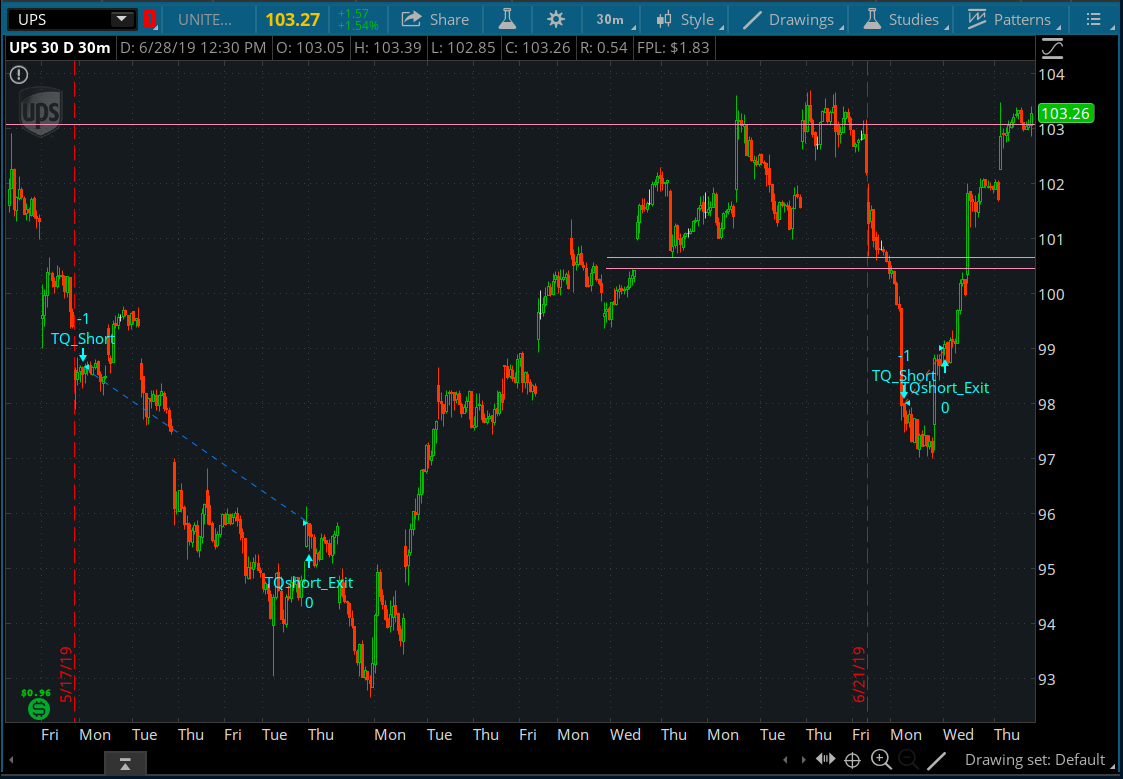

Here is a strategy based on the Trend Quality indicator that gives you buy and sell signals. It's useful for backtesting purposes and enhances your current trading setup.

Credit:

TQ Long Entry

Code:

declare LONG_ENTRY;

input tqfastLength = 52;

input tqslowLength = 15;

input tqtrendLength = 4;

input tqnoiseType = {default linear, squared};

input tqnoiseLength = 250;

input tqcorrectionFactor = 2;

input TrendThreshold = 3;

input tradeSize = 1;

def MorningOpenHour = 9;

def MorningCloseHour = 12.5;

def AfternoonOpenHour = 13.5;

def AfternoonCloseHour = 16;

def secondsSinceMidnight = secondsFromTime(0);

def safetimemorning = secondsSinceMidnight > MorningOpenHour * 60 * 60 and secondsSinceMidnight < MorningCloseHour * 60 * 60;

def safetimeafternoon = secondsSinceMidnight > AfternoonOpenHour * 60 * 60 and secondsSinceMidnight < AfternoonCloseHour * 60 * 60;

def safetime = safetimemorning or safetimeafternoon;

def TrendQ = TrendQuality(tqfastlength, tqslowlength, tqtrendLength, tqnoiseType, tqnoiseLength, tqcorrectionFactor);

def trendqualityrising = TrendQ > TrendThreshold and TrendQ[1] <= TrendThreshold;

SetColor(GetColor(1));

addOrder(trendqualityrising and safetime, open[-1], tradeSize);

alert(trendqualityrising and safetime, "TQ Long Entry.", Alert.BAR, Sound.NoSound);TQ Long Exit

Code:

declare LONG_EXIT;

input tqfastLength = 7;

input tqslowLength = 15;

input tqtrendLength = 4;

input tqnoiseType = {default linear, squared};

input tqnoiseLength = 250;

input tqcorrectionFactor = 2;

input TrendThreshold = 5;

input tradeSize = 1;

def TrendQ = TrendQuality(tqfastlength, tqslowlength, tqtrendLength, tqnoiseType, tqnoiseLength, tqcorrectionFactor);

def trendqualityfallen = TrendQ < 1 and TrendQ[1] >= TrendThreshold and TrendQ[2] >= TrendThreshold;

SetColor(GetColor(1));

addOrder(trendqualityfallen, open[-1], tradeSize);TQ Short Entry

Code:

declare SHORT_ENTRY;

input tqfastLength = 52;

input tqslowLength = 15;

input tqtrendLength = 4;

input tqnoiseType = {default linear, squared};

input tqnoiseLength = 250;

input tqcorrectionFactor = 2;

input TrendThreshold = 3;

input tradeSize = 1;

def MorningOpenHour = 9;

def MorningCloseHour = 12.5;

def AfternoonOpenHour = 13.5;

def AfternoonCloseHour = 16;

def secondsSinceMidnight = secondsFromTime(0);

def safetimemorning = secondsSinceMidnight > MorningOpenHour * 60 * 60 and secondsSinceMidnight < MorningCloseHour * 60 * 60;

def safetimeafternoon = secondsSinceMidnight > AfternoonOpenHour * 60 * 60 and secondsSinceMidnight < AfternoonCloseHour * 60 * 60;

def safetime = safetimemorning or safetimeafternoon;

def TrendQ = TrendQuality(tqfastlength, tqslowlength, tqtrendLength, tqnoiseType, tqnoiseLength, tqcorrectionFactor);

def trendqualityrising = TrendQ < -TrendThreshold and TrendQ[1] >= -TrendThreshold;

SetColor(GetColor(1));

addOrder(trendqualityrising, open[-1], tradeSize);

alert(trendqualityrising and safetime, "TQ Short Entry.", Alert.BAR, Sound.NoSound);TQ Short Exit

Code:

declare SHORT_EXIT;

input tqfastLength = 7;

input tqslowLength = 15;

input tqtrendLength = 4;

input tqnoiseType = {default linear, squared};

input tqnoiseLength = 250;

input tqcorrectionFactor = 2;

input TrendThreshold = 5;

input tradeSize = 1;

def TrendQ = TrendQuality(tqfastlength, tqslowlength, tqtrendLength, tqnoiseType, tqnoiseLength, tqcorrectionFactor);

def trendqualityfallen = TrendQ > -1 and TrendQ[1] <= -TrendThreshold and TrendQ[2] <= -TrendThreshold;

SetColor(GetColor(1));

addOrder(trendqualityfallen, open[-1], tradeSize);Credit: