AdamantBidoof

New member

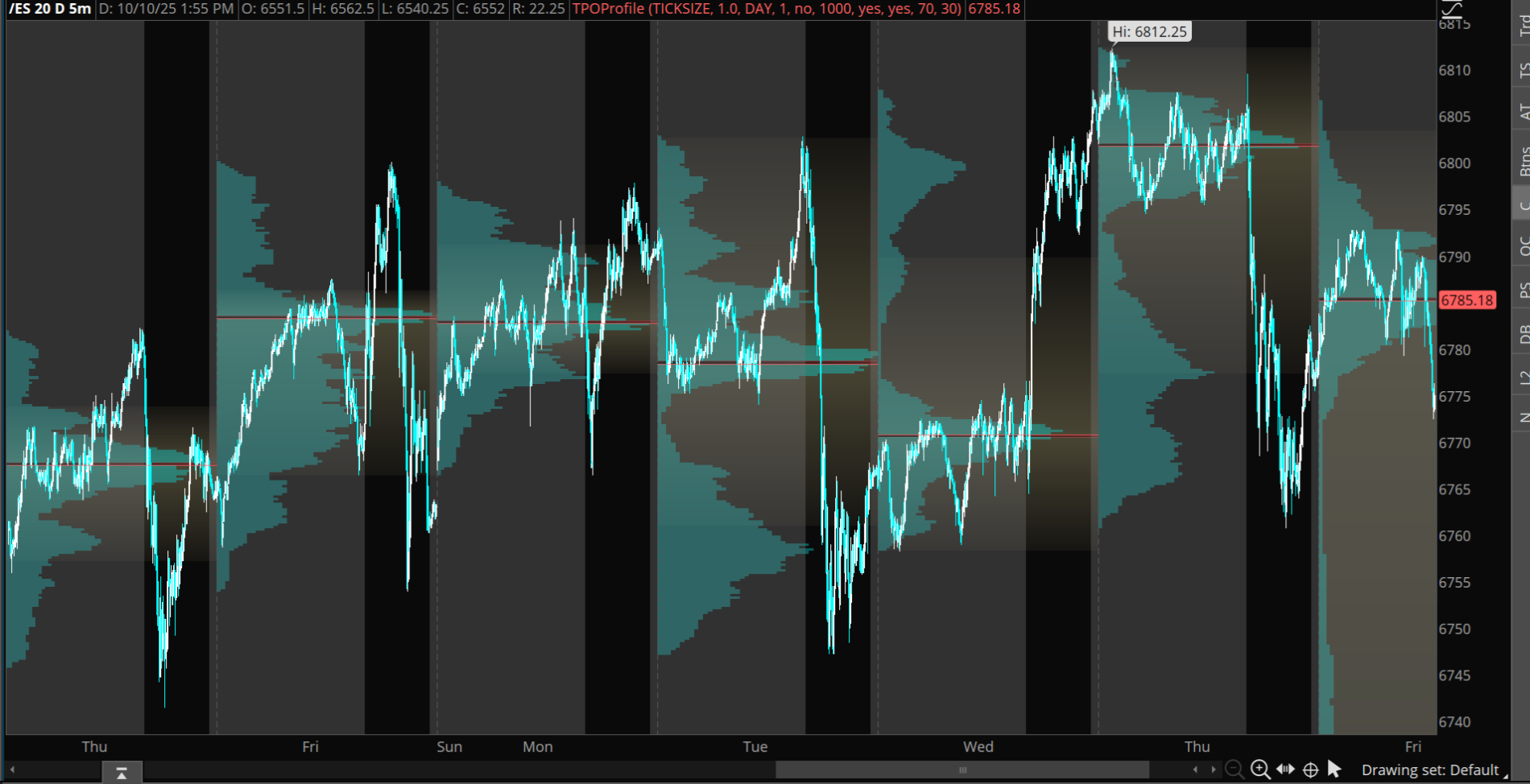

Is there a way or code to have the blue TPO profile NOT the levels move onto the next day like in this example? not just the levels.

# ########################################

# TPO (Time Profile) + POC/VAH/VAL + IB Lines

declare upper;

# ########################################

# Globals

def sc = close;

def sh = high;

def sl = low;

def so = open;

def na = Double.NaN;

# ########################################

# Inputs

input showProfile = yes;

input showLevels = yes;

input showBubbles = yes;

input profileMode = {default DAY, RTH}; # DAY = new profile each date; RTH = splits by RTH/ETH boundary

input rthStart = 0930;

input rthEnd = 1600;

input valueAreaPercent = 70.0;

input pricePerRow = PricePerRow.AUTOMATIC;

input showIB = yes;

input ibMinutes = 60;

input showOnExpansion = no;

def aggOK = GetAggregationPeriod() < AggregationPeriod.DAY;

def inRTH = SecondsFromTime(rthStart) >= 0 and SecondsTillTime(rthEnd) > 0;

def startNew =

if !aggOK then 0

else if profileMode == profileMode.DAY then GetYYYYMMDD() <> GetYYYYMMDD()[1]

else (inRTH && !inRTH[1]) or (!inRTH && inRTH[1]);

profile tpo = TimeProfile(

pricePerRow = pricePerRow,

"startNewProfile" = startNew,

"onExpansion" = showOnExpansion,

"value area percent" = valueAreaPercent

);

tpo.Show(

color = if showProfile then Color.GRAY else Color.CURRENT,

"poc color"= if showProfile then Color.YELLOW else Color.CURRENT,

"va color" = if showProfile then Color.CYAN else Color.CURRENT,

opacity = 45

);

def POC = tpo.GetPointOfControl();

def VAH = tpo.GetHighestValueArea();

def VAL = tpo.GetLowestValueArea();

plot pPOC = if showLevels && aggOK then POC else na;

pPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pPOC.SetLineWeight(2);

plot pVAH = if showLevels && aggOK then VAH else na;

pVAH.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pVAH.SetLineWeight(1);

plot pVAL = if showLevels && aggOK then VAL else na;

pVAL.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pVAL.SetLineWeight(1);

# ########################################

# Initial Balance (IB) = first ibMinutes of RTH

def newRTH = aggOK && (inRTH && !inRTH[1]);

def ibSec = SecondsFromTime(rthStart);

def inIB = aggOK && inRTH && ibSec >= 0 && ibSec < ibMinutes * 60;

rec ibH = if newRTH then sh else if inIB then Max(sh, ibH[1]) else ibH[1];

rec ibL = if newRTH then sl else if inIB then Min(sl, ibL[1]) else ibL[1];

plot pIBH = if showIB && aggOK then ibH else na;

pIBH.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pIBH.SetStyle(Curve.SHORT_DASH);

plot pIBL = if showIB && aggOK then ibL else na;

pIBL.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pIBL.SetStyle(Curve.SHORT_DASH);

# ########################################

# Right-edge bubbles

def lastBar = !IsNaN(sc) && IsNaN(sc[-1]);

AddChartBubble(showBubbles && lastBar && showLevels && aggOK, POC, "POC " + AsPrice(POC), Color.YELLOW, no);

AddChartBubble(showBubbles && lastBar && showLevels && aggOK, VAH, "VAH " + AsPrice(VAH), Color.CYAN, no);

AddChartBubble(showBubbles && lastBar && showLevels && aggOK, VAL, "VAL " + AsPrice(VAL), Color.CYAN, yes);

AddChartBubble(showBubbles && lastBar && showIB && aggOK, ibH, "IBH " + AsPrice(ibH), Color.LIGHT_GRAY, no);

AddChartBubble(showBubbles && lastBar && showIB && aggOK, ibL, "IBL " + AsPrice(ibL), Color.LIGHT_GRAY, yes);

AddLabel(!aggOK, "TPO/TimeProfile is intended for intraday charts", Color.RED);There is this one - ( I think the bubble labels need to be looked at though)Hmmm Interesting. @antwerks have you heard of this?

# filename: MR__EZ_VP_TPO_Hybrid_Profile_Optimized_

# source: https://usethinkscript.com/threads/go-with-the-flow.20732/post-151684

# _VP_TPO_Hybrid_Profile_Optimized_

# Based on: https://usethinkscript.com/threads/go-with-the-flow.20732/post-151661

# Combines Volume Profile and Time Profile features with optimized performance

# ===== Session Control =====

input begin = 1800; # Session start time

def rth = SecondsFromTime(begin) == 0 and secondsTillTime(begin) == 0;

# ===== Profile Configuration =====

input pricePerRowHeightMode = {AUTOMATIC, default TICKSIZE};

def height = if pricePerRowHeightMode == pricePerRowHeightMode.AUTOMATIC

then PricePerRow.AUTOMATIC

else PricePerRow.TICKSIZE;

def height2 = PricePerRow.AUTOMATIC;

input timePerProfile = {CHART, MINUTE, HOUR, default DAY, WEEK, MONTH, "OPT EXP", BAR};

input multiplier = 1;

input profiles = 2;

input valueAreaPercent = 70;

input showpointofcontrol = yes;

input showvaluearea = no;

input showvolumehistogram = yes;

input opacity = 50;

input shownakedonly = yes;

input start = 0;

input showLabels = yes; # Added option to toggle labels

input bubbleOffset = 10; # Number of bars from current bar where bubbles appear

input showBubblesOnNewProfiles = yes; # Show bubbles when new profiles are created

# ===== Period/Timing Logic =====

def period;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

switch (timePerProfile) {

case CHART:

period = 0;

case MINUTE:

period = Floor(seconds / 60 + day_number * 24 * 60);

case HOUR:

period = Floor(seconds / 3600 + day_number * 24);

case DAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

case WEEK:

period = Floor(day_number / 7);

case MONTH:

period = Floor(month - First(month));

case "OPT EXP":

period = exp_opt - First(exp_opt);

case BAR:

period = BarNumber() - 1;

}

# ===== Volume Profile Creation =====

# Current profile

profile vol = VolumeProfile("startNewProfile" = rth,

"onExpansion" = no,

"numberOfProfiles" = 1000,

pricePerRow = height);

# Previous profiles

def count = CompoundValue(1,

if period != period[1]

then (count[1] + period - period[1]) % multiplier

else count[1],

0);

def cond = count < count[1] + period - period[1];

profile vol2 = VolumeProfile("startNewProfile" = cond,

"numberOfProfiles" = profiles,

"pricePerRow" = height2,

"value area percent" = valueAreaPercent,

onExpansion = no);

# ===== Current Session Levels =====

def pca = if IsNaN(vol.GetPointOfControl()) then pca[1] else vol.GetPointOfControl();

def hVA = if IsNaN(vol.GetHighestValueArea()) then hVA[1] else vol.GetHighestValueArea();

def lVA = if IsNaN(vol.GetLowestValueArea()) then lVA[1] else vol.GetLowestValueArea();

# Current session values accounting for RTH

def poc = if !rth or IsNaN(close) then poc[1] else pca;

def ub = if !rth or IsNaN(close) then ub[1] else hVA;

def lb = if !rth or IsNaN(close) then lb[1] else lVA;

# ===== Previous Session Levels =====

# Previous Value Area High and Low

def HVA2 = if IsNaN(vol.GetHighestValueArea()) then HVA2[1] else vol.GetHighestValueArea();

def pHVA = CompoundValue(1, if cond then HVA2[1] else pHVA[1], Double.NaN);

def LVA2 = if IsNaN(vol.GetLowestValueArea()) then LVA[1] else vol.GetLowestValueArea();

def pLVA = CompoundValue(1, if cond then LVA2[1] else pLVA[1], Double.NaN);

# Previous POC

def POC2 = if IsNaN(vol.GetPointOfControl()) then POC2[1] else vol.GetPointOfControl();

def pPOC = CompoundValue(1, if cond then POC2[1] else pPOC[1], Double.NaN);

# ===== Plot Current Session Levels =====

plot VPOC = poc;

plot VAH = ub;

plot VAL = lb;

VPOC.SetDefaultColor(Color.GREEN);

VAH.SetDefaultColor(Color.ORANGE);

VAL.SetDefaultColor(Color.ORANGE);

VPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAH.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAL.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VPOC.SetLineWeight(2);

VAH.SetLineWeight(2);

VAL.SetLineWeight(2);

# ===== Plot Previous Session Levels =====

plot PrevVHVA = pHVA;

plot PrevVLVA = pLVA;

PrevVHVA.SetDefaultColor(Color.PLUM);

PrevVLVA.SetDefaultColor(Color.PLUM);

PrevVHVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVLVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVHVA.SetLineWeight(2);

PrevVLVA.SetLineWeight(2);

plot PrevVPOC = pPOC;

PrevVPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVPOC.SetDefaultColor(Color.MAGENTA);

PrevVPOC.SetLineWeight(2);

# ===== Show Volume Profile =====

vol.Show(CreateColor(0, 102, 204),

if showpointofcontrol then Color.GREEN else Color.CURRENT,

if showvaluearea then Color.YELLOW else Color.CURRENT,

if showvolumehistogram then opacity else 0);

# ===== Naked Virgin POCs Script =====

# This has been optimized to be more efficient

script NakedVirginPOC {

input days_back = 1;

def volp = reference VolumeProfile("time per profile" = "DAY",

"on expansion" = no,

"price per row height mode" = "TICKSIZE");

def ymd = GetYYYYMMDD();

def y = if ymd != ymd[1] then y[1] + 1 else y[1];

# Get POC for the specific day

def pc = if IsNaN(close)

then pc[1]

else if y == HighestAll(y) - days_back

then volp

else pc[1];

# Check if POC has been touched

plot x = if y > HighestAll(y) - days_back and

(Between(pc, low, high) or close crosses pc)

then BarNumber()

else Double.NaN;

# Return POC if it's "naked" (untouched)

plot poc = if IsNaN(LowestAll(x))

then pc

else if BarNumber() > LowestAll(x)

then Double.NaN

else pc;

}

# ===== Global Colors =====

DefineGlobalColor("NakedPOC", Color.WHITE);

DefineGlobalColor("TouchedPOC", Color.MAGENTA);

# ===== Generate Naked POCs =====

# This has been optimized to use a loop-like approach

# It fixes the issue with repetitive code and makes it more maintainable

def isLastBar = BarNumber() == HighestAll(BarNumber());

def isTouched1 = !IsNaN(LowestAll(NakedVirginPOC(1 + start).x));

def isTouched2 = !IsNaN(LowestAll(NakedVirginPOC(2 + start).x));

def isTouched3 = !IsNaN(LowestAll(NakedVirginPOC(3 + start).x));

def isTouched4 = !IsNaN(LowestAll(NakedVirginPOC(4 + start).x));

def isTouched5 = !IsNaN(LowestAll(NakedVirginPOC(5 + start).x));

# Plot Naked Virgin POCs only if they haven't been touched

plot v1 = if shownakedonly and isTouched1 then Double.NaN else NakedVirginPOC(1 + start).poc;

plot v2 = if shownakedonly and isTouched2 then Double.NaN else NakedVirginPOC(2 + start).poc;

plot v3 = if shownakedonly and isTouched3 then Double.NaN else NakedVirginPOC(3 + start).poc;

plot v4 = if shownakedonly and isTouched4 then Double.NaN else NakedVirginPOC(4 + start).poc;

plot v5 = if shownakedonly and isTouched5 then Double.NaN else NakedVirginPOC(5 + start).poc;

# Style the Naked Virgin POCs

v1.AssignValueColor(if isTouched1 then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v2.AssignValueColor(if isTouched2 then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v3.AssignValueColor(if isTouched3 then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v4.AssignValueColor(if isTouched4 then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v5.AssignValueColor(if isTouched5 then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v1.SetPaintingStrategy(PaintingStrategy.DASHES);

v2.SetPaintingStrategy(PaintingStrategy.DASHES);

v3.SetPaintingStrategy(PaintingStrategy.DASHES);

v4.SetPaintingStrategy(PaintingStrategy.DASHES);

v5.SetPaintingStrategy(PaintingStrategy.DASHES);

v1.SetLineWeight(2);

v2.SetLineWeight(2);

v3.SetLineWeight(2);

v4.SetLineWeight(2);

v5.SetLineWeight(2);

# ===== Labels =====

# Bubble placement and visibility control

#input bubbleOffset = 10; # Number of bars from current bar where bubbles appear

#input showBubblesOnNewProfiles = yes; # Show bubbles when a new profile is created

# Calculate bubble locations

def currentBar = HighestAll(if !IsNaN(close) then BarNumber() else Double.NaN);

def bubbleBar = currentBar + bubbleOffset;

def isTargetBar = BarNumber() == bubbleBar;

# Profile boundary conditions for bubble placement

def newProfile = period != period[1];

def profileStart = CompoundValue(1, if newProfile then BarNumber() else profileStart[1], 0);

# Add bubbles at the offset from current bar and at profile start points for current session

# Current Day POC, VAH, VAL

AddChartBubble(isTargetBar and showLabels, VPOC, "POC", Color.GREEN, yes);

AddChartBubble(isTargetBar and showLabels, VAH, "VAH", Color.ORANGE, yes);

AddChartBubble(isTargetBar and showLabels, VAL, "VAL", Color.ORANGE, yes);

# Previous Day POC, VAH, VAL

AddChartBubble(isTargetBar and showLabels, PrevVPOC, "PVPOC", Color.MAGENTA, yes);

AddChartBubble(isTargetBar and showLabels, PrevVHVA, "PVHVA", Color.YELLOW, yes);

AddChartBubble(isTargetBar and showLabels, PrevVLVA, "PVLVA", Color.YELLOW, yes);

# Additional bubbles at the start of each new profile (like in the original code)

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels,

PrevVHVA[1], "PVHVA", Color.YELLOW, yes);

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels,

PrevVLVA[1], "PVLVA", Color.YELLOW, yes);

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels,

PrevVPOC[1], "PVPOC", Color.MAGENTA, yes);

# Naked Virgin POCs - bubbles at offset and when POC changes

AddChartBubble(isTargetBar and showLabels and !isTouched1 and !IsNaN(v1),

v1, "NV-POC1", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !isTouched2 and !IsNaN(v2),

v2, "NV-POC2", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !isTouched3 and !IsNaN(v3),

v3, "NV-POC3", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !isTouched4 and !IsNaN(v4),

v4, "NV-POC4", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !isTouched5 and !IsNaN(v5),

v5, "NV-POC5", GlobalColor("NakedPOC"), yes);#VolumeProfile_Choice_of_Displaying_Input_Dates_Times_v1

#Dates and Times must show on chart

#

input startdate = 20250826;

input enddate = 20250827;

input starttime = 1600;

input endtime = 0930;

input show_profilehigh_low = yes;

#Show vol profile will display the profile area when set to yes. However, since we have no control over the function vol.show, the profile for the area beyond the selected dates/times will also display. Therefore the default is set to no.

input show_vol_profile = no;

input show_label = yes;

AddLabel(show_label, "VolProfile: " + AsPrice(startdate) + " at " + AsPrice(starttime) + " to " + AsPrice(enddate) + " at " + AsPrice(endtime), Color.YELLOW);

input pricePerRowHeightMode = {AUTOMATIC, default TICKSIZE, CUSTOM};

input customRowHeight = 1.0;

input onExpansion = no;

input profiles = 2;

input showPointOfControl = yes;

input showValueArea = no;

input valueAreaPercent = 70;

input opacity = 50;

def na = Double.NaN;

def bn = BarNumber();

def begin = if GetYYYYMMDD() == startdate and SecondsFromTime(starttime)[1] < 0 and SecondsFromTime(starttime) >= 0 then bn else na;

def end = if GetYYYYMMDD() == enddate and SecondsFromTime(endtime)[1] < 0 and SecondsFromTime(endtime) >= 0 then bn else na;

def tz = Between(bn, HighestAll(begin), HighestAll(end));

def zone = 1;

def cond = tz != tz[1];

def height;

switch (pricePerRowHeightMode) {

case AUTOMATIC:

height = PricePerRow.AUTOMATIC;

case TICKSIZE:

height = PricePerRow.TICKSIZE;

case CUSTOM:

height = customRowHeight;

}

profile vol = VolumeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent);

def pc = if IsNaN(vol.GetPointOfControl()) then pc[1] else vol.GetPointOfControl();

def hVA = if IsNaN(vol.GetHighestValueArea()) then hVA[1] else vol.GetHighestValueArea();

def lVA = if IsNaN(vol.GetLowestValueArea()) then lVA[1] else vol.GetLowestValueArea();

def hProfile = if IsNaN(vol.GetHighest()) then hProfile[1] else vol.GetHighest();

def lProfile = if IsNaN(vol.GetLowest()) then lProfile[1] else vol.GetLowest();

def POC_ = if tz == zone then pc else na;

def ProfileHigh_ = if tz == zone then hProfile else na;

def ProfileLow_ = if tz == zone then lProfile else na;

def VAHigh_ = if tz == zone then hVA else na;

def VALow_ = if tz == zone then lVA else na;

plot POC = POC_;

plot VAHigh = VAHigh_;

plot VALow = VALow_;

plot ProfileHigh = if !show_profilehigh_low then na else ProfileHigh_;

plot ProfileLow = if !show_profilehigh_low then na else ProfileLow_;

DefineGlobalColor("Profile", Color.GRAY);

DefineGlobalColor("Point Of Control", Color.RED);

DefineGlobalColor("Value Area", Color.GRAY);

vol.Show(if show_vol_profile then GlobalColor("Profile") else Color.CURRENT);#, if showPointOfControl then GlobalColor("Point Of Control") else Color.CURRENT, if showValueArea then GlobalColor("Value Area") else Color.CURRENT, opacity);

POC.SetDefaultColor(GlobalColor("Point Of Control"));

POC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VALow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAHigh.SetDefaultColor(GlobalColor("Value Area"));

VALow.SetDefaultColor(GlobalColor("Value Area"));

ProfileHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProfileLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProfileHigh.SetDefaultColor(GetColor(3));

ProfileLow.SetDefaultColor(GetColor(3));

input bubbles = yes;

input n = 6;

AddChartBubble(bubbles and tz[n] == 1 and tz[n - 1] == 0, VAHigh[n], "VAH", Color.YELLOW, yes);

AddChartBubble(bubbles and tz[n] == 1 and tz[n - 1] == 0, VALow[n], "VAL", Color.YELLOW, no);

AddChartBubble(bubbles and tz[n] == 1 and tz[n - 1] == 0, POC[n], "POC", Color.RED, no);

##

# Quant Trading App Volume Profile

# Created: September 15, 2021

#

# Credit: Bryant Littrean, Thinkorswim

# Contact: [email protected]

# Trading Litt Youtube: https://bit.ly/trading-litt-yt

# Quant Trading App Discord: https://quanttradingdiscord.com

# 20220427 Sleepyz added timeperprofile for Day, Week, Month options

#

def multiplier = 1;

def onExpansion = no;

def profiles = 1000;

input profileSession = {default Day, Week, Month};

input showPointOfControl = yes;

input showValueArea = yes;

input valueAreaPercent = 68;

input opacity = 90;

def period;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

switch (profileSession) {case DAY: period = countTradingDays(min(first(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

case WEEK: period = floor(day_number / 7);case MONTH: period = floor(month - first(month));}

def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0);def cond = count < count[1] + period - period[1];

def height = PricePerRow.TICKSIZE;profile vol = VolumeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent);

def con = CompoundValue(1, onExpansion, no);

def pc = if IsNaN(vol.GetPointOfControl()) and con then pc[1] else vol.GetPointOfControl();

def hVA = if IsNaN(vol.GetHighestValueArea()) and con then hVA[1] else vol.GetHighestValueArea();

def lVA = if IsNaN(vol.GetLowestValueArea()) and con then lVA[1] else vol.GetLowestValueArea();

def hProfile = if IsNaN(vol.GetHighest()) and con then hProfile[1] else vol.GetHighest();def lProfile = if IsNaN(vol.GetLowest()) and con then lProfile[1] else vol.GetLowest();

def plotsDomain = IsNaN(close) == onExpansion;plot POC = if plotsDomain then pc else Double.NaN;plot ProfileHigh = if plotsDomain then hProfile else Double.NaN;plot ProfileLow = if plotsDomain then lProfile else Double.NaN;

plot VAHigh = if plotsDomain then hVA else Double.NaN;

plot VALow = if plotsDomain then lVA else Double.NaN;DefineGlobalColor("Profile", CreateColor(70, 70, 70));DefineGlobalColor("Point Of Control", CreateColor(255, 215, 0));DefineGlobalColor("Value Area", CreateColor(95, 140, 230));

vol.Show(GlobalColor("Profile"), if showPointOfControl then GlobalColor("Point Of Control") else Color.CURRENT, if showValueArea then GlobalColor("Value Area") else Color.CURRENT, opacity);

POC.SetDefaultColor(GlobalColor("Point Of Control"));

POC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

POC.SetLineWeight(2);VAHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VALow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAHigh.SetDefaultColor(GlobalColor("Value Area"));

VALow.SetDefaultColor(GlobalColor("Value Area"));

ProfileHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);ProfileLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProfileHigh.SetDefaultColor(GetColor(3));

ProfileLow.SetDefaultColor(GetColor(3));

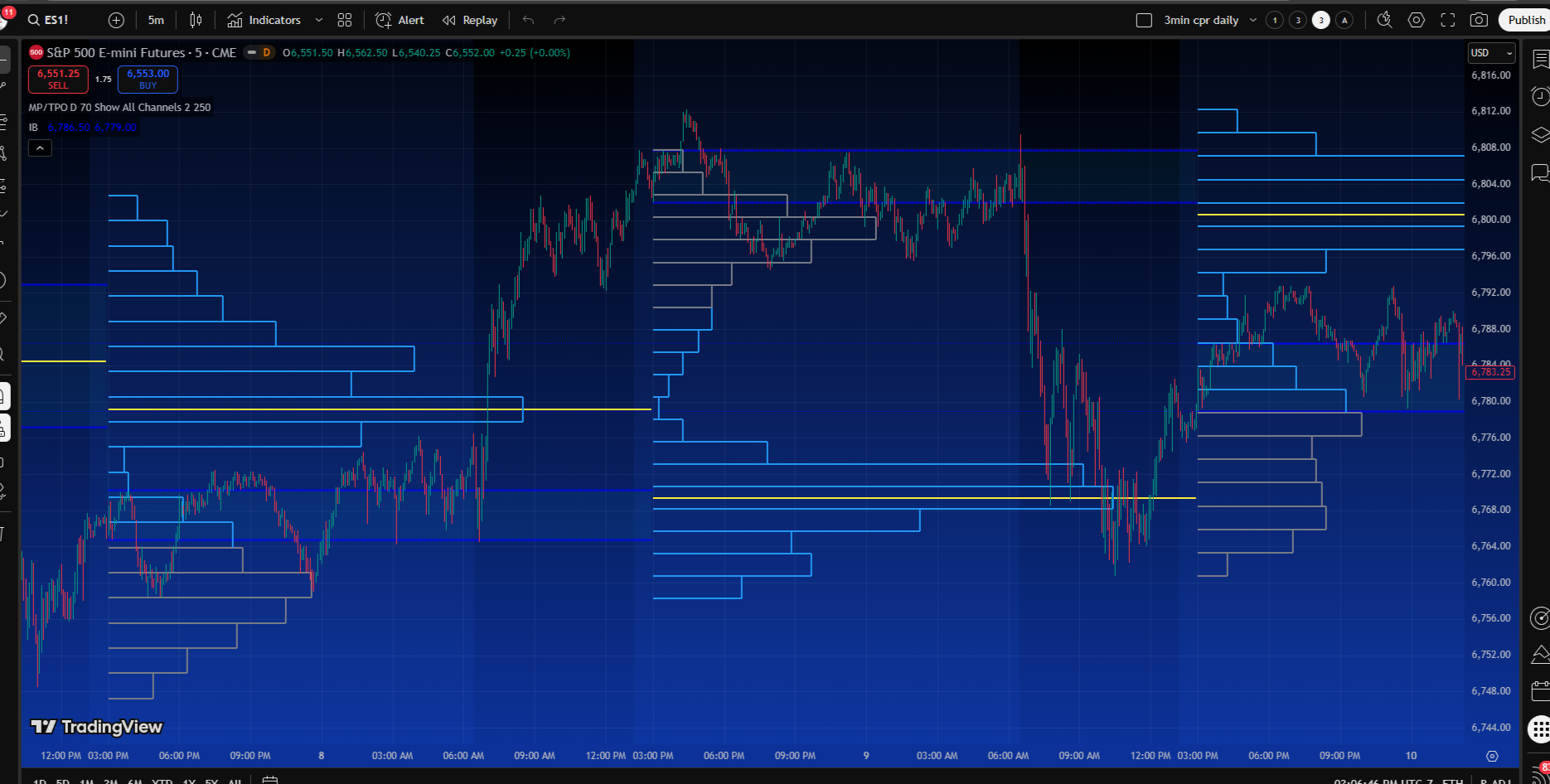

ProfileHigh.Hide();ProfileLow.Hide();Interesting! Thank Ant.Now there is this one QTA VP that you can load 2 or more (2 is plenty) and it gives you day and week POC and as you can see the week POC can be seen as a support resistance - supply demand zone as price action is supported or rejected along with the daily POC

View attachment 26546Code:# # Quant Trading App Volume Profile # Created: September 15, 2021 # # Credit: Bryant Littrean, Thinkorswim # Contact: [email protected] # Trading Litt Youtube: https://bit.ly/trading-litt-yt # Quant Trading App Discord: https://quanttradingdiscord.com # 20220427 Sleepyz added timeperprofile for Day, Week, Month options # def multiplier = 1; def onExpansion = no; def profiles = 1000; input profileSession = {default Day, Week, Month}; input showPointOfControl = yes; input showValueArea = yes; input valueAreaPercent = 68; input opacity = 90; def period; def yyyymmdd = GetYYYYMMDD(); def seconds = SecondsFromTime(0); def month = GetYear() * 12 + GetMonth(); def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd)); def dom = GetDayOfMonth(yyyymmdd); def dow = GetDayOfWeek(yyyymmdd - dom + 1); def expthismonth = (if dow > 5 then 27 else 20) - dow; def exp_opt = month + (dom > expthismonth); switch (profileSession) {case DAY: period = countTradingDays(min(first(yyyymmdd), yyyymmdd), yyyymmdd) - 1; case WEEK: period = floor(day_number / 7);case MONTH: period = floor(month - first(month));} def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0);def cond = count < count[1] + period - period[1]; def height = PricePerRow.TICKSIZE;profile vol = VolumeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent); def con = CompoundValue(1, onExpansion, no); def pc = if IsNaN(vol.GetPointOfControl()) and con then pc[1] else vol.GetPointOfControl(); def hVA = if IsNaN(vol.GetHighestValueArea()) and con then hVA[1] else vol.GetHighestValueArea(); def lVA = if IsNaN(vol.GetLowestValueArea()) and con then lVA[1] else vol.GetLowestValueArea(); def hProfile = if IsNaN(vol.GetHighest()) and con then hProfile[1] else vol.GetHighest();def lProfile = if IsNaN(vol.GetLowest()) and con then lProfile[1] else vol.GetLowest(); def plotsDomain = IsNaN(close) == onExpansion;plot POC = if plotsDomain then pc else Double.NaN;plot ProfileHigh = if plotsDomain then hProfile else Double.NaN;plot ProfileLow = if plotsDomain then lProfile else Double.NaN; plot VAHigh = if plotsDomain then hVA else Double.NaN; plot VALow = if plotsDomain then lVA else Double.NaN;DefineGlobalColor("Profile", CreateColor(70, 70, 70));DefineGlobalColor("Point Of Control", CreateColor(255, 215, 0));DefineGlobalColor("Value Area", CreateColor(95, 140, 230)); vol.Show(GlobalColor("Profile"), if showPointOfControl then GlobalColor("Point Of Control") else Color.CURRENT, if showValueArea then GlobalColor("Value Area") else Color.CURRENT, opacity); POC.SetDefaultColor(GlobalColor("Point Of Control")); POC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); POC.SetLineWeight(2);VAHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); VALow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); VAHigh.SetDefaultColor(GlobalColor("Value Area")); VALow.SetDefaultColor(GlobalColor("Value Area")); ProfileHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);ProfileLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); ProfileHigh.SetDefaultColor(GetColor(3)); ProfileLow.SetDefaultColor(GetColor(3)); ProfileHigh.Hide();ProfileLow.Hide();

# ===============================

# VOLUME PROFILE BREAKOUT SYSTEM

# Indicator ONLY

# ===============================

input lengthEMA = 55;

input lengthSMA = 200;

input volumeSpikeMult = 2.0;

# -------------------------------

# SESSION FILTER

# -------------------------------

def isRegularHours = GetTime() >= RegularTradingStart(GetYYYYMMDD()) and

GetTime() <= RegularTradingEnd(GetYYYYMMDD());

# -------------------------------

# MOVING AVERAGES

# -------------------------------

def EMA55 = ExpAverage(close, lengthEMA);

def SMA200 = Average(close, lengthSMA);

plot pEMA55 = EMA55;

plot pSMA200 = SMA200;

pEMA55.SetDefaultColor(Color.YELLOW);

pSMA200.SetDefaultColor(Color.MAGENTA);

# -------------------------------

# VWAP

# -------------------------------

plot VWAP = reference VWAP();

VWAP.SetDefaultColor(Color.CYAN);

VWAP.SetLineWeight(2);

# -------------------------------

# CURRENT DAY VOLUME PROFILE

# -------------------------------

profile vp = VolumeProfile("startNewProfile" = yes, "onExpansion" = no);

def POC = vp.GetPointOfControl();

def VAH = vp.GetHighestValueArea();

def VAL = vp.GetLowestValueArea();

def validToday = !IsNaN(POC);

plot POCline = if validToday then POC else Double.NaN;

plot VAHline = if validToday then VAH else Double.NaN;

plot VALline = if validToday then VAL else Double.NaN;

POCline.SetDefaultColor(Color.CYAN);

VAHline.SetDefaultColor(Color.GREEN);

VALline.SetDefaultColor(Color.RED);

# -------------------------------

# PRIOR DAY PROFILE (expansion trick)

# -------------------------------

profile vpPrev = VolumeProfile("startNewProfile" = yes, "onExpansion" = yes);

def POC_prev = vpPrev.GetPointOfControl();

def VAH_prev = vpPrev.GetHighestValueArea();

def VAL_prev = vpPrev.GetLowestValueArea();

def validPrev = !IsNaN(POC_prev);

plot PrevPOC = if validPrev then POC_prev else Double.NaN;

plot PrevVAH = if validPrev then VAH_prev else Double.NaN;

plot PrevVAL = if validPrev then VAL_prev else Double.NaN;

PrevPOC.SetDefaultColor(Color.WHITE);

PrevVAH.SetDefaultColor(Color.WHITE);

PrevVAL.SetDefaultColor(Color.WHITE);

# -------------------------------

# VOLUME SPIKE

# -------------------------------

def volAvg = Average(volume, 50);

def volSpike = volume > volAvg * volumeSpikeMult;

plot VolSpikeDot = if volSpike then low - TickSize() else Double.NaN;

VolSpikeDot.SetPaintingStrategy(PaintingStrategy.POINTS);

VolSpikeDot.SetDefaultColor(Color.ORANGE);

VolSpikeDot.SetLineWeight(3);

# -------------------------------

# BREAKOUT CONDITIONS

# -------------------------------

def breakoutVAH = close > VAH;

def breakdownVAL = close < VAL;

def breakPrevPOC = close crosses above POC_prev or close crosses below POC_prev;

def bullishTrend = close > EMA55 and EMA55 > SMA200 and close > VWAP;

def bearishTrend = close < EMA55 and EMA55 < SMA200 and close < VWAP;

# -------------------------------

# SIGNAL CONDITIONS (with session filter)

# -------------------------------

def strongLongSignal = isRegularHours and bullishTrend and volSpike and (breakoutVAH or breakPrevPOC);

def relaxedLongSignal = isRegularHours and close > EMA55 and volume > volAvg * 1.2 and (close > VAH or close > POC_prev);

def shortSignal = isRegularHours and bearishTrend and volSpike and (breakdownVAL or breakPrevPOC);

# -------------------------------

# PLOTS

# -------------------------------

plot StrongLongArrow = if strongLongSignal then low else Double.NaN;

StrongLongArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

StrongLongArrow.SetDefaultColor(Color.GREEN);

StrongLongArrow.SetLineWeight(3);

plot SoftLongArrow = if relaxedLongSignal and !strongLongSignal then low else Double.NaN;

SoftLongArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

SoftLongArrow.SetDefaultColor(Color.YELLOW);

SoftLongArrow.SetLineWeight(2);

plot ShortArrow = if shortSignal then high else Double.NaN;

ShortArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

ShortArrow.SetDefaultColor(Color.RED);

ShortArrow.SetLineWeight(3);

# ========================

# LABELS SECTION

# ========================

AddLabel(yes, "Volume Profile Breakout System", Color.WHITE);

# Market Session Label

AddLabel(yes,

if isRegularHours then "Market: Regular Session"

else "Market: After Hours",

if isRegularHours then Color.GREEN else Color.DARK_RED

);

# Trend Status

AddLabel(yes,

if bullishTrend then "Trend: Bullish"

else if bearishTrend then "Trend: Bearish"

else "Trend: Neutral",

if bullishTrend then Color.GREEN

else if bearishTrend then Color.RED

else Color.GRAY

);

# Volume Spike Info

AddLabel(yes,

if volSpike then "Volume Spike: YES"

else "Volume Spike: NO",

if volSpike then Color.ORANGE else Color.DARK_GRAY

);

# Breakout Info

AddLabel(yes,

if breakoutVAH then "Breaking VAH ↑"

else if breakdownVAL then "Breaking VAL ↓"

else "Within Value Area",

if breakoutVAH then Color.GREEN

else if breakdownVAL then Color.RED

else Color.GRAY

);

AddLabel(yes,

if breakPrevPOC then "Crossing Prev POC"

else "Below/Above Prev POC",

if breakPrevPOC then Color.CYAN else Color.DARK_GRAY

);

# Signal Summary

AddLabel(yes,

if strongLongSignal then "🔔 STRONG BULLISH SIGNAL"

else if relaxedLongSignal then "⚠️ SOFT BULLISH SIGNAL"

else "No Signal",

if strongLongSignal then Color.GREEN

else if relaxedLongSignal then Color.YELLOW

else Color.DARK_GRAY

);

# -------------------------------

# END OF INDICATOR

# -------------------------------Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| J | Question on Line Properties | Questions | 1 | |

| T | ThinkScript ---> Excel Question | Questions | 5 | |

|

|

API Question | Questions | 1 | |

| B | Order Set-up Question | Questions | 10 | |

| W | XSP Question on a chart signal | Questions | 4 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.