Hi All,

I just joined recently, and have been browsing the indicator forums. I found one that I'd like to explore more. The code is in this post. I'd like to get a scanner for it made.

https://usethinkscript.com/threads/sar-macd-for-thinkorswim.15409/

Is this the right forum to ask this question in?

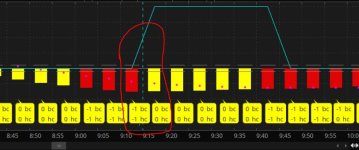

So I'm looking to be able to scan a watch list say S&P500 stocks for stocks where the red colored bar has turned yellow within a certain number of bars, which would be choose able. For time frames, I'm thinking, 1hr, 2hr,4hr,1D. I have drawn arrows on the chart picture below, so show what I'm referring to.

Thanks for taking a look at this!

here is what i did,

you want something based on the histogram colors, so determine what causes them.

this is the histogram and code to change its colors.

macd.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

macd.AssignValueColor(if macdSel then

if bc>0 then CreateColor(1, 185, 7) else

if bc<0 then CreateColor(224, 4, 4) else Color.YELLOW else

if hc>0 then CreateColor(1, 185, 7) else

if hc<0 then CreateColor(224, 4, 4) else Color.YELLOW);

so bc and hc determine the colors. i could stare at the code and figure out the logic, but the if-thens are a little starnge, and it's easier to just draw a bubble with values, to see what is going on.

addchartbubble(1, -0.5,

bc + " bc\n" +

hc + " hc"

, color.yellow, no);

you want a red to yellow transition, so,

when the hisogram is red, bc and hc are -1.

when yellow, they are both 0.

so we need to find when they are = 0 and on the previous bar they were -1.

i could add another bubble, but a verticalline also works. this draws a vertical line just before the first yellow bar, right where you want.

addverticalline(

(bc[1] == -1 and hc[1] == -1 and bc[0] == 0 and hc[0] == 0),

"-",

color.cyan);

the next thing to do is count the bars from that signal and compare the count to some number.

you want a scan study to have 1 plot and for it to be true for the desired situation.

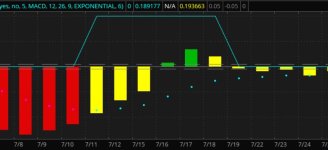

plot z will be true on the signal and for the 5 bars after it.

for a scan or column, you will have to edit the code to change an input number.

def cnt = if (bc[1] == -1 and hc[1] == -1 and bc[0] == 0 and hc[0] == 0) then 1 else cnt[1] + 1;

# scan for signals less than x bars ago

input max_cnt = 6;

plot z = cnt <= max_cnt;

there should be a pulsed line plot on the histogram, a line that goes to 1 on the first yellow bar and stays at 1 for the next 5 bars.

once we get to this point and verify the plot formula, we can remove all the code after it. scans need just 1 plot, no labels, no other plots, no bubbles, no clouds.

watchlist study/scan

sarmacd

http://tos.mx/!HJFiGHME

5 minute time

Code:

# sarmacd

# SAR_MACD_Scan_scan_01

#https://usethinkscript.com/threads/sar-macd-scan.19909/

#SAR MACD Scan

# https://usethinkscript.com/threads/sar-macd-for-thinkorswim.15409/

# to scan a watch list for stocks where the red colored bar has turned yellow within a certain number of bars

# ----------------------------

#https://usethinkscript.com/threads/sar-macd-for-thinkorswim.15409/

#Indicators Custom

#SAR MACD for ThinkOrSwim

#samer800 May 6, 2023

#Buy Condition:

#MA Color - Blue

#Histogram- Above Zero

#Histogram/Candle -Green

#MA Crossover is must

#Sell Condition:

#MA Color - Red

#Histogram- Below Zero

#Histogram/Candle -Red

#MA Cross under is must

#Warning: Must not be used as a standalone indicator. Use for confirmation of your Buy Sell Signals and Entry only.

#// https://www.tradingview.com/v/uXB6f9Y5/

#// © traderharikrishna

#indicator("SARMACD")

# Converted and mod by Sam4Cok@Samer800 - 05/2023

declare lower;

def na = double.nan;

def bn = barnumber();

input ColorBars = yes;

input ShowSignals = no;

input sideways = 5;#,'sideways')

input GraphType = {default MACD, HIST}; # 'Graph Type'

input fastLength = 12;

input slowLength = 26;

input macdLength = 9;

input averageType = AverageType.EXPONENTIAL;

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def last = isNaN(close);

def macdSel = GraphType==GraphType.MACD;

def HistSel = GraphType==GraphType.HIST;

def sar = ParabolicSAR();

def cross = crosses(close,sar);

def sa = if cross then close else sa[1];

def dir = if sar < close then 1 else -1;

def m = MovingAverage(averageType, close, fastLength) - MovingAverage(averageType, close, slowLength);

def s = MovingAverage(averageType, m, MACDLength);

def h = m - s;

def bc = if dir == 1 and close > sa and m>0 then 1 else

if dir == -1 and close < sa and m<0 then -1 else 0;

def hc = if dir == 1 and close > sa and h>0 then 1 else

if dir == -1 and close < sa and h<0 then -1 else 0;

def cnt = if (bc[1] == -1 and hc[1] == -1 and bc[0] == 0 and hc[0] == 0) then 1 else cnt[1] + 1;

# scan for signals less than x bars ago

input max_cnt = 6;

plot z = if bn == 1 then 0 else cnt <= max_cnt;

addchartbubble(0, -0.5,

bc + " bc\n" +

hc + " hc"

, color.yellow, no);

addverticalline(0 and

(bc[1] == -1 and hc[1] == -1 and bc[0] == 0 and hc[0] == 0),

"-",

color.cyan);

#