Author Message:

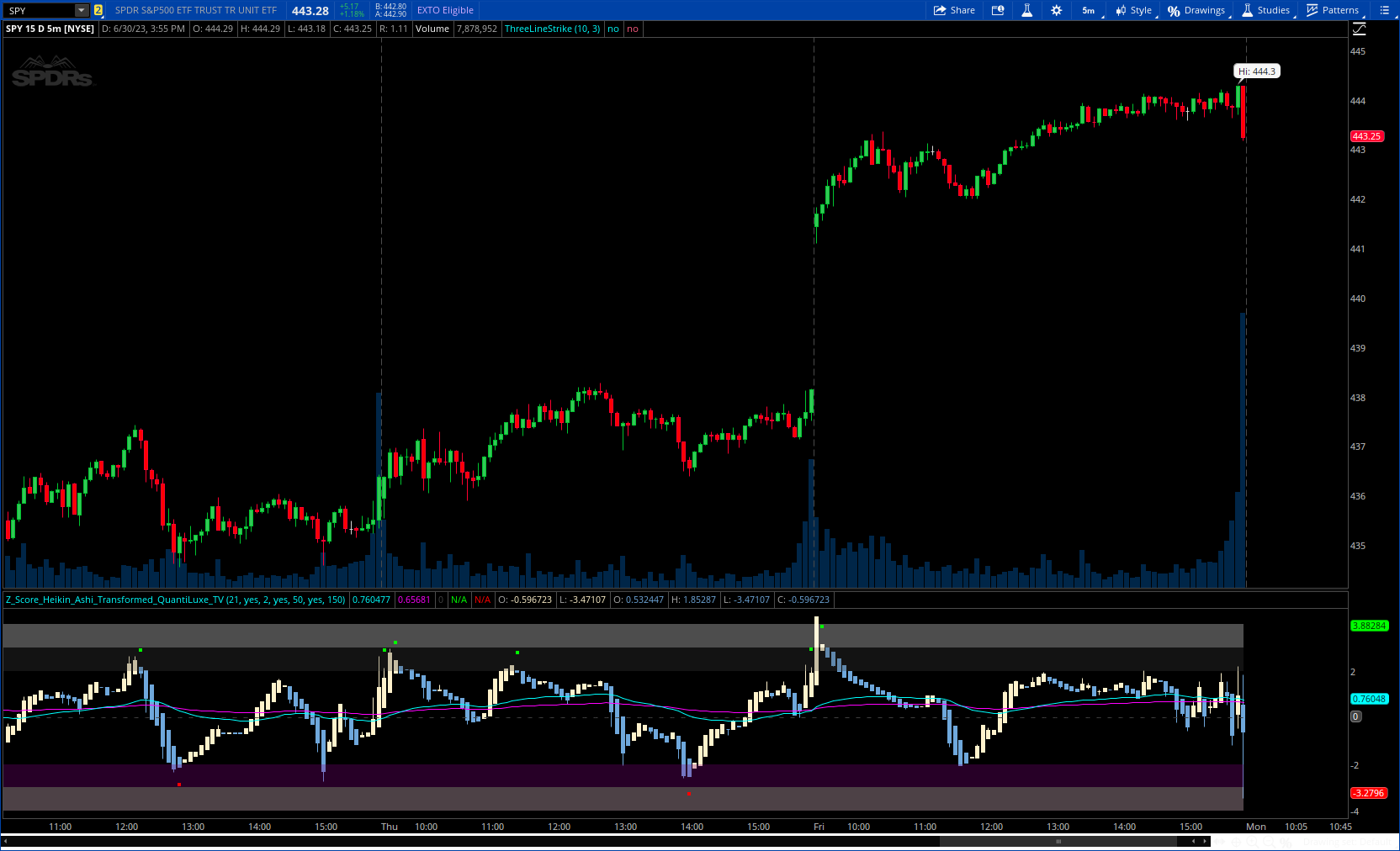

he Z-Score Heikin-Ashi Transformed (𝘡 𝘏-𝘈) indicator is a powerful technical tool that combines the principles of Z-Score and Heikin Ashi to provide traders with a smoothed representation of price movements and a standardized measure of market volatility.

The 𝘡 𝘏-𝘈 indicator applies the Z-Score calculation to price data and then transforms the resulting Z-Scores using the Heikin Ashi technique. Understanding the individual components of Z-Score and Heikin Ashi will provide a foundation for comprehending the methodology and unique features of this indicator.

More Details : https://www.tradingview.com/v/MFW8vsmU/

CODE:

CSS:

#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#https://www.tradingview.com/v/MFW8vsmU/

#// © QuantiLuxe

#indicator("Z-Score Heikin Ashi Transformed", "{?} - ? ?-?", false)

# converted by Sam4Cok@Samer800 - 07/2023

declare lower;

#f_z(src, len) =>

script f_z {

input src = close;

input len = 21;

def mean = Average(src, len);

def dev = StDev(src, len);

def f_z = (src - mean) / dev;

plot out = f_z;

}

input Zperiod = 21; # 'Z Period'

input showSignals = yes;

input ReversionThreshold = {"1", default "2", "3"}; # "Reversion Threshold"

input showMovAvgLine1 = yes;

input movAvgLength1 = 50;

input showMovAvgLine2 = yes;

input movAvgLength2 = 150;

def na = Double.NaN;

def last = isNaN(close);

def revt;

Switch (ReversionThreshold) {

Case "1" : revt = 1;

Case "2" : revt = 2;

Case "3" : revt = 3;

}

#-- Colors

DefineGlobalColor("colup", CreateColor(255,242,204));

DefineGlobalColor("coldn", CreateColor(111,168,220));

DefineGlobalColor("colema1", Color.CYAN);

DefineGlobalColor("colema2", Color.MAGENTA);

DefineGlobalColor("low", CreateColor(255,214,232));

DefineGlobalColor("dlow", Color.PLUM);

def o_z = f_z(open, Zperiod);

def h_z = f_z(high, Zperiod);

def l_z = f_z(low, Zperiod);

def c_z = f_z(close, Zperiod);

def haClose = (o_z + h_z + l_z + c_z) / 4;

def haOpen = CompoundValue(1, (haOpen[1] + haClose[1]) / 2, (o_z + c_z) / 2);

def haHigh = Max(h_z, Max(haOpen, haClose));

def haLow = Min(l_z, Min(haOpen, haClose));

#def ohlc = (haClose + haOpen + haHigh + haLow) / 4;

def haColor = if haClose > haOpen then 1 else

if haClose < haOpen then -1 else 0;

def OpenUp = if haColor > 0 then haOpen else na;

def OpenDn = if haColor < 0 then haOpen else na;

# Plot the new Chart

AddChart(high = if haColor > 0 then haHigh else na , low = haLow , open = haClose, close = OpenUp,

type = ChartType.CANDLE, growcolor = GlobalColor("colup"));

AddChart(high = if haColor < 0 then haHigh else na, low = haLow , open = OpenDn, close = haClose,

type = ChartType.CANDLE, growcolor = GlobalColor("coldn"));

plot EMA1 = if showMovAvgLine1 then ExpAverage(haClose, movAvgLength1) else na;

plot EMA2 = if showMovAvgLine2 then ExpAverage(haClose, movAvgLength2) else na;

EMA1.SetDefaultColor(GlobalColor("colema1"));

EMA2.SetDefaultColor(GlobalColor("colema2"));

plot zero = if last then na else 0; # "Mid Line"

zero.SetStyle(Curve.SHORT_DASH);

zero.SetDefaultColor(Color.DARK_GRAY);

def max = if last then na else 4;

def hh = if last then na else 3;

def lh = if last then na else 2;

DefineGlobalColor("high", Color.DARK_GRAY);

DefineGlobalColor("dhigh", Color.WHITE);

AddCloud(hh, lh, GlobalColor("dhigh"));

AddCloud(max, hh, GlobalColor("high"));

def min = if last then na else -4;

def ll = if last then na else -3;

def hl = if last then na else -2;

AddCloud(hl, ll, GlobalColor("dlow"));

AddCloud(ll, min, GlobalColor("low"));

def dn = haHigh[1] < haHigh[2];

def up = haLow[1] > haLow[2];

plot SigUp = if !showSignals then na else

if (haHigh > revt and haHigh < haHigh[1] and !dn) then haHigh + 0.75 else na; # "OB"

plot SigDn = if !showSignals then na else

if (haLow < -revt and haLow > haLow[1] and !up) then haLow - 0.75 else na; # "OS"

SigUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

SigDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

SigUp.SetDefaultColor(Color.GREEN);

SigDn.SetDefaultColor(Color.RED);

#--- END of CODE

Last edited by a moderator: