Author Message:

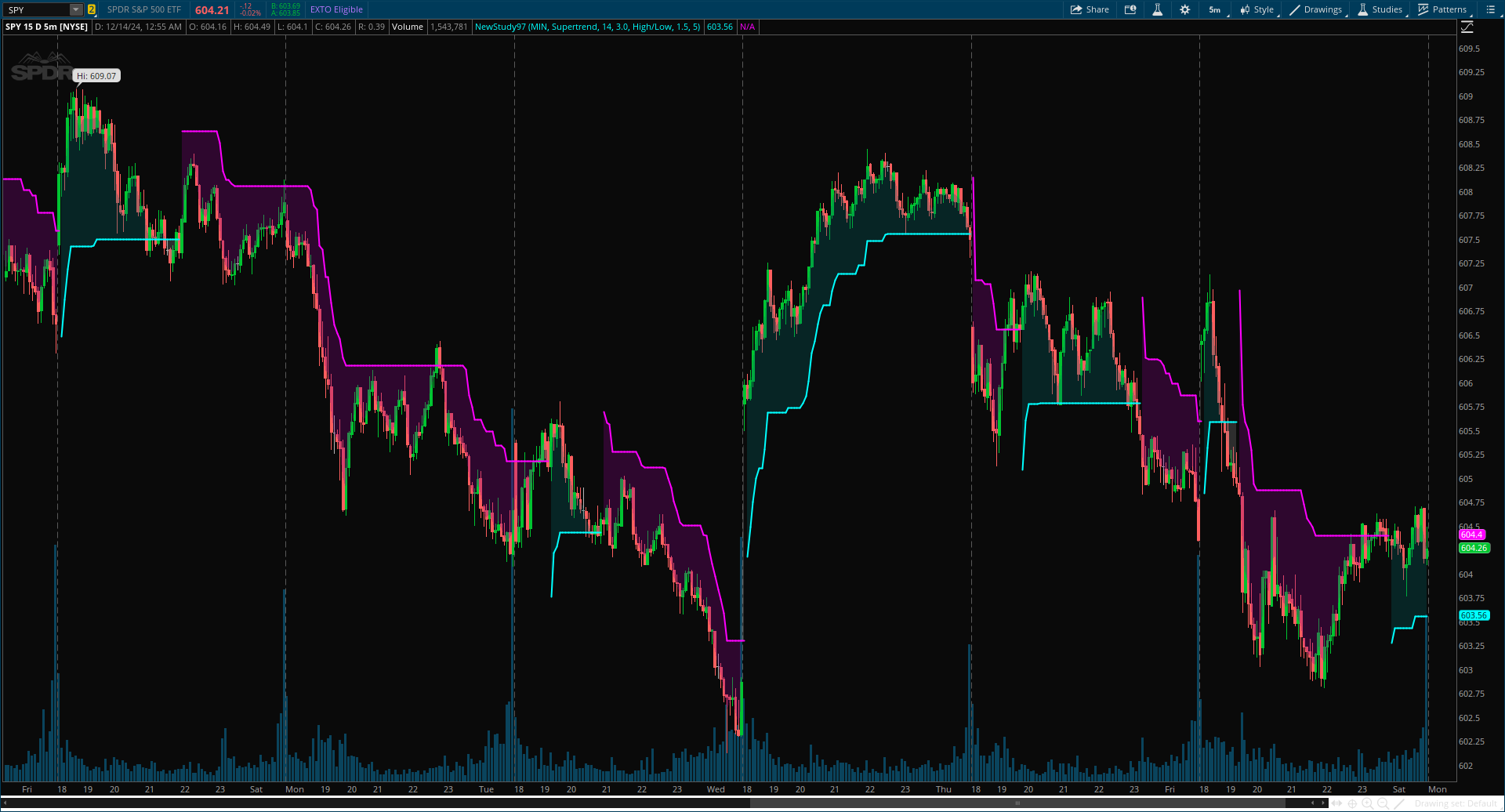

This script is an enhanced version of the classic Supertrend indicator. It incorporates an additional feature that ensures trend reversals are more reliable by introducing a Fakeout Index Limit and a Fakeout ATR Mult. This helps avoid false trend changes that could occur due to short-term price fluctuations or market noise.

CODE:

CSS:

#// Indicator for TOS

#// © EmreKb

#indicator("[EmreKb] Supertrend Fakeout", "ST Fakeout", overlay = true)

# Converted by Sam4Cok@Samer800 - 12/2024

input timeframe = AggregationPeriod.MIN;

input showOptions = {Default "Supertrend", "Bar Color", "Supertrend & Bar Color"};

input atrLength = 14; # "Supertrend ATR Length"

input atrMultiplier = 3.0; # "Supertrend ATR Mult"

input FakeoutBreakType = {default "High/Low", "Close"}; # "Fakeout Type"

input FakoutAtrMult = 1.5; # "Fakout ATR Mult"

input FakeoutCountLimit = 5; # "Fakeout Index Limit"

def na = Double.NaN;

def cap = GetAggregationPeriod();

def tf = Max(cap, timeframe);

def showST = showOptions==showOptions."Supertrend" or showOptions==showOptions."Supertrend & Bar Color";

def colorBars = showOptions==showOptions."Bar Color" or showOptions==showOptions."Supertrend & Bar Color";

def highSrc;

def lowSrc;

switch (FakeoutBreakType) {

case "Close" :

highSrc = close(Period = tf);

lowSrc = close(Period = tf);

default :

highSrc = high(Period = tf);

lowSrc = low(Period = tf);

}

Script f_supertrend {

input nATR = 1;

input atrMultiplier = 3.0;

input highSrc = high;

input lowSrc = low;

input FAKEOUT_INDEX_LIMIT = 5;

input FAKEOUT_ATR_MULT = 1.5;

def na = Double.NaN;

def src = (highSrc + lowSrc) / 2;

def lower = src - nATR * atrMultiplier;

def upper = src + nATR * atrMultiplier;

def state = {default ini, Bull, Bear};

def dnLine;

def upLine;

def fakeoutIndex;

def fakeoutSt;

def dn = if isNaN(dnLine[1]) then lower else if !dnLine[1] then lower else dnLine[1];

def up = if isNaN(upLine[1]) then upper else if !upLine[1] then upper else upLine[1];

def dnLine1 = if state[1] == state.Bull and dn > lower then dn else lower;

def upLine1 = if state[1] == state.Bear and up < upper then up else upper;

Switch (state[1]) {

Case Bull :

if lowSrc < dnLine[1] {

if (IsNaN(fakeoutIndex[1]) or IsNaN(fakeoutSt[1])) {

state = state[1];

upLine = upLine[1];

dnLine = dnLine[1];

fakeoutSt = upLine1;

fakeoutIndex = 0;

} else if (fakeoutIndex[1] >= FAKEOUT_INDEX_LIMIT) or ((dnLine[1] - lowSrc) > nATR * FAKEOUT_ATR_MULT) {

state = state.Bear;

upLine = fakeoutSt[1];

dnLine = dnLine1;

fakeoutSt = na;

fakeoutIndex = na;

} else {

state = state[1];

upLine = upLine[1];

dnLine = dnLine[1];

fakeoutSt = fakeoutSt[1];

fakeoutIndex = fakeoutIndex[1] + 1;

}

} else {

state = state[1];

upLine = upLine1;

dnLine = dnLine1;

fakeoutSt = na;

fakeoutIndex = na;

}

Case Bear:

if highSrc > upLine[1] {

if (IsNaN(fakeoutIndex[1]) or IsNaN(fakeoutSt[1])) {

state = state[1];

upLine = upLine[1];

dnLine = dnLine[1];

fakeoutSt = dnLine1;

fakeoutIndex = 0;

} else if (fakeoutIndex[1] >= FAKEOUT_INDEX_LIMIT) or ((highSrc - upLine[1]) > nATR * FAKEOUT_ATR_MULT) {

state = state.Bull;

upLine = upLine1;

dnLine = fakeoutSt[1];

fakeoutSt = na;

fakeoutIndex = na;

} else {

state = state[1];

upLine = upLine[1];

dnLine = dnLine[1];

fakeoutSt = fakeoutSt[1];

fakeoutIndex = fakeoutIndex[1] + 1;

}

} else {

state = state[1];

upLine = upLine1;

dnLine = dnLine1;

fakeoutSt = na;

fakeoutIndex = na;

}

Default :

dnLine = dnLine1;

upLine = upLine1;

state = state.Bull;

fakeoutSt = na;

fakeoutIndex = na;

}

plot st = if state == state.Bull then dnLine else upLine;

plot dir = if state == state.Bear then 0 else 1;

}

def tr = if isNaN(high(Period = tf)[1]) then (high(Period = tf) - low(Period = tf)) else

TrueRange(high(Period = tf), close(Period = tf), low(Period = tf));

def nATR = WildersAverage(tr, atrLength);

def trend = f_supertrend(nATR, atrMultiplier, highSrc, lowSrc, FakeoutCountLimit, FakoutAtrMult).dir;

def st = f_supertrend(nATR, atrMultiplier, highSrc, lowSrc, FakeoutCountLimit, FakoutAtrMult).st;

plot stBull = if showST and trend == 1 then st else na; # "Suptrend Bullish"

plot stBear = if !showST or trend == 1 then na else st; # "Suptrend Bearish"

stBull.SetLineWeight(2);

stBear.SetLineWeight(2);

stBull.SetDefaultColor(Color.CYAN);

stBear.SetDefaultColor(Color.MAGENTA);

AddCloud(if showST and trend == 1 then ohlc4 else na, st, CreateColor(0, 100, 100), Color.GRAY);

AddCloud(if !showST or trend == 1 then na else st , ohlc4, Color.PLUM, Color.GRAY);

#-- Bar Color

AssignPriceColor(if !colorBars then Color.CURRENT else

if trend == 1 then if close > st then Color.GREEN else Color.DARK_GREEN else

if close < st then Color.RED else Color.DARK_RED);

#-- END of CODE