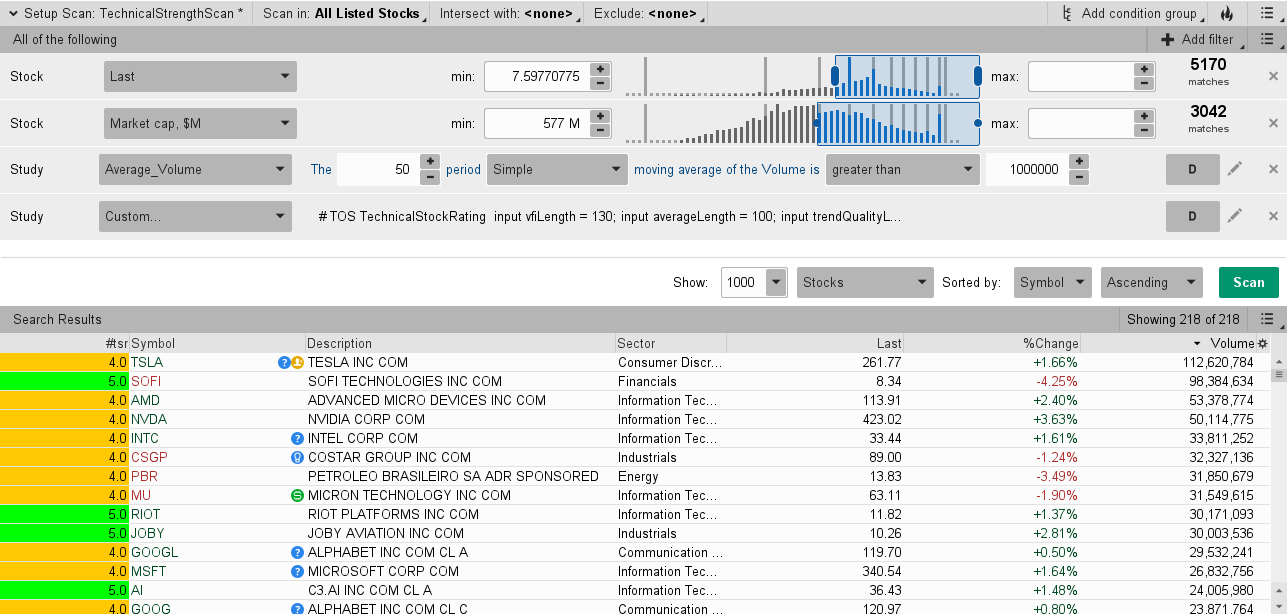

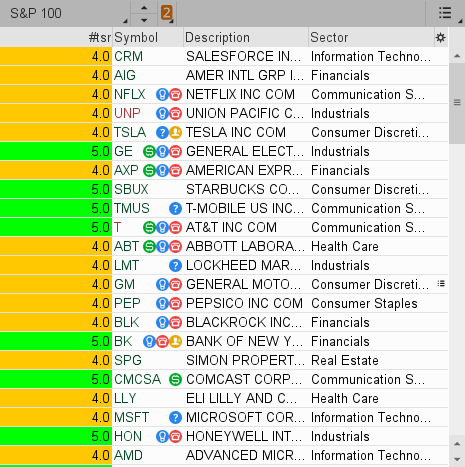

# TOS TechnicalStockRating

input vfiLength = 130;

input averageLength = 100;

input trendQualityLength = 63;

input maxStiffness = 7;

input marketIndex = "SPY";

input weightForMoneyFlow = 1.0;

input weightForTradingAboveAverage = 1.0;

input weightForUptrend = 1.0;

input weightForTrendQuality = 1.0;

input weightForMarketDirection = 2.0;

def vfi = reference VolumeFlowIndicator(length = vfiLength, "max volume cut off" = 2.5);

def sma = Average(close, averageLength);

def ema = ExpAverage(close(marketIndex), averageLength);

def stiffness = Sum(close < sma, trendQualityLength);

plot Score;

score.hide();

def MoneyFlow = vfi > 0;

def TradingAboveAverage = close > sma;

def Uptrend = sma > sma[4];

def TrendQuality = stiffness <= maxStiffness;

def MarketDirection = ema >= ema[2];

Score = (!isnan(weightForMoneyFlow) * !isnan(MoneyFlow)) + (!isnan(weightForTradingAboveAverage) * !isnan(TradingAboveAverage)) + (!isnan(weightForUptrend * Uptrend)) + (!isnan(weightForTrendQuality * TrendQuality)) + (!isnan(weightForMarketDirection) * !isnan(MarketDirection));

DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ;

DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ;

DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ;

AddLabel(yes, "Score=" +score,

if Score> 5 then GlobalColor("Pre_Cyan") else

if Score==5 then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(!isnan(MoneyFlow), "Money flow",

if MoneyFlow then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(!isnan(TradingAboveAverage), "Trading above average",

if TradingAboveAverage then GlobalColor("LabelGreen") else GlobalColor("LabelRed") );

AddLabel(!isnan(Uptrend), "Uptrend",

if Uptrend then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(!isnan(TrendQuality), "Trend quality",

if TrendQuality then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));

AddLabel(!isnan(MarketDirection), "Market direction",

if MarketDirection then GlobalColor("LabelGreen") else GlobalColor("LabelRed"));