Ramisegal

Active member

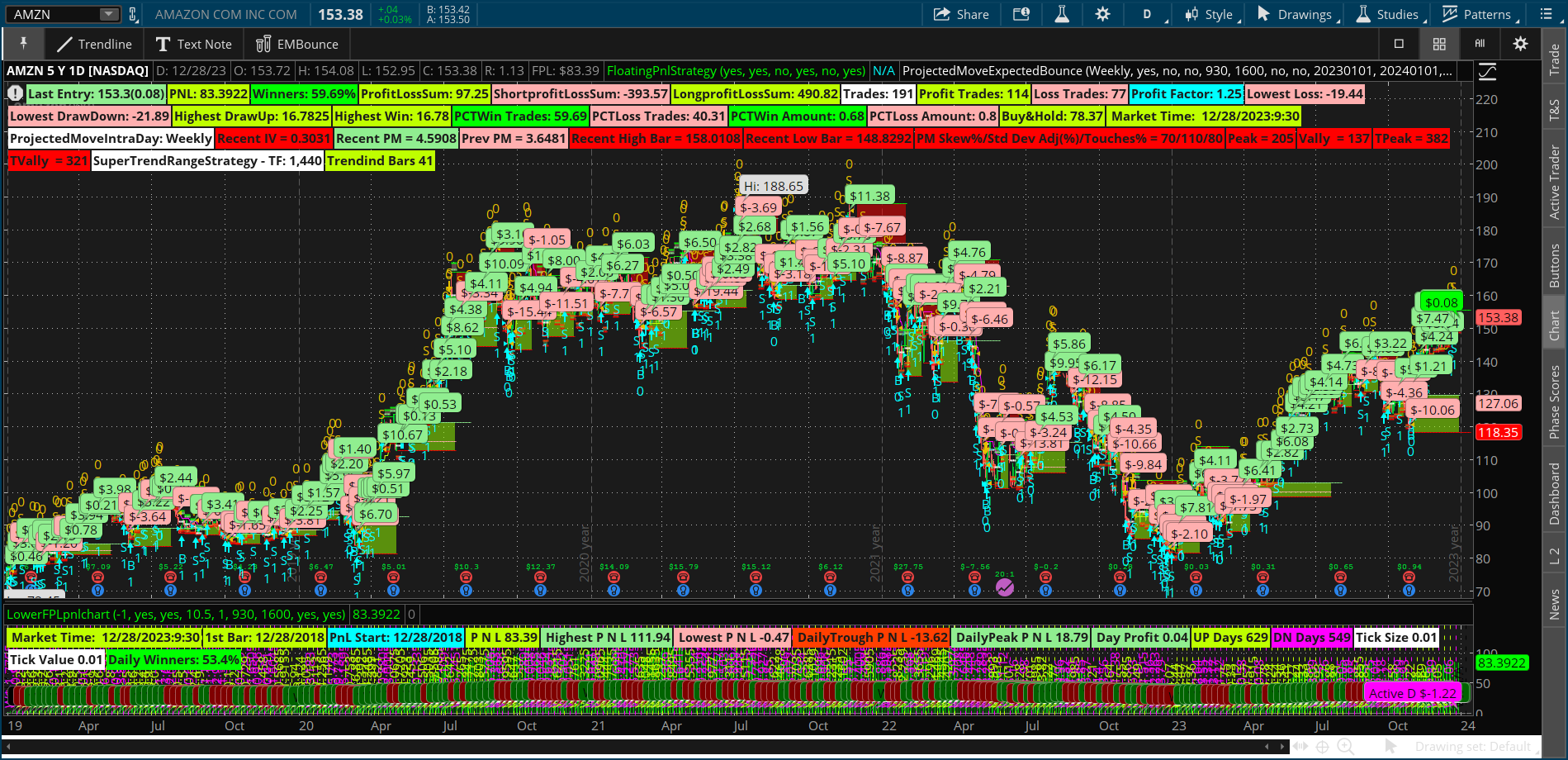

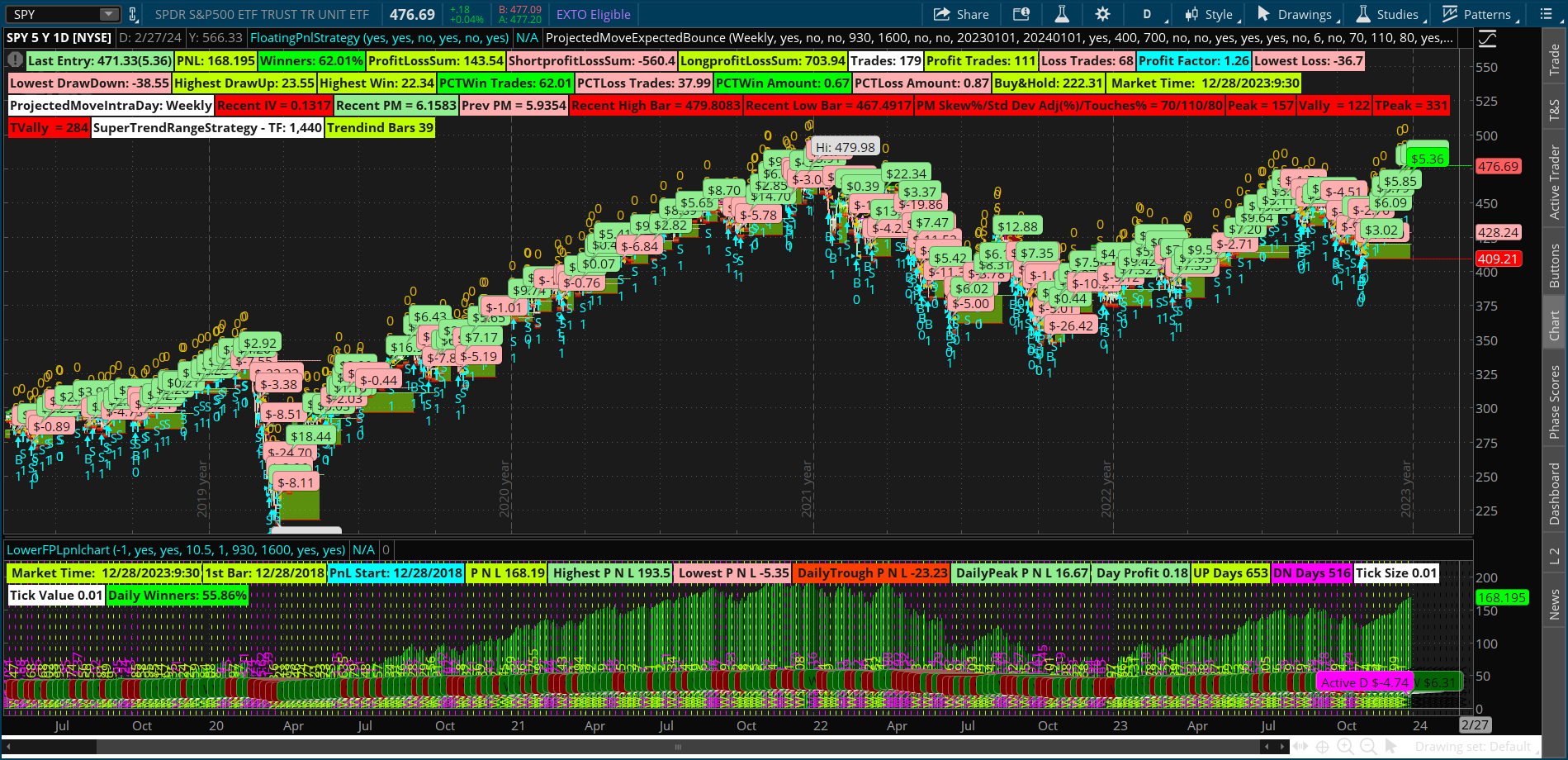

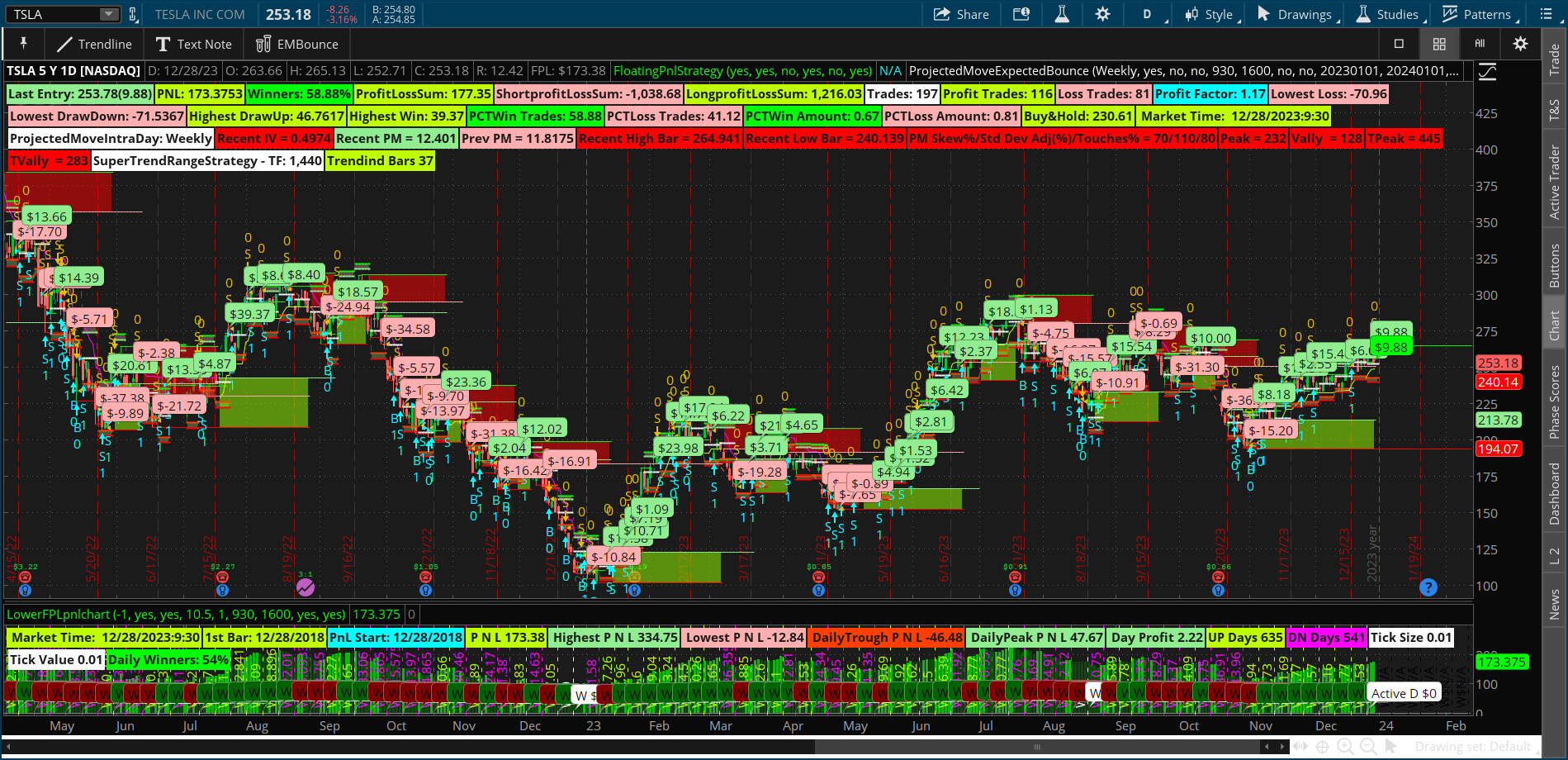

Strategy: Projected Move Expected Bounce

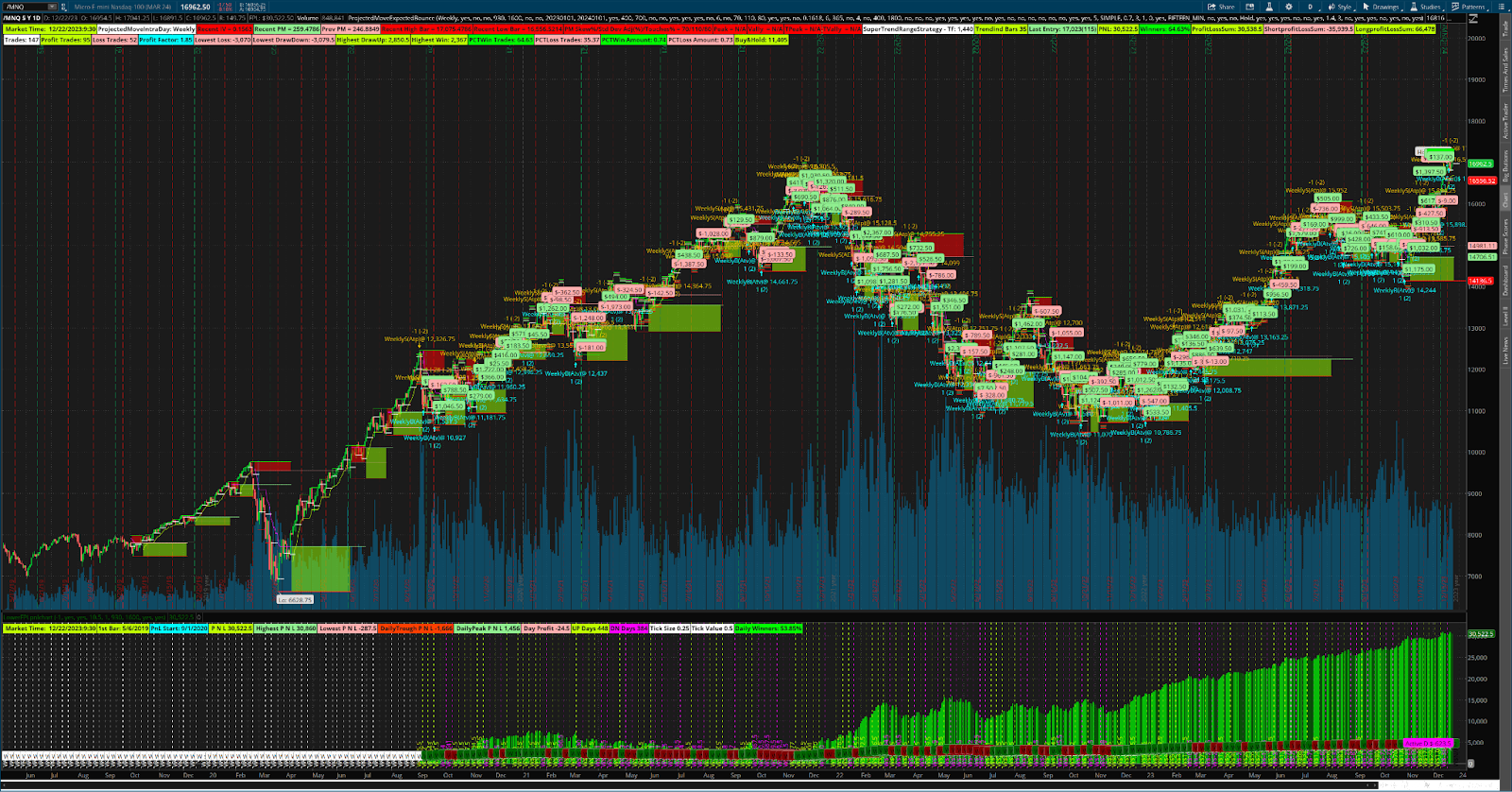

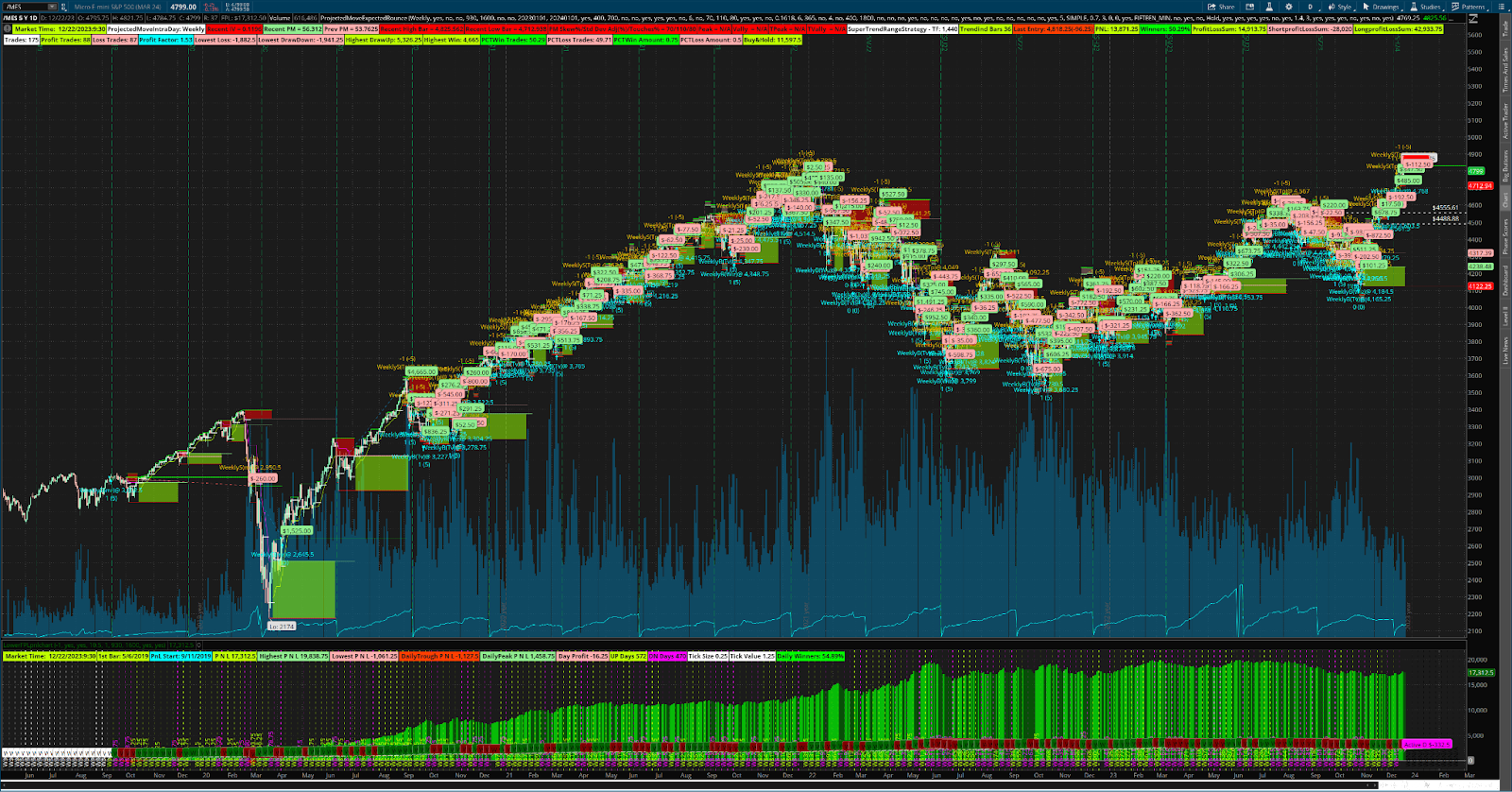

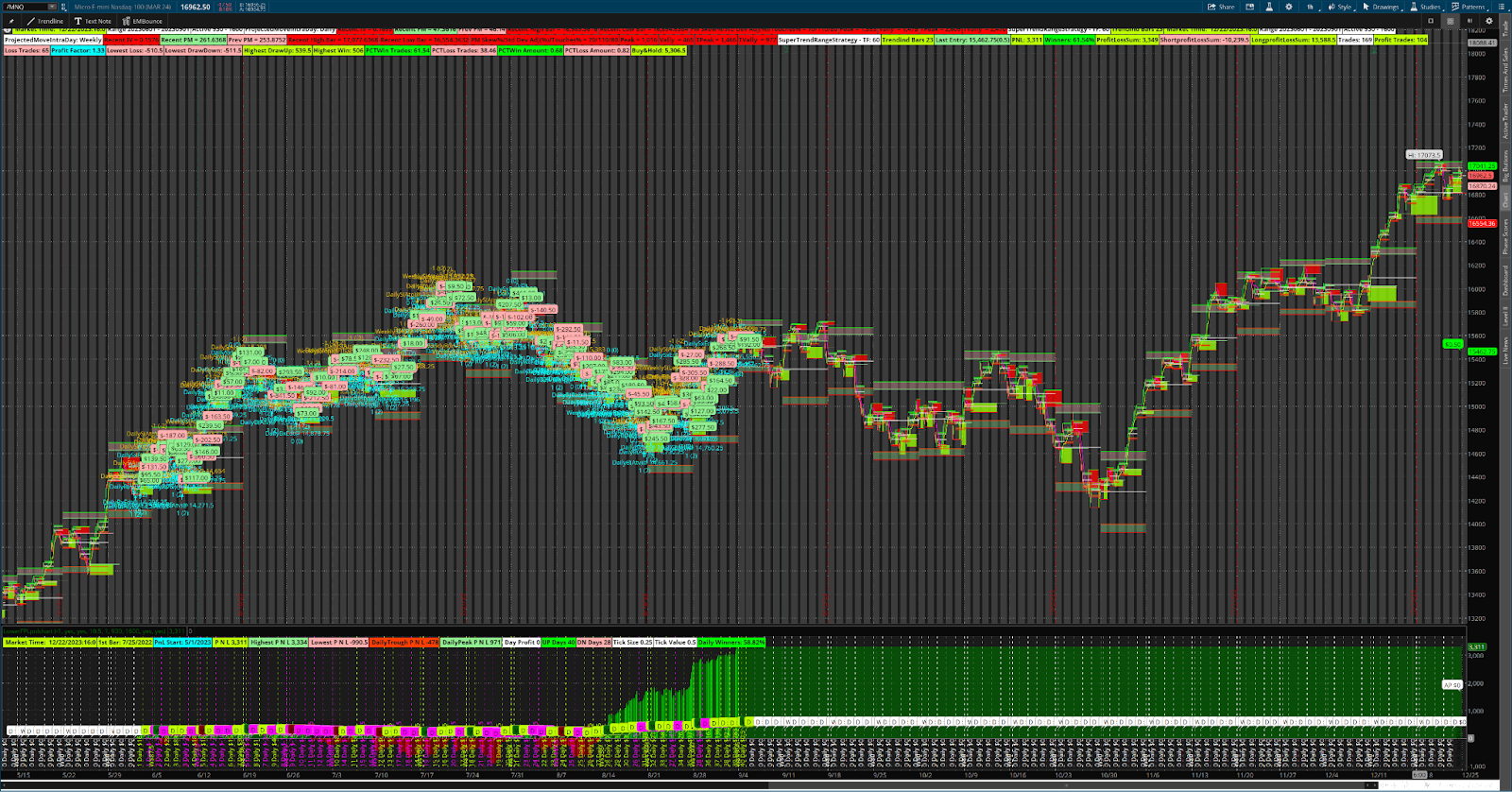

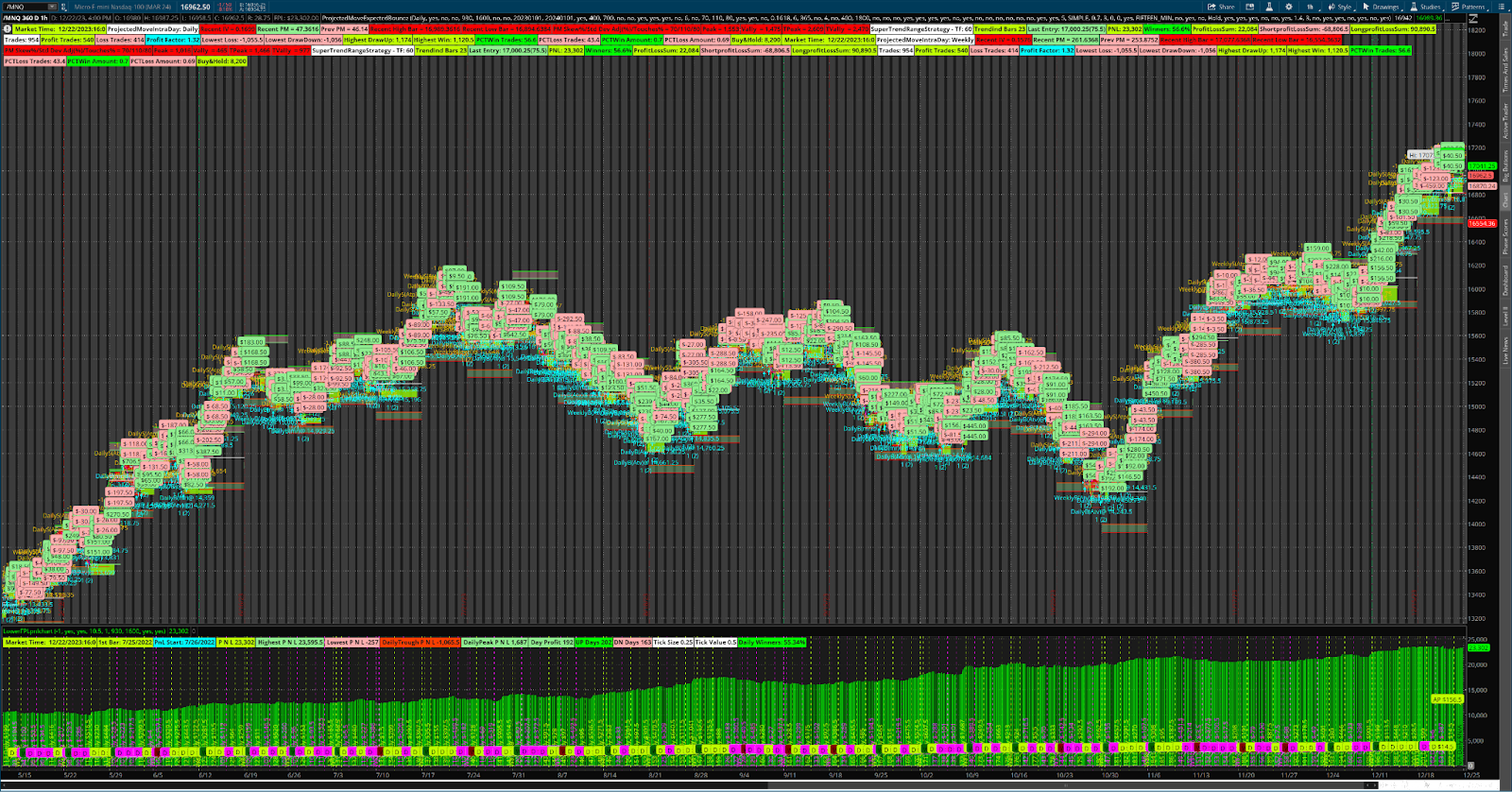

This strategy is using the core concept from Theo trade to calculate the range the option market is pricing the underline and expecting price will be in for the next coming week.

Conditions for entries are based on a price bounce to and from the projected levels.

The strategy can be configured to run in 1 of 2 modes:

Weekly: projections per week

Daily: Intra day projections per period

For lower time frames 2 instances of the strategy can run simultaneously one for each mode (add the strategy twice to the chart), I will share a grid with the setup. The default setup is weekly, change it to daily on one of them. (enable the dashboard to display the trade odds only on 1 of the instances) this option will also allow each instance to operate in a context of the active session

An option to only Long or only short may be suited with the underline

Future versions will have input for sessions, days of the week as conditional entries.

Other than chart aggregation is used with a re-painting safeguard where though the higher aggregation period lookback is optional it will always be set to a minimum of 1 for a higher time frame and all calculations will be done when the period ends.

Options to limit the strategy to a date range and active session, limit number of projection plots, display trades statistics dashboard so when adding other strategies such as stop loss and/or take profit to the chart all are factored in in the dashboard with P&L bubbles on every position change matching the strategy report, additional contracts orders are limited to 1 per period and more…

I have added additional options and conditional orders as I continue to backtest new ideas. I wouldn't feel comfortable trading without having some proof that my trade plan works. Backtests are one way to reach that conviction.

Another requirement for me is that the trade must have an explainable/understandable edge.

Hopefully I documented all the important conditions in the code and tool tips. Let me know if you have any questions.

Please share your ideas on any improvements you see fit.

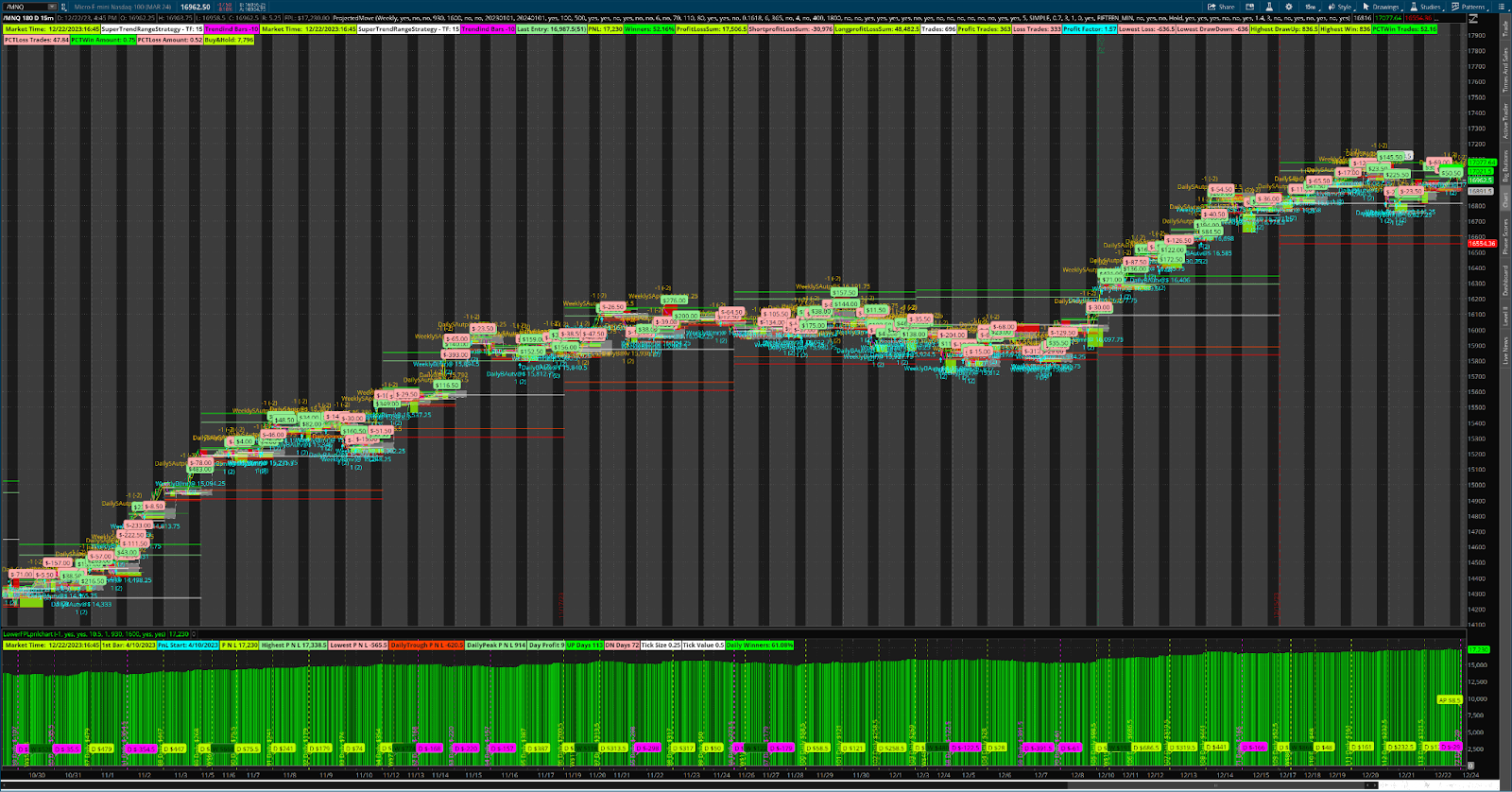

Daily MES

Daily MNQ

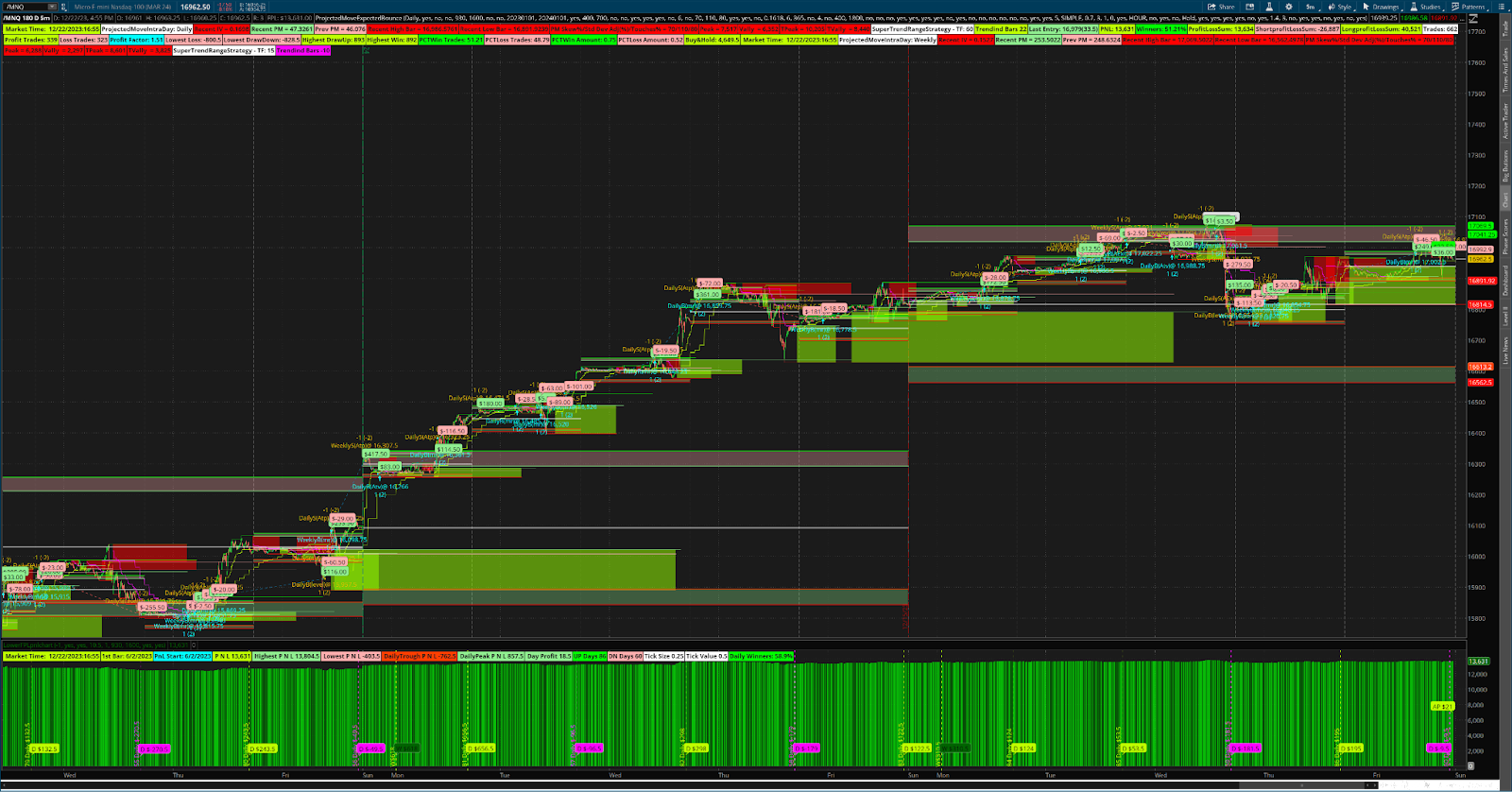

Hourly MNQ with limiting date range and trade session

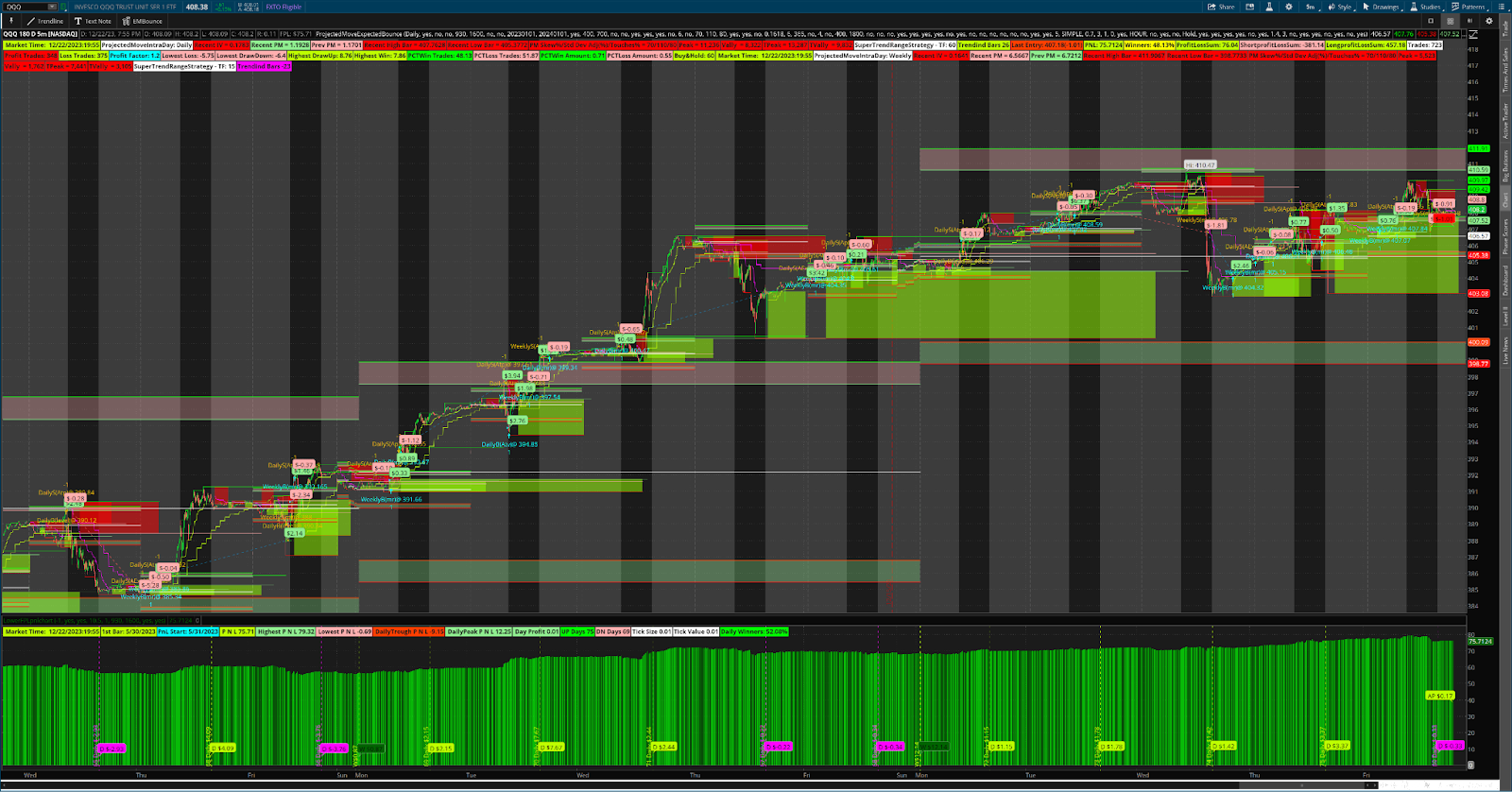

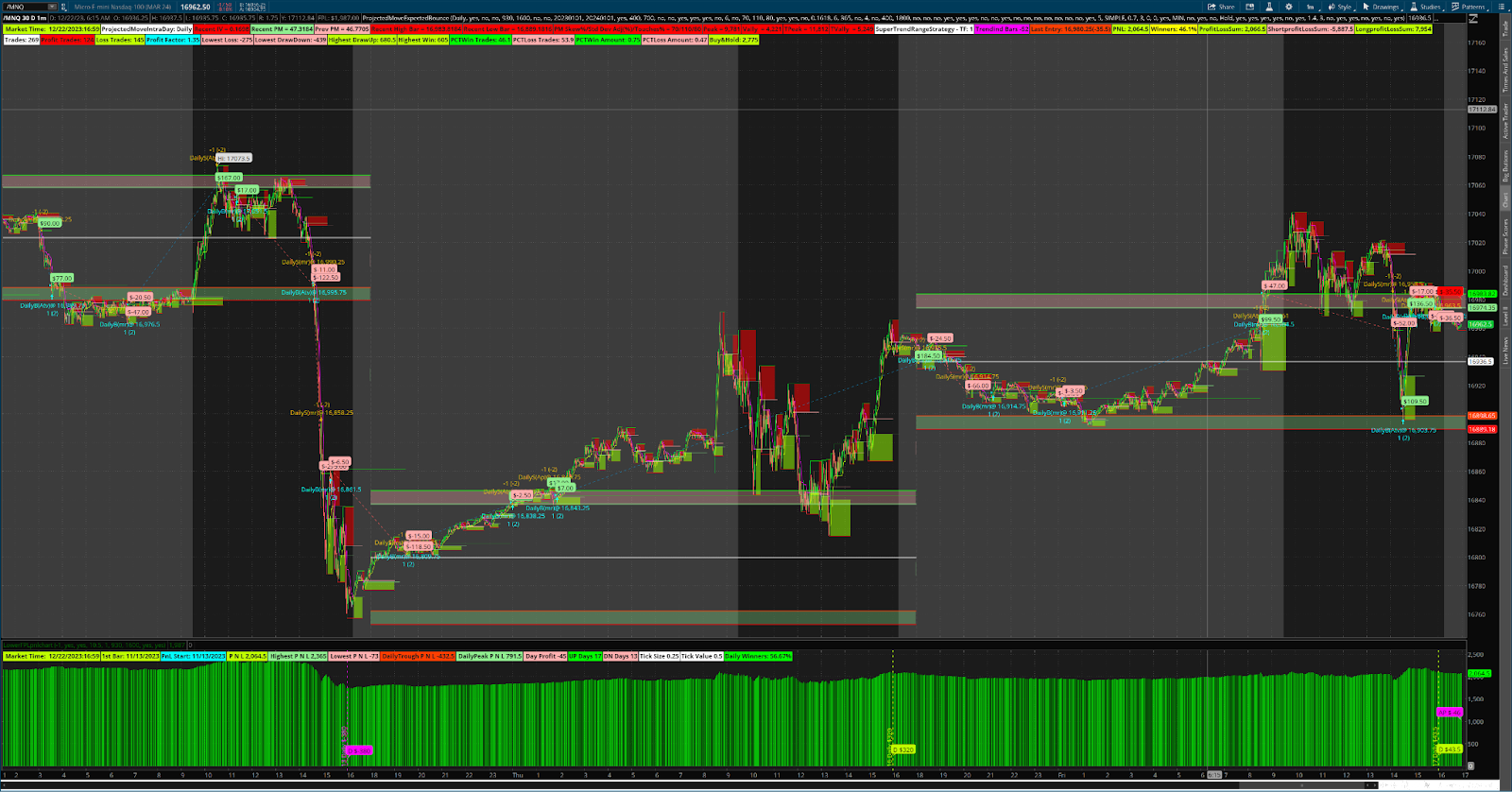

Lower time frames MNQ

RamiSegal: ProjectedMovesExpectedBounce

Share link: http://tos.mx/DLJM1wv

01/02/2024 Recent update (cleaned up code, renamed input variables )

Share link: http://tos.mx/Nld04El

I updated the code above (minor typos) and included a few more examples where the strategy is configured with a Long Entry bias.

rsegal_ProjectedMoveandExpectedBounce_long_bias

Share grid: http://tos.mx/n5FHeWw

Your comments are helpful please provide them.

This strategy is using the core concept from Theo trade to calculate the range the option market is pricing the underline and expecting price will be in for the next coming week.

Conditions for entries are based on a price bounce to and from the projected levels.

The strategy can be configured to run in 1 of 2 modes:

Weekly: projections per week

Daily: Intra day projections per period

For lower time frames 2 instances of the strategy can run simultaneously one for each mode (add the strategy twice to the chart), I will share a grid with the setup. The default setup is weekly, change it to daily on one of them. (enable the dashboard to display the trade odds only on 1 of the instances) this option will also allow each instance to operate in a context of the active session

An option to only Long or only short may be suited with the underline

Future versions will have input for sessions, days of the week as conditional entries.

Other than chart aggregation is used with a re-painting safeguard where though the higher aggregation period lookback is optional it will always be set to a minimum of 1 for a higher time frame and all calculations will be done when the period ends.

Options to limit the strategy to a date range and active session, limit number of projection plots, display trades statistics dashboard so when adding other strategies such as stop loss and/or take profit to the chart all are factored in in the dashboard with P&L bubbles on every position change matching the strategy report, additional contracts orders are limited to 1 per period and more…

I have added additional options and conditional orders as I continue to backtest new ideas. I wouldn't feel comfortable trading without having some proof that my trade plan works. Backtests are one way to reach that conviction.

Another requirement for me is that the trade must have an explainable/understandable edge.

Hopefully I documented all the important conditions in the code and tool tips. Let me know if you have any questions.

Please share your ideas on any improvements you see fit.

Daily MES

Daily MNQ

Hourly MNQ with limiting date range and trade session

Lower time frames MNQ

RamiSegal: ProjectedMovesExpectedBounce

Share link: http://tos.mx/DLJM1wv

01/02/2024 Recent update (cleaned up code, renamed input variables )

Share link: http://tos.mx/Nld04El

Code:

##-------------------------------------------------------------------------------------

## Rami Segal ## https://usethinkscript.com/members/ramisegal.8158/

##---------------------------- ProjectedMoveExpectedBounce ----------------------------

##---- inspired by... ---------------------------------------------------------------------------------

##-------------------------------------------------------------------------------------

# TheoTrade_Weely_Expected_Move

# Copyright TheoTrade LLC

# V08.11.2017

# Free for use. Header credits must be included when any form of the code included in # This package is used.

#

# User assumes all risk. Author not responsible for errors or use of tool.

# scripted by Todd Rind

#

# Thanks to all those who have freely shared ThinkScript concepts over the Web.

#

# The study is used to analyze the DAILY CLOSING performance of an equity against

# the expected move (EM) for any ticker.

# The study works for daily aggregation only.

# Best performance will be against ETF's due to the option and stock implied volatility

# typically being close. When looking at equities, earnings will cause a difference

# between volatility for options and stock. That is, option volatility may be

# elevated as compared to the stock volatility. Since option volatility cannont

# be accessed from ThinkScript, the script EM will be lower than the EM found

# in the option chain.

#

# NEW LOGIC

#

# Drawing line from previous close.

# Completed the daily calculations for inside EM.

# Turn the "dots" for the bars exceeding EM to RED.

# Added logic for "touches". The "dots" for touches are BLUE.

# Touches are a calculated bandwidth around the EM bars. EX:

# High touches occur when either the high or close is within the calculated

# bandwidth of the EM. Default is 90% of EM.

#

# MINOR ISSUES TO MONITOR

#

# Remove the bars not marked with EM levels from the % occurance calculation.

# Fixed by making sure high & low bar > 1.

#

# Note sent to TOS Support about counter issues when checking day number-no response

# from TO. It appears that occasionally a bar out of view is used as the start.

# Seems to sometimes make Friday count one to many.

#

#-------------------- Header End ----------------------------

##-------------------------------------------------------------------------------------

## Rami Segal ## https://usethinkscript.com/members/ramisegal.8158/

##---------------------------- ProjectedMoveExpectedBounce ----------------------------

##-------------------------------------------------------------------------------------

##############################################################################

######################## ProjectedMove User Input ##################

##############################################################################

input mode = {default "Weekly", "Daily"};#hint mode: Daily for Lower time frames, weekly for daily time frame only.

input EnableStrategy = yes; #hint EnableStrategy: Enable or Disable the strategy

input UseMarketTime = no; #hint UseMarketTime: When UseMarketTime is true the Strategy simulates trades from TradeTimeStart to TradeTimeEnd

Input UseTradeOffTradeTime = no; #hint UseTradeOffTradeTime: When UseTradeOffTradeTime is true the Strategy simulates trades from TradeTimeEnd to TradeTimeStart

input TradeTimeStart = 0930;

input TradeTimeEnd = 1600;

input UseMarketTradeTimeToExitPositions = no;#hint UseMarketTradeTimeToExitPositions: When UseMarketTradeTimeToExitPositions is true the Strategy will close any open positions at TradeTimeEnd

input UseDateRange = no; #hint UseDateRange: Strategy simulate trades within the date range specified

input ActiveStartDate = 20230101;

input ActiveEndDate = 20240101;

input ShowTime = yes; #hint ShowTime: Display time, Time updates based on the chart aggregation period

##-------------------------------------------------------------------------------------

################################################################################## PreMarket #################

input PreMarketStart = 0400; #hint PreMarketStart: Plot Highs and Lows per PreMarket start time

input PreMarketEnd = 0700; #hint PreMarketEnd: Plot Highs and Lows per PreMarket End time

input ShowPreMarketCloud = no;

input ShowPreMarketLines = no;

##-------------------------------------------------------------------------------------

################################################################################## Look and feel #################

input ShowProjectedMoveCalculations = no;

input ShowProjectedMovePlots= yes;#hint ShowProjectedMovePlots:Hide or show the Projected Move lines

input ShowProjectedMoveClouds= yes;

input showOnlyLastPeriod = no;#hint showOnlyLastPeriod:Limit the Projected Move lines to recent Daily or Weekly mode

input showOnlyLastPeriodLength = 6;#hint showOnlyLastPeriodLength:The number of periods to display the Project Move lines

input ShowDebugVerticalIV = no;#hint ShowDebugVerticalIV:Show verticalHorizontalFilter lines with the implied volatility on period switch

input ProjectedMoveSkewPercent = 70; #hint ProjectedMoveSkewPercent:Projected Move offset percent

input ProjectedMoveExpensionPercent = 110;#hint ProjectedMoveExpensionPercent:Extend the Projected Move to determine the High and Low Bar for the period

input ProjectedMoveTouchesPercent = 80;#hint ProjectedMoveTouchesPercent: Projected Move offset percent to determine the Touch bar offset from the High and Low Bar for the period

##-------------------------------------------------------------------------------------

##################################################################################

################################################################################## For debugging

##################################################################################

input UseCurrentChartClose = yes;#hint UseCurrentChartClose: Use Daily close or current chart close price to project the Move For debugging

input UseImpVol = yes; #hint UseImpVol: Use Implied volatility or IV override value For debugging

input UseDailyIv = no; #hint UseDailyIv: For debugging

input Iv_override = 0.1618; #hint Iv_override: Value to use for IV For debugging

##-------------------------------------------------------------------------------------

################################################################################## The square root of time

##################################################################################

input IvWeekdays = 6; #hint UseImpVol: Number of days per week period to use in the square root of time

input IvYearDays = 365; #hint IvYearDays: Number of days a year period to use in the square root of time

input UseDaySession = no;#hint UseDaySession: Used in Daily mode to start the projection per DaySessionHour value

input DaySessionHour = 4;#hint DaySessionHour: Used in Daily mode to start the projection per hour value

input UseActiveMarkets = no;#hint UseActiveMarkets: Start intraday projections at DaySessionStartTime and DaySessionCloseTime

input DaySessionStartTime = 0400;#hint DaySessionStartTime: Used in Daily mode

input DaySessionCloseTime = 1800;#hint DaySessionCloseTime: Used in Daily mode

##-------------------------------------------------------------------------------------

################################################################################## Simulate trades

##################################################################################

input useEntryAlerts = no;

input useSignalAlerts = no;

input OrderSimbol = yes; #hint OrderSimbol: Display B or S for Order Entry vs Detail entry price and order source

input useSignalOrderEntry = no;

input UseAutoPmOrBounceTouch = yes; #hint UseAuto: When UseAuto is true, Simulate trades when UsePmAuto or UseTouchAuto and any bounce of the edges of the projected moves lines

input UsePmAuto= yes;#hint UsePmAuto: When UseAuto is true, Simulate trades when price reaches the edges of the High or low projected move lines

input UseTouchAuto= yes;#hint UseTouchAuto: When UseAuto is true, Simulate trades when price bounce of the edges of the High or low projected touch lines

input UsePmShiftingLevels = yes;#hint UsePmShiftingLevels: Levels are set to the most recent projected move lines when the projected moves are shifting direction from period to period. when UseLevels is true, Simulate trades when the close price exceeds the levels

input UseTouchWithinPmEdge = no; #hint UseTouchWithinPmEdge: high or low within the Projected Move and touch lines

input UseTouchBreachPmEdge = yes; #hint UseTouchBreachPmEdge: high or low Breach the Projected Move touch line

input UseProjectedMove= no; #hint UseProjectedMove: Simulate trades when price reaches the edges of the projected move line

input UseProjectedMoveTouch= no; #hint UseProjectedMoveTouch: Simulate trades when price touches the edges of the projected move touch line

input UseBuyBias = no; #hint UseBuyBias: When UseBuyBias is true and if UseLevels is true the Direction will be included and any bounce of the edges of the projected moves lines, Simulate Long trades only and exit long on a Short signal.

input UseSellBias = no; #hint UseSellBias: When UseSellBias is true and if UseLevels is true the Direction will include any bounce of the edges of the projected moves lines, , Simulate Short trades only and exit Short on a Long signal.

input UseDirectionMove = no; #hint UseDirectionMove: When UseDirectionMove is true, Simulate trades in the direction of the most recent bounce

input UseMarketShiftPmExit = no;#hint UseMarketShiftPmExit: When UseExit is true, Projections reversals from previous period direction, Close all Simulated trades

input UseeMarketShiftPmAutoExit= yes; #hint UseeMarketShiftPmAutoExit: When UseAutoExit is true, Close Simulated trades as UseExit and Reopen a position in the reverse direction

##-------------------------------------------------------------------------------------

######################## End: ProjectedMove User Input ##############################################

##########################################################################################################

##-------------------------------------------------------------------------------------

##################################################################################

############# Time ###############

##-------------------------------------------------------------------------------------

def TimeZone = 10.5;

def activedaterange = GetYYYYMMDD() >= ActiveStartDate and GetYYYYMMDD() <= ActiveEndDate;

def activerange = if UseDateRange then activedaterange else 1;

def Hours = Floor(TimeZone + SecondsFromTime(0930) / 60 / 60) - 1;

def Minutes = ((TimeZone + SecondsFromTime(930) / 60 / 60) % 1) * 60;

AddLabel(ShowTime, " Market Time: " + GetMonth() + "/" + GetDayOfMonth(GetYYYYMMDD()) + "/" + (AsPrice(GetYear())) + ":" + Hours + ":" + Minutes , if !IsNaN(GetTime()) then Color.LIME else if IsNaN(GetTime()) then Color.PINK else Color.WHITE);

AddLabel(UseDateRange, if UseDateRange then "Range " + asPrice(ActiveStartDate) + " - " + asPrice(ActiveEndDate) else "" , Color.WHITE );

##################################################################################

####################### ActiveTradeTime ############################

##-------------------------------------------------------------------------------------

def Active = if GetDay() != GetDay()[1] then 0 else if SecondsTillTime(TradeTimeStart) <= 0 and SecondsTillTime(TradeTimeEnd) >= 0 then 1 else 0;

def ActiveTradeTime = if UseTradeOffTradeTime then !Active else if UseMarketTime then if SecondsTillTime(TradeTimeStart) <= 0 and SecondsTillTime(TradeTimeEnd) >= 0 then 1 else 0 else 1;

def closeallmarket = ( if UseMarketTime and UseTradeOffTradeTime then ActiveTradeTime[1] and !ActiveTradeTime and UseMarketTradeTimeToExitPositions else !ActiveTradeTime and ActiveTradeTime[1]) and UseMarketTradeTimeToExitPositions;

AddLabel(UseMarketTime, if ActiveTradeTime then "Active " + asPrice(TradeTimeStart) + " - " + asPrice(TradeTimeEnd) else "" , Color.WHITE );

##-------------------------------------------------------------------------------------

##################################################################################

AddOrder(OrderType.BUY_TO_CLOSE, EnableStrategy and closeallmarket, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = mode+"BxEdt@ " + open[-1]) ;

AddOrder(OrderType.SELL_TO_CLOSE, EnableStrategy and closeallmarket, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = mode+"SxEdt" + open[-1]);

AddOrder(OrderType.BUY_TO_CLOSE, EnableStrategy and !activerange, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = mode+"BxRange@ " + open[-1]) ;

AddOrder(OrderType.SELL_TO_CLOSE, EnableStrategy and !activerange, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = mode+"SxRange@" + open[-1]);

##################################################################################

##################################################################################

##################################################################################

##-------------------------------------------------------------------------------------

##-------------------------------------------------------------------------------------

##-------------------------------------------------------------------------------------

##################################################################

# Projected Move Mode #

##################################################################

###Daily for Lower timeframes, weekly for daily time frame only.

def UseWeekly ;

switch (mode) {

case "Weekly":

UseWeekly = 1;

case "Daily":

UseWeekly = 0;

}

##################################################################

# Projected Move Price #

##################################################################

def AggregationPeriod = AggregationPeriod.DAY;

def PriceHigh = if UseCurrentChartClose then high[0] else high(period = aggregationPeriod)[0];

def PriceLow = if UseCurrentChartClose then low[0] else low(period = aggregationPeriod)[0];

def PriceClose = if UseCurrentChartClose then close[0] else close(period = aggregationPeriod)[0];

def ivPriceClose = if IsNaN(close(period = aggregationPeriod)[1]) then close[1] else close(period = aggregationPeriod)[1];

def DaySessionActive = if GetDay() != GetDay()[1] then 0 else if SecondsTillTime(DaySessionStartTime) <= 0 and SecondsTillTime(DaySessionCloseTime) >= 0 then 1 else 0;

##################################################################

# # implied volatility #

##################################################################

def Dailyiv = imp_volatility(period = aggregationPeriod)[1];

def iv = if UseDailyIv then Dailyiv else if UseWeekly then impVolatility() else imp_volatility();

##################################################################

# Projected Move calculations #

##################################################################

## True when weekly period changed

def calcw = if GetDayOfWeek(GetYYYYMMDD()) == 1 or ( (GetDayOfWeek(GetYYYYMMDD()[1]) == 5 and GetDayOfWeek(GetYYYYMMDD()) == 2))

then 1 else 0;

## true when intraday period changed, if day session and hour selected or day session active session or the daily aggregation period changed (based on user INPUT)

def calcpm = if UseWeekly then calcw else if UseDaySession and Hours == DaySessionHour and Hours <> Hours[1]

then 1 else if UseActiveMarkets then DaySessionActive[1] <> DaySessionActive else if ivPriceClose <> ivPriceClose[1] then 1 else 0;

## declare variables to populate on perriod change

def PojectedMove_IV;

def PojectedMove;

def Pojected_high_bar;

def Pojected_low_bar;

def pm_close;

def weekcnt;

def Pojected_Touch_high_bar;

def Pojected_Touch_low_bar;

if calcpm == 1 and calcpm[1] == 0

then {

pm_close = if UseWeekly then ivPriceClose else if UseCurrentChartClose then PriceClose else ivPriceClose;

PojectedMove_IV = if UseImpVol then iv else Iv_override;

PojectedMove = ( if UseWeekly then (pm_close * PojectedMove_IV * Sqrt(IVweekdays) / Sqrt(IvYearDays) * ProjectedMoveSkewPercent / 100 * ProjectedMoveExpensionPercent / 100) else pm_close * PojectedMove_IV * Sqrt(1 / IVweekdays) / Sqrt(IvYearDays) * ProjectedMoveSkewPercent / 100 * ProjectedMoveExpensionPercent / 100);

Pojected_high_bar = (pm_close) + PojectedMove;

Pojected_Touch_high_bar = (pm_close) + (PojectedMove * ProjectedMoveTouchesPercent / 100);

Pojected_low_bar = ( pm_close) - PojectedMove;

Pojected_Touch_low_bar = (pm_close ) - (PojectedMove * ProjectedMoveTouchesPercent / 100);

weekcnt = weekcnt[1] + 1;

}

else {

PojectedMove_IV = PojectedMove_IV[1];

PojectedMove = PojectedMove[1];

Pojected_high_bar = Pojected_high_bar[1];

Pojected_Touch_high_bar = Pojected_Touch_high_bar[1];

Pojected_low_bar = Pojected_low_bar[1];

Pojected_Touch_low_bar = Pojected_Touch_low_bar[1];

pm_close = pm_close[1];

weekcnt = weekcnt[1];

}

## End declare variables to populate on perriod change

##################################################################

# # projections Peak and Vally #

##################################################################

## exceed projections

def peak = if Pojected_high_bar > 1 and PriceClose > Pojected_high_bar then 1 else 0;

def valley = if Pojected_low_bar > 1 and PriceClose < Pojected_low_bar then 1 else 0;

##original theotrade

#def touchpeak = if Pojected_high_bar > 1 and ((high < Pojected_high_bar and high >= Pojected_Touch_high_bar) or (close < Pojected_high_bar and close >= Pojected_Touch_high_bar)) then 1 else 0;

#def touchvalley = if Pojected_low_bar > 1 and ((low > Pojected_low_bar and low <= Pojected_Touch_low_bar) or (close > Pojected_low_bar and close <= Pojected_Touch_low_bar)) then 1 else 0;

## touch stay or bounce

## options for true condition: if UseTouchWithin is true then high or close are between the upper edge and the upper touch projection lines else just the high is higher then the upper projection touch line and if UseTouchBreach is false then low must be under the upper touch line.

## the theotrade original script where the close is in between the projection high touch line and the projection high line

def touchpeak = if Pojected_high_bar > 1 and

(

(if UseTouchWithinPmEdge

then

PriceHigh < Pojected_high_bar and PriceHigh >= Pojected_Touch_high_bar

else

PriceHigh >= Pojected_Touch_high_bar

and

if UseTouchBreachPmEdge

then

1

else

PriceLow < Pojected_Touch_high_bar )

or

(PriceClose < Pojected_high_bar and PriceClose >= Pojected_Touch_high_bar)

) then 1 else 0;

## options for true condition: if UseTouchWithin is true then low or close are between the lower edge and the lower touch projection lines else just the low is lower then the lower projection touch line and if UseTouchBreach is false then high must be above the lower projection touch line.

def touchvalley = if Pojected_low_bar > 1 and

(

( if UseTouchWithinPmEdge

then

PriceLow> Pojected_low_bar and PriceLow <= Pojected_Touch_low_bar

else

PriceLow<= Pojected_Touch_low_bar

and

if UseTouchBreachPmEdge then

1 else

PriceHigh > Pojected_Touch_low_bar )

or

(PriceClose > Pojected_low_bar and PriceClose <= Pojected_Touch_low_bar)

) then 1 else 0;

## count all peaks and vallys

def pkcnt = if peak then pkcnt[1] + 1 else pkcnt[1] ;

def vcnt = if valley then vcnt[1] + 1 else vcnt[1] ;

def tpkcnt = if touchpeak then tpkcnt[1] + 1 else tpkcnt[1] ;

def tvcnt = if touchvalley then tvcnt[1] + 1 else tvcnt[1] ;

## count all touches peaks and vallys per period and reset to 0 on period change

## this is to control one order per perriod per peak or vally

## additional orders on a new period mostly a double down on the position if enabled in global strategy settings

def peakcnt = if weekcnt != weekcnt[1] or valley then 0 else if peak then peakcnt[1] + 1 else peakcnt[1] ;

def valleycnt = if weekcnt != weekcnt[1] or peak then 0 else if valley then valleycnt[1] + 1 else valleycnt[1] ;

def touchpeakcnt = if weekcnt != weekcnt[1] or touchvalley then 0 else if touchpeak then touchpeakcnt[1] + 1 else touchpeakcnt[1] ;

def touchvalleynt = if weekcnt != weekcnt[1] or touchpeak then 0 else if touchvalley then touchvalleynt[1] + 1 else touchvalleynt[1] ;

## control the number of plots to display per mode

## variable used: weekcnt is the period counter for the strategy mode

def slp = if showOnlyLastPeriod and if UseWeekly then weekcnt > highestAll(weekcnt)-showOnlyLastPeriodLength else weekcnt > highestAll(weekcnt)-3 then 1 else 0;

plot ProjectionStart ;

plot ProjectionHigh ;

plot ProjectionLow ;

plot ProjectionHighTouch ;

plot ProjectionLowTouch;

if showOnlyLastPeriod {

ProjectionHigh = if Pojected_high_bar < 1 then Double.NaN else if slp then Pojected_high_bar else Double.NaN;

ProjectionLow = if Pojected_low_bar < 1 then Double.NaN else if slp then Pojected_low_bar else Double.NaN;

ProjectionStart = if pm_close < 1 then Double.NaN else if slp then pm_close else Double.NaN;

ProjectionHighTouch = if Pojected_high_bar < 1 then Double.NaN else if slp then Pojected_Touch_high_bar else Double.NaN;

ProjectionLowTouch = if Pojected_low_bar < 1 then Double.NaN else if slp then Pojected_Touch_low_bar else Double.NaN;

} else {

ProjectionHigh = if Pojected_high_bar < 1 then Double.NaN else Pojected_high_bar;

ProjectionLow = if Pojected_low_bar < 1 then Double.NaN else Pojected_low_bar;

ProjectionStart = if pm_close < 1 then Double.NaN else pm_close;

ProjectionHighTouch = if Pojected_high_bar < 1 then Double.NaN else Pojected_Touch_high_bar;

ProjectionLowTouch = if Pojected_low_bar < 1 then Double.NaN else Pojected_Touch_low_bar;

}

## clouds will show per showOnlyLastPeriod since they hinge on the plots

## shade between projections and touches

addCloud(if ShowProjectedMoveClouds then ProjectionHigh else double.nan, ProjectionHighTouch,color.pink );

addCloud(if ShowProjectedMoveClouds then ProjectionLowTouch else double.nan,ProjectionLow , color.light_green);

## hide and show projections plots

ProjectionHigh.SetHiding( !ShowProjectedMovePlots);

ProjectionHigh.SetDefaultColor(Color.GREEN);

ProjectionHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProjectionHigh.SetLineWeight(2);

ProjectionLow.SetHiding( !ShowProjectedMovePlots);

ProjectionLow.SetDefaultColor(Color.RED);

ProjectionLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProjectionLow.SetLineWeight(2);

ProjectionStart.SetHiding( !ShowProjectedMovePlots);

ProjectionStart.SetDefaultColor(Color.WHITE);

ProjectionStart.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProjectionStart.SetLineWeight(2);

ProjectionHighTouch.SetHiding( !ShowProjectedMovePlots);

ProjectionHighTouch.SetDefaultColor(Color.LIGHT_GREEN);

ProjectionHighTouch.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProjectionHighTouch.SetLineWeight(2);

ProjectionLowTouch.SetHiding( !ShowProjectedMovePlots);

ProjectionLowTouch.SetDefaultColor(Color.LIGHT_RED);

ProjectionLowTouch.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProjectionLowTouch.SetLineWeight(2);

##################################################################

# Levels #

##################################################################

## capture the previous projections on a new perriod, this is used for the projections trend

def prevPojectedMove = if PojectedMove <> PojectedMove[1] then PojectedMove[1] else prevPojectedMove[1] ;

def prevhighbar = if Pojected_high_bar <> Pojected_high_bar[1] then Pojected_high_bar[1] else prevhighbar[1];

def prevlowbar = if Pojected_low_bar <> Pojected_low_bar[1] then Pojected_low_bar[1] else prevlowbar[1];

##################################################################

# ## Show Projections calculations #

##################################################################

AddLabel(ShowProjectedMoveCalculations, "ProjectedMoveIntraDay: " +mode , Color.WHITE );

AddLabel(UseDateRange, if activerange then "Strategy Range " + AsPrice(ActiveStartDate) + " - " + AsPrice(ActiveEndDate) else "" , Color.WHITE );

AddLabel(ShowProjectedMoveCalculations, "Recent IV = " + PojectedMove_IV);

AddLabel(ShowProjectedMoveCalculations, "Recent PM = " + PojectedMove, if prevPojectedMove <= PojectedMove then Color.LIGHT_GREEN else Color.PINK);

AddLabel(ShowProjectedMoveCalculations, "Prev PM = " + prevPojectedMove, if prevPojectedMove >= PojectedMove then Color.LIGHT_GREEN else Color.PINK);

AddLabel(ShowProjectedMoveCalculations, "Recent High Bar = " + Pojected_high_bar);

AddLabel(ShowProjectedMoveCalculations, "Recent Low Bar = " + Pojected_low_bar);

AddLabel(ShowProjectedMoveCalculations, "PM Skew%/Std Dev Adj(%)/Touches% = " + ProjectedMoveSkewPercent + "/" + ProjectedMoveExpensionPercent + "/" + ProjectedMoveTouchesPercent);

AddLabel(ShowProjectedMoveCalculations, "Peak = " + pkcnt);

AddLabel(ShowProjectedMoveCalculations, "Vally = " + vcnt);

AddLabel(ShowProjectedMoveCalculations, "TPeak = " + tpkcnt);

AddLabel(ShowProjectedMoveCalculations, "TVally = " + tvcnt);

## for debug sometimes the iv from TOS is double.nan "n/a"

AddVerticalLine(ShowDebugVerticalIV and weekcnt <> weekcnt[1] , "EM:" + " (" + PojectedMove_IV + ")" , if Pojected_low_bar > Pojected_low_bar[1] then Color.GREEN else if Pojected_high_bar < Pojected_high_bar[1] then Color.RED else if Pojected_low_bar > Pojected_low_bar[1] and Pojected_high_bar < Pojected_high_bar[1] then Color.WHITE else Color.CYAN);

##################################################################

# PREMARKET #

##################################################################

#PREMARKET HIGHS AND LOWS

def PreMarketTimeRange = secondsFromTime(PreMarketStart) >= 0 and secondsTillTime(PreMarketEnd) >= 0;

def PreMarket = PreMarketTimeRange and !PremarketTimeRange[1];

def Pre_Market_High = compoundValue(1, if((high > Pre_Market_High[1] and PremarketTimeRange) or PreMarket, high, Pre_Market_High[1]), high);

def Pre_Market_Low = compoundValue(1, if((low < Pre_Market_Low[1] and PremarketTImeRange) or PreMarket, low, Pre_Market_Low[1]), low);

plot PreMarketHigh = if Pre_Market_High == Pre_Market_High[1] then Pre_Market_High else double.nan;

PreMarketHigh.SetStyle(curve.short_dash);

PreMarketHigh.SetDefaultColor(color.light_gray);

PreMarketHigh.Sethiding(!ShowPreMarketLines);

plot PreMarketLow = if Pre_Market_Low == Pre_Market_Low[1] then Pre_Market_Low else double.nan;

PreMarketLow.SetStyle(curve.short_dash);

PreMarketLow.SetDefaultColor(color.light_gray);

PreMarketLow.Sethiding(!ShowPreMarketLines);

AddCloud(if ShowPreMarketCloud then PreMarketHigh else double.nan, if ShowPreMarketCloud then PreMarketLow else double.nan, color.light_gray, color.light_gray);

##################################################################

# Shifting Levels #

##################################################################

## 1 for higher Projections , -1 for lower

def emdir = if Pojected_high_bar > 1 and Pojected_high_bar >= prevhighbar then 1 else if Pojected_high_bar > 1 and Pojected_high_bar <= prevhighbar then -1 else 0;

# price level of projections shifting direction

def buylevel = if emdir > 0 and emdir[1] < 0 then prevlowbar else buylevel[1];

def selllevel = if emdir < 0 and emdir[1] > 0 then prevhighbar else selllevel[1];

## plot the levels

plot buylevels = if slp then buylevel else double.nan;

plot selllevels = if slp then selllevel else double.nan;

buylevels.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

selllevels.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

buylevels.SetDefaultColor(if UseWeekly then Color.CYAN else Color.yellow);

selllevels.SetDefaultColor(if UseWeekly then Color.plum else Color.Dark_orange);

buylevels.SetStyle(curve.short_dash);

selllevels.SetStyle(curve.short_dash);

## conditions for entry based on close above previous perriod Projections

def buyabovelevels = PriceClose >= Max(buylevel , selllevel) ;

def sellunderlevels = PriceClose <= Min(buylevel , selllevel) ;

## condition for entry based on the most recent direction

def leveldir = if Pojected_high_bar > 1 and Pojected_high_bar > prevhighbar then 1 else if Pojected_high_bar > 1 and Pojected_high_bar < prevhighbar then -1 else leveldir[1];

#condition for entry based on most recent touch or peak

def Dailydirection = if (valley or touchvalley) then 1 else if (peak or touchpeak) then -1 else if IsNaN(Dailydirection[1]) then 0 else Dailydirection[1];

##################################################################

# ProjectedMove and Expected bounce Strategy Orders #

##################################################################

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and UsePmShiftingLevels and activerange and buyabovelevels and !buyabovelevels[1], price = open[-1], name = if OrderSimbol then "B" else mode+"B(level)@ " + open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(4));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and UsePmShiftingLevels and activerange and sellunderlevels and !sellunderlevels[1], price = open[-1], name = if OrderSimbol then "S" else mode+"S(Level)@ " + open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseProjectedMoveTouch and touchvalley and touchvalleynt == 1 and touchvalleynt[1] == 0, name = if OrderSimbol then "B" else mode+"B(Tv)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseProjectedMoveTouch and touchpeak and touchpeakcnt == 1 and touchpeakcnt[1] == 0, name = if OrderSimbol then "S" else mode+"S(Tp)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseProjectedMove and valley and valleycnt == 1 and valleycnt[1]== 0 , name = if OrderSimbol then "B" else mode+"B(V)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseProjectedMove and peak and peakcnt == 1 and peakcnt[1] == 0, name = if OrderSimbol then "S" else mode+"S(V)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseDirectionMove and Dailydirection > 0 and leveldir> 0, name = if OrderSimbol then "B" else mode+"B(>d)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseDirectionMove and Dailydirection < 0 and leveldir < 0, name = if OrderSimbol then "S" else mode+"S(<d)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseAutoPmOrBounceTouch and UseTouchAuto and touchvalleynt == 1 and touchvalleynt[1] == 0, name = if OrderSimbol then "B" else mode+"B(Atv)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseAutoPmOrBounceTouch and UseTouchAuto and touchpeakcnt == 1 and touchpeakcnt[1] == 0, name = if OrderSimbol then "S" else mode+"S(Atp)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseAutoPmOrBounceTouch and UsePmAuto and valleycnt == 1 and valleycnt[1] == 0, name = if OrderSimbol then "B" else mode+"B(Av)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and UseAutoPmOrBounceTouch and UsePmAuto and peakcnt == 1 and peakcnt[1] == 0, name = if OrderSimbol then "S" else mode+"S(Ap)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and usebuybias and if UsePmShiftingLevels then leveldir > 0 else 1 and ( ( valleycnt == 1 and valleycnt[1] == 0 ) or (touchvalleynt == 1 and touchvalleynt[1] == 0)), name = if OrderSimbol then "B" else mode+"B>>>@$ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_TO_CLOSE,!useSignalOrderEntry and EnableStrategy and activerange and usebuybias and ( touchpeakcnt == 1 and touchpeakcnt[1] == 0 or peakcnt == 1 and peakcnt[1] == 0 ), name = if OrderSimbol then "Sx" else mode+"S>x@$ " + Open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and usesellbias and if UsePmShiftingLevels then leveldir < 0 else 1 and ( touchpeakcnt == 1 and touchpeakcnt[1] == 0 or peakcnt == 1 and peakcnt[1] == 0 ), name = if OrderSimbol then "S" else mode+"S<<<@$ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_TO_CLOSE,!useSignalOrderEntry and EnableStrategy and activerange and usesellbias and ( ( valleycnt == 1 and valleycnt[1] == 0 ) or (touchvalleynt == 1 and touchvalleynt[1] == 0)), name = if OrderSimbol then "Bx" else mode+"B<x@$ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

def pmvalid = Pojected_high_bar > 1;

AddOrder(OrderType.SELL_auto,!useSignalOrderEntry and EnableStrategy and activerange and pmvalid and UseeMarketShiftPmAutoExit and Dailydirection > 0 and Pojected_high_bar < Pojected_low_bar[1], name = if OrderSimbol then "S" else mode+"S(AExit)@ " + Open[-1], price = Open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_auto,!useSignalOrderEntry and EnableStrategy and activerange and pmvalid and UseeMarketShiftPmAutoExit and Dailydirection < 0 and Pojected_low_bar > Pojected_high_bar[1], name = if OrderSimbol then "B" else mode+"B(AExit)$ " + Open[-1], price = Open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_TO_CLOSE,!useSignalOrderEntry and EnableStrategy and activerange and pmvalid and UseMarketShiftPmExit and Dailydirection > 0 and Pojected_high_bar < Pojected_low_bar[1], name = if OrderSimbol then "S" else mode+"S(Exit)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_TO_CLOSE,!useSignalOrderEntry and EnableStrategy and activerange and pmvalid and UseMarketShiftPmExit and Dailydirection < 0 and Pojected_low_bar > Pojected_high_bar[1], name = if OrderSimbol then "Bx" else mode+"B(Exit)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

##################################################################

# End of ProjectedMove and Expected bounce Strategy #

##################################################################

##################################################################

# End of ProjectedMove and Expected bounce Strategy Orders #

##################################################################

##@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

# SUPERTREND

##@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

##################################################################

# Everything below can be removed from the Projected move strategy #

##################################################################

input UseSuperTrendRangeBar = yes; #hint UseSuperTrendRangeBar: Modified TrueRange SuperTrend.

input UseInputOtherTimeFrames = yes;

input otf_AggregationPeriod = AggregationPeriod.FIFTEEN_MIN; #hint otf_AggregationPeriod: SuperTrend time frame

input otf_nATR = 5; #hint otf_nATR: Length for Momentum calculations.

input otf_AvgType = AverageType.SimPLE;

input otf_ATRMult = 0.7;

input otf_TMV = 3; #hint TMV: Modified TrueRange SuperTrend periods.

input otf_Aggregation_Periodoffset = 1; #hint Aggregation_Periodoffset : Higher aggregation will always default to 1 to avoid re painting

input otf_AggregationPeriodHighestHighLowestLowOffset = 0;

##########################################################################################################################################################

def otf_timeFrame = if GetAggregationPeriod() > otf_AggregationPeriod then GetAggregationPeriod()

else if UseInputOtherTimeFrames then otf_AggregationPeriod else GetAggregationPeriod() ;

def AggregationPeriodoffset = if otf_timeFrame > GetAggregationPeriod() then 1 else otf_Aggregation_Periodoffset;

def tmvotf_priceclose = (highest( close( period = otf_timeFrame)[max(AggregationPeriodoffset,0)],otf_TMV)[otf_AggregationPeriodHighestHighLowestLowOffset]+ lowest( close( period = otf_timeFrame)[max(AggregationPeriodoffset,0)],otf_TMV)[otf_AggregationPeriodHighestHighLowestLowOffset])/2;

def tmvotf_pricehigh = highest(high( period = otf_timeFrame)[max(AggregationPeriodoffset,0)],otf_TMV)[otf_AggregationPeriodHighestHighLowestLowOffset];

def tmvotf_pricelow = lowest( low( period = otf_timeFrame)[max(AggregationPeriodoffset,0)], otf_TMV)[otf_AggregationPeriodHighestHighLowestLowOffset];

def otf_priceclose = close( period = otf_timeFrame)[max(AggregationPeriodoffset,0)];

def otf_pricehigh = high( period = otf_timeFrame)[max(AggregationPeriodoffset,0)];

def otf_pricelow = low( period = otf_timeFrame)[max(AggregationPeriodoffset,0)];;

def otf_h = if UseSuperTrendRangeBar then tmvotf_pricehigh else otf_pricehigh;

def otf_l = if UseSuperTrendRangeBar then tmvotf_pricelow else otf_pricelow;

def otf_c = if UseSuperTrendRangeBar then tmvotf_priceclose else otf_priceclose;

def otf_TrueRange = TrueRange(otf_h, otf_c, otf_l) ;

def otf_ATR = if UseSuperTrendRangeBar then MovingAverage(otf_AvgType, TrueRange(otf_h, otf_c, otf_l), otf_nATR) else otf_TrueRange ;

def otf_UP = otf_c+ (otf_ATRMult * otf_ATR);

def otf_DN = otf_c+ (-otf_ATRMult * otf_ATR);

def otf_lowestup = if otf_UP <= otf_lowestup[1] then otf_UP[0] else if otf_c < otf_lowestup[1] and otf_c < otf_UP[0] then otf_lowestup[1] else otf_UP[0];

def otf_highestdn = if otf_DN >= otf_highestdn[1] then otf_DN[0] else if otf_c > otf_highestdn[1] and otf_c > otf_DN[0] then otf_highestdn[1] else otf_DN[0];

def otf_trend = if otf_c[0] crosses below otf_highestdn[1] then -1 else if otf_c[0] crosses above otf_lowestup[1] then 1 else otf_trend[1];

def otf_sellmodeprice = if otf_trend < 0 and otf_trend <> otf_trend[1] then otf_highestdn[1] else otf_sellmodeprice[1];

def otf_buymodeprice = if otf_trend > 0 and otf_trend <> otf_trend[1] then otf_lowestup[1] else otf_buymodeprice[1];

plot otf_sellcrossprice = if otf_trend <> 0 then otf_sellmodeprice else Double.NaN;

plot otf_buycrossprice = if otf_trend <> 0 then otf_buymodeprice else Double.NaN;

otf_sellcrossprice.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

otf_buycrossprice.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

otf_buycrossprice.setdefaultColor(Color.LIGHT_GREEN);

otf_sellcrossprice.setdefaultColor(Color.PINK);

otf_sellcrossprice.SetStyle(Curve.FIRM );

otf_sellcrossprice.SetLineWeight(1);

otf_buycrossprice.SetStyle(Curve.FIRM );

otf_buycrossprice.SetLineWeight(1);

plot otf_sell = if otf_trend < 0 then otf_lowestup[0] else Double.NaN ;

plot otf_buy = if otf_trend > 0 then otf_highestdn[0] else Double.NaN ;

otf_buy .setdefaultColor(Color.lime);

otf_sell.setdefaultColor(Color.magenta);

def otf_barUp = otf_trend > 0 ;

def otf_barDown = otf_trend < 0 ;

def otf_barUpCount = CompoundValue(1, if otf_barUp then (if IsNaN(otf_barUpCount[1]) then 0 else otf_barUpCount[1]) + 1 else 0, 0);

def otf_barDownCount = CompoundValue(1, if otf_barDown then ( if IsNaN( otf_barDownCount[1]) then 0 else otf_barDownCount[1] ) - 1 else 0, 0);

def otf_trendcnt = otf_barDownCount + otf_barUpCount ;

input ShowSuperTrendLabels = yes;

AddLabel(ShowSuperTrendLabels, "SuperTrendRangeStrategy - TF: " +otf_timeFrame/60000, color.white);

AddLabel(ShowSuperTrendLabels, "Trendind Bars " + (otf_trendcnt) , if otf_trend > 0 then Color.LIME else Color.MAGENTA );

input UseMomentumFilter = no;

input TradeFrequecy= {Default "Hold", "Swing", "Scalp"};

def tf;

Switch (TradeFrequecy) {

Case "Swing":

tf = 3;

Case "Scalp":

tf = 2;

Case "Hold":

tf = 1;

}

AddLabel(UseMomentumFilter, "Momentum Filter: " + TradeFrequecy, color.white);

def otf_trendlowestlow;

def otf_trendhighesthigh;

if otf_trend < 0

then

{

otf_trendlowestlow = if otf_trend == otf_trend[1] then if (if UseMomentumFilter then (if tf==3 then close else if tf==2 then low else if tf==1 then high else low) else low) < otf_trendlowestlow[1] then low else otf_trendlowestlow[1] else low[1];

otf_trendhighesthigh = otf_trendhighesthigh[1];

}

else

if otf_trend > 0

then

{

otf_trendlowestlow = otf_trendlowestlow[1];

otf_trendhighesthigh = if otf_trend == otf_trend[1] then if (if UseMomentumFilter then (if tf==3 then close else if tf==2 then high else if tf==1 then low else high) else high) > otf_trendhighesthigh[1] then high else otf_trendhighesthigh[1] else high[1];

}

else

{

otf_trendlowestlow = otf_trendlowestlow[1];

otf_trendhighesthigh = otf_trendhighesthigh[1];

}

Input ShowSuperTrendHighAndLow = yes;

def trendlowest = if otf_trend<>otf_trend[1] and otf_trend > 0 then otf_trendlowestlow[1] else trendlowest[1];

def trendhighest = if otf_trend<>otf_trend[1] and otf_trend < 0 then otf_trendhighesthigh[1] else trendhighest[1];

plot STrendlowestlow = if ShowSuperTrendHighAndLow and otf_trend > 0 and otf_trendlowestlow == otf_trendlowestlow[1]then otf_trendlowestlow else double.NaN;

plot STrendhighesthigh = if ShowSuperTrendHighAndLow and otf_trend < 0 and otf_trendhighesthigh == otf_trendhighesthigh[1] then otf_trendhighesthigh else double.NaN;

STrendlowestlow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

STrendhighesthigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

STrendlowestlow.SetDefaultColor(color.red);

STrendhighesthigh.SetDefaultColor(color.green);

##################################################################################################################

######################################### Trend shifting upper and lower bands #########################################################

##################################################################################################################

def max1h = max( otf_trendhighesthigh,otf_sellcrossprice );

def min1h = min( otf_trendhighesthigh,otf_sellcrossprice ) ;

def max1l = max( otf_trendlowestlow,otf_buycrossprice ) ;

def min1l = min( otf_trendlowestlow,otf_buycrossprice ) ;

#################################

input ShowOrderBlockCloud = yes;

#################################

addCloud(if ShowOrderBlockCloud and otf_trendcnt < 0 then min1h else double.NaN ,max1h, color.red );

addCloud(if ShowOrderBlockCloud and otf_trendcnt > 0 then max1l else double.NaN ,min1l, color.green );

#################################

input ShowSuperTrendHighAndLowOrderBlockCloud = yes;

addCloud(if ShowSuperTrendHighAndLowOrderBlockCloud and otf_trendcnt < 0 then otf_sellcrossprice else double.NaN , strendhighesthigh );

addCloud(if ShowSuperTrendHighAndLowOrderBlockCloud and otf_trendcnt > 0 then otf_buycrossprice else double.NaN , strendlowestlow );

def cloudrange = absValue( if otf_trendcnt < 0 then otf_sellmodeprice - otf_trendhighesthigh else otf_buymodeprice - otf_trendlowestlow);

input useIntraDaySignalsOnDailyMode = no; #hint useIntraDaySignalsOnDailyMode: Strategy simulate intra day trades on daily time frame

input UseCloudRange = no;#hint UseLessRisk: Strategy simulate when trend momentum is on and new high delta from previous high is less than the cloudrange*RiskFactor

input UseAtrCloudRange = yes;#hint UseMoreRisk: Strategy simulate when trend momentum is on and new high delta from previous high is less than the ATR*RiskFactor

input RiskFactor = 1.4;#hint RiskFactor: Cloud percentage factor

input RiskBars = 3;#hint RiskBars: Number of bars to calculate for momentum delta

def enableIntraday = if !useIntraDaySignalsOnDailyMode then if getAggregationPeriod() < aggregationPeriod.DAY then 1 else 0 else 1;

def buylIGHTisk = otf_trendhighesthigh > otf_trendhighesthigh[1] and close > otf_trendhighesthigh[RiskBars] ;

def SelllIGHTisk = otf_trendlowestlow < otf_trendlowestlow[1] and close < otf_trendlowestlow[RiskBars] ;

def buyLessRisk = otf_trendhighesthigh > otf_trendhighesthigh[1] and close > otf_trendhighesthigh[RiskBars] and (otf_trendhighesthigh- otf_trendhighesthigh[RiskBars] <= cloudrange*RiskFactor);

def sellLessRisk = otf_trendlowestlow < otf_trendlowestlow[1] and close < otf_trendlowestlow[RiskBars] and ( otf_trendlowestlow- otf_trendlowestlow[RiskBars] <= -cloudrange*RiskFactor);

def buyMoreRisk = otf_trendhighesthigh > otf_trendhighesthigh[1] and close > otf_trendhighesthigh[1] and (otf_trendhighesthigh- otf_trendhighesthigh[RiskBars] <= otf_ATR*RiskFactor);

def sellMoreRisk = otf_trendlowestlow < otf_trendlowestlow[1] and close < otf_trendlowestlow[1] and ( otf_trendlowestlow- otf_trendlowestlow[RiskBars] <= -otf_ATR*RiskFactor);

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseCloudRange and buyLessRisk and !buyLessRisk[1], name = if OrderSimbol then "B" else mode+"B(lr)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseCloudRange and sellLessRisk and !sellLessRisk[1], name = if OrderSimbol then "S" else mode+"S(lr)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseAtrCloudRange and buyMoreRisk and !buyMoreRisk[1], name = if OrderSimbol then "B" else mode+"B(mr)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseAtrCloudRange and sellMoreRisk and !sellMoreRisk[1], name = if OrderSimbol then "S" else mode+"S(mr)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

##################################################################

# Gandalf Pattern #

##################################################################

script gwiz{

input i_aggregation = aggregationPeriod.DAY;

def aggregation = if i_aggregation < getaggregationPeriod() then getaggregationPeriod() else i_aggregation;

def averagePrice = ohlc4(period = aggregation)[1];

def medianPrice = hl2(period = aggregation)[1];

def medianBodyPrice = ( open(period = aggregation)[1] +close(period = aggregation)[1]) /2; # MidBodyVal();

def Long = (averagePrice[1] < medianPrice[1] and

medianPrice[2] <= averagePrice[1] and

medianBodyPrice[2] <= averagePrice[3]) or

(averagePrice[1] < medianPrice[3] and

medianBodyPrice < medianPrice[2] and

medianBodyPrice[1] < medianBodyPrice[2]);

plot Exit = (averagePrice[1] < medianBodyPrice[1] and

medianPrice[2] == medianBodyPrice[3] and

medianBodyPrice[1] <= medianBodyPrice[4]) or

(averagePrice[2] < medianBodyPrice and

medianPrice[4] <= averagePrice[3] and

medianBodyPrice[1] <= averagePrice[1]);

}

def gwiztrue = if gwiz(aggregationPeriod.month).Long or gwiz(aggregationPeriod.week).Long or gwiz(aggregationPeriod.DAY).Long or

gwiz(AggregationPeriod.FOUR_HOURS).Long or gwiz(AggregationPeriod.HOUR).Long or gwiz(AggregationPeriod.FIFTEEN_MIN) or gwiz(AggregationPeriod.FIVE_MIN).Long or gwiz(AggregationPeriod.MIN).Long then 1

else if gwiz(aggregationPeriod.month).Exit or gwiz(aggregationPeriod.week).Exit or gwiz(aggregationPeriod.DAY).Exit or

gwiz(AggregationPeriod.FOUR_HOURS).Exit or gwiz(AggregationPeriod.HOUR).Exit or gwiz(AggregationPeriod.FIFTEEN_MIN) or gwiz(AggregationPeriod.FIVE_MIN).Exit or gwiz(AggregationPeriod.MIN).Exit then -1 else gwiztrue[1] ;

input UseGwiz = NO;#hint UseGwiz: Strategy simulate Long orders when Gandelf Long Entry Price Pattern is found on any timeframe and no new lower lows are registered. Exit entries are simulated when the supertrend turns bearish or close price is under the reversing projections levels

AddOrder(OrderType.BUY_to_open,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and ( UseGwiz ) and gwiztrue and !SelllIGHTisk, name = if OrderSimbol then "B" else mode+"B(Wiz)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_to_close,!useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and UseGwiz and ((SelllIGHTisk )or (sellunderlevels and !sellunderlevels[1])), name = if OrderSimbol then "Sx" else mode+"Sx(mr)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

def buy_ind =

(EnableStrategy and activerange and UsePmShiftingLevels and buyabovelevels and !buyabovelevels[1]) or

(EnableStrategy and activerange and UseProjectedMoveTouch and touchvalley and touchvalleynt == 1 and touchvalleynt[1] == 0) or

(EnableStrategy and activerange and UseProjectedMove and valley and valleycnt == 1 and valleycnt[1]== 0 ) or

(EnableStrategy and activerange and UseDirectionMove and Dailydirection > 0 and leveldir> 0) or

(EnableStrategy and activerange and UseAutoPmOrBounceTouch and UseTouchAuto and touchvalleynt == 1 and touchvalleynt[1] == 0) or

(EnableStrategy and activerange and UseAutoPmOrBounceTouch and UsePmAuto and valleycnt == 1 and valleycnt[1] == 0) or

(EnableStrategy and activerange and usebuybias and if UsePmShiftingLevels then leveldir > 0 else 1 and ( ( valleycnt == 1 and valleycnt[1] == 0 ) or (touchvalleynt == 1 and touchvalleynt[1] == 0))) or

(EnableStrategy and activerange and UseeMarketShiftPmAutoExit and pmvalid and Dailydirection < 0 and Pojected_low_bar > Pojected_high_bar[1]) or

(EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseCloudRange and buyLessRisk and !buyLessRisk[1]) or

(EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseAtrCloudRange and buyMoreRisk and !buyMoreRisk[1]) or

(EnableStrategy and activerange and ActiveTradeTime and ( UseGwiz ) and gwiztrue and !SelllIGHTisk);

def sell_ind =

(EnableStrategy and activerange and UsePmShiftingLevels and sellunderlevels and !sellunderlevels[1]) or

(EnableStrategy and activerange and UseProjectedMoveTouch and touchpeak and touchpeakcnt == 1 and touchpeakcnt[1] == 0) or

(EnableStrategy and activerange and UseProjectedMove and peak and peakcnt == 1 and peakcnt[1] == 0) or

(EnableStrategy and activerange and UseDirectionMove and Dailydirection < 0 and leveldir < 0) or

(EnableStrategy and activerange and UseAutoPmOrBounceTouch and UseTouchAuto and touchpeakcnt == 1 and touchpeakcnt[1] == 0) or

(EnableStrategy and activerange and UseAutoPmOrBounceTouch and UsePmAuto and peakcnt == 1 and peakcnt[1] == 0) or

(EnableStrategy and activerange and usesellbias and if UsePmShiftingLevels then leveldir < 0 else 1 and ( touchpeakcnt == 1 and touchpeakcnt[1] == 0 or peakcnt == 1 and peakcnt[1] == 0 )) or

( EnableStrategy and activerange and UseeMarketShiftPmAutoExit and pmvalid and Dailydirection > 0 and Pojected_low_bar < Pojected_high_bar[1]) or

(EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseCloudRange and sellLessRisk and !sellLessRisk[1]) or

(EnableStrategy and activerange and ActiveTradeTime and enableIntraday and UseAtrCloudRange and sellMoreRisk and !sellMoreRisk[1]) or

(EnableStrategy and activerange and ActiveTradeTime and UseGwiz and ((SelllIGHTisk )or (sellunderlevels and !sellunderlevels[1])));

##################################################################

# Alerts #

##################################################################

def SellStop = closeallmarket or !activerange or

(EnableStrategy and activerange and ActiveTradeTime and usebuybias and ( touchpeakcnt == 1 and touchpeakcnt[1] == 0 or peakcnt == 1 and peakcnt[1] == 0)

) or

(EnableStrategy and activerange and ActiveTradeTime and UseMarketShiftPmExit and Dailydirection > 0 and Pojected_high_bar < Pojected_low_bar[1]) ;

def BuyStop = closeallmarket or !activerange or

(EnableStrategy and activerange and ActiveTradeTime and usesellbias and ( ( valleycnt == 1 and valleycnt[1] == 0 ) or (touchvalleynt == 1 and touchvalleynt[1] == 0)))or

(EnableStrategy and activerange and ActiveTradeTime and UseMarketShiftPmExit and Dailydirection < 0 and Pojected_low_bar > Pojected_high_bar[1]) or

(EnableStrategy and activerange and ActiveTradeTime and UseGwiz and ((SelllIGHTisk )or (sellunderlevels and sellunderlevels[1])));

def BuySignal = buy_ind;

def SellSignal = sell_ind;

#######################################

## Maintain the position of trades

#######################################

def CurrentPosition; # holds whether flat = 0 long = 1 short = -1

if (BarNumber() == 1) or IsNaN(CurrentPosition[1]) {

CurrentPosition = 0;

} else {

if CurrentPosition[1] == 0 { # FLAT

if (BuySignal) {

CurrentPosition = 1;

} else if (SellSignal) {

CurrentPosition = -1;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == 1 { # LONG

if (SellSignal) {

CurrentPosition = -1;

} else if (BuyStop) {

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == -1 { # SHORT

if (BuySignal) {

CurrentPosition = 1;

} else if (SellStop) {

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else {

CurrentPosition = CurrentPosition[1];

}

}

def isLong = if CurrentPosition == 1 then 1 else 0;

def isShort = if CurrentPosition == -1 then 1 else 0;

def isFlat = if CurrentPosition == 0 then 1 else 0;

def isOrder = if CurrentPosition == CurrentPosition[1] then 0 else 1; # Status changed so it's a new order

def orderPrice = if (isOrder and (BuySignal or SellSignal)) then open[-1] else orderPrice[1];

def pricelevel = orderPrice;

def prevpricelevel = if pricelevel <> pricelevel[1] then pricelevel[1] else prevpricelevel[1];

plot OrderBlock = pricelevel;

OrderBlock.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

OrderBlock.SetDefaultColor(color.cyan);

def top = if prevpricelevel < pricelevel then pricelevel else prevpricelevel ;

def bottom = if prevpricelevel > pricelevel then pricelevel else prevpricelevel ;

input ShowCloud = no;

def maxlvl = max(prevpricelevel,pricelevel);

def minlvl = min(prevpricelevel,pricelevel);

addCloud(if ShowCloud and islong then maxlvl else double.nan , minlvl, color.green);

addCloud(if ShowCloud and isshort then minlvl else double.nan , maxlvl, color.red);

AddOrder(OrderType.BUY_AUTO,useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and buysignal, name = if OrderSimbol then "B" else "B(*)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_AUTO,useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and sellsignal, name = if OrderSimbol then "S" else "S(*)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

AddOrder(OrderType.BUY_to_close,useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and buystop, name = if OrderSimbol then "Bx" else "B(x)@ " + open[-1], price = open[-1], tickcolor = GetColor(1), arrowcolor = GetColor(1));

AddOrder(OrderType.SELL_to_close,useSignalOrderEntry and EnableStrategy and activerange and ActiveTradeTime and sellstop, name = if OrderSimbol then "Sx" else "S(x)@ " + open[-1], price = open[-1], tickcolor = GetColor(4), arrowcolor = GetColor(4));

def buyalert = islong;

def sellalert =isshort;

def alertprice = if IsNaN(EntryPrice()) then 0 else EntryPrice();

def alertposchange = ( alertprice <> alertprice[1] and alertprice == 0 ) or ( alertprice <> alertprice[1] and alertprice[1] == 0 ) or ( alertprice <> alertprice[1] and alertprice[1] > 0 and alertprice[0] > 0 );

def Activealert = (useEntryAlerts and alertposchange and absValue(alertprice-alertprice[1] )>0) or ( useSignalAlerts and (sellalert or buyalert)) ;

Alert(Activealert and Activealert and !Activealert[1] and buyalert, "Buy Signal", Alert.BAR, Sound.Ding);

Alert(Activealert and Activealert and !Activealert[1] and sellalert, "Sell Signal" , Alert.BAR, Sound.Ding);

#######################################

## START of Strategies DashBoard

####################################

addOrder(OrderType.BUY_AUTO, no); #dont change this line

input enableDashBoard = no;

input ShowStrategyCurrentPnlBubble = yes;

input ShowStrategyPnlBubble = no;

input ShowStrategyPnlEntryBubble = yes;

input ShowStrategyPnlVertical = no;

Input ShowStrategyProfitLossLabels = yes;

def fpl = FPL();

def StrategyEntryprice = if IsNaN(EntryPrice()) then 0 else EntryPrice();

def ep = entryprice();

def poschange = ( StrategyEntryprice <> StrategyEntryprice[1] and StrategyEntryprice == 0 ) or ( StrategyEntryprice <> StrategyEntryprice[1] and StrategyEntryprice[1] == 0 ) or ( StrategyEntryprice <> StrategyEntryprice[1] and StrategyEntryprice[1] > 0 and StrategyEntryprice[0] > 0 );

def pnlentry = if poschange then fpl[1] else pnlentry[1];

def currentprofit = fpl() - pnlentry[1];

def pnlprofit = if pnlentry <> pnlentry[1] then fpl()[1] - pnlentry[1] else 0 ;

def entryprofit = (if pnlprofit> 0 then 1 else -1 ) * absValue( if poschange then if StrategyEntryprice == 0 then open[0] - ep[1] else ep-ep[1] else 0) ;

def dollarentryprofitloss = Round(((entryprofit ) / TickSize()) * TickValue());

AddChartBubble(enableDashBoard and ShowStrategyPnlEntryBubble and poschange and absValue(dollarentryprofitloss )>0, open[0], AsDollars(dollarentryprofitloss[0]), if dollarentryprofitloss[0] > 0 then Color.light_GREEN else if dollarentryprofitloss[0] < 0 then Color.pink else Color.BLUE);

AddVerticalLine(ShowStrategyPnlVertical and ShowStrategyPnlEntryBubble and poschange, AsDollars(fpl) + " (" + dollarentryprofitloss + ")" , if dollarentryprofitloss > 0 then Color.GREEN else if dollarentryprofitloss < 0 then Color.RED else if pnlentry == 0 then Color.WHITE else Color.CYAN);

def fplpnlprofit = pnlprofit;

AddChartBubble(enableDashBoard and ShowStrategyPnlBubble and poschange[0] and absValue(fplpnlprofit )>0, open[0], AsDollars(fplpnlprofit[0]), if fplpnlprofit[0] > 0 then Color.GREEN else if fplpnlprofit[0] < 0 then Color.RED else Color.BLUE);

AddVerticalLine(enableDashBoard and ShowStrategyPnlVertical and ShowStrategyPnlBubble and poschange, AsDollars(fpl) + " (" + pnlprofit + ")" , if pnlprofit > 0 then Color.GREEN else if pnlprofit < 0 then Color.RED else if pnlentry == 0 then Color.WHITE else Color.CYAN);

def lastentry =if isnan( entryprice()) then lastentry[1] else entryprice() ;

AddChartBubble(enableDashBoard and ShowStrategyCurrentPnlBubble and !IsNaN(close) and IsNaN(close [-1] ) and HighestAll(BarNumber()) and absValue(currentprofit)> 0, lastentry, AsDollars(currentprofit[0]), if currentprofit[0] > 0 then Color.green else if currentprofit[0] < 0 then Color.red else Color.BLUE);

def pl = if ShowStrategyPnlEntryBubble then if isnan( dollarentryprofitloss) then 0 else dollarentryprofitloss else if isnan(fplpnlprofit) then 0 else fplpnlprofit;

def StrategyLongprofitLossSum = CompoundValue(1, if BarNumber() == 1 then 0 else if pl > 0 then StrategyLongprofitLossSum[1] + pl[0] else StrategyLongprofitLossSum[1], 0);

def StrategyShortprofitLossSum = CompoundValue(1, if BarNumber() == 1 then 0 else if pl < 0 then StrategyShortprofitLossSum[1] + pl[0] else StrategyShortprofitLossSum[1], 0);

def StrategyProfittradecnt = if BarNumber() == 1 then 0 else if pl > 0 then StrategyProfittradecnt[1] + 1 else StrategyProfittradecnt[1] ;

def Strategylosstradecnt = if BarNumber() == 1 then 0 else if pl < 0 then Strategylosstradecnt[1] + 1 else Strategylosstradecnt[1] ;

def Strategytradecnt = StrategyProfittradecnt + Strategylosstradecnt;

# What percent were winners

def StrategyPCTWin = Round(((StrategyProfittradecnt) / (Strategytradecnt)) * 100, 2) ;

def StrategyPCTLoss = Round(((Strategylosstradecnt) / (Strategytradecnt)) * 100, 2) ;

def StrategyPCTWinamt = Round(((absValue(StrategyLongprofitLossSum/StrategyProfittradecnt)) /absValue( (StrategyLongprofitLossSum/StrategyProfittradecnt) + absValue(StrategyShortprofitLossSum/Strategytradecnt))) * 1, 2) ;

def PCTLossamt = Round(((absValue(StrategyShortprofitLossSum/Strategylosstradecnt)) /absValue( (StrategyLongprofitLossSum/StrategyProfittradecnt) + absValue(StrategyShortprofitLossSum/Strategytradecnt))) * 1, 2) ;

plot PltEntryPrice = if enableDashBoard then ep else double.nan;

PltEntryPrice.SetPaintingStrategy(PaintingStrategy.DASHES);

PltEntryPrice.SetdefaultColor(color.cyan);

PltEntryPrice.assignValueColor(if currentprofit then color.green else

if entryprofit < 0 then color.red else color.cyan );

def Strategylowestdrawdown = min(if isnan(currentprofit) then 0 else currentprofit,Strategylowestdrawdown[1]);

def StrategyHigestdrawUp = max(if isnan(currentprofit) then 0 else currentprofit,StrategyHigestdrawUp[1]);

def Strategylowestloss = min(pl,Strategylowestloss[1]);

def highestwin = max(pl,highestwin[1]);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels,"Last Entry: "+lastentry +"("+currentprofit +")" ,if currentprofit > 0 then color.light_green else if currentprofit < 0 then color.light_red else color.cyan );

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "PNL: " + (FPL()), if FPL() > 0 then Color.LIME else Color.RED);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Winners: " + StrategyPCTWin + "%", if StrategyPCTWin > 50 then Color.GREEN else if StrategyPCTWin > 40 then Color.YELLOW else Color.GRAY);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "ProfitLossSum: " + (StrategyLongprofitLossSum + StrategyShortprofitLossSum), if (StrategyLongprofitLossSum + StrategyShortprofitLossSum) > 0 then Color.LIME else Color.RED);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "ShortprofitLossSum: " + (StrategyShortprofitLossSum), Color.pink);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "LongprofitLossSum: " + (StrategyLongprofitLossSum), Color.LIME);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Trades: " + (Strategytradecnt), Color.WHITE);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Profit Trades: " + (StrategyProfittradecnt), if StrategyProfittradecnt > Strategylosstradecnt then Color.LIME else Color.RED);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Loss Trades: " + (Strategylosstradecnt), if StrategyProfittradecnt < Strategylosstradecnt then Color.LIME else Color.pink);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Profit Factor: " +round(absvalue (StrategyLongprofitLossSum/StrategyShortprofitLossSum)),color.cyan);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Lowest Loss: " + (Strategylowestloss), Color.pink);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Lowest DrawDown: " + (Strategylowestdrawdown), Color.pink);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Highest DrawUp: " + (StrategyHigestdrawUp), Color.LIME);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Highest Win: " + (highestwin), Color.LIME);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "PCTWin Trades: " + (StrategyPCTWin), Color.GREEN);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "PCTLoss Trades: " + (StrategyPCTLoss), Color.PINK);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "PCTWin Amount: " + (StrategyPCTWinamt), Color.GREEN);

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "PCTLoss Amount: " + (PCTLossamt), Color.PINK);

def firstentry = if Strategytradecnt ==1 then close[1] else firstentry[1];

def buyandhold = Round(((close - firstentry ) / TickSize()) * TickValue());

AddLabel(enableDashBoard and ShowStrategyProfitLossLabels, "Buy&Hold: " + (buyandhold), if buyandhold > 0 then Color.LIME else Color.RED);

#######################################

## END of Strategy DashBoard

#######################################I updated the code above (minor typos) and included a few more examples where the strategy is configured with a Long Entry bias.

rsegal_ProjectedMoveandExpectedBounce_long_bias

Share grid: http://tos.mx/n5FHeWw

Your comments are helpful please provide them.

Last edited: