Hello All,

I am looking for RSI script.

Using the ToS RSI calculation: RSI()

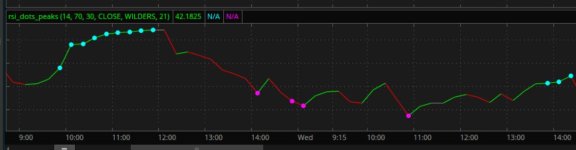

Adding a blue dot for new RSI highs and red dots for new RSI lows, within a given period.

For example,

if I choose my period to be 21,

if I choose my period to be 52,

By increasing, I meant if the current RSI value is higher than the previous one and vice versa. Thank you so much!

Please help.

Thank you very much!

I am looking for RSI script.

Using the ToS RSI calculation: RSI()

Adding a blue dot for new RSI highs and red dots for new RSI lows, within a given period.

For example,

if I choose my period to be 21,

- each time the RSI makes a high considering the last 21 bars, it will show a blue dot on the RSI line.

- The same is true for RSI making a new low considering the previous 21 bars; at that instant, a red dot would appear on the RSI line.

if I choose my period to be 52,

- blue dot for new 52-bar RSI highs

- red dots for new 52-bar RSI lows.

By increasing, I meant if the current RSI value is higher than the previous one and vice versa. Thank you so much!

Please help.

Thank you very much!

Last edited by a moderator: