You should upgrade or use an alternative browser.

VWAP deviations as horizontal lines?

- Thread starter Alex

- Start date

Sorry I meant that the horizontal lines would adjust and move accordingly to the vwap bubbles to the right. Instead of the traditional vwap bands.@Alex You said it yourself, VWAP move throughout the day. It's not static. As a result, you can't display it as a horizontal line.

germanburrito

Active member

This would actually be a great ideaCorrect

Can you think of a study that has that coded in it, we can take the code from there.

input numDevDn = -2.0;

input numDevUp = 2.0;

input timeFrame = {default DAY, WEEK, MONTH};

def cap = getAggregationPeriod();

def errorInAggregation =

timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or

timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH;

assert(!errorInAggregation, "timeFrame should be not less than current chart aggregation period");

def yyyyMmDd = getYyyyMmDd();

def periodIndx;

switch (timeFrame) {

case DAY:

periodIndx = yyyyMmDd;

case WEEK:

periodIndx = Floor((daysFromDate(first(yyyyMmDd)) + getDayOfWeek(first(yyyyMmDd))) / 7);

case MONTH:

periodIndx = roundDown(yyyyMmDd / 100, 0);

}

def isPeriodRolled = compoundValue(1, periodIndx != periodIndx[1], yes);

def volumeSum;

def volumeVwapSum;

def volumeVwap2Sum;

if (isPeriodRolled) {

volumeSum = volume;

volumeVwapSum = volume * vwap;

volumeVwap2Sum = volume * Sqr(vwap);

} else {

volumeSum = compoundValue(1, volumeSum[1] + volume, volume);

volumeVwapSum = compoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap);

volumeVwap2Sum = compoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap));

}

def price = volumeVwapSum / volumeSum;

def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(price), 0));

def upper = price + numDevUp * deviation;

def lower = price + numDevDn * deviation;

def currentbar = if !isnan(close) && isnan(close[-1]) then barnumber() else double.nan;

def vwap_line = if barnumber() == currentbar then price else double.nan;

def upper_line = if barnumber() == currentbar then upper else double.nan;

def lower_line = if barnumber() == currentbar then lower else double.nan;

plot VWAP = highestall(vwap_line);

plot UpperBand = highestall(upper_line);

plot LowerBand = highestall(lower_line);

VWAP.setDefaultColor(getColor(0));

UpperBand.setDefaultColor(getColor(2));

LowerBand.setDefaultColor(getColor(4));germanburrito

Active member

# Horizontal Line at current VWAP JQ

# chatroom request for generic

# 2020-11-18

def currentbar = if !isnan(close) && isnan(close[-1]) then barnumber() else double.nan;

def var1 = if barnumber() == currentbar then vwap else double.nan;

plot currentVWAP = highestall(var1);

#plot debug = vwap;

# That's All Folks!Heres the link if you need it

http://tos.mx/cZOtww6

germanburrito

Active member

thank you much guys, this community is truly great!@Alex @germanburrito Updated the code above to do exactly what you want. Thanks to @BenTen

Heres the link if you need it

http://tos.mx/cZOtww6

germanburrito

Active member

declare lower;

plot b = barnumber();

#VM_MIDAS_StandartDeviationBands;

def Data = BarNumber();

input Number_Of_Bar = 1;

input price = close;

def bar = Data >= Number_Of_Bar;

def pv = if bar then pv[1] + price * volume else 0;

def cumvolume = if bar then cumvolume[1] + volume else 0;

plot vw = pv / cumvolume;

def bars = Data - Number_Of_Bar;

def sample = if bar then sample[1] + Sqr(price - vw) else 0;

def var = sample / bars;

def dev = Sqrt(var);

plot dev1 = vw + dev * 2;

plot dev2 = vw - (dev * 2);

plot dev3 = vw + (dev * 1);

plot devN1 = vw - dev * 1;

vw.setdefaultColor(color.yellow);

dev1.SetDefaultColor(Color.White);

dev2.SetDefaultColor(Color.White);

dev3.SetDefaultColor(Color.White);

devn1.SetDefaultColor(Color.White);

dev1.Setlineweight(2);

dev2.Setlineweight(2);

dev3.Setlineweight(2);

devn1.Setlineweight(2);You mean something like this Consecutive Bar Counter?@Soloways With this you can set the bar where you want the count to start from, youre goiont to need a bar counter that goes in the lower study

https://usethinkscript.com/threads/consecutive-bar-count-indicator-for-thinkorswim.324/

I am not entirely sure what you mean by Bar Counter.....and setting it

germanburrito

Active member

no the settings on the indicator ask for a bar number, to tell what the needed bar number you use a lower indicatorYou mean something like this Consecutive Bar Counter?

https://usethinkscript.com/threads/consecutive-bar-count-indicator-for-thinkorswim.324/

I am not entirely sure what you mean by Bar Counter.....and setting it

ok thank youno the settings on the indicator ask for a bar number, to tell what the needed bar number you use a lower indicator

I appreciate your help

to be honest, i am completely lostno the settings on the indicator ask for a bar number, to tell what the needed bar number you use a lower indicator

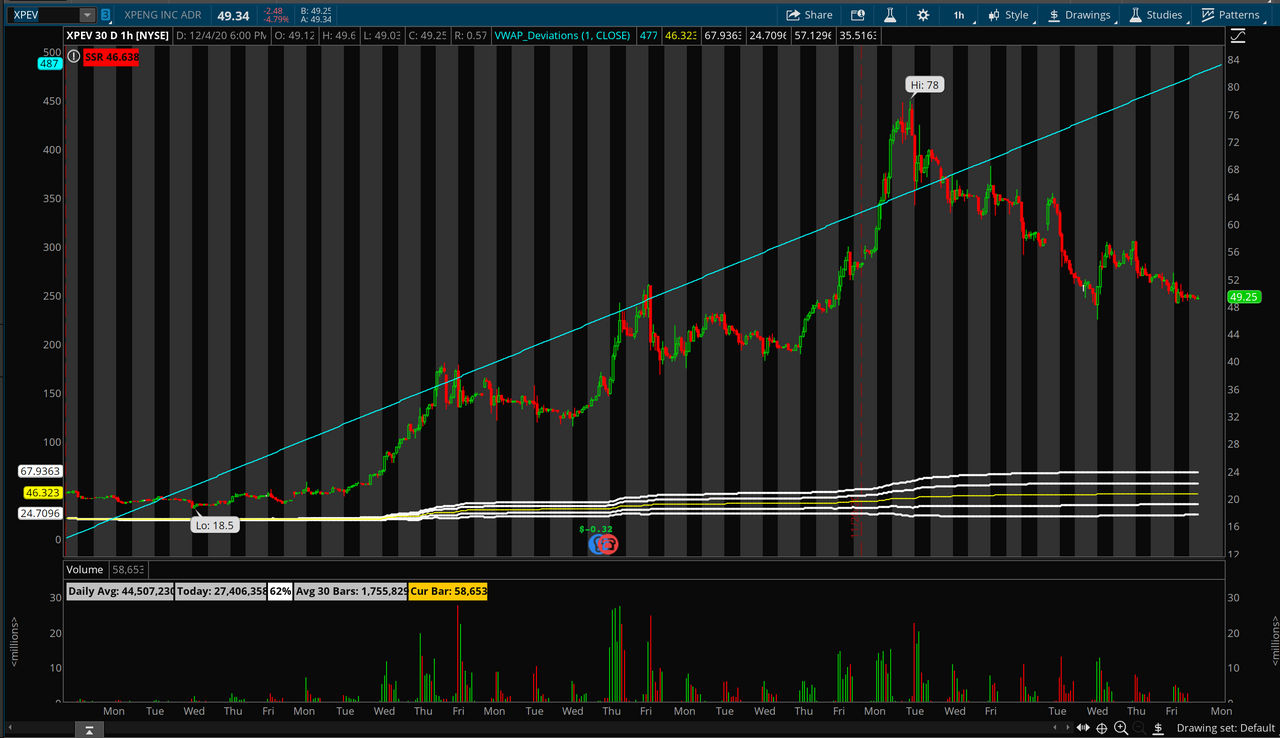

so i loaded your code you put together

and added it to XPEV 30D 1HR chart and this is what i get

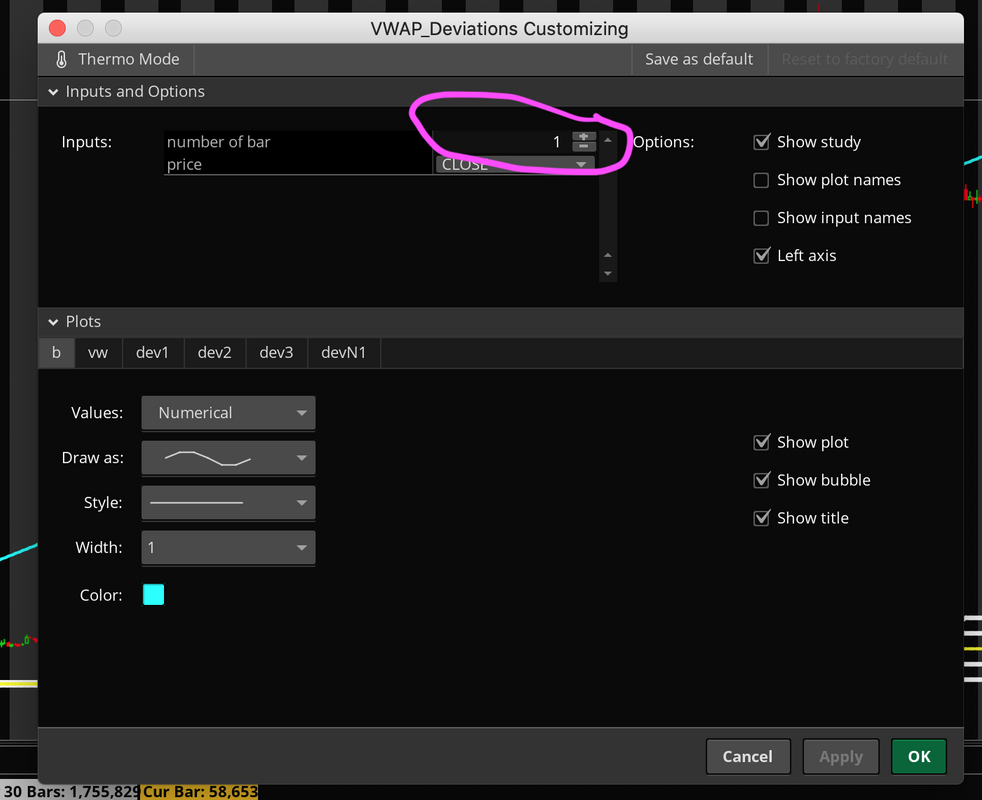

so to change the bar number in the settings of the indicator.....

i understood it to be this.....

so what number of bars should i enter in order for the my chart to look like the example chart i posted in the beginning

like this....

germanburrito

Active member

YOU NEED LOWER INDICATOR THAT TELL YOU WHAT THE NUMBER BAR YOU WANT TO START THE CALCULATION FROM IS HERES IT IS....to be honest, i am completely lost

so i loaded your code you put together

and added it to XPEV 30D 1HR chart and this is what i get

so to change the bar number in the settings of the indicator.....

i understood it to be this.....

so what number of bars should i enter in order for the my chart to look like the example chart i posted in the beginning

like this....

WHAT YOU DO IS YOU HOVER OVER THE BAR YOU WANT TO START FROM, YOU SEE THE BAR NUMBER AND YOU INPUT IT IN THE VWAP

declare lower;

plot b = barnumber();

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| B | put two standard deviations onto anchored VWAP | Questions | 2 | |

| P | VWAP Deviations Band Scanner | Questions | 2 | |

| J | VWAP in a custom Scan filter not returning TRUE | Questions | 4 | |

| S | a fast EMA crossover with VWAP as a trend filter for scalping? | Questions | 1 | |

| F | Multiday VWAP - Monday Issue | Questions | 1 |

Similar threads

-

-

-

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

Similar threads

-

-

-

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/