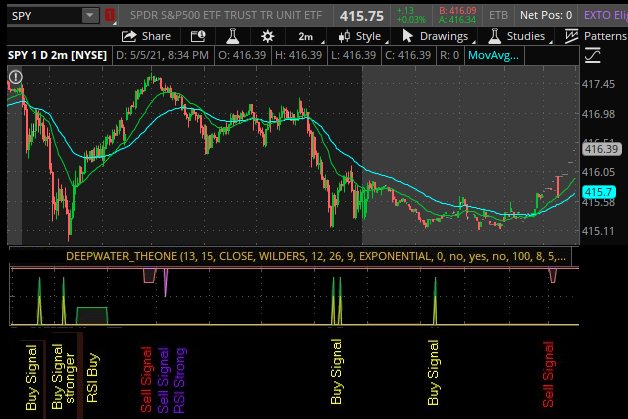

May I know? How to enable those remarks "Buy Signal" , "Sell Signal" on the chart?I call this study THE ONE. It is basically throw everything but the kitchen sink into one study that would help both a new trader and an experienced trader, Alerts me to things gapping, stocks suddenly seeing large volume, stocks with RSIs in extreme ranges. There are so many widgets of script in here that I look forward to others trying to improve it for the group. It is my payback to all of you who taught me so much and were unselfish with your knowledge and code. This is the one study I can not live without. I have 3 monitors and 30 charts I watch and "THE ONE" is the only indicator under each chart. I recently added what I call cumulative RSI extreme to it. What it does is if RSI goes overbought or oversold it starts cumulating and incrementing a count that seems to give a pretty good sell or buy signal. I have never seen this done and it is some neat code. I also look at MACD as it rounds over the top or bottom to trigger buy or sell signals. I do this with Spikes. Spikes from the top down are sells. Spikes from the Bottom up are buys. IT MAY BE THE EASIEST STUDY AS FAR AS SIGNALING YOU. IF SOMETHING IS IN ALERT AND NEEDS A LOOK YOU GET AN ALERT. EASY FOR NOVICE and NEWBIES. Just load it and watch it for a week. This is not financial advice. it is a tool to help you make your own decisions.

P.S. The code will give signals a bit differently on different time scales so always look at charts that are say 1D 1Min, 2D 5Min and 10D 30Min (these are only examples) and compare the buy and sell signals it's giving you. Enjoy I am Also running BillWilliams Indicator and Christpher84 ConfirmationCandles (without the arrows) upper and CC Candles Lower Indicators plus I also am running RSI with a RSI Avg only on my main screen chart.

5/17/2021 Added a stronger Buy indicator discriminator for Yellow/Green Buy Spikes.

5/20/2021 Added a stronger buy signal (taller) if a second buy comes within 14 candles of a previous strong buy. Changed Line Width to 2 or 3 to sharpen signal visibility. Reordered plot of yellow line to be after plot of stronger Green buys therefore you should only see Yellow Spike for over sold and only a larger Green Spike for the Strong Buy. No more yellow/Green Spikes.

#DEEPWATER_THE ONE 5/20/2021 revision

#https://usethinkscript.com/threads/deepwater_the-one.6518/

declare lower;

input length = 20;

input length2 = 15;

input price = close;

input averageType = AverageType.WILDERS;

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input averageTypeMACD = AverageType.EXPONENTIAL;

def Diff = MACD(fastLength, slowLength, MACDLength, averageTypeMACD).Diff;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def RSIAvg3 = MovingAverage(averageType, (RSI), 3);

def RSIAvg5 = MovingAverage(averageType, (RSI), 5);

def RSI3OverSoldpivit = RSIAvg3 > RSIAvg3[1] and RSIAvg3[1] > RSIAvg3[2] and RSIAvg3[2] < RSIAvg3[3] and RSIAvg3[3] < RSIAvg3 [4];

def RSI3OverBoughtpivit = RSIAvg3 < RSIAvg3[1] and RSIAvg3[1] < RSIAvg3[2] and RSIAvg3[2] > RSIAvg3[3] and RSIAvg3[3] > RSIAvg3 [4];

#--------------------5 day MA

input displace = 0;

input showBreakoutSignals = no;

def MAvgExp14 = ExpAverage(price[-displace], 14);

#--------------------oversold

def twoBarPivotMACD = Diff > Diff[1] and Diff[1] > Diff[2] and Diff[2] < Diff[3] and Diff[3] < Diff [4];

def overSoldRSI = RSI <= 32;

def overSoldRSIHeavy = RSI <= 30 and Diff < 0 and (close < close[7]);

def TrendReversalalert = (twoBarPivotMACD and Highest(overSoldRSI, 6) > 0) / 3;

Alert(TrendReversalalert, "Buy Alert");

plot TrendReversal1 = (twoBarPivotMACD and RSIAvg3 < 45 and Highest(overSoldRSIHeavy, 6) > 0) / 1.4;

plot TrendReversalstrongbuy = ((TrendReversal1[1] > 0 or TrendReversal1[2] > 0 or TrendReversal1[3] > 0 or TrendReversal1[4] > 0 or TrendReversal1[5] > 0 or TrendReversal1[6] > 0 or TrendReversal1[7] > 0 or TrendReversal1[8] > 0 or TrendReversal1[9] > 0 or TrendReversal1[10] > 0 or TrendReversal1[11] > 0 or TrendReversal1[12] > 0 or TrendReversal1[13] > 0 or TrendReversal1[14] > 0) and twoBarPivotMACD and RSIAvg3 < 45 and Highest(overSoldRSIHeavy, 6) > 0) / 1.1;

plot TrendReversal = (twoBarPivotMACD and TrendReversalstrongbuy < 1 and Highest(overSoldRSI, 6) > 0) / 3;

TrendReversal.SetDefaultColor(GetColor(4));#yellow

TrendReversal1.SetDefaultColor(GetColor(6));#green

TrendReversalstrongbuy.SetDefaultColor(GetColor(6));#green

TrendReversalstrongbuy.SetLineWeight(3);

TrendReversal1.SetLineWeight(2);

AddLabel(yes, if TrendReversal > 0 then "Buy" else "");

Alert( TrendReversalalert > 0, "Chart is now Oversold ", Alert.BAR, Sound.Ring);

AddLabel(TrendReversalalert > 0

, "Chart is now Oversold ", Color.LIME);

#-----------------------Overbought

def twoBarPivotMACD1 = Diff < Diff[1] and Diff[1] < Diff[2] and Diff[2] > Diff[3] and Diff[3] > Diff [4];

def overboughtRSI = RSIAvg3 >= 65 and Diff > 0;

def TrendReversalalert20 = (twoBarPivotMACD1 and Highest(overboughtRSI[1], 7) > 0);

plot TrendReversal20 = 1 - (((RSIAvg3 >= 68 and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit)/ 1.5) ;

plot TrendReversal20a = 1 - ((((RSIAvg3 >= 60 and RSIAvg3 < 68 )and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit) / 4) ;

TrendReversal20.SetDefaultColor(GetColor(5)); #Red

TrendReversal20a.SetDefaultColor(GetColor(2)); #lt Red

TrendReversal20a.SetLineWeight(2);

TrendReversal20.SetLineWeight(3);

plot TrendReversal50 = 1 - ((RSIAvg5 >= 70 and close < MAvgExp14) / 2) ;

TrendReversal50.SetDefaultColor(GetColor(0)); #Red

TrendReversal50.SetLineWeight(3);

AddLabel(yes, if TrendReversal20 < 1 then "Sell" else "");

Alert( TrendReversal20 < 1 , "Chart is now Overbought ", Alert.BAR, Sound.Ring);

AddLabel(TrendReversal20 < 1, "Chart is now Overbought ", Color.LIME);

input show_label = yes;

input show_bubble = no;

#--------------------------- Large 5X and 10X Volume Alert

input AverageLength = 100;

input VolumeMultiplier = 8;

input VolumeMultiplier2 = 5;

input MinutesAfterOpen = 30;

def AvgVol = Average(volume, AverageLength);

def VolX = (volume > AvgVol * VolumeMultiplier) ;

def Vol10X = (volume > AvgVol * 10) ;

Alert(VolX, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes);

AddLabel(VolX > 0, " Has 5X Volume Spike ", Color.LIGHT_GREEN);

Alert(Vol10X, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes);

AddLabel(Vol10X > 0, " Has 10X Volume Spike ", Color.LIGHT_GREEN);

#-------------------------------------GAP UP Price

def IsUp = close > open;

def IsDown = close < open;

def IsDoji = IsDoji();

def avgRange = 0.05 * Average(high - low, 20);

def GapUp =

IsUp[1] and

IsUp[0] and

high[1] < low[0] and

high[1] < open[0] and

(volume > AvgVol * 5) ;

Alert(GapUp, Concat(GetSymbolPart(), " GAPUP" ), Alert.BAR, Sound.Ring);

AddLabel(GapUp > 0, " GAP Up ", Color.LIGHT_GREEN);

#---------------------------------Large Price change 3%

def Priceup =

IsUp[1] and

IsUp[0] and

high[1] < high[0] and

high[2] * 1.02 < high[0] and

high[3] * 1.03 < high[0] and

(volume > AvgVol * 3) ;

Alert(Priceup, Concat(GetSymbolPart(), " Price JUMP" ), Alert.BAR, Sound.Bell);

AddLabel(Priceup > 0, " Price JUMP ", Color.CYAN);

#---------------------------------HugePrice change 6%

def Priceup2 =

IsUp[1] and

IsUp[0] and

high[1] < high[0] and

high[3] * 1.04 < high[0] and

high[4] * 1.06 < high[0] and

(volume > AvgVol * 3) ;

Alert(Priceup2, Concat(GetSymbolPart(), " JUMP! JUMP! JUMP" ), Alert.BAR, Sound.Chimes);

AddLabel(Priceup2 > 0, " JUMP! JUMP! JUMP ", Color.LIGHT_RED);

#-----------------------------------------------------------------------------------------

#--------------------------RSI cumulative running total

def MAvgExp7 = ExpAverage(price[-displace], 7);

def RSICalc = 50 * (ChgRatio + 1);

def RSICalc1 = if RSI > 70 then 3 else if RSI < 30 then -3 else 0;

def RSICalc2 = if RSI[1] > 70 then 2 else if RSI[1] < 30 then -2 else 0;

def RSICalc3 = if RSI[2] > 70 then 1 else if RSI[2] < 30 then -1 else 0;

def RSICalc4 = if RSI[3] > 70 then 1 else if RSI[3] < 30 then -1 else 0;

def RSICalc5 = if RSI[4] > 70 then 1 else if RSI[4] < 30 then -1 else 0;

def RSICalc6 = if RSI[5] > 70 then 1 else if RSI[5] < 30 then -1 else 0;

def RSICalc7 = if RSI[6] > 70 then 1 else if RSI[6] < 30 then -1 else 0;

def RSICalc8 = if RSI[7] > 70 then 1 else if RSI[7] < 30 then -1 else 0;

def RSICalc9 = if RSI[8] > 70 then 1 else if RSI[8] < 30 then -1 else 0;

def RSICalc10 = if RSI[9] > 70 then 1 else if RSI[9] < 30 then -1 else 0;

def RSICalc11 = if RSI[10] > 70 then 1 else if RSI[10] < 30 then -1 else 0;

def RSICalc12 = if RSI[11] > 70 then 1 else if RSI[11] < 30 then -1 else 0;

def RSICalc13 = if RSI[12] > 70 then 1 else if RSI[12] < 30 then -1 else 0;

def RSICalc14 = if RSI[13] > 70 then 1 else if RSI[13] < 30 then -1 else 0;

def RSICalc15 = if RSI[14] > 70 then 1 else if RSI[14] < 30 then -1 else 0;

def RSICalc16 = if RSI[15] > 70 then 1 else if RSI[15] < 30 then -1 else 0;

def RSICalc17 = if RSI[16] > 70 then 1 else if RSI[16] < 30 then -1 else 0;

def RSICalc18 = if RSI[17] > 70 then 1 else if RSI[17] < 30 then -1 else 0;

def RSICalc19 = if RSI[18] > 70 then 1 else if RSI[18] < 30 then -1 else 0;

def RSICalc20 = if RSI[19] > 70 then 1 else if RSI[19] < 30 then -1 else 0;

def RSICalc21 = if RSI[20] > 70 then 1 else if RSI[20] < 30 then -1 else 0;

def RSICalc22 = if RSI[21] > 70 then 1 else if RSI[21] < 30 then -1 else 0;

def RSICalc23 = if RSI[22] > 70 then 1 else if RSI[22] < 30 then -1 else 0;

def RSICalc24 = if RSI[23] > 70 then 1 else if RSI[23] < 30 then -1 else 0;

def RSICalc25 = if RSI[24] > 70 then 1 else if RSI[24] < 30 then -1 else 0;

def RSICalc26 = if RSI[25] > 70 then 1 else if RSI[25] < 30 then -1 else 0;

def RSICalc27 = if RSI[26] > 70 then 1 else if RSI[26] < 30 then -1 else 0;

def RSICalc28 = if RSI[27] > 70 then 1 else if RSI[27] < 30 then -1 else 0;

def RSICalc29 = if RSI[28] > 70 then 1 else if RSI[28] < 30 then -1 else 0;

def RSICalc30 = if RSI[29] > 70 then 1 else if RSI[29] < 30 then -1 else 0;

def RSI30DayAvg = RSICalc1 + RSICalc2 + RSICalc3 + RSICalc4 + RSICalc5 + RSICalc6 + RSICalc7 + RSICalc8 + RSICalc9 + RSICalc10 + RSICalc11 + RSICalc12 + RSICalc13 + RSICalc14 + RSICalc15 + RSICalc16 + RSICalc17 + RSICalc18 + RSICalc19 + RSICalc20 + RSICalc21 + RSICalc22 + RSICalc23 + RSICalc24 + RSICalc25 + RSICalc26 + RSICalc27 + RSICalc28 + RSICalc29 + RSICalc30;

AddLabel(RSI30DayAvg >= 10 and RSI30DayAvg < 20, " RSI SELL: " + RSI30DayAvg + " ", Color.ORANGE);

AddLabel(RSI30DayAvg >= 20, " RSI SELL: " + RSI30DayAvg + " ", Color.RED);

AddLabel(RSI30DayAvg <= -10 and RSI30DayAvg > -20, " RSI BUY: " + RSI30DayAvg + " ", Color.LIME);

AddLabel(RSI30DayAvg <= -20, " RSI BUY: " + RSI30DayAvg + " ", Color.DARK_GREEN);

plot TrendReversal5 = 1 - (((RSI30DayAvg >= 10 and RSI30DayAvg < 15) and close < MAvgExp7) / 2) ;

TrendReversal5.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal5a = 1 - (((RSI30DayAvg >= 16 and RSI30DayAvg < 25) and close < MAvgExp7) / 1.3) ;

TrendReversal5a.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal5b = 1 - ((RSI30DayAvg >= 25 and close < MAvgExp7) / 1.05) ;

TrendReversal5b.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal6 = ((RSI30DayAvg <= -15 and close > MAvgExp7 ) * .3) ;

TrendReversal6.SetDefaultColor(GetColor(6)); #green

plot TrendReversal6a = (((RSI30DayAvg <= -20 and RSI30DayAvg > -30) and close > MAvgExp7) * .85) ;

TrendReversal6a.SetDefaultColor(GetColor(6)); #green

TrendReversal6a.SetLineWeight(3);

TrendReversal5b.SetLineWeight(3);

TrendReversal6.SetLineWeight(2);

TrendReversal5a.SetLineWeight(2);

#End Code

The code is on Page 1 first entry. Copy all the code. On your chart select 'Studies', 'Edit Studies', 'Create' Paste the new code over the top of 'plot Data = close;' Lastly give it a new name where NewStudy0 is. You can call it Deepwater_The_One or whatever you want. Apply and OK to save it. Should appear on your chart lower sectionMay I know? How to enable those remarks "Buy Signal" , "Sell Signal" on the chart?

Thanks for your instructions. After installing the study, I can see those spikes. However I cannot see those remarks in words on the chart?The code is on Page 1 first entry. Copy all the code. On your chart select 'Studies', 'Edit Studies', 'Create' Paste the new code over the top of 'plot Data = close;' Lastly give it a new name where NewStudy0 is. You can call it Deepwater_The_One or whatever you want. Apply and OK to save it. Should appear on your chart lower section

You have a chart setup icon on your chart menu and in it is an Appearance Tab. I go with Candles and Fill up Green and Red but also you can change background. I changed mine to Black to see the charts easier. Also the text only comes up on alerts. You should see them if a stock gets Volatile.Thanks for your instructions. After installing the study, I can see those spikes. However I cannot see those remarks in words on the chart?

The signals appear in the lower area below the charts vice directly on the chart. The Alerts will appear down there also when the stock gets active.May I know? How to enable those remarks "Buy Signal" , "Sell Signal" on the chart?

I can see the signals clearly shown under the Lower study in my charts, when using the spikes as a guide the result was very promising. However I still cannot display the following remarks under my chart!The signals appear in the lower area below the charts vice directly on the chart. The Alerts will appear down there also when the stock gets active.

https://ibb.co/6YQGQKF

OH LOL. NOW I UNDERSTAND. I took the Image Screen grab into a graphics program, rotated it 90 degrees and wrote those words so folks could Identify the symbol when they saw it. Those are not in the code. I added them to the image afterward for informational use only. Hope that clears it upI can see the signals clearly shown under the Lower study in my charts, when using the spikes as a guide the result was very promising. However I still cannot display the following remarks under my chart!

https://ibb.co/6YQGQKF

Last edited:

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 6

-

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 10

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 7

-

Smart Money w/Gallium Nitride For ThinkOrSwim

- Started by Adeodatus

- Replies: 11

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1186

Online

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 6

-

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 10

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 7

-

Smart Money w/Gallium Nitride For ThinkOrSwim

- Started by Adeodatus

- Replies: 11

Similar threads

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 6

-

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 10

-

Repaints AGAIG Trading The QQQs & SPY For Profit With ThinkOrSwim?

- Started by csricksdds

- Replies: 7

-

Smart Money w/Gallium Nitride For ThinkOrSwim

- Started by Adeodatus

- Replies: 11

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.