Hey team,

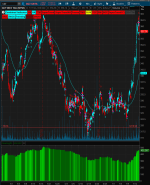

I added one condition to this script that all buy orders should, along with the bullish conditions and rth conditions that work flawlessly, be executed only when the close is above the 200 EMA, but for some reason it is not applying that condition. The last few lines of code is where I added a PriceAboveEMA condition which doesn't get recognized by the back testing strategy AddOrders, or at least it doesn't appear to to me. This indicator is purely a confirmation indicator I use on higher time frames. I've noticed it is not as versatile for various equities at lower time frames, and thus, not my indicator used to base my buy/sells on.

I added one condition to this script that all buy orders should, along with the bullish conditions and rth conditions that work flawlessly, be executed only when the close is above the 200 EMA, but for some reason it is not applying that condition. The last few lines of code is where I added a PriceAboveEMA condition which doesn't get recognized by the back testing strategy AddOrders, or at least it doesn't appear to to me. This indicator is purely a confirmation indicator I use on higher time frames. I've noticed it is not as versatile for various equities at lower time frames, and thus, not my indicator used to base my buy/sells on.

Code:

#trend, a momentum and a cycle based indicator for ThinkorSwim V2.0

#@hockeycoachdoug Community Request

declare upper;

#INPUTS

#input TRADESIZE = 100;

input tradeDollars = 2000;

input thresholdbull = 7;

input thresholdbear = 7;

input showLabels = yes;

input PaintBars = yes;

input ADXPaintBarsMode = no;

input enableNeutralMACDPainter = no;

input aggregationPeriod = AggregationPeriod.WEEK;

input EMAlength2 = 200;

input displace = 0;

input StartTrading = 0630;

input EndTrading = 1300;

def rth = if SecondsFromTime(StartTrading) > 0 and SecondsTillTime(EndTrading) > 0 then 1 else 0;

#CORE

DefineGlobalColor("CycleLineColor", Color.RED);

DefineGlobalColor("CyclehistColor", Color.BLUE);

DefineGlobalColor("ZeroLineColor", Color.YELLOW);

DefineGlobalColor("Bullish", Color.CYAN);

DefineGlobalColor("Bearish", Color.RED);

DefineGlobalColor("Neutral", Color.MAGENTA); #Color.YELLOW

DefineGlobalColor("Off", Color.DARK_GRAY);

DefineGlobalColor("On", Color.CYAN);

DefineGlobalColor("Sync1", Color.YELLOW);

DefineGlobalColor("Sync2", Color.CYAN);

DefineGlobalColor("Up", Color.CYAN);

DefineGlobalColor("Down", Color.RED);

DefineGlobalColor("NUp", Color.DARK_GREEN);

DefineGlobalColor("NDown", Color.DARK_RED);

DefineGlobalColor("Neutral", Color.BLUE);

DefineGlobalColor("Neutral2", Color.PLUM);

def StockPrice = close;

def TRADESIZE = Round(tradeDollars/StockPrice);

def h = high;

def l = low;

def o = open;

def c = close;

def hl = hl2;

def h1 = high(period = aggregationPeriod);

def l1 = low(period = aggregationPeriod);

def o1 = open(period = aggregationPeriod);

def c1 = close(period = aggregationPeriod);

def hl2 = hl2(period = aggregationPeriod);

def na = Double.NaN;

#AddLabel(showLabels, "A trend, momentum and cycle Trading System v3.2", Color.CYAN);

AddLabel(showLabels, "Combined Indicator", Color.CYAN);

####################################

##### START OF MODULES SECTION #####

####################################

#START OF HA1 - Heikin Ashi Candles Module V1.0

#

#CHANGELOG

# 2020.01.26 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableHA1 = yes; #Heikin Ashi Candles

def HA1_haopen;

def HA1_hahigh;

def HA1_halow;

def HA1_haclose;

def HA1_sState;

def HA1_sBullish;

def HA1_sBearish;

def HA1_sNeutral;

HA1_haopen = CompoundValue(1, (HA1_haopen[1] + HA1_haclose[1]) / 2, (o[1] + c[1]) / 2);

HA1_hahigh = Max(Max(h, HA1_haopen), HA1_haclose[1]);

HA1_halow = Min(Min(l, HA1_haopen), HA1_haclose[1]);

HA1_haclose = (o + h + l + c) / 4;

HA1_sState = if HA1_haclose > HA1_haopen then 100 else -100;

HA1_sBullish = if(enableHA1 and HA1_sState == 100,1,0);

HA1_sBearish = if(enableHA1 and HA1_sState == -100,1,0);

HA1_sNeutral = 0;

AddLabel(showlabels and enableHA1, "HA",

if IsNan(HA1_sState) then COLOR.DARK_GRAY else

if HA1_sState[-displace] > 0 then Color.CYAN else

if HA1_sState[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF HA1 - Heikin Ashi Candles Module V1.0

#START OF HAMTF - Heikin Ashi Candles MTF Module V1.0

#

#CHANGELOG

# 2020.01.26 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

def HAMTF_haopen;

def HAMTF_hahigh;

def HAMTF_halow;

def HAMTF_haclose;

def HAMTF_sState;

def HAMTF_sBullish;

def HAMTF_sBearish;

def HAMTF_sNeutral;

input enableHAMTF = yes; #Heikin Ashi Candles MTF

HAMTF_haopen = CompoundValue(1, (HAMTF_haopen[1] + HAMTF_haclose[1]) / 2, (o1[1] + c1[1]) / 2);

HAMTF_hahigh = Max(Max(h1, HAMTF_haopen), HAMTF_haclose[1]);

HAMTF_halow = Min(Min(l1, HAMTF_haopen), HAMTF_haclose[1]);

HAMTF_haclose = (o1 + h1 + l1 + c1) / 4;

HAMTF_sState = if HAMTF_haclose > HAMTF_haopen then 100 else -100;

HAMTF_sBullish = if(enableHAMTF and HAMTF_sState == 100,1,0);

HAMTF_sBearish = if(enableHAMTF and HAMTF_sState == -100,1,0);

HAMTF_sNeutral = 0;

AddLabel(showlabels and enableHAMTF, "HA",

if IsNan(HAMTF_sState) then COLOR.DARK_GRAY else

if HAMTF_sState[-displace] > 0 then Color.CYAN else

if HAMTF_sState[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF HAMTF - Heikin Ashi Candles MTF Module V1.0

#START OF TTM - TTM Trend Module V1.0

#

#CHANGELOG

# 2020.01.26 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableTTM = yes; #TTM Trend

def TTM_trendup;

def TTM_trenddown;

def TTM_sState;

def TTM_sBullish;

def TTM_sBearish;

def TTM_sNeutral;

TTM_trendup = if TTM_Trend().TrendUp == 1 then 1 else 0;

TTM_trenddown = if TTM_Trend().TrendDown == 1 then 1 else 0;

TTM_sState = if TTM_trendup then 100 else if TTM_trenddown then -100 else 0;

TTM_sBullish = if(enableTTM and TTM_sState == 100,1,0);

TTM_sBearish = if(enableTTM and TTM_sState == -100,1,0);

TTM_sNeutral = 0;

AddLabel(showlabels and enableTTM, "TTM", if IsNan(TTM_sState) then COLOR.DARK_GRAY else

if TTM_sState[-displace] > 0 then Color.CYAN else

if TTM_sState[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF TTM - TTM Trend Module V1.0

#START OF ST1 - SuperTrend (Mobius) Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableSuperTrend = yes; #ST1 - SuperTrend (Mobius)

input ST1_atrmult = 1.0; #SuperTrend

input ST1_natr = 4; #SuperTrend

input ST1_avgtype = AverageType.HULL; #SuperTrend

def ST1_atr = MovingAverage(ST1_avgtype, TrueRange(h, c, l), ST1_natr);

def ST1_up = hl + (ST1_atrmult * ST1_atr);

def ST1_dn = hl + (-ST1_atrmult * ST1_atr);

def ST1_st = if c < ST1_st[1] then ST1_up else ST1_dn;

def ST1_ssupertrend = if c < ST1_st then -100 else 100;

def ST1_sbullish = enableSuperTrend and ST1_ssupertrend == 100;

def ST1_sbearish = enableSuperTrend and ST1_ssupertrend == -100;

def ST1_sneutral = 0;

AddLabel(showlabels and enableSuperTrend, "SuperTrend", if IsNan(ST1_ssupertrend) then COLOR.DARK_GRAY else

if ST1_ssupertrend[-displace] > 0 then Color.CYAN else

if ST1_ssupertrend[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF ST1 - SuperTrend (Mobius) Module V1.0

#START OF STHA - SuperTrend HA (Mobius) Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableSuperTrendHA = yes; #ST1 - SuperTrend HA (Mobius)

input STHA_atrmult = 1.0; #SuperTrend

input STHA_natr = 4; #SuperTrend

input STHA_avgtype = AverageType.HULL; #SuperTrend

def STHA_atr = MovingAverage(STHA_avgtype, TrueRange(ha1_hahigh, ha1_HAclose, ha1_HAlow), STHA_natr);

def STHA_up = HL + (STHA_atrmult * STHA_atr);

def STHA_dn = HL + (-STHA_atrmult * STHA_atr);

def STHA_st = if c < STHA_st[1] then STHA_up else STHA_dn;

def STHA_ssupertrend = if c < STHA_st then -100 else 100;

def STHA_sbullish = enableSuperTrendHA and STHA_ssupertrend == 100;

def STHA_sbearish = enableSuperTrendHA and STHA_ssupertrend == -100;

def STHA_sneutral = 0;

AddLabel(showlabels and enableSuperTrend, "SuperTrendHA", if IsNan(STHA_ssupertrend) then COLOR.DARK_GRAY else

if STHA_ssupertrend[-displace] > 0 then Color.CYAN else

if STHA_ssupertrend[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF STHA - SuperTrend HA (Mobius) Module V1.0

#START OF FRE - Frema Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableFrema = yes; #FREMA

input FRE_aa = .1; #FREMA

def FRE_cc;

def FRE_zeroline = 0;

def FRE_re1;

def FRE_re2;

def FRE_re3;

def FRE_re4;

def FRE_re5;

def FRE_re6;

def FRE_re7;

def FRE_re8;

def FRE_ema;

FRE_cc = if FRE_cc[1] == 0 then .9 else 1 – FRE_aa;

FRE_ema = FRE_aa * c + FRE_cc * FRE_ema[1];

FRE_re1 = FRE_cc * FRE_ema + FRE_ema[1];

FRE_re2 = Power(FRE_cc, 2) * FRE_re1 + FRE_re1[1];

FRE_re3 = Power(FRE_cc, 4) * FRE_re2 + FRE_re2[1];

FRE_re4 = Power(FRE_cc, 8) * FRE_re3 + FRE_re3[1];

FRE_re5 = Power(FRE_cc, 16) * FRE_re4 + FRE_re4[1];

FRE_re6 = Power(FRE_cc, 32) * FRE_re5 + FRE_re5[1];

FRE_re7 = Power(FRE_cc, 64) * FRE_re6 + FRE_re6[1];

FRE_re8 = Power(FRE_cc, 128) * FRE_re7 + FRE_re7[1];

def FRE_ema_signal = FRE_ema – FRE_aa * FRE_re8;

def FRE_sfrema = if (FRE_ema_signal > FRE_zeroline) then 100 else -100;

def FRE_sbullish = enableFrema and FRE_sfrema == 100;

def FRE_sbearish = enableFrema and FRE_sfrema == -100;

def FRE_sneutral = 0;

AddLabel(showlabels and enableFrema, "Frema", if IsNan(FRE_sfrema) then COLOR.DARK_GRAY else

if FRE_sfrema[-displace] > 0 then Color.CYAN else

if FRE_sfrema[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF FRE - Frema Module V1.0

#START OF TMO - TMO Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableTMO = yes; #TMO

input TMO_length = 14; #TMO

input TMO_calclength = 5; #TMO

input TMO_smoothlength = 3; #TMO

def TMO_data = fold i = 0 to TMO_length

with s

do s + (if c > getValue(o, i)

then 1

else if c < getValue(o, i)

then - 1

else 0);

def TMO_ema5 = ExpAverage(TMO_data, TMO_calclength);

def TMO_main = ExpAverage(TMO_ema5, TMO_smoothlength);

def TMO_signal = ExpAverage(TMO_main, TMO_smoothlength);

def TMO_smain = if TMO_main > TMO_signal then 100 else -100;

def TMO_ssignal = if TMO_main > TMO_signal then 100 else - 100;

def TMO_ob = if isNaN(c) then double.nan else round(TMO_length * .7);

def TMO_os = if isNaN(c) then double.nan else -round(TMO_length * .7);

def TMO_stmo = if TMO_main > TMO_signal then 100 else -100;

def TMO_sbullish = enableTMO and TMO_stmo == 100;

def TMO_sbearish = enableTMO and TMO_stmo == -100;

def TMO_sneutral = 0;

AddLabel(showlabels and enableTMO, "TMO", if IsNan(TMO_stmo) then COLOR.DARK_GRAY else

if TMO_stmo[-displace] > 0 then Color.CYAN else

if TMO_stmo[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF TMO - TMO Module V1.0

#START OF SL1 - SLIM Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableSLIM = yes;

input SL1_ssuperfast = 8;

input SL1_sfast = 13;

input SL1_sslow = 21;

def SL1_superfast = ExpAverage(c[-displace], SL1_ssuperfast);

def SL1_fast = ExpAverage(c[-displace], SL1_sfast);

def SL1_slow = ExpAverage(c[-displace], SL1_sslow);

def SL1_buy = SL1_superfast > SL1_fast and SL1_fast > SL1_slow and l > SL1_superfast;

def SL1_stopbuy = SL1_superfast <= SL1_fast;

def SL1_buynow = !SL1_buy[1] and SL1_buy;

def SL1_buysignal = CompoundValue(1, if SL1_buynow and !SL1_stopbuy then 1

else if SL1_buysignal[1] == 1 and SL1_stopbuy then 0 else SL1_buysignal[1], 0);

def SL1_buy_signal = SL1_buysignal[1] == 0 and SL1_buysignal == 1;

def SL1_momentum_down = SL1_buysignal[1] == 1 and SL1_buysignal == 0;

def SL1_sell = SL1_superfast < SL1_fast and SL1_fast < SL1_slow and h < SL1_superfast;

def SL1_stopsell = SL1_superfast >= SL1_fast;

def SL1_sellnow = !SL1_sell[1] and SL1_sell;

def SL1_sellsignal = CompoundValue(1, if SL1_sellnow and !SL1_stopsell then 1

else if SL1_sellsignal[1] == 1 and SL1_stopsell then 0 else SL1_sellsignal[1], 0);

def SL1_sell_signal = SL1_sellsignal[1] == 0 and SL1_sellsignal;

def SL1_momentum_up = SL1_sellsignal[1] == 1 and SL1_sellsignal == 0;

def SL1_sstate = if SL1_buy_signal then 100 else if SL1_momentum_up then 10 else if SL1_sell_signal then -100 else if SL1_momentum_down then -10 else SL1_sstate[1];

def SL1_sbullish = enableSLIM and SL1_sstate == 100;

def SL1_sbearish = enableSLIM and SL1_sstate == -100;

def SL1_sneutral = 0;

AddLabel(showlabels and enableSLIM, "SLIM", if IsNan(SL1_sstate) then COLOR.DARK_GRAY else

if SL1_sstate[-displace] >= 100 then Color.CYAN else

if SL1_sstate[-displace] <= -100 then COLOR.RED

else COLOR.YELLOW);

#END OF SL1 - SLIM Module V1.0

#START OF TOP - TOP Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableTOP = yes; #TOP

input TOP_fastcyclelength = 5; #TOP

input TOP_slowcyclelength = 8; #TOP

def TOP_fastvar = ExpAverage((H + L) / 2, TOP_fastcyclelength);

def TOP_slowvar = Average((H + L) / 2, TOP_slowcyclelength);

def TOP_diffvar = TOP_fastvar - TOP_slowvar;

def TOP_pdiffvar = TOP_diffvar;

def TOP_pdiffvar2 = TOP_diffvar;

def TOP_stop = if TOP_diffvar > 0 then 100 else -100;

def TOP_sbullish = enableTOP and TOP_stop == 100;

def TOP_sbearish = enableTOP and TOP_stop == -100;

def TOP_sneutral = 0;

AddLabel(showlabels and enableTOP, "TOP", if IsNan(TOP_stop) then COLOR.DARK_GRAY else

if TOP_stop[-displace] > 0 then Color.CYAN else

if TOP_stop[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF TOP - TOP Module V1.0

#START OF DMI - DMI Trend Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableDMI = yes; #DMI Trend

input DMI_dmilength = 13;

def DMI_hidiff = h - h[1];

def DMI_lodiff = l[1] - l;

def DMI_plusdm = if DMI_hidiff > DMI_lodiff and DMI_hidiff > 0 then DMI_hidiff else 0;

def DMI_minusdm = if DMI_lodiff > DMI_hidiff and DMI_lodiff > 0 then DMI_lodiff else 0;

def DMI_atrdmi = WildersAverage(TrueRange(h, c, l), DMI_dmilength);

Def DMI_diplus = 100 * WildersAverage(DMI_plusdm, DMI_dmilength) / DMI_atrdmi;

Def DMI_diminus = 100 * WildersAverage(DMI_minusdm, DMI_dmilength) / DMI_atrdmi;

def DMI_sdmi = if DMI_diplus > DMI_diminus then 100 else if DMI_diminus > DMI_diplus then -100 else 0;

def DMI_sbullish = enableDMI and DMI_sdmi == 100;

def DMI_sbearish = enableDMI and DMI_sdmi == -100;

def DMI_sneutral = 0;

AddLabel(showlabels and enableDMI, "DMI", if IsNan(DMI_sdmi) then COLOR.DARK_GRAY else

if DMI_sdmi[-displace] > 0 then Color.CYAN else

if DMI_sdmi[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF DMI - DMI Trend Module V1.0

#START OF BOP - BOP Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableBOP = yes; #BOP

input BOP_averagetype = {Simple, Exponential, default Weighted, Wilders, Hull, Disabled};

input BOP_boplength = 16;

def BOP_rawbmp = if h != l then (c - o) / (h - l) else 1;

def BMP;

switch (BOP_averagetype) {

case Simple:

BMP = Average(BOP_rawbmp, BOP_boplength);

case Exponential:

BMP = ExpAverage(BOP_rawbmp, BOP_boplength);

case Weighted:

BMP = wma(BOP_rawbmp, BOP_boplength);

case Wilders:

BMP = WildersAverage(BOP_rawbmp, BOP_boplength);

case Hull:

BMP = HullMovingAvg(BOP_rawbmp, BOP_boplength);

case Disabled:

BMP = BOP_rawbmp;

}

def BOP_sbop = if BMP > 0 then 100 else -100;

def BOP_sbullish = enableBOP and BOP_sbop == 100;

def BOP_sbearish = enableBOP and BOP_sbop == -100;

def BOP_sneutral = 0;

AddLabel(showlabels and enableBOP, "BOP", if IsNan(BOP_sbop) then COLOR.DARK_GRAY else

if BOP_sbop[-displace] > 0 then Color.CYAN else

if BOP_sbop[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF BOP - BOP Module V1.0

#START OF STCCI - Super Trend w/CCI Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableSuperTrendCCI = yes; #Super Trend w/CCI

input STCCI_lengthcci = 50;

input STCCI_lengthatr = 21;

input STCCI_atrfactor = 1.0;

def STCCI_pricedata = hl;

def STCCI_atrcci = Average(TrueRange(h, c, l), STCCI_lengthatr) * STCCI_atrfactor;

def STCCI_price = c + l + h;

def STCCI_lindev = lindev(STCCI_price, STCCI_lengthcci);

def STCCI_cci = if STCCI_lindev == 0

then 0

else (STCCI_price - Average(STCCI_price, STCCI_lengthcci)) / STCCI_lindev / 0.015;

def STCCI_mt1 = if STCCI_cci > 0

then Max(STCCI_mt1[1], STCCI_pricedata - STCCI_atrcci)

else Min(STCCI_mt1[1], STCCI_pricedata + STCCI_atrcci);

def STCCI_ssupertrendcci = if c < STCCI_mt1 and c < ST1_st then -100 else if C > STCCI_mt1 and c > ST1_st then 100 else 0;

def STCCI_sbullish = enableSuperTrendCCI and STCCI_ssupertrendcci == 100;

def STCCI_sbearish = enableSuperTrendCCI and STCCI_ssupertrendcci == -100;

def STCCI_sneutral = 0;

AddLabel(showlabels and enableSuperTrendCCI, "SuperTrendCCI", if IsNan(STCCI_ssupertrendcci) then COLOR.DARK_GRAY else

if STCCI_ssupertrendcci[-displace] > 0 then Color.CYAN else

if STCCI_ssupertrendcci[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF STCCI - Super Trend w/CCI Module V1.0

#START OF CTT - CCI + TTM squeeze + TTM trend Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableCCITTM = yes; #CCI + TTM squeeze + TTM trend

def CTT_ccibuy = CCI(length = 14).CCI > 0 and CCI(length = 50).CCI > 0;

def CTT_ccisell = CCI(length = 14).CCI < 0 and CCI(length = 50).CCI < 0;

def CTT_strendup = TTM_Trend().TrendUp;

def CTT_strenddn = TTM_Trend().TrendDown;

def CTT_squeezeup = TTM_Squeeze().Histogram >= 0;

def CTT_squeezedn = TTM_Squeeze().Histogram <= 0;

def CTT_buy = CTT_ccibuy and CTT_strendup and CTT_squeezeup;

def CTT_sell = CTT_ccisell and CTT_strenddn and CTT_squeezedn;

def CTT_sccittm = if CTT_buy then 100 else if CTT_sell then -100 else 0;

def CTT_sbullish = enableCCITTM and CTT_sccittm == 100;

def CTT_sbearish = enableCCITTM and CTT_sccittm == -100;

def CTT_sneutral = 0;

AddLabel(showlabels and enableCCITTM, "CCI+TTM", if IsNan(CTT_sccittm) then COLOR.DARK_GRAY else

if CTT_sccittm[-displace] > 0 then Color.CYAN else

if CTT_sccittm[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF CTT - CCI + TTM squeeze + TTM trend Module V1.0

#START OF DRSI - Derivative RSI Oscillator Module V1.0

#

#CHANGELOG

# 2020.01.29 V1.0 @diazlaz Initial Module Release

#

#CREDITS

# Derivative RSI Oscillator

# Can be used alone as a smoother RSI or as part of the Carting Wealth strategy when

# combined with the MACD and MAs Charting Wealth study.

# By Horserider 12/25/2019

#USAGE

#

#Derivative RSI Oscillator

input enableDRSI = yes; #Derivative RSI Oscillator

input DRSI_length = 14;

input DRSI_length1 = 5;

input DRSI_length2 = 3;

input DRSI_length3 = 9;

input DRSI_price = close;

input DRSI_averagetype = averagetype.EXPONENTIAL;

input DRSI_averagetype2 = averagetype.SIMPLE;

def DRSI_netchgavg = WildersAverage(DRSI_price - DRSI_price[1], DRSI_length);

def DRSI_totchgavg = WildersAverage(AbsValue(DRSI_price - DRSI_price[1]), DRSI_length);

def DRSI_chgratio = if DRSI_totchgavg != 0 then DRSI_netchgavg / DRSI_totchgavg else 0;

def DRSI_rsi = (50 * (DRSI_chgratio + 1) - 50);

def DRSI_x = MovingAverage(DRSI_averagetype,DRSI_rsi, DRSI_length1);

def DRSI_x2 = MovingAverage(DRSI_averagetype, DRSI_x, DRSI_length2);

def DRSI_xs = MovingAverage(DRSI_averagetype2, DRSI_x2 , DRSI_length3);

def DRSI_rsi__linediff = DRSI_x2 - DRSI_xs;

def DRSI_rsi_line = DRSI_rsi__linediff;

def DRSI_sstate = if DRSI_rsi_line >= 0 then if DRSI_rsi_line > DRSI_rsi_line[1] then 100 else 10 else if DRSI_rsi_line < DRSI_rsi_line[1] then -100 else -10;

def DRSI_sbullish = enableDRSI and DRSI_sstate > 0;

def DRSI_sbearish = enableDRSI and DRSI_sstate < 0;

def DRSI_sneutral = 0;

AddLabel(showlabels and enableDRSI, "DRSI", if IsNan(DRSI_sstate) then COLOR.DARK_GRAY else

if DRSI_sstate[-displace] > 0 then Color.CYAN else

if DRSI_sstate[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF DRSI - Derivative RSI Oscillator Module V1.0

#START OF SWCA - Schaff Wave CrossOver Average Module V1.0

#

#CHANGELOG

# 2020.02.01 V1.0 @diazlaz Initial Module Release

#

#CREDITS

#

#USAGE

#

input enableSWCA = yes;

input SWCA_fastlengthtrend = 48;

input SWCA_slowlengthtrend = 104;

input SWCA_kperiodtrend = 36;

input SWCA_dperiodtrend = 8;

input SWCA_averagetypetrend = AverageType.EXPONENTIAL;

input SWCA_fastlengthwave = 12;

input SWCA_slowlengthwave = 26;

input SWCA_kperiodwave = 9;

input SWCA_dperiodwave = 2;

input SWCA_averagetypewave = AverageType.EXPONENTIAL;

def SWCA_macdtrend = MovingAverage(SWCA_averagetypetrend, c, SWCA_fastlengthtrend) - MovingAverage(SWCA_averagetypetrend, c, SWCA_slowlengthtrend);

def SWCA_macdwave = MovingAverage(SWCA_averagetypewave, c, SWCA_fastlengthwave) - MovingAverage(SWCA_averagetypewave, c, SWCA_slowlengthwave);

def SWCA_fastk1trend = FastKCustom(SWCA_macdtrend, SWCA_kperiodtrend);

def SWCA_fastk1wave = FastKCustom(SWCA_macdwave, SWCA_kperiodwave);

def SWCA_fastd1trend = MovingAverage(SWCA_averagetypetrend, SWCA_fastk1trend, SWCA_dperiodtrend);

def SWCA_fastd1wave = MovingAverage(SWCA_averagetypewave, SWCA_fastk1wave, SWCA_dperiodwave);

def SWCA_fastk2trend = FastKCustom(SWCA_fastd1trend, SWCA_kperiodtrend);

def SWCA_fastk2wave = FastKCustom(SWCA_fastd1wave, SWCA_kperiodwave);

def SWCA_stctrend = MovingAverage(SWCA_averagetypetrend, SWCA_fastk2trend, SWCA_dperiodtrend);

def SWCA_stcwave = MovingAverage(SWCA_averagetypewave, SWCA_fastk2wave, SWCA_dperiodwave);

def SWCA_sstate = if SWCA_stctrend > SWCA_stcwave then 100 else -100;

def SWCA_sbullish = enableSWCA and SWCA_sstate == 100;

def SWCA_sbearish = enableSWCA and SWCA_sstate == -100;

def SWCA_sneutral = 0;

AddLabel(showlabels and enableSWCA, "SWCA", if IsNan(SWCA_sstate) then COLOR.DARK_GRAY else

if SWCA_sstate[-displace] > 0 then Color.CYAN else

if SWCA_sstate[-displace] < 0 then COLOR.RED

else COLOR.DARK_GRAY);

#END OF SWCA - Schaff Wave CrossOver Average Module V1.0

###################################

##### END OF MODULES SECTION #####

###################################

#ADX TRENDING

input ADXlength = 8; #ADX

input ADXTrending = 25; #ADX

input showADXBar = yes;

input DI_length = 8;

def DX = if (diplus(di_length) + diminus(di_length) > 0) then 100 * AbsValue(diplus(di_length) - diminus(di_length)) / (diplus(di_length) + diminus(di_length)) else 0;

def ADX = WildersAverage(DX, adxlength);

plot ADXCross = LowestAll(low);

ADXCross.SetPaintingStrategy(PaintingStrategy.LINE);

ADXCross.AssignValueColor(

if ADX > ADXTrending then Color.LIME

else Color.DARK_GRAY);

ADXCross.SetLineWeight(5);

ADXCross.SetHiding(!showADXBar);

#MACD Neutal Eval

input fastLength_1 = 12;

input slowLength_1 = 26;

input MACDLength_1 = 9;

input AverageType_1 = {SMA, default EMA};

def macd_Val_1 = MACD(fastLength_1, slowLength_1, MACDLength_1, AverageType_1).Value;

def macd_Avg1 = MACD(fastLength_1, slowLength_1, MACDLength_1, AverageType_1).Avg;

def MACD_trig = if MACD().value > MACD().avg then 1 else 0;

AddLabel(showlabels,

if ADX > ADXTrending then "Trending" else

"Non Trending",

if IsNan(c) then COLOR.DARK_GRAY else

if ADX > ADXTrending then Color.CYAN else

COLOR.DARK_GRAY);

AddLabel(showlabels,

"MACD",

if IsNan(c) then COLOR.DARK_GRAY else

if macd_Val_1 > macd_Avg1 then COLOR.DARK_GREEN else

COLOR.DARK_RED);

#STATE

def sResults = HA1_sState + HAMTF_sState + TTM_sState + ST1_ssupertrend + STHA_ssupertrend + FRE_sfrema + TMO_stmo + SL1_sstate + TOP_stop + DMI_sdmi + BOP_sbop

+ STCCI_ssupertrendcci + CTT_sccittm + DRSI_sstate + SWCA_sstate;

def sBullish = HA1_sBullish + HAMTF_sBullish + TTM_sBullish + ST1_sbullish + STHA_sbullish + FRE_sbullish + TMO_sbullish + SL1_sbullish + TOP_sbullish + DMI_sbullish + BOP_sbullish + STCCI_sbullish + CTT_sbullish + DRSI_sbullish + SWCA_sbullish;

def sBearish = HA1_sBearish + HAMTF_sBearish + TTM_sBearish + ST1_sbearish + STHA_sbearish + FRE_sbearish + TMO_sbearish + SL1_sbearish + TOP_sbearish + DMI_sbearish + BOP_sbearish + STCCI_sbearish + CTT_sbearish + DRSI_sbearish + SWCA_sbearish;

def bullish = if(sBullish >= thresholdbull,1,0);

def bearish = if(sBearish >= thresholdbear,1,0);

def sState = if bullish then 100 else if bearish then -100 else 0;

def sState2 = if sState != 0 then sState else sState2[1];

#COLORBARS

AssignPriceColor(

if PaintBars then

if ADXPaintBarsMode then if ADX > ADXTrending then COLOR.ORANGE else COLOR.DARK_GRAY

else

if bullish then Color.CYAN else if bearish then COLOR.RED

else

if enableNeutralMACDPainter then

if macd_Val_1 > macd_Avg1 then COLOR.DARK_GREEN else COLOR.DARK_RED

else

COLOR.GRAY

else COLOR.CURRENT);

AddLabel(showlabels,

if bullish[-displace] then "LONG" else

if bearish[-displace] then "SHORT"

else "HOLD",

if IsNan(c) then COLOR.DARK_GRAY else

if bullish[-displace] then Color.CYAN else

if bearish[-displace] then COLOR.RED

else COLOR.GRAY);

#END OF trend, a momentum and a cycle based indicator for ThinkorSwim V2.0

#Testing also above EMA 200

def PriceAboveEMA = if MovAvgExponential(EMAlength2) is less than close then 1 else 0;

# Bullish Orders

AddOrder(OrderType.BUY_TO_OPEN, condition = PriceAboveEMA and bullish and bullish[2] and rth==1, price = open[-1], Tradesize = TRADESIZE, arrowcolor = Color.CYAN, name = " ");

AddOrder(OrderType.SELL_TO_CLOSE, condition = bearish and rth==1, price = open[-1], Tradesize = TRADESIZE, arrowcolor = Color.RED, name = " ");

#Alert(SuperTrendUP, "Bullish!", Alert.BAR,Sound.bell);

#Alert(SuperTrendDN, "Bearish!", Alert.BAR,Sound.bell);Attachments

Last edited: