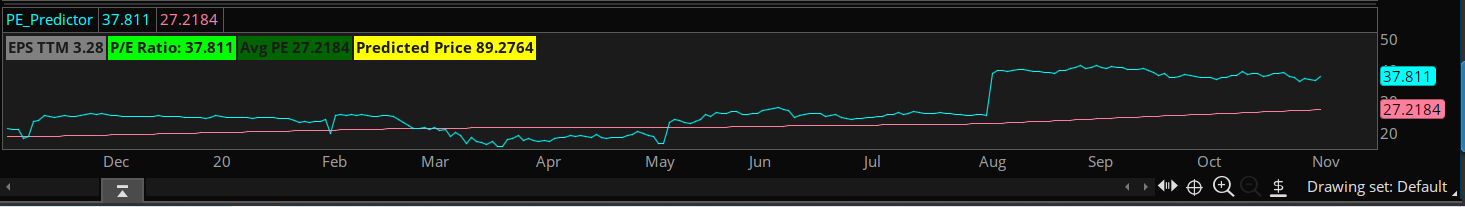

Intro: This indicator is very simple and just slightly more sophisticated then the original found at thinkorswims site here. This indicator uses the trailing 12 month PE average over the last 12 months and gives you the price the stock normally trades at relative to that value. This could be used to identify overhyped stocks that are good for shorting. One strategy I am researching is finding stocks that are deviating significantly from their average PE going into earnings, creating an unrealistic expectation scenario that the stock will be unlikely to live up to. My research is combining this with V shaped RSI spikes and resistance levels to identify top heavy stocks.

Caveats: Only works on daily charts and is not split adjusted so will give inaccurate results at times. Obviously the values would be meaningless on a company that had a negative eps.

Notes: Sometimes the predicted price doesnt make sense, but I believe that is the purpose of this indicator, to find values that dont make sense in order to find out if there is a way to profit from the unbalance. As always it is just another tool, mostly to try to bridge the gap from our normal TA to the fundamental analysis.

Code:

Caveats: Only works on daily charts and is not split adjusted so will give inaccurate results at times. Obviously the values would be meaningless on a company that had a negative eps.

Notes: Sometimes the predicted price doesnt make sense, but I believe that is the purpose of this indicator, to find values that dont make sense in order to find out if there is a way to profit from the unbalance. As always it is just another tool, mostly to try to bridge the gap from our normal TA to the fundamental analysis.

Code:

Code:

declare lower;

def AE = if IsNaN(GetActualEarnings()) then 0 else GetActualEarnings();

def EPS_TTM = Sum(AE, 252);

plot pe = close / EPS_TTM;

plot SMA = Average(pe, 252);

AddLabel(yes, "EPS TTM " + EPS_TTM, color.Gray);

AddLabel(yes, "P/E Ratio: " + pe, color.Green);

AddLabel(yes, "Avg PE " + SMA, Color.DARK_GREEN);

AddLabel(yes, "Predicted Price " + SMA*EPS_TTM,Color.Yellow);