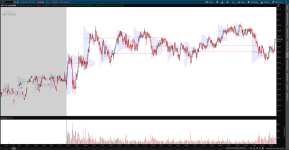

#VolumeProfile_Extended_POCs_HVAs_LVAs_for_x_Daysback_and_Limited_Plots_when_crossed

#More can be added using the logic below

#Sleepyz - usethinkscript request @yardlay

#Added HVA * LVA Lines and Plot limit when crossed for all 3;

#Added Price to Most Recent Naked Labels

script v {

input daysback = 1;

def volp = reference VolumeProfile("time per profile" = "DAY", "on expansion" = no, "price per row height mode" = "TICKSIZE");

def ymd = GetYYYYMMDD();

def y = if ymd != ymd[1] then y[1] + 1 else y[1];

def pc = if IsNaN(close)

then pc[1] else

if y == HighestAll(y) - daysback

then volp else

pc[1];

plot x = if y > HighestAll(y) - daysback and Between(pc, low, high)

then BarNumber() else Double.NaN;

plot poc = if IsNaN(LowestAll(x))

then pc

else if BarNumber() > LowestAll(x)

then Double.NaN

else pc;

}

script vh {

input daysback = 1;

def volh = reference VolumeProfile("time per profile" = "DAY", "on expansion" = no, "price per row height mode" = "TICKSIZE").VAHigh;

def ymd = GetYYYYMMDD();

def y = if ymd != ymd[1] then y[1] + 1 else y[1];

def ph = if IsNaN(close)

then ph[1] else

if y == HighestAll(y) - daysback

then volh else

ph[1];

plot x = if y > HighestAll(y) - daysback and Between(ph, low, high)

then BarNumber() else Double.NaN;

plot hva = if IsNaN(LowestAll(x))

then ph

else if BarNumber() > LowestAll(x)

then Double.NaN

else ph;

}

script vl {

input daysback = 1;

def voll = reference VolumeProfile("time per profile" = "DAY", "on expansion" = no, "price per row height mode" = "TICKSIZE").VALow;

def ymd = GetYYYYMMDD();

def y = if ymd != ymd[1] then y[1] + 1 else y[1];

def pl = if IsNaN(close)

then pl[1] else

if y == HighestAll(y) - daysback

then voll else

pl[1];

plot x = if y > HighestAll(y) - daysback and Between(pl, low, high)

then BarNumber() else Double.NaN;

plot val = if IsNaN(LowestAll(x))

then pl

else if BarNumber() > LowestAll(x)

then Double.NaN

else pl;

}

DefineGlobalColor("H", Color.YELLOW);

DefineGlobalColor("L", Color.YELLOW);

DefineGlobalColor("P", Color.WHITE);

DefineGlobalColor("NB", Color.MAGENTA);

plot v1 = v(1).poc;

v1.AssignValueColor(if IsNaN(LowestAll(v(1).x)) then GlobalColor("NB") else GlobalColor("P"));

v1.SetPaintingStrategy(PaintingStrategy.DASHES);

v1.SetLineWeight(1);

plot v2 = v(2).poc;

v2.AssignValueColor(if IsNaN(LowestAll(v(2).x)) then GlobalColor("NB") else GlobalColor("P"));

v2.SetPaintingStrategy(PaintingStrategy.DASHES);

v2.SetLineWeight(1);

plot v3 = v(3).poc;

v3.AssignValueColor(if IsNaN(LowestAll(v(3).x)) then GlobalColor("NB") else GlobalColor("P"));

v3.SetPaintingStrategy(PaintingStrategy.DASHES);

v3.SetLineWeight(1);

plot v4 = v(4).poc;

v4.AssignValueColor(if IsNaN(LowestAll(v(4).x)) then GlobalColor("NB") else GlobalColor("P"));

v4.SetPaintingStrategy(PaintingStrategy.DASHES);

v4.SetLineWeight(1);

plot v5 = v(5).poc;

v5.AssignValueColor(if IsNaN(LowestAll(v(5).x)) then GlobalColor("NB") else GlobalColor("P"));

v5.SetPaintingStrategy(PaintingStrategy.DASHES);

v5.SetLineWeight(1);

plot v6 = v(6).poc;

v6.AssignValueColor(if IsNaN(LowestAll(v(6).x)) then GlobalColor("NB") else GlobalColor("P"));

v6.SetPaintingStrategy(PaintingStrategy.DASHES);

v6.SetLineWeight(1);

plot v7 = v(7).poc;

v7.AssignValueColor(if IsNaN(LowestAll(v(7).x)) then GlobalColor("NB") else GlobalColor("P"));

v7.SetPaintingStrategy(PaintingStrategy.DASHES);

v7.SetLineWeight(1);

plot v8 = v(8).poc;

v8.AssignValueColor(if IsNaN(LowestAll(v(8).x)) then GlobalColor("NB") else GlobalColor("P"));

v8.SetPaintingStrategy(PaintingStrategy.DASHES);

v8.SetLineWeight(1);

plot v9 = v(9).poc;

v9.AssignValueColor(if IsNaN(LowestAll(v(9).x)) then GlobalColor("NB") else GlobalColor("P"));

v9.SetPaintingStrategy(PaintingStrategy.DASHES);

v9.SetLineWeight(1);

plot v10 = v(10).poc;

v10.AssignValueColor(if IsNaN(LowestAll(v(10).x)) then GlobalColor("NB") else GlobalColor("P"));

v10.SetPaintingStrategy(PaintingStrategy.DASHES);

v10.SetLineWeight(1);

;

AddLabel(1, "Most Recent Naked --> POC: " +

if IsNaN(LowestAll(v(1).x)) then "V1: " + v1 else

if IsNaN(LowestAll(v(2).x)) then "V2: " + v2 else

if IsNaN(LowestAll(v(3).x)) then "V3: " + v3 else

if IsNaN(LowestAll(v(4).x)) then "V4: " + v4 else

if IsNaN(LowestAll(v(5).x)) then "V5: " + v5 else

if IsNaN(LowestAll(v(6).x)) then "V6: " + v6 else

if IsNaN(LowestAll(v(7).x)) then "V7: " + v7 else

if IsNaN(LowestAll(v(8).x)) then "V8: " + v8 else

if IsNaN(LowestAll(v(9).x)) then "V9: " + v9 else

if IsNaN(LowestAll(v(10).x)) then "V10: " + v10 else

"NO V", Color.YELLOW) ;

plot vh1 = vh(1).hva;

vh1.AssignValueColor(if IsNaN(LowestAll(vh(1).x)) then GlobalColor("NB") else GlobalColor("H"));

vh1.SetPaintingStrategy(PaintingStrategy.DASHES);

vh1.SetLineWeight(1);

plot vh2 = vh(2).hva;

vh2.AssignValueColor(if IsNaN(LowestAll(vh(2).x)) then GlobalColor("NB") else GlobalColor("H"));

vh2.SetPaintingStrategy(PaintingStrategy.DASHES);

vh2.SetLineWeight(1);

plot vh3 = vh(3).hva;

vh3.AssignValueColor(if IsNaN(LowestAll(vh(3).x)) then GlobalColor("NB") else GlobalColor("H"));

vh3.SetPaintingStrategy(PaintingStrategy.DASHES);

vh3.SetLineWeight(1);

plot vh4 = vh(4).hva;

vh4.AssignValueColor(if IsNaN(LowestAll(vh(4).x)) then GlobalColor("NB") else GlobalColor("H"));

vh4.SetPaintingStrategy(PaintingStrategy.DASHES);

vh4.SetLineWeight(1);

plot vh5 = vh(5).hva;

vh5.AssignValueColor(if IsNaN(LowestAll(vh(5).x)) then GlobalColor("NB") else GlobalColor("H"));

vh5.SetPaintingStrategy(PaintingStrategy.DASHES);

vh5.SetLineWeight(1);

plot vh6 = vh(6).hva;

vh6.AssignValueColor(if IsNaN(LowestAll(vh(6).x)) then GlobalColor("NB") else GlobalColor("H"));

vh6.SetPaintingStrategy(PaintingStrategy.DASHES);

vh6.SetLineWeight(1);

plot vh7 = vh(7).hva;

vh7.AssignValueColor(if IsNaN(LowestAll(vh(7).x)) then GlobalColor("NB") else GlobalColor("H"));

vh7.SetPaintingStrategy(PaintingStrategy.DASHES);

vh7.SetLineWeight(1);

plot vh8 = vh(8).hva;

vh8.AssignValueColor(if IsNaN(LowestAll(vh(8).x)) then GlobalColor("NB") else GlobalColor("H"));

vh8.SetPaintingStrategy(PaintingStrategy.DASHES);

vh8.SetLineWeight(1);

plot vh9 = vh(9).hva;

vh9.AssignValueColor(if IsNaN(LowestAll(vh(9).x)) then GlobalColor("NB") else GlobalColor("H"));

vh9.SetPaintingStrategy(PaintingStrategy.DASHES);

vh9.SetLineWeight(1);

plot vh10 = vh(10).hva;

vh10.AssignValueColor(if IsNaN(LowestAll(vh(10).x)) then GlobalColor("NB") else GlobalColor("H"));

vh10.SetPaintingStrategy(PaintingStrategy.DASHES);

vh10.SetLineWeight(1);

;

AddLabel(1, " VAH: " +

if IsNaN(LowestAll(vh(1).x)) then "VH1: " + vh1 else

if IsNaN(LowestAll(vh(2).x)) then "VH2: " + vh2 else

if IsNaN(LowestAll(vh(3).x)) then "VH3: " + vh3 else

if IsNaN(LowestAll(vh(4).x)) then "VH4: " + vh4 else

if IsNaN(LowestAll(vh(5).x)) then "VH5: " + vh5 else

if IsNaN(LowestAll(vh(6).x)) then "VH6: " + vh6 else

if IsNaN(LowestAll(vh(7).x)) then "VH7: " + vh7 else

if IsNaN(LowestAll(vh(8).x)) then "VH8: " + vh8 else

if IsNaN(LowestAll(vh(9).x)) then "VH9: " + vh9 else

if IsNaN(LowestAll(vh(10).x)) then "VH10: " + vh10 else

"NO VH", Color.WHITE) ;

plot vl1 = vl(1).val;

vl1.AssignValueColor(if IsNaN(LowestAll(vl(1).x)) then GlobalColor("NB") else GlobalColor("L"));

vl1.SetPaintingStrategy(PaintingStrategy.DASHES);

vl1.SetLineWeight(1);

plot vl2 = vl(2).val;

vl2.AssignValueColor(if IsNaN(LowestAll(vl(2).x)) then GlobalColor("NB") else GlobalColor("L"));

vl2.SetPaintingStrategy(PaintingStrategy.DASHES);

vl2.SetLineWeight(1);

plot vl3 = vl(3).val;

vl3.AssignValueColor(if IsNaN(LowestAll(vl(3).x)) then GlobalColor("NB") else GlobalColor("L"));

vl3.SetPaintingStrategy(PaintingStrategy.DASHES);

vl3.SetLineWeight(1);

plot vl4 = vl(4);

vl4.AssignValueColor(if IsNaN(LowestAll(vl(4).x)) then GlobalColor("NB") else GlobalColor("L"));

vl4.SetPaintingStrategy(PaintingStrategy.DASHES);

vl4.SetLineWeight(1);

plot vl5 = vl(5).val;

vl5.AssignValueColor(if IsNaN(LowestAll(vl(5).x)) then GlobalColor("NB") else GlobalColor("L"));

vl5.SetPaintingStrategy(PaintingStrategy.DASHES);

vl5.SetLineWeight(1);

plot vl6 = vl(6).val;

vl6.AssignValueColor(if IsNaN(LowestAll(vl(6).x)) then GlobalColor("NB") else GlobalColor("L"));

vl6.SetPaintingStrategy(PaintingStrategy.DASHES);

vl6.SetLineWeight(1);

plot vl7 = vl(7).val;

vl7.AssignValueColor(if IsNaN(LowestAll(vl(7).x)) then GlobalColor("NB") else GlobalColor("L"));

vl7.SetPaintingStrategy(PaintingStrategy.DASHES);

vl7.SetLineWeight(1);

plot vl8 = vl(8).val;

vl8.AssignValueColor(if IsNaN(LowestAll(vl(8).x)) then GlobalColor("NB") else GlobalColor("L"));

vl8.SetPaintingStrategy(PaintingStrategy.DASHES);

vl8.SetLineWeight(1);

plot vl9 = vl(9).val;

vl9.AssignValueColor(if IsNaN(LowestAll(vl(9).x)) then GlobalColor("NB") else GlobalColor("L"));

vl9.SetPaintingStrategy(PaintingStrategy.DASHES);

vl9.SetLineWeight(1);

plot vl10 = vl(10).val;

vl10.AssignValueColor(if IsNaN(LowestAll(vl(10).x)) then GlobalColor("NB") else GlobalColor("L"));

vl10.SetPaintingStrategy(PaintingStrategy.DASHES);

vl10.SetLineWeight(1);

;

AddLabel(1, " VAL: " +

if IsNaN(LowestAll(vl(1).x)) then "VL1: " + vl1 else

if IsNaN(LowestAll(vl(2).x)) then "VL2: " + vl2 else

if IsNaN(LowestAll(vl(3).x)) then "VL3: " + vl3 else

if IsNaN(LowestAll(vl(4).x)) then "VL4: " + vl4 else

if IsNaN(LowestAll(vl(5).x)) then "VL5: " + vl5 else

if IsNaN(LowestAll(vl(6).x)) then "VL6: " + vl6 else

if IsNaN(LowestAll(vl(7).x)) then "VL7: " + vl7 else

if IsNaN(LowestAll(vl(8).x)) then "VL8: " + vl8 else

if IsNaN(LowestAll(vl(9).x)) then "VL9: " + vl9 else

if IsNaN(LowestAll(vl(10).x)) then "VL10: " + vl10 else

"NO VL", Color.YELLOW) ;

input showbubbles = yes;

input bubblemover = 3;

def b = bubblemover;

def b1 = b + 1;

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v1[b], "1P " + v1 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v2[b], "2P " + v2 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v3[b], "3P " + v3 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v4[b], "4P " + v4 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v5[b], "5P " + v5 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v6[b], "6P " + v6 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v7[b], "7P " + v7 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v8[b], "8P " + v8 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v9[b], "9P " + v9 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), v10[b], "10P " + v10 , GlobalColor("P"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh1[b], "1H " + vh1 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh2[b], "2H " + vh2 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh3[b], "3H " + vh3 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh4[b], "4H " + vh4 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh5[b], "5H " + vh5 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh6[b], "6H " + vh6 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh7[b], "7H " + vh7 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh8[b], "8H " + vh8 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh9[b], "9H " + vh9 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vh10[b], "10H " + vh10 , GlobalColor("H"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl1[b], "1L " + vl1 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl2[b], "2L " + vl2 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl3[b], "3L " + vl3 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl4[b], "4L " + vl4 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl5[b], "5L " + vl5 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl6[b], "6L " + vl6 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl7[b], "7L " + vl7 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl8[b], "8L " + vl8 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl9[b], "9L " + vl9 , GlobalColor("L"));

AddChartBubble(showbubbles and IsNaN(close[b]) and !IsNaN(close[b1]), vl10[b], "10L " + vl10 , GlobalColor("L"));

v1.HideBubble();

v2.HideBubble();

v3.HideBubble();

v4.HideBubble();

v5.HideBubble();

v6.HideBubble();

v7.HideBubble();

v8.HideBubble();

v9.HideBubble();

v10.HideBubble();

vh1.HideBubble();

vh2.HideBubble();

vh3.HideBubble();

vh4.HideBubble();

vh5.HideBubble();

vh6.HideBubble();

vh7.HideBubble();

vh8.HideBubble();

vh9.HideBubble();

vh10.HideBubble();

vl1.HideBubble();

vl2.HideBubble();

vl3.HideBubble();

vl4.HideBubble();

vl5.HideBubble();

vl6.HideBubble();

vl7.HideBubble();

vl8.HideBubble();

vl9.HideBubble();

vl10.HideBubble();

#Bubbles @ Crosses

DefineGlobalColor("HC", Color.light_red);

DefineGlobalColor("LC", Color.light_green);

DefineGlobalColor("PC", Color.orange);

input lookback = 2;

def ymd = GetYYYYMMDD();

def y = if ymd != ymd[1] then y[1] + 1 else y[1];

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v1[-1]) and v1, v1, "P1", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v2[-1]) and v2, v2, "P2", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v3[-1]) and v3, v3, "P3", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v4[-1]) and v4, v4, "P4", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v5[-1]) and v5, v5, "P5", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v6[-1]) and v6, v6, "P6", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v7[-1]) and v7, v7, "P7", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v8[-1]) and v8, v8, "P8", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v9[-1]) and v9, v9, "P9", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(v10[-1]) and v10, v10, "P10", globalcolor("PC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh1[-1]) and vh1, vh1, "H1", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh2[-1]) and vh2, vh2, "H2", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh3[-1]) and vh3, vh3, "H3", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh4[-1]) and vh4, vh4, "H4", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh5[-1]) and vh5, vh5, "H5", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh6[-1]) and vh6, vh6, "H6", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh7[-1]) and vh7, vh7, "H7", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh8[-1]) and vh8, vh8, "H8", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh9[-1]) and vh9, vh9, "H9", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vh10[-1]) and vh10, vh10, "H10", globalColor("HC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl1[-1]) and vl1, vl1, "L1", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl2[-1]) and vl2, vl2, "L2", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl3[-1]) and vl3, vl3, "L3", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl4[-1]) and vl4, vl4, "L4", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl5[-1]) and vl5, vl5, "L5", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl6[-1]) and vl6, vl6, "L6", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl7[-1]) and vl7, vl7, "L7", globalColor("LC"))

;addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl8[-1]) and vl8, vl8, "L8", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl9[-1]) and vl9, vl9, "L9", globalColor("LC"));

addchartBubble(if lookback <= highestall(y)-y then double.nan else isnan(vl10[-1]) and vl10, vl10, "L10", globalColor("LC"));