Happy Holidays!

I have been a very active user of these extremely valuable resources that you guys have created, and appreciate it very much!

I would like to scan for stocks based on these parameters.

For example:

show me stocks (on Monday) whose implied (weekly) move is greater than $1, $3, $5, etc

or show me stocks whose implied move is greater than 10%

and or filter by only displaying those whose implied volatility is greater than 100% and has a daily option volume of 10,000

I would be very grateful if someone can make for me the "Full Package" whatever studies, indicators, custom scripts are needed to create the output - ideally a user friendly watchlist which can be sorted by the critical inputs

Please let me know if any more information is needed.

Thanks in advance and have a wonderful holiday season!!

Forgive me but in my limited understanding this doesn't sound correct.

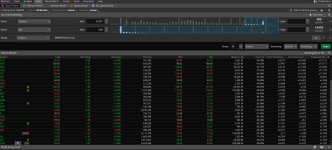

I have already gotten this far on my own - see screenshot below (last four columns of results) where I can scan and sort based on expected move.

Also I have a study installed which shows me the implied percent move (second screenshot white and purple labels on top)

I think using these two combined there should be a way to do it.

Maybe someone else can help?

Here are the two scripts

EMWATCH:

Here is the script for the implied daily move

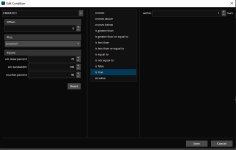

To be honest I don't even know how to use the EMWATCH script - I just set it to show me ones that are "True" (see screenshot

My goal is to find stocks with a HIGH weekly and/or daily implied/expected move.

High can either be percentage based (above 10%) or dollar amount (above $5),

It would also be helpful to be able to show (sort or filter) by the options volume - but if this is not possible I can work without it.

I also have this script but I have no idea what to do with it or how to utilize it:

It is from this thread where they say there is a scanner:

https://usethinkscript.com/threads/implied-move-based-on-weekly-options-for-thinkorswim.1449

Either way thanks a lot for your support!!

I have been a very active user of these extremely valuable resources that you guys have created, and appreciate it very much!

I would like to scan for stocks based on these parameters.

For example:

show me stocks (on Monday) whose implied (weekly) move is greater than $1, $3, $5, etc

or show me stocks whose implied move is greater than 10%

and or filter by only displaying those whose implied volatility is greater than 100% and has a daily option volume of 10,000

I would be very grateful if someone can make for me the "Full Package" whatever studies, indicators, custom scripts are needed to create the output - ideally a user friendly watchlist which can be sorted by the critical inputs

Please let me know if any more information is needed.

Thanks in advance and have a wonderful holiday season!!

Forgive me but in my limited understanding this doesn't sound correct.

I have already gotten this far on my own - see screenshot below (last four columns of results) where I can scan and sort based on expected move.

Also I have a study installed which shows me the implied percent move (second screenshot white and purple labels on top)

I think using these two combined there should be a way to do it.

Maybe someone else can help?

Here are the two scripts

EMWATCH:

Code:

# EMswitch Weely_Expected_Move

####################################

# TheoTrade_Weely_Expected_Move

def agg = GetAggregationPeriod();

input em_skew_percent = 70;

input em_bandwidth = 100;

input touches_percent = 90;

#

# routine to force looking for the highest bar number

#

def barcount = BarNumber();

def lastbar = HighestAll(if IsNaN(high) then 0 else barcount);

def ivGapHi;

def expmove;

def high_bar;

def low_bar;

def em_close;

def weekcnt;

def touch_high_bar;

def touch_low_bar;

############ logic to check for holidays #########

# Change EM calculation on Monday (Day #1) or when last trading day

# was a Friday (Day #5) and the current day is Tuesday (Day #2).

#

# Continue assumption that EM is being calculated on a Saturday. 6 days

# to expire.

############

if GetDayOfWeek(GetYYYYMMDD()) == 1 or (getdayofweek(getYYYYMMDD()[1]) == 5 and getdayofweek(getyyyymmdd()) == 2)

then {

ivGapHi = imp_volatility()[1];

expmove = close[1] * ivGapHi * Sqrt(6) / Sqrt(365) * em_skew_percent / 100 * em_bandwidth / 100;

high_bar = close[1] + expmove;

touch_high_bar = close[1] + (expmove * touches_percent/100);

low_bar = close[1] - expmove;

touch_low_bar = close[1] - (expmove * touches_percent/100);

em_close = close[1];

weekcnt=weekcnt[1] + 1;

}

else {

ivGapHi = ivGapHi[1];

expmove = expmove[1];

high_bar = high_bar[1];

touch_high_bar = touch_high_bar[1];

low_bar = low_bar[1];

touch_low_bar= touch_low_bar[1];

em_close = em_close[1];

weekcnt = weekcnt[1];

}

def peak = if high_bar > 1 and Close > high_bar then 1 else 0;

def valley = if low_bar > 1 and Close < low_bar then 1 else 0;

def touchpeak = if high_bar > 1 and ((High >= touch_high_bar and High >= touch_high_bar) or (Close < high_bar and close >= touch_high_bar)) then 1 else 0;

def touchvalley = if low_bar > 1 and ((Low <= touch_low_bar and Low <= touch_low_bar) or (Close > low_bar and Close <= touch_low_bar)) then 1 else 0;

def pkcnt = if peak then pkcnt[1] + 1 else pkcnt[1] ;

def vcnt = if valley then vcnt[1] + 1 else vcnt[1] ;

def peakcnt = if weekcnt != weekcnt[1] or valley then 0 else if peak then peakcnt[1] + 1 else peakcnt[1] ;

def valleycnt = if weekcnt != weekcnt[1] or peak then 0 else if valley then valleycnt[1] + 1 else valleycnt[1] ;

def touchpeakcnt = if weekcnt != weekcnt[1] or touchvalley then 0 else if touchpeak then touchpeakcnt[1] + 1 else touchpeakcnt[1] ;

def touchvalleynt = if weekcnt != weekcnt[1] or touchpeak then 0 else if touchvalley then touchvalleynt[1] + 1 else touchvalleynt[1] ;

#plot Data = expmove;

def Dailydirection = if (valley or touchvalley) then 1 else if ( peak or touchpeak) then -1 else if IsNaN(Dailydirection[1]) then 0 else Dailydirection[1];

plot emswitch = Dailydirection <> Dailydirection[1];Here is the script for the implied daily move

Code:

#Implied Average Daily Move% Formula ~ IV%*sqrt(1/365)*sqrt(2/pi)

#Per @SqueezeMetrics

#"Implied volatility is quoted as an annualized standard deviation. So, e.g., "40% IV" theoretically* means that there's a ~68% chance that the underlying ends within ±40% of where it is now after 365 calendar days.

#*an unwarranted extrapolation

#For the small audience of volatility enthusiasts *without* masochistic tendencies, consider this: The use of annualization and standard deviation are arbitrary and stupid.

#Why? Because options are priced using mean outcomes (like everything), and hedge-replication is done daily.

#So to translate 40% IV to "implied average daily move," do this:

#40% * √(1/365) * √(2/π) = 1.67%

#"±1.67% average daily move."

#Much less stupid."

#I, @CommercialGary, much more stupid than Squeeze, made this for use WITH 0DTE

#USING THE "TIMELEFT" VARIABLE BELOW MEANS IT WILL ONLY WORKS ON INTRADAY(IE LESS THAN A DAY) TIMEFRAMES AND ONLY DURING REGULAR TRADING HOURS, IF WANTING TO USE DURING AFTER/PREMARKET JUST CHANGE "TIMELEFT" TO DTE WHICH IS ALREADY INPUT AT 1 OR JUST REPLACE WITH 1. THATLL BE THE IMPLIED AVG DAILY MOVE. OR U CAN ADD AN IF ELSE STATEMENT TO TIMELEFT SO IT AUTO REVERTS TO 1 OUTSIDE REG TRADING HOURS.

#GOODLUCK.

input Series_IV = 1; #term series, 1 is front most.

input DTE = 1; #days to expiry, replace timeleft if you want to know avg given #days to expiry instead of time remaining

def rth = 2*(RegularTradingEnd(GetYYYYMMDD()) - RegularTradingStart(GetYYYYMMDD())) / AggregationPeriod.HOUR;

AddLabel(yes, "RTH duration (30min): " + rth);

input CloseTime = 1600;

def thirtyminRemained = 2*SecondsTillTime(CloseTime) /3600;

AddLabel(1, "30minsRemain: " + thirtyminRemained);

def timeleft = thirtyminRemained / rth;

AddLabel(1, "timeleft: " + timeleft);

def pi = Double.Pi;

def IV1 = SeriesVolatility(series = Series_IV); #gives the tos' option chain series IV, particularly the front most expiration.

AddLabel(1, "SeriesIV1 = " + AsPercent(IV1

), Color.WHITE); #make sure it matches the IV on chain just in case

def ImpAvgDailyMove = IV1 * Sqrt( timeleft / 365) * Sqrt(2 / pi);

def dm = ImpAvgDailyMove * close; #gives impl daily move in $ instead of %

AddLabel(1, "ImpliedAvgPercentMove= +/- " + AsPercent(ImpAvgDailyMove), Color.VIOLET);

AddLabel(1, "ImpliedAvgMove= +/- " + AsPrice(dm), Color.CYAN);

#WONT SHOW UP ON DAILY TIMEFRAMES OR HIGHER. IF YOU JUST WANT DAILY IMPLIED MOVE REPLACE

#TIMELEFT WITH 1.

#On an intraday chart it calcs the avg implied move given remaining time to expiration.To be honest I don't even know how to use the EMWATCH script - I just set it to show me ones that are "True" (see screenshot

My goal is to find stocks with a HIGH weekly and/or daily implied/expected move.

High can either be percentage based (above 10%) or dollar amount (above $5),

It would also be helpful to be able to show (sort or filter) by the options volume - but if this is not possible I can work without it.

I also have this script but I have no idea what to do with it or how to utilize it:

It is from this thread where they say there is a scanner:

https://usethinkscript.com/threads/implied-move-based-on-weekly-options-for-thinkorswim.1449

Code:

# Mobius_

# Implied Move For Various Times based on the Series IV

# Mobius

# V01.03.2017

input show_label = yes;

input nDays = 4; #hint nDays: Days left in series.

input Series_IV = 1; #hint Series_IV: Series 1 is closest expirery.

input defClose = {default "Friday"};

input ShowLabels = yes;

input show252day = no;

input show365day = no;

input show1day = yes;

input Label_Color_Choice = {default "pink", "cyan", "orange", "gray", "yellow", "red", "green", "dark_gray", "light_yellow", "white"};

def CurrentDOW = GetDayOfWeek(GetYYYYMMDD());

def cbar = if CurrentDOW == 5

then BarNumber()

else cbar[1];

def c = if BarNumber() == cbar

then close(period = AggregationPeriod.DAY)

else c[1];

def t;

switch (defClose) {

case Friday:

t = if BarNumber() == cbar

then close(period = AggregationPeriod.DAY)

else c[1];

}

def IV = if IsNaN(imp_volatility(period = AggregationPeriod.DAY))

then IV[1]

else imp_volatility(period = AggregationPeriod.DAY);

def seriesIV = SeriesVolatility(series = Series_IV);

def ImpMove = (((t * seriesIV * Sqrt(nDays)) / Sqrt(365)) / TickSize()) * TickSize();

def ImpMove252 = (((t * seriesIV * Sqrt(nDays)) / Sqrt(252)) / TickSize()) * TickSize();

def ImpMove365 = (((t * seriesIV * Sqrt(nDays)) / Sqrt(365)) / TickSize()) * TickSize();

def ImpMove1 = Round(((t * seriesIV * Sqrt(1)) / Sqrt(365)) / TickSize(), 0) * TickSize();

def LastBar= if !IsNaN(close) and IsNaN(close[-1])

then barnumber()

else Double.NaN;

def upline = if !IsNaN(close) and IsNaN(close[-1])

then t + ImpMove

else if IsNaN(close)

then upline[1]

else Double.NaN;

def upper = if BarNumber() >= HighestAll(lastBar) and

BarNumber() <= HighestAll(lastBar) + nDays

then upline

else Double.NaN;

def lowline = if !IsNaN(close) and IsNaN(close[-1])

then t - ImpMove

else if IsNaN(close)

then lowline[1]

else Double.NaN;

def lower = if BarNumber() >= HighestAll(lastBar) and

BarNumber() <= HighestAll(lastBar) + nDays

then lowline

else Double.NaN;

def emu = close > upper;

def emub = high > upper and close < upper;

def emd = close < lower;

def emdb = low < lower and close > lower;

plot scan = emu or emub or emd or emdb;

# End Code Implied Moves From Series IV

AssignBackgroundColor(

if scan and

emu then Color.lime else

if emd then color.light_red else

if emdb then color.dark_red else

if emub then color.dark_green else color.black);

addlabel(yes,

if emu then "Abv" else

if emd then "Blw" else

if emub then "RDn" else

if emdb then "RUp" else "In");Either way thanks a lot for your support!!

Attachments

Last edited: