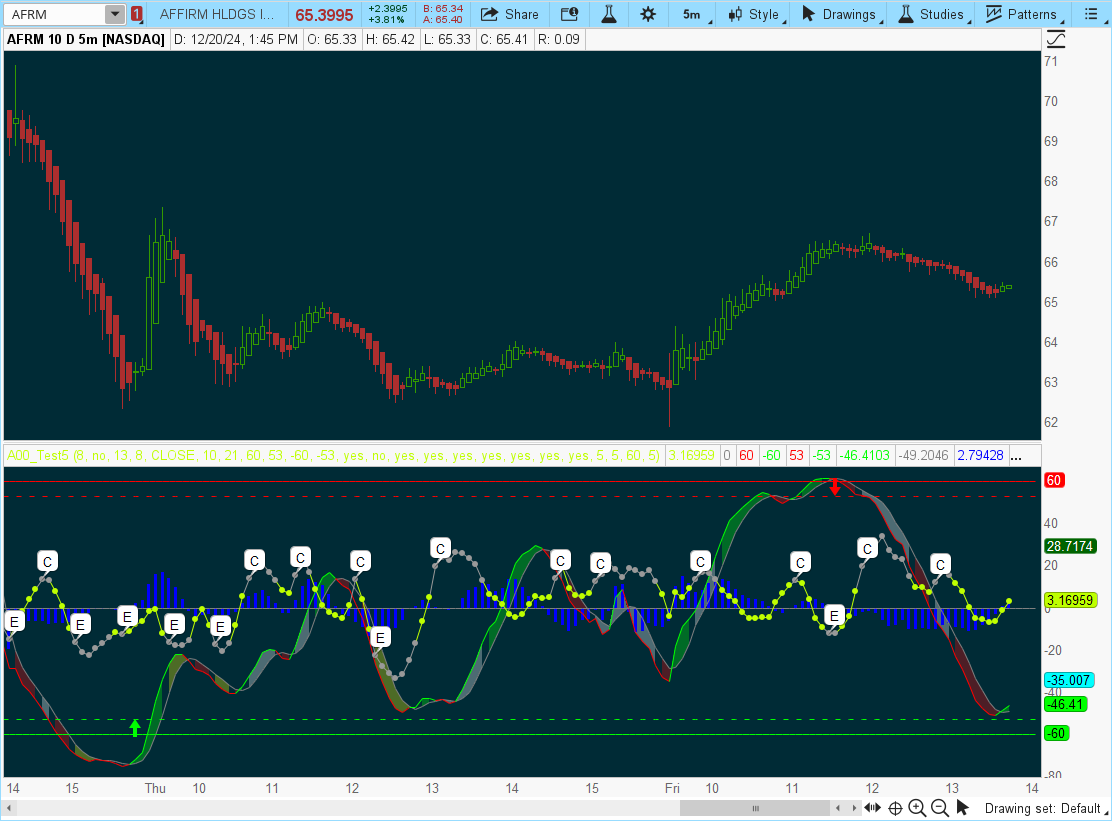

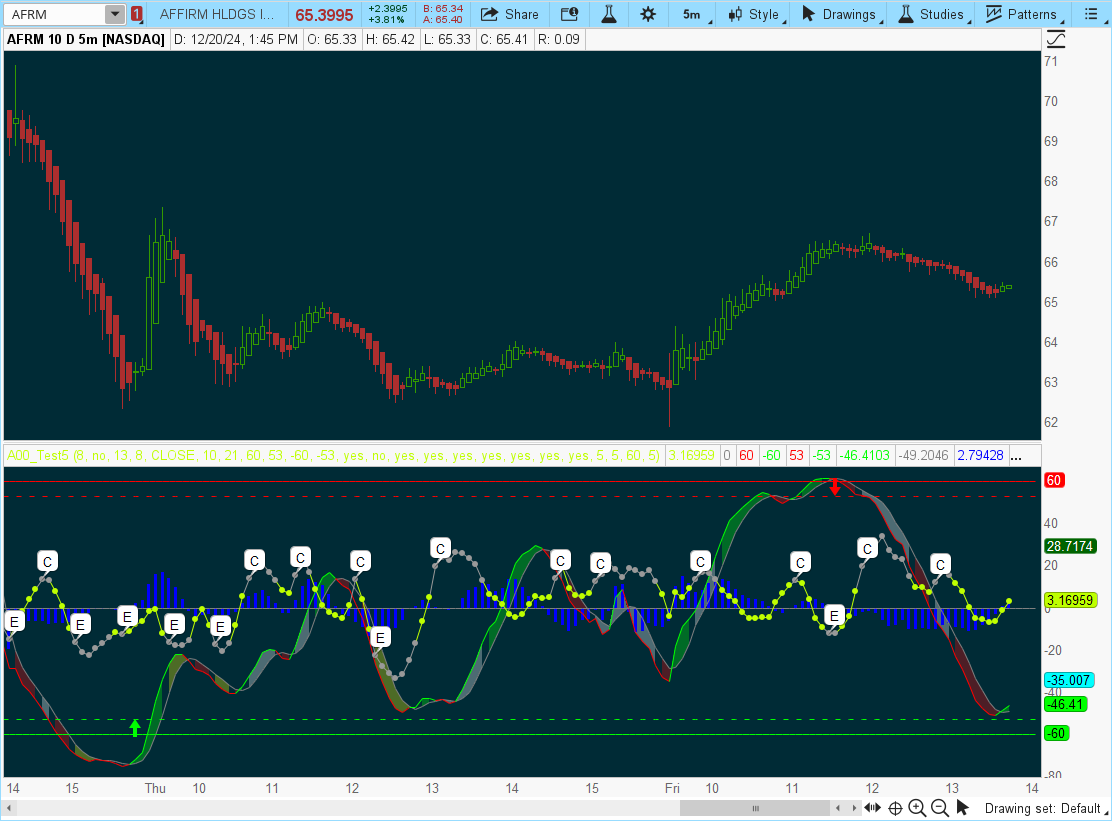

Wave Trend Oscillator with Fractal Energy and divergence indicator

indicator is used to identify potential trend changes and entry/exit points by analyzing the cyclical movements of price and divergences.

Wave Trend is no lag but like all oscillators works well when a trade trends but is rife with false signals when it does not.

https://tos.mx/!WRYrx5cs

indicator is used to identify potential trend changes and entry/exit points by analyzing the cyclical movements of price and divergences.

Wave Trend is no lag but like all oscillators works well when a trade trends but is rife with false signals when it does not.

https://tos.mx/!WRYrx5cs

Code:

# RSI-Laguerre Self Adjusting With Fractal Energy Gaussian Price Filter

# Mobius

# V01.12.2016

# Both Fractal Energy and RSI are plotted. RSI in cyan and FE in yellow. Look for trend exhaustion in the FE and a reversal of RSI or Price compression in FE and an RSI reversal.

declare lower;

#Inputs:

input nFE = 8;#hint nFE: length for Fractal Energy calculation.

input AlertOn = no;

input Glength = 13;

input betaDev = 8;

input data = close;

def w = (2 * Double.Pi / Glength);

def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

def alpha = (-beta + Sqrt(beta * beta + 2 * beta));

def Go = Power(alpha, 4) * open +

4 * (1 – alpha) * Go[1] – 6 * Power( 1 - alpha, 2 ) * Go[2] +

4 * Power( 1 - alpha, 3 ) * Go[3] - Power( 1 - alpha, 4 ) * Go[4];

def Gh = Power(alpha, 4) * high +

4 * (1 – alpha) * Gh[1] – 6 * Power( 1 - alpha, 2 ) * Gh[2] +

4 * Power( 1 - alpha, 3 ) * Gh[3] - Power( 1 - alpha, 4 ) * Gh[4];

def Gl = Power(alpha, 4) * low +

4 * (1 – alpha) * Gl[1] – 6 * Power( 1 - alpha, 2 ) * Gl[2] +

4 * Power( 1 - alpha, 3 ) * Gl[3] - Power( 1 - alpha, 4 ) * Gl[4];

def Gc = Power(alpha, 4) * data +

4 * (1 – alpha) * Gc[1] – 6 * Power( 1 - alpha, 2 ) * Gc[2] +

4 * Power( 1 - alpha, 3 ) * Gc[3] - Power( 1 - alpha, 4 ) * Gc[4];

# Variables:

def o;

def h;

def l;

def c;

# Calculations

o = (Go + Gc[1]) / 2;

h = Max(Gh, Gc[1]);

l = Min(Gl, Gc[1]);

c = (o + h + l + Gc) / 4;

plot gamma = 100 *(Log(Sum((Max(Gh, Gc[1]) - Min(Gl, Gc[1])), nFE) /

(Highest(gh, nFE) - Lowest(Gl, nFE)))

/ Log(nFE))-50;

gamma.DefineColor("Con", CreateColor( 153, 153, 153));

gamma.DefineColor("EX", CreateColor( 153, 153, 153));

gamma.AssignValueColor(if gamma > 12 then gamma.Color("Con") else if gamma < -12 then gamma.Color("EX") else color.LIME);

def FE_Consolidation = gamma > 12 and gamma[1] < 12;

#AddLabel(FE_Consolidation, " Fractal Energy Consolidation ", Color.YELLOW);

def FE_Exhaustion = gamma < -12 and gamma[1] > -12;

#AddLabel(FE_Exhaustion, " Fractal Energy Exhaustion ", Color.YELLOW);

AddChartBubble(FE_Consolidation, gamma, "C", COLOR.WHITE);

AddChartBubble(FE_Exhaustion, gamma, "E", COLOR.WHITE);

gamma.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

# End Code RSI_Laguerre Self Adjusting with Fractal Energy

#WT_LB Short Name TV

input Channel_Length = 10; #10

input Average_Length = 21; #10

input over_bought_1 = 60;

input over_bought_2 = 53;

input over_sold_1 = -60;

input over_sold_2 = -53;

input show_bubbles = yes;

input show_sec_bbls = no;

input show_alerts = yes;

def ap = hlc3;

def esa = ExpAverage(ap, Channel_Length);

def d = ExpAverage(AbsValue(ap - esa), Channel_Length);

def ci = (ap - esa) / (0.015 * d);

def tci = ExpAverage(ci, Average_Length);

def wt1 = tci;

def wt2 = SimpleMovingAvg(wt1, 4);

#def zero = 0;

plot zero = 0;

zero.SetDefaultColor( Color.GRAY );

plot obLevel1 = over_bought_1;

obLevel1.SetDefaultColor(Color.RED);

plot osLevel1 = over_sold_1;

osLevel1.SetDefaultColor(Color.GREEN);

plot obLevel2 = over_bought_2;

obLevel2.SetDefaultColor(Color.RED);

obLevel2.SetStyle(Curve.SHORT_DASH);

plot osLevel2 = over_sold_2;

osLevel2.SetDefaultColor(Color.GREEN);

osLevel2.SetStyle(Curve.SHORT_DASH);

plot wt1_1 = wt1;

wt1_1.assignvalueColor(if wt1 > wt2 then color.green else color.red);

plot wt2_1 = wt2;

wt2_1.SetDefaultColor(Color.gray);

#wt2_1.SetStyle(Curve.POINTS);

plot wt3 = (wt1 - wt2);

wt3.SetDefaultColor(Color.BLUE);

wt3.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

def signal1 = wt1 crosses above wt2 and wt1 < over_sold_2;

plot Signal = if signal1 then (signal1 * over_sold_2) else Double.NaN;

Signal.SetDefaultColor(Color.GREEN);

Signal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Signal.SetLineWeight(3);

Signal.HideTitle();

def signal2 = wt1 crosses below wt2 and wt1 > over_bought_2;

plot Signal2_ = if signal2 then (signal2 * over_bought_2) else Double.NaN;

Signal2_.SetDefaultColor(Color.RED);

Signal2_.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

Signal2_.SetLineWeight(3);

Signal2_.HideTitle();

def wt_1t = if gamma >= -12 and gamma <= 12 then wt1 else double.NaN;

def wt_1e = if gamma <= -12 then wt1 else double.NaN;

def wt_1c = if gamma >= 12 then wt1 else double.NaN;

def wt_2t = if gamma >= -12 and gamma <= 12 then wt2 else double.NaN;

def wt_2e = if gamma <= -12 then wt2 else double.NaN;

def wt_2c = if gamma >= 12 then wt2 else double.NaN;

addcloud(wt_1t,wt_2t, color.green, color.red);

addcloud(wt_1c,wt_2c, color.white, color.white);

addcloud(wt_1e,wt_2e, color.yellow, color.yellow);

#----Div-----------

input ShowLastDivLines = yes;

input ShowLastHiddenDivLines = yes;

input DivBull = yes; # "Plot Bullish"

input DivBear = yes; # "Plot Bearish"

input DivHiddenBull = yes; # "Plot Hidden Bullish"

input DivHiddenBear = yes; # "Plot Hidden Bearish"

input LookBackRight = 5; # "Pivot Lookback Right"

input LookBackLeft = 5; # "Pivot Lookback Left"

input MaxLookback = 60; # "Max of Lookback Range"

input MinLookback = 5; # "Min of Lookback Range"

def divSrc = wt1;

def na = Double.NaN;

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

##############

_BN = BarNumber();

_nan = Double.NaN;

_VStop = if !isNaN(dat) and lbr > 0 and lbl > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat,-a) else dat < GetValue(dat,-a) else _nan;

if (HL > 0) {

_V = if _BN > lbL + 1 and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL + 1 and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

#_inRange(cond) =>

script _inRange {

input cond = yes;

input rangeUpper = 60;

input rangeLower = 5;

def bars = if cond then 0 else bars[1] + 1;

def inrange = (rangeLower <= bars) and (bars <= rangeUpper);

plot retrun = inRange;

}

def pl_ = findpivots(divSrc,-1, LookBackLeft, LookBackRight);

def ph_ = findpivots(divSrc, 1, LookBackLeft, LookBackRight);

def pl = !isNaN(pl_);

def ph = !isNaN(ph_);

def pll = lowest(divSrc,LookBackLeft);

def phh = highest(divSrc,LookBackLeft);

def sll = lowest(low, LookBackLeft);

def shh = highest(high, LookBackLeft);

#-- Pvt Low

def plStart = if pl then yes else plStart[1];

def plFound = if (plStart and pl) then 1 else 0;

def vlFound1 = if plFound then divSrc else vlFound1[1];

def vlFound_ = if vlFound1!=vlFound1[1] then vlFound1[1] else vlFound_[1];

def vlFound = if !vlFound_ then pll else vlFound_;

def plPrice1 = if plFound then low else plPrice1[1];

def plPrice_ = if plPrice1!=plPrice1[1] then plPrice1[1] else plPrice_[1];

def plPrice = if !plPrice_ then sll else plPrice_;

#-- Pvt High

def phStart = if ph then yes else phStart[1];

def phFound = if (phStart and ph) then 1 else 0;

def vhFound1 = if phFound then divSrc else vhFound1[1];

def vhFound_ = if vhFound1!=vhFound1[1] then vhFound1[1] else vhFound_[1];

def vhFound = if !vhFound_ then phh else vhFound_;

def phPrice1 = if phFound then high else phPrice1[1];

def phPrice_ = if phPrice1!=phPrice1[1] then phPrice1[1] else phPrice_[1];

def phPrice = if !phPrice_ then sll else phPrice_;

#// Regular Bullish

def inRangePl = _inRange(plFound[1],MaxLookback,MinLookback);

def oscHL = divSrc > vlFound and inRangePl;

def priceLL = low < plPrice and divSrc <= 40;

def bullCond = plFound and oscHL and priceLL;

#// Hidden Bullish

def oscLL = divSrc < vlFound and inRangePl;

def priceHL = low > plPrice and divSrc <= 50;

def hiddenBullCond = plFound and oscLL and priceHL;

#// Regular Bearish

def inRangePh = _inRange(phFound[1],MaxLookback,MinLookback);

def oscLH = divSrc < vhFound and inRangePh;

def priceHH = high > phPrice and divSrc >= 60;;

def bearCond = phFound and oscLH and priceHH;

#// Hidden Bearish

def oscHH = divSrc > vhFound and inRangePh;

def priceLH = high < phPrice and divSrc >= 50;

def hiddenBearCond = phFound and oscHH and priceLH;

#------ Bubbles

def bullBub = DivBull and bullCond;

def HbullBub = DivHiddenBull and hiddenBullCond;

def bearBub = DivBear and bearCond;

def HbearBub = DivHiddenBear and hiddenBearCond;

addchartbubble(bullBub, divSrc, "R", color.GREEN, yes);

addchartbubble(bearBub, divSrc, "R", CreateColor(156,39,176), no);

addchartbubble(HbullBub, divSrc, "H", color.DARK_green, yes);

addchartbubble(HbearBub, divSrc, "H", color.DARK_red, no);

##### Lines

def bar = BarNumber();

#-- Bear Line

def lastPhBar = if ph then bar else lastPhBar[1];

def prePhBar = if lastPhBar!=lastPhBar[1] then lastPhBar[1] else prePhBar[1];

def priorPHBar = if bearCond then prePhBar else priorPHBar[1];

#-- Bull Line

def lastPlBar = if pl then bar else lastPlBar[1];

def prePlBar = if lastPlBar!=lastPlBar[1] then lastPlBar[1] else prePlBar[1];

def priorPLBar = if bullCond then prePlBar else priorPLBar[1];

def lastBullBar = if bullCond then bar else lastBullBar[1];

def lastBearBar = if bearCond then bar else lastBearBar[1];

def HighPivots = ph and bar >= HighestAll(priorPHBar) and bar <= HighestAll(lastBearBar);

def LowPivots = pl and bar >= HighestAll(priorPLBar) and bar <= HighestAll(lastBullBar);

def pivotHigh = if HighPivots then divSrc else na;

def pivotLow = if LowPivots then divSrc else na;

plot PlotHline = if ShowLastDivLines then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.MAGENTA);

plot PlotLline = if ShowLastDivLines then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.CYAN);

#--- Hidden Lines

#-- Bear Line

def priorHPHBar = if hiddenBearCond then prePhBar else priorHPHBar[1];

#-- Bull Line

def priorHPLBar = if hiddenBullCond then prePlBar else priorHPLBar[1];

def lastHBullBar = if hiddenBullCond then bar else lastHBullBar[1];

def lastHBearBar = if hiddenBearCond then bar else lastHBearBar[1];

def HighHPivots = ph and bar >= HighestAll(priorHPHBar) and bar <= HighestAll(lastHBearBar);

def LowHPivots = pl and bar >= HighestAll(priorHPLBar) and bar <= HighestAll(lastHBullBar);

def pivotHidHigh = if HighHPivots then divSrc else na;

def pivotHidLow = if LowHPivots then divSrc else na;

plot PlotHBearline = if ShowLastHiddenDivLines then pivotHidHigh else na;

PlotHBearline.EnableApproximation();

PlotHBearline.SetDefaultColor(Color.DARK_RED);

plot PlotHBullline = if ShowLastHiddenDivLines then pivotHidLow else na;

PlotHBullline.EnableApproximation();

PlotHBullline.SetDefaultColor(Color.DARK_GREEN);

#-- END of CODE

Last edited by a moderator: