Mars_resident

New member

Hello everyone, I have been actively reading and improving my trading through this forum. I have been successful in day trading but I am still looking to improve my performance as an investor. I have spent quite some time experimenting with ton of different indicators.

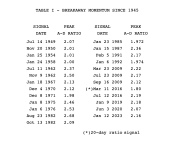

One of the most promising technical indicator, I came across is market breadth indicators. In particular, Breakaway momentum (https://www.walterdeemer.com/bam.htm), Zweig and Whaley ( https://docs.cmtassociation.org/pdfs/dowaward-2010.pdf) and 70 percent thrust (https://quantifiableedges.com/a-3x-70-breadth-thrust-signal/). I have studied how markets behave when these trigger and I am just amazed. Most recently a combination of these triggered on November 6, and we all know what happened next.

I see very little on this forum regarding these thrust signals. There is one thread (https://usethinkscript.com/threads/breadth-thrust-indicator-for-thinkorswim.2131/#post-20076 ). This thread shared the code for these thrust signals but after some research, I discovered it's not correct. For example, when you launch Breakaway momentum code, it gives you way some false positives ( compare it to : https://www.walterdeemer.com/bam.htm)

I was wondering if any of you can help with coding for these thrusts or if you already have one and don't mind sharing it.

One of the most promising technical indicator, I came across is market breadth indicators. In particular, Breakaway momentum (https://www.walterdeemer.com/bam.htm), Zweig and Whaley ( https://docs.cmtassociation.org/pdfs/dowaward-2010.pdf) and 70 percent thrust (https://quantifiableedges.com/a-3x-70-breadth-thrust-signal/). I have studied how markets behave when these trigger and I am just amazed. Most recently a combination of these triggered on November 6, and we all know what happened next.

I see very little on this forum regarding these thrust signals. There is one thread (https://usethinkscript.com/threads/breadth-thrust-indicator-for-thinkorswim.2131/#post-20076 ). This thread shared the code for these thrust signals but after some research, I discovered it's not correct. For example, when you launch Breakaway momentum code, it gives you way some false positives ( compare it to : https://www.walterdeemer.com/bam.htm)

I was wondering if any of you can help with coding for these thrusts or if you already have one and don't mind sharing it.