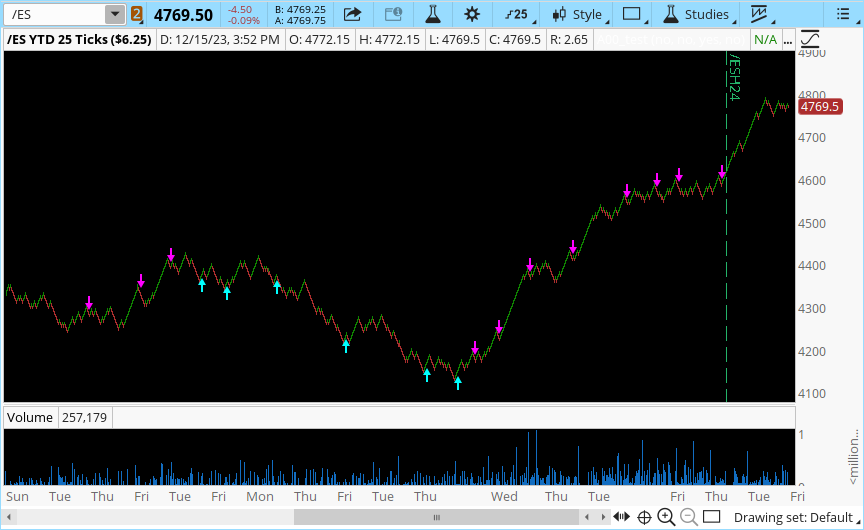

check the belowhello group! i will like to have this awesome indicator convert into TOS, the only link for this indicator is a google drive, here is the video with the links.

//@version=4

//

// =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-= THE ONE RENKO TO RULE THEM ALL =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

// Designed to be used on Renko 1s, Traditional 4. I primary trade the US 100 PEPPERSTONE (which is NQ futures)

// Version 1 created by TraderOracle 11/18/2023

// Version 1.1 - Fixed flag and squeeze overlapping, plus changed colors to be more intuitive

//

study(title="The One Renko To Rule Them All", overlay=true, shorttitle="The One Renko 1.1")

bShowFlags = input(false, title="Show Flags", group="Main Settings")

bShowDots = input(false, title="Show Dots", group="Main Settings")

bShowX = input(true, title="Show Big X for Buy/Sell", group="Main Settings")

bUseDeadSimple = input(false, title="Use Dead Simple Reversal", group="Main Settings")

bUpCurve = close > close[1] and close[1] > close[2] and close[2] > close[3] and close[3] < close[4] and close[4] < close[5] and close[5] < close[6] ? 1 : 0

bDownCurve = close < close[1] and close[1] < close[2] and close[2] < close[3] and close[3] > close[4] and close[4] > close[5] and close[5] > close[6] ? 1 : 0

//

// =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-= ULTIMATE REVERSAL 1.22 =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

// These are volume patterns I noticed after backtesting reversals for many months

//

var cColor = color.rgb(194, 196, 197)

basis = sma(close, 30)

dev = 2 * stdev(close, 30)

upper = basis + dev

lower = basis - dev

is0Green = close > open

is1Green = close[1] > open[1]

is2Green = close[2] > open[2]

is3Green = close[3] > open[3]

is4Green = close[4] > open[4]

is0Red = not is0Green

is1Red = not is1Green

is2Red = not is2Green

is3Red = not is3Green

is4Red = not is4Green

// Pattern #1 - small red bar, larger red bar, small green bar

up1 = (volume[1] > volume[2] and volume < volume[1] and is0Green and is1Red and is2Red)

down1 = (volume[1] > volume[2] and volume < volume[1] and is0Red and is1Green and is2Green)

// Pattern #2 - small red bar, larger red bar, even LARGER red bar, small green bar

up2 = (volume[2] > volume[3] and volume[3] > volume[4] and volume[1] < volume[2] and volume < volume[2] and is0Green and is1Red and is2Red and is3Red and is4Red)

down2 = (volume[2] > volume[3] and volume[3] > volume[4] and volume[1] < volume[2] and volume < volume[2] and is0Red and is1Green and is2Green and is3Green and is4Green)

// Pattern #3 - 4 bars of the same color, then a different color bar that's larger than all 4 previous

up3 = (is1Red and is2Red and is3Red and is4Red and is0Green and volume > volume[1] and volume > volume[2] and volume > volume[3] and volume > volume[4])

down3 = (is1Green and is2Green and is3Green and is4Green and is0Red and volume > volume[1] and volume > volume[2] and volume > volume[3] and volume > volume[4])

// snippet from Candlestick Reversal System by LonesomeTheDove

pivotlbar = 5

highleftempty = pivothigh(pivotlbar, 0)

lowleftempty = pivotlow(pivotlbar, 0)

wick_multiplier = 10

body_percentage = 1

O = open

C = close

H = high

L = low

Wlongsignal = (C > O) and (O - L) >= ((C - O) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(C < O) and (C - L) >= ((O - C) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(C == O and C != H) and (H - L) >= ((H - C) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(O == H and C == H) and (H - L) >= sma((H - L), 50)

Wshortsignal = (C < O) and (H - O) >= ((O - C) * wick_multiplier) and (C - L) <= ((H - L) * body_percentage) or

(C > O) and (H - C) >= ((C - O) * wick_multiplier) and (C - L) <= ((H -L) * body_percentage) or

(C == O and C != L) and (H - L) >= ((C - L) * wick_multiplier) and (C - L) <= ((H - L) * body_percentage) or

(O == L and C == L) and (H - L) >= sma((H - L), 50)

// Candlestick pattern is technically Pattern #4

up4 = lowleftempty and Wlongsignal

down4 = highleftempty and Wshortsignal

upsie1 = rma(max(change(close), 0), 14)

downsie1 = rma(-min(change(close), 0), 14)

MyRsi = downsie1 == 0 ? 100 : upsie1 == 0 ? 0 : 100 - (100 / (1 + upsie1 / downsie1))

BollingerCross = false

up99 = (up1 or up2 or up3 or up4)

down99 = (down1 or down2 or down3 or down4)

bColor = color.rgb(199, 197, 197)

if (MyRsi < 60)

down99 := false

if (MyRsi > 40)

up99 := false

// version 1.21 - I wasn't showing Bollinger Bands/RSI unless it also was volume rules, which kinda ruins the point of the update. Fixed...

if (close < (lower - 2) or (lower - 2) and MyRsi < 30)

bColor := color.rgb(255, 53, 53)

up99 := true

if (close > (upper + 2) or open > (upper + 2) and MyRsi > 80)

bColor := color.rgb(255, 53, 53)

down99 := true

// eliminate dupes

if (up99[1])

up99 := false

if (down99[1])

down99 := false

atr = atr(10)

pos2 = high + (1.6 * atr)

pos3 = low - (1.6 * atr)

// My implementation of DEAD SIMPLE REVERSAL from PaidToFade

q1 = close[1] < open[1] and close > open

q2 = close > open[1]

q3 = lowest(low,3) < lowest (low,50)[1] or lowest(low,3) < lowest(low,50)[2] or lowest(low,3) < lowest(low,50)[3]

buyme = q1 and q2 and q3

q4 = close[1] > open[1] and close < open

q5 = close < open[1]

q6 = highest(high,3) > highest (high,50)[1] or highest(high,3) > highest(high,50)[2] or highest(high,3) > highest(high,50)[3]

sellme = q4 and q5 and q6

if (buyme and bUseDeadSimple)

bColor := color.lime

//up99 := true

if (sellme and bUseDeadSimple)

bColor := color.lime

//down99 := true

plotshape(down99 and bShowFlags ? pos2 : na, title="Reversal Sell Signal", style=shape.flag, location=location.absolute, color=bColor, size=size.tiny)

plotshape(up99 and bShowFlags ? pos3 : na, title="Reversal Buy Signal", style=shape.flag, location=location.absolute, color=bColor, size=size.tiny)

//

// =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-= SQUEEZE MOMENTUM RELAXER 2.1 =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

// This is an improper use of TTM Squeeze. I capture the shift between a squeeze condition, and a relaxed condition

//

var cGreen = 0

var cRed = 0

var pos = false

var neg = false

// Keltner Channel

esma(close, length)=>

s = sma(close, 20)

e = ema(close, 20)

true ? e : s

ma1 = esma(close, 20)

rangema1 = atr(10)

upper1 = ma1 + rangema1 * 2

lower1 = ma1 - rangema1 * 2

KeltnerCross = crossover(close, upper1) or crossover(close, lower1)

// ADX

upq4 = rma(max(change(close), 0), 14)

downq4 = rma(-min(change(close), 0), 14)

rsi = downq4 == 0 ? 100 : upq4 == 0 ? 0 : 100 - (100 / (1 + upq4 / downq4))

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(14, 14) // ADX DI Length = 14, ADX Length. = 14

sigabove11 = sig > 11 // ADX Value = 11

// WAE Dead Zone

calc_macd(source, fastLength, slowLength) =>

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

fastMA - slowMA

t1 = (calc_macd(close, 20, 40) - calc_macd(close[1], 20, 40))*150

t2 = (calc_macd(close[2], 20, 40) - calc_macd(close[3], 20, 40))*150

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

// Squeeze Momentum

useTrueRange = true

source = close

basis5 = sma(close, 20)

dev1 = 1.5 * stdev(close, 20)

upperBB = basis5 + dev1

lowerBB = basis5 - dev1

ma = sma(close, 20)

rangeQ = useTrueRange ? tr : (high - low)

rangema = sma(rangeQ, 20)

upperKC = ma + rangema * 1.5

lowerKC = ma - rangema * 1.5

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

// Had to change this from the original

avg1 = avg(highest(high, 20), lowest(low, 20))

avg2 = avg(avg1, sma(close, 20))

val = linreg(close - avg2, 20, 0)

pos := false

neg := false

// if squeeze is bright RED, increment by one

if (val < nz(val[1]) and val < 5 and not sqzOn)

cRed := cRed + 1

// if squeeze is bright GREEN, increment by one

if (val > nz(val[1]) and val > 5 and not sqzOn)

cGreen := cGreen + 1

// if bright RED squeeze is now dim, momentum has changed. Is ADX also above 11? - add a marker to chart

if (val > nz(val[1]) and cRed > 1 and val < 5 and not pos[1] and sigabove11 == true)

cRed := 0

pos := true

// if bright GREEN squeeze is now dim, momentum has changed. Is ADX also above 11? - add a marker to chart

if (val < nz(val[1]) and cGreen > 1 and val > 5 and not neg[1] and sigabove11 == true)

cGreen := 0

neg := true

buySignal1 = pos

sellSignal1 = neg

// Basic diamond color: Yellow as default, and Red is RSI is overbought or sold

bColor4 = iff(rsi < 34 or rsi > 66, color.rgb(255, 0, 0), color.rgb(189, 189, 189)) // RSI Overbought Value = 34, RSI Oversold Value = 66

// If we crossed Keltner channel, then color is Aqua

// cColor4 = iff(KeltnerCross, color.rgb(50, 255, 67), bColor4)

cColor4 = bColor4

plotshape(buySignal1 and bShowDots ? pos : na, title="Squeeze Buy Signal", style=shape.diamond, location=location.belowbar, color=cColor4, size=size.tiny)

plotshape(sellSignal1 and bShowDots ? neg : na, title="Squeeze Sell Signal", style=shape.diamond, location=location.abovebar, color=cColor, size=size.tiny)

// BUY SELL SIGNALS

//buySignals = 0

//for history1 = 0 to iLookBack - 1

// if (buySignal1[history1])

// buySignals := buySignals + 1

//sellSignals = 0

//for history1 = 0 to iLookBack - 1

// if (sellSignals[history1])

// sellSignals := sellSignals + 1

//upSignals = 0

//for history1 = 0 to iLookBack - 1

// if (up99[history1])

// upSignals := upSignals + 1

//downSignals = 0

//for history1 = 0 to iLookBack - 1

// if (downSignals[history1])

// down99 := downSignals + 1

bBuyFlag = buySignal1 or buySignal1[1] or buySignal1[2] or buySignal1[3] or buySignal1[4] or buySignal1[5] or buySignal1[6]

bBuySqueeze = up99 or up99[1] or up99[2] or up99[3] or up99[4] or up99[5] or up99[6]

bSellFlag = sellSignal1 or sellSignal1[1] or sellSignal1[2] or sellSignal1[3] or sellSignal1[4] or sellSignal1[5] or sellSignal1[6]

bSellSqueeze = down99 or down99[1] or down99[2] or down99[3] or down99[4] or down99[5] or down99[6]

plotshape(bUpCurve and bBuyFlag and bBuySqueeze and bShowX ? 1 : na, title="X Buy Signal", location=location.belowbar, style=shape.xcross, size=size.normal, color=color.rgb(11, 255, 141))

plotshape(bDownCurve and bSellFlag and bSellSqueeze and bShowX ? 1 : na, title="X Sell Signal", location=location.abovebar, style=shape.xcross, size=size.normal, color=color.rgb(255, 12, 12))

alertcondition(bUpCurve, title='One Renko BUY', message='One Renko BUY')

alertcondition(bDownCurve, title='One Renko SELL', message='One Renko SELL')

//

// =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-= RENKO INTENSITY =-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

// TBD

//

@samer800 please take a look when you get a change please, this look really good for day trading on 2000 tick charts. thank you in advance!

@samer800 hopelly you can help us to get this indicator in TOS, thanks in advance!

CSS:

#// =-= THE ONE RENKO TO RULE THEM ALL =

#// Designed to be used on Renko 1s, Traditional 4. I primary trade the US 100 PEPPERSTONE (which is NQ futures)

#// Version 1 created by TraderOracle 11/18/2023

#// Version 1.1 - Fixed flag and squeeze overlapping, plus changed colors to be more intuitive

#study(title="The One Renko To Rule Them All", overlay=true, shorttitle="The One Renko 1.1")

# Converted by Sam4Cok@Samer800 - 12/2023

input showReversalSignals = no; # "Show Flags"

input showSqueezeSignals = no; # "Show Dots"

input showBuySellSignals = yes; # "Show Big X for Buy/Sell"

input UseDeadSimpleReversal = no; # "Use Dead Simple Reversal"

def na = Double.NaN;

def bUpCurve = close > close[1] and close[1] > close[2] and close[2] > close[3] and close[3] < close[4] and close[4] < close[5] and close[5] < close[6];# ? 1 : 0;

def bDownCurve = close < close[1] and close[1] < close[2] and close[2] < close[3] and close[3] > close[4] and close[4] > close[5] and close[5] > close[6];# ? 1 : 0

#// ULTIMATE REVERSAL 1.22 =-=-=-=-=-=-=-=-=-

#// These are volume patterns I noticed after backtesting reversals for many months

DefineGlobalColor("cColor", CreateColor(194, 196, 197));

DefineGlobalColor("b1Color", CreateColor(199, 197, 197));

DefineGlobalColor("b0Color", CreateColor(255, 53, 53));

def basis = Average(close, 30);

def dev = 2 * StDev(close, 30);

def upper = basis + dev;

def lower = basis - dev;

def is0Green = close > open;

def is1Green = close[1] > open[1];

def is2Green = close[2] > open[2];

def is3Green = close[3] > open[3];

def is4Green = close[4] > open[4];

def is0Red = !is0Green;

def is1Red = !is1Green;

def is2Red = !is2Green;

def is3Red = !is3Green;

def is4Red = !is4Green;

#// Pattern #1 - small red bar, larger red bar, small green bar

def up1 = (volume[1] > volume[2] and volume < volume[1] and is0Green and is1Red and is2Red);

def down1 = (volume[1] > volume[2] and volume < volume[1] and is0Red and is1Green and is2Green);

#// Pattern #2 - small red bar, larger red bar, even LARGER red bar, small green bar

def up2 = (volume[2] > volume[3] and volume[3] > volume[4] and volume[1] < volume[2] and volume < volume[2] and is0Green and is1Red and is2Red and is3Red and is4Red);

def down2 = (volume[2] > volume[3] and volume[3] > volume[4] and volume[1] < volume[2] and volume < volume[2] and is0Red and is1Green and is2Green and is3Green and is4Green);

#// Pattern #3 - 4 bars of the same color, then a different color bar that's larger than all 4 previous

def up3 = (is1Red and is2Red and is3Red and is4Red and is0Green and volume > volume[1] and volume > volume[2] and volume > volume[3] and volume > volume[4]);

def down3 = (is1Green and is2Green and is3Green and is4Green and is0Red and volume > volume[1] and volume > volume[2] and volume > volume[3] and volume > volume[4]);

#// snippet from Candlestick Reversal System by LonesomeTheDove

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

def _pivotRange;

##############

_BN = BarNumber();

_nan = Double.NaN;

_pivotRange = lbL + lbL;

_VStop = if !IsNaN(dat[_pivotRange]) and lbR > 0 and lbL > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat, -a) else dat < GetValue(dat, -a) else _nan;

if (HL > 0) {

_V = if _BN > lbL and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

def pivotlbar = 5;

def highleftempty = findpivots(high, 1, pivotlbar, 0);

def lowleftempty = findpivots(low - 1, pivotlbar, 0);

def wick_multiplier = 10;

def body_percentage = 1;

def O = open;

def C = close;

def H = high;

def L = low;

def Wlongsignal = (C > O) and (O - L) >= ((C - O) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(C < O) and (C - L) >= ((O - C) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(C == O and C != H) and (H - L) >= ((H - C) * wick_multiplier) and (H - C) <= ((H - L) * body_percentage) or

(O == H and C == H) and (H - L) >= Average((H - L), 50);

def Wshortsignal = (C < O) and (H - O) >= ((O - C) * wick_multiplier) and (C - L) <= ((H - L) * body_percentage) or

(C > O) and (H - C) >= ((C - O) * wick_multiplier) and (C - L) <= ((H - L) * body_percentage) or

(C == O and C != L) and (H - L) >= ((C - L) * wick_multiplier) and (C - L) <= ((H - L) * body_percentage) or

(O == L and C == L) and (H - L) >= Average((H - L), 50);

#// Candlestick pattern is technically Pattern #4

def up4 = !isNaN(lowleftempty) and Wlongsignal;

def down4 = !isNaN(highleftempty) and Wshortsignal;

def MyRsi = rsi(Price = close, Length = 14);

def up990 = (up1 or up2 or up3 or up4);

def down990 = (down1 or down2 or down3 or down4);

def bColor1;

def bColor = if (close < (lower - 2) or (lower - 2) and MyRsi < 30) then -1 else

if (close > (upper + 2) or open > (upper + 2) and MyRsi > 80) then -1 else 0;

def down99 = if down99[1] then no else

if (close > (upper + 2) or open > (upper + 2) and MyRsi > 80) then yes else

if (MyRsi < 60) then no else down990;

def up99 = if up99[1] then no else

if (close < (lower - 2) or (lower - 2) and MyRsi < 30) then yes else

if (MyRsi > 40) then no else up990;

def atr = atr(Length = 10);

def pos2 = high + (1.1 * atr);

def pos3 = low - (1.1 * atr);

#// My implementation of DEAD SIMPLE REVERSAL from PaidToFade

def q1 = close[1] < open[1] and close > open;

def q2 = close > open[1];

def q3 = Lowest(low, 3) < Lowest (low, 50)[1] or Lowest(low, 3) < Lowest(low, 50)[2] or Lowest(low, 3) < Lowest(low, 50)[3];

def buyme = q1 and q2 and q3;

def q4 = close[1] > open[1] and close < open;

def q5 = close < open[1];

def q6 = Highest(high, 3) > Highest (high, 50)[1] or Highest(high, 3) > Highest(high, 50)[2] or Highest(high, 3) > Highest(high, 50)[3];

def sellme = q4 and q5 and q6;

if (buyme and UseDeadSimpleReversal) {

bColor1 = 1;

} else

if (sellme and UseDeadSimpleReversal) {

bColor1 = 1;

} else {

bColor1 = bColor;

}

plot RevSell = if down99 and showReversalSignals then pos2 else na; #"Reversal Sell Signal

RevSell.AssignValueColor(if bColor1 > 0 then Color.CYAN else

if bColor1 < 0 then Color.MAGENTA else color.WHITE);

RevSell.SetPaintingStrategy(PaintingStrategy.SQUARES);

plot RevBuy = if up99 and showReversalSignals then pos3 else na; # "Reversal Buy Signal

RevBuy.AssignValueColor(if bColor1 > 0 then Color.CYAN else

if bColor1 < 0 then Color.MAGENTA else color.WHITE);

RevBuy.SetPaintingStrategy(PaintingStrategy.SQUARES);

#// This is an improper use of TTM Squeeze.

#// Keltner Channel

def esma = ExpAverage(close, 20);

def ma1 = esma;

def rangema1 = atr(Length = 10);

def upper1 = ma1 + rangema1 * 2;

def lower1 = ma1 - rangema1 * 2;

def KeltnerCross = (close Crosses Above upper1) or (close Crosses Above lower1);

def sig = Reference adx();# // ADX DI Length = 14, ADX Length. = 14

def sigabove11 = sig > 11;# // ADX Value = 11

#// WAE Dead Zone

Script calc_macd {

input source = close;

input fastLength = 20;

input slowLength = 40;

def fastMA = ExpAverage(source, fastLength);

def slowMA = ExpAverage(source, slowLength);

def calc_macd = fastMA - slowMA;

plot out = calc_macd;

}

def t1 = (calc_macd(close, 20, 40) - calc_macd(close[1], 20, 40))*150;

def t2 = (calc_macd(close[2], 20, 40) - calc_macd(close[3], 20, 40))*150;

def trendUp = if (t1 >= 0) then t1 else 0;

def trendDown = if (t1 < 0) then (-1*t1) else 0;

#// Squeeze Momentum

def source = close;

def basis5 = Average(close, 20);

def dev1 = 1.5 * stdev(close, 20);

def upperBB = basis5 + dev1;

def lowerBB = basis5 - dev1;

def ma = Average(close, 20);

def tr = TrueRange(high, close, low);

def rangeQ = if !isNaN(tr) then tr else (high - low);

def rangema = Average(rangeQ, 20);

def upperKC = ma + rangema * 1.5;

def lowerKC = ma - rangema * 1.5;

def sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC);

def sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC);

def noSqz = (!sqzOn) and (!sqzOff);

#// Had to change this from the original

def avg1 = (highest(high, 20) + lowest(low, 20)) / 2;

def avg2 = (avg1 + Average(close, 20)) / 2;

def val = Inertia(close - avg2, 20);

def cGreen;# = 0

def cRed;# = 0

def pos;# = false

def neg;# = false

if (val < val[1] and cGreen[1] > 1 and val > 5 and !neg[2] and sigabove11) {

cGreen = 0;

neg = yes;

cRed = cRed[1];

pos = no;

} else

if (val > val[1] and cRed[1] > 1 and val < 5 and !pos[2] and sigabove11) {

cRed = 0;

pos = yes;

cGreen = cGreen[1];

neg = neg[1];

} else

if (val > val[1] and val > 5 and !sqzOn) {

cGreen = cGreen[1] + 1;

cRed = cRed[1];

pos = no;#pos[1];

neg = no;#neg[1];

} else

if (val < val[1] and val < 5 and !sqzOn) {

cRed = cRed[1] + 1;

cGreen = cGreen[1];

pos = no;#pos[1];

neg = no;#neg[1];

} else {

cGreen = cGreen[1];

cRed = cRed[1];

pos = no;#pos[1];

neg = no;#neg[1];

}

def buySignal1 = pos;

def sellSignal1 = neg;

#// Basic diamond color: Yellow as default, and Red is RSI is overbought or sold

def bColor4 = if(myrsi < 34 or myrsi > 66, -1, 0);

plot sqBuy = if buySignal1 and showSqueezeSignals then pos else na;#, title="Squeeze Buy Signal"

plot sqSell = if sellSignal1 and showSqueezeSignals then neg else na;#, title="Squeeze Sell Signal"

sqBuy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

sqBuy.AssignValueColor(if bColor4 < 0 then Color.RED else CreateColor(189, 189, 189));

sqSell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

sqSell.AssignValueColor(if bColor4 < 0 then Color.RED else CreateColor(189, 189, 189));

def bBuyFlag = buySignal1 or buySignal1[1] or buySignal1[2] or buySignal1[3] or buySignal1[4] or buySignal1[5] or buySignal1[6];

def bBuySqueeze = up99 or up99[1] or up99[2] or up99[3] or up99[4] or up99[5] or up99[6];

def bSellFlag = sellSignal1 or sellSignal1[1] or sellSignal1[2] or sellSignal1[3] or sellSignal1[4] or sellSignal1[5] or sellSignal1[6];

def bSellSqueeze = down99 or down99[1] or down99[2] or down99[3] or down99[4] or down99[5] or down99[6];

plot xBuy = if bUpCurve and bBuyFlag and bBuySqueeze and showBuySellSignals then 1 else na; # "X Buy Signal"

plot xSell = if bDownCurve and bSellFlag and bSellSqueeze and showBuySellSignals then 1 else na; # "X Sell Signal"

xBuy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

xSell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

xBuy.setDefaultColor(Color.CYAN);

xSell.setDefaultColor(Color.MAGENTA);

#End OF Code