The Andean Oscillator is a technical tool designed to analyze market trends using bands, which are visual guides for price movement. For beginners, it’s helpful to first google the basics of trading with bands to ensure you have a solid foundation before diving into this indicator.

This oscillator provides several insights, but its primary focus is on two components: the bull component (green line) and the bear component (blue line). These lines represent bullish (upward) and bearish (downward) price trends, respectively.

you may find full details on the indicator below.

https://alpaca.markets/learn/andean...ed-on-an-online-algorithm-for-trend-analysis/

TV original code

https://www.tradingview.com/script/x9qYvBYN-Andean-Oscillator/

New update ----

converted it to Andean-MACD ..

CODE:

This oscillator provides several insights, but its primary focus is on two components: the bull component (green line) and the bear component (blue line). These lines represent bullish (upward) and bearish (downward) price trends, respectively.

- Bull Component (Green Line): A rising green line signals increasing bullish momentum, suggesting prices are trending upward.

- Bear Component (Blue Line): A rising blue line indicates growing bearish momentum, suggesting prices are trending downward.

Key Signals:

- Bull > Bear: When the green line is above the blue line, the market is in an uptrend, and higher highs may be expected.

- Bear > Bull: When the blue line is above the green line, the market is in a downtrend, and lower lows are more likely.

you may find full details on the indicator below.

https://alpaca.markets/learn/andean...ed-on-an-online-algorithm-for-trend-analysis/

TV original code

https://www.tradingview.com/script/x9qYvBYN-Andean-Oscillator/

CSS:

#https://alpaca.markets/learn/andean-oscillator-a-new-technical-indicator-based-on-an-online-algorithm-for-trend-analysis/

#https://www.tradingview.com/script/x9qYvBYN-Andean-Oscillator/

#/indicator("Andean Oscillator")

# Converted and mod by Sam4Cok@Samer800 - 07/2022

declare lower;

#//Settings

input length = 50;

input sig_length = 9; #'Signal Length')

input ShowCloud = yes;

input BullBearLines = yes;

input SignalLine = yes;

input showHist = yes;

########## Colors ########

DefineGlobalColor("Sky1" , CreateColor(0, 221, 255));

DefineGlobalColor("Sky2" , CreateColor(4, 188, 217));

DefineGlobalColor("Sky4" , CreateColor(4, 127, 145));

DefineGlobalColor("Sky5" , CreateColor(4, 103, 117));

DefineGlobalColor("Magenta1" , CreateColor(216, 0, 255));

DefineGlobalColor("Magenta2" , CreateColor(187, 4, 219));

DefineGlobalColor("Magenta4" , CreateColor(123, 3, 143));

DefineGlobalColor("Magenta5" , CreateColor(100, 2, 117));

DefineGlobalColor("Blue" , CreateColor(17, 118, 242));

DefineGlobalColor("Lime" , CreateColor(1, 255, 0));

############

script nz {

input data = 1;

input repl = 0;

def ret_val = if IsNaN(data) then repl else data;

plot return = ret_val;

}

def na = Double.NaN;

#//Exponential Envelopes

def alpha = 2 / (length + 1);

def C = close;

def O = open;

def up1 = nz(Max(Max(C, O) , Max(up1[1] - (up1[1] - C) * alpha, C)));

def up2 = nz(Max(Max(C * C, O * O), Max(up2[1] - (up2[1] - C * C) * alpha, C * C)));

def dn1 = nz(Min(Min(C, O) , Min(dn1[1] + (C - dn1[1]) * alpha, C)));

def dn2 = nz(Min(Min(C * C, O * O), Min(dn2[1] + (C * C - dn2[1]) * alpha, C * C)));

#//Components

def bull = Sqrt(dn2 - dn1 * dn1);

def bear = Sqrt(up2 - up1 * up1);

def signal = ExpAverage(Max(bull, bear), sig_length);

def ExUp = bull > bear and bull > signal and bull > bull[1];

def ExUp1 = bull > bear and bull > signal and bull < bull[1];

def Up = bull > bear and bull < signal and bull > bull[1];

def Up11 = bull > bear and bull < signal and bull < bull[1];

def ExDn = bear > bull and bear > signal and bear > bear[1];

def ExDn1 = bear > bull and bear > signal and bear < bear[1];

def Dn = bear > bull and bear < signal and bear > bear[1];

def Dn11 = bear > bull and bear < signal and bear < bear[1];

#//Plots

plot bullLine = if BullBearLines then bull else na; #'Bullish Component'

bullLine.SetDefaultColor(GlobalColor("Lime"));

bullLine.SetLineWeight(2);

bullLine.HideTitle();

plot bearLine = if BullBearLines then bear else na; #'Bearish Component'

bearLine.SetDefaultColor(GlobalColor("Blue"));

bearLine.SetLineWeight(2);

bearLine.HideTitle();

plot SigLine = if SignalLine then signal else na;#'Signal'

SigLine.AssignValueColor(if ExUp then GlobalColor("Sky1") else

if ExUp1 then GlobalColor("Sky2") else

if up then GlobalColor("Sky4") else

if up11 then GlobalColor("Sky5") else

if ExDn then GlobalColor("Magenta1") else

if ExDn1 then GlobalColor("Magenta2") else

if Dn then GlobalColor("Magenta4") else

if Dn11 then GlobalColor("Magenta5") else color.GRAY);

SigLine.SetLineWeight(3);

SigLine.HideTitle();

plot SigHist = if ShowHist then signal else na;#'Signal'

SigHist.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

SigHist.SetLineWeight(2);

SigHist.AssignValueColor(if ExUp then GlobalColor("Sky1") else

if ExUp1 then GlobalColor("Sky2") else

if up then GlobalColor("Sky4") else

if up11 then GlobalColor("Sky5") else

if ExDn then GlobalColor("Magenta1") else

if ExDn1 then GlobalColor("Magenta2") else

if Dn then GlobalColor("Magenta4") else

if Dn11 then GlobalColor("Magenta5") else color.GRAY);

AddCloud(if ShowCloud then bullLine else na, bearLine, Color.DARK_GREEN, Color.DARK_RED);

#//----END----------------------------------------New update ----

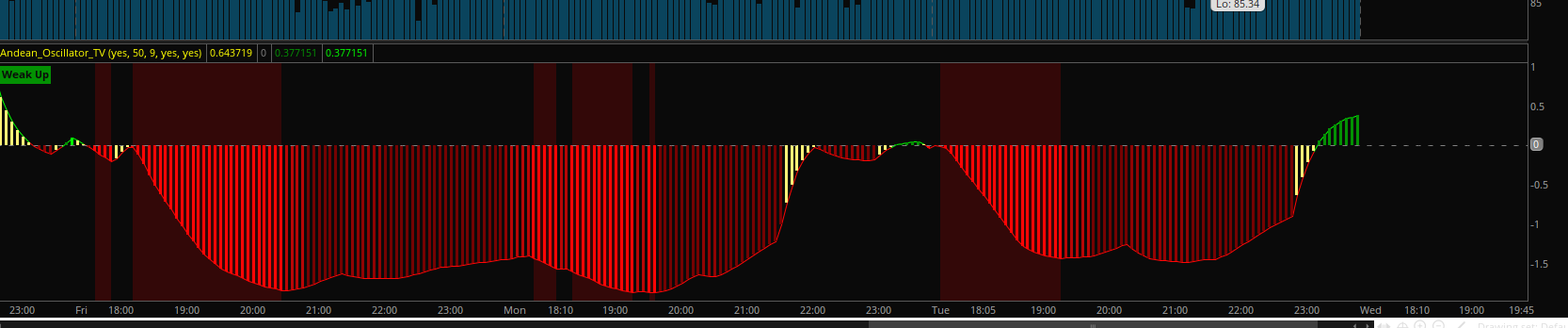

converted it to Andean-MACD ..

CODE:

CSS:

#https://alpaca.markets/learn/andean-oscillator-a-new-technical-indicator-based-on-an-online-algorithm-for-trend-analysis/

#https://www.tradingview.com/script/x9qYvBYN-Andean-Oscillator/

#/indicator("Andean Oscillator")

# Converted and mod by Sam4Cok@Samer800 - 07/2022.

# V1.5 included Histogram option, label, Background & bug fix. 08/2022.

declare lower;

#//Settings

input label = Yes;

input length = 50;

input sig_length = 9; #'Signal Length')

input ShowCloud = yes;

input showHist = yes;

########## Colors ########

DefineGlobalColor("Green1" , CreateColor(1, 255, 0));

DefineGlobalColor("Green2" , CreateColor(4, 181, 4));

DefineGlobalColor("Green3" , CreateColor(3, 145, 3));

DefineGlobalColor("Green4" , CreateColor(2, 117, 2));

DefineGlobalColor("Red1" , CreateColor(255, 5, 5));

DefineGlobalColor("Red2" , CreateColor(184, 6, 6));

DefineGlobalColor("Red3" , CreateColor(145, 3, 3));

DefineGlobalColor("Red4" , CreateColor(117, 2, 2));

############

script nz {

input data = Close;

input repl = 0;

def ret_val = if IsNaN(data) then repl else data;

plot return = ret_val;

}

def na = Double.NaN;

#//Exponential Envelopes

def alpha = 2 / (length + 1);

def up1;

def up2;

def dn1;

def dn2;

up1 = if isNaN(up1[1]) then 0 else nz(Max(Max(close, open), up1[1] - (up1[1] - close) * alpha), close);

up2 = if isNaN(up2[1]) then 0 else nz(Max(Max(Sqr(close), Sqr(open)), up2[1] - (up2[1] - Sqr(close)) * alpha), Sqr(Close));

dn1 = if isNaN(dn1[1]) then 0 else nz(Min(Min(close, open), dn1[1] + (close - dn1[1]) * alpha), close);

dn2 = if isNaN(dn2[1]) then 0 else nz(Min(Min(Sqr(close), Sqr(open)), dn2[1] + (Sqr(close) - dn2[1]) * alpha), Sqr(close));

#//Components

def bull = Sqrt(dn2 - dn1 * dn1);

def bear = Sqrt(up2 - up1 * up1);

def Signal = ExpAverage(Max(bull, bear), sig_length);

def sigBull = ExpAverage(bull, sig_length);

def sigBear = ExpAverage(bear, sig_length);

def differ = sigBull - sigBear;

def ExUp = bull > bear and bull > Signal and differ > differ[1] and differ >= 0;

def ExUp1 = bull > bear and bull > Signal and differ < differ[1] and differ >= 0;

def Up = bull > bear and bull < Signal and differ > differ[1] and differ >= 0;

def Up11 = bull > bear and bull < Signal and differ < differ[1] and differ >= 0;

def ExDn = bear > bull and bear > Signal and differ < differ[1] and differ < 0;

def ExDn1 = bear > bull and bear > Signal and differ > differ[1] and differ < 0;

def Dn = bear > bull and bear < Signal and differ < differ[1] and differ < 0;

def Dn11 = bear > bull and bear < Signal and differ > differ[1] and differ < 0;

#//Plots

plot SigLine = Signal;#'Signal'

SigLine.SetHiding(showHist);

SigLine.SetDefaultColor(Color.YELLOW);

plot bullLine = bull; #'Bullish Component'

bullLine.SetDefaultColor(Color.GREEN);

bullLine.SetLineWeight(2);

bullLine.SetHiding(showHist);

bullLine.HideTitle();

plot bearLine = bear; #'Bearish Component'

bearLine.SetDefaultColor(Color.RED);

bearLine.SetLineWeight(2);

bearLine.SetHiding(showHist);

bearLine.HideTitle();

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.GRAY);

ZeroLine.SetStyle(Curve.SHORT_DASH);

ZeroLine.SetHiding(!showHist);

plot diff = differ;

diff.SetDefaultColor(GetColor(5));

diff.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

diff.SetLineWeight(3);

diff.SetHiding(!showHist);

diff.AssignValueColor(if ExUp then GlobalColor("Green1") else

if ExUp1 then GlobalColor("Green2") else

if Up then GlobalColor("Green3") else

if Up11 then GlobalColor("Green4") else

if ExDn then GlobalColor("Red1") else

if ExDn1 then GlobalColor("Red2") else

if Dn then GlobalColor("Red3") else

if Dn11 then GlobalColor("Red4") else CreateColor(255, 241, 118));

plot diffLine = differ;

diffLine.SetHiding(!showHist);

diffLine.AssignValueColor( if diff >= 0 then GlobalColor("Green1") else

GlobalColor("Red1"));

AddCloud(if ShowCloud and !showHist then bull else na, bear , Color.DARK_GREEN, Color.DARK_RED);

AddCloud(if ShowCloud and !showHist then bear else na, Signal, Color.RED, Color.DARK_GREEN);

AddCloud(if ShowCloud and !showHist then bull else na, Signal, Color.GREEN, Color.DARK_RED);

AddCloud(if ShowCloud then if ExUp then Double.POSITIVE_INFINITY else

if ExDn then Double.NEGATIVE_INFINITY else na else na,

if ExUp then Double.NEGATIVE_INFINITY else

if ExDn then Double.POSITIVE_INFINITY else na,

GlobalColor("Green3"), GlobalColor("Red3"));

addlabel(Label and ExUp, "Xtrm Up", GlobalColor(“Green1”));

addlabel(Label and ExUp1,"Up", GlobalColor(“Green2”));

addlabel(Label and Up, "Weak Up", GlobalColor(“Green3”));

addlabel(Label and Up11, "X Weak Up",GlobalColor(“Green4”));

addlabel(Label and ExDn, "Xtrm Dwn", GlobalColor(“Red1”));

addlabel(Label and ExDn1,"Dwn", GlobalColor(“Red2”));

addlabel(Label and Dn, "Weak Dwn", GlobalColor(“Red3”));

addlabel(Label and Dn11, "X weak dwn", GlobalColor(“Red4”));

#//----END----------------------------------------

Last edited by a moderator: