Author Message:

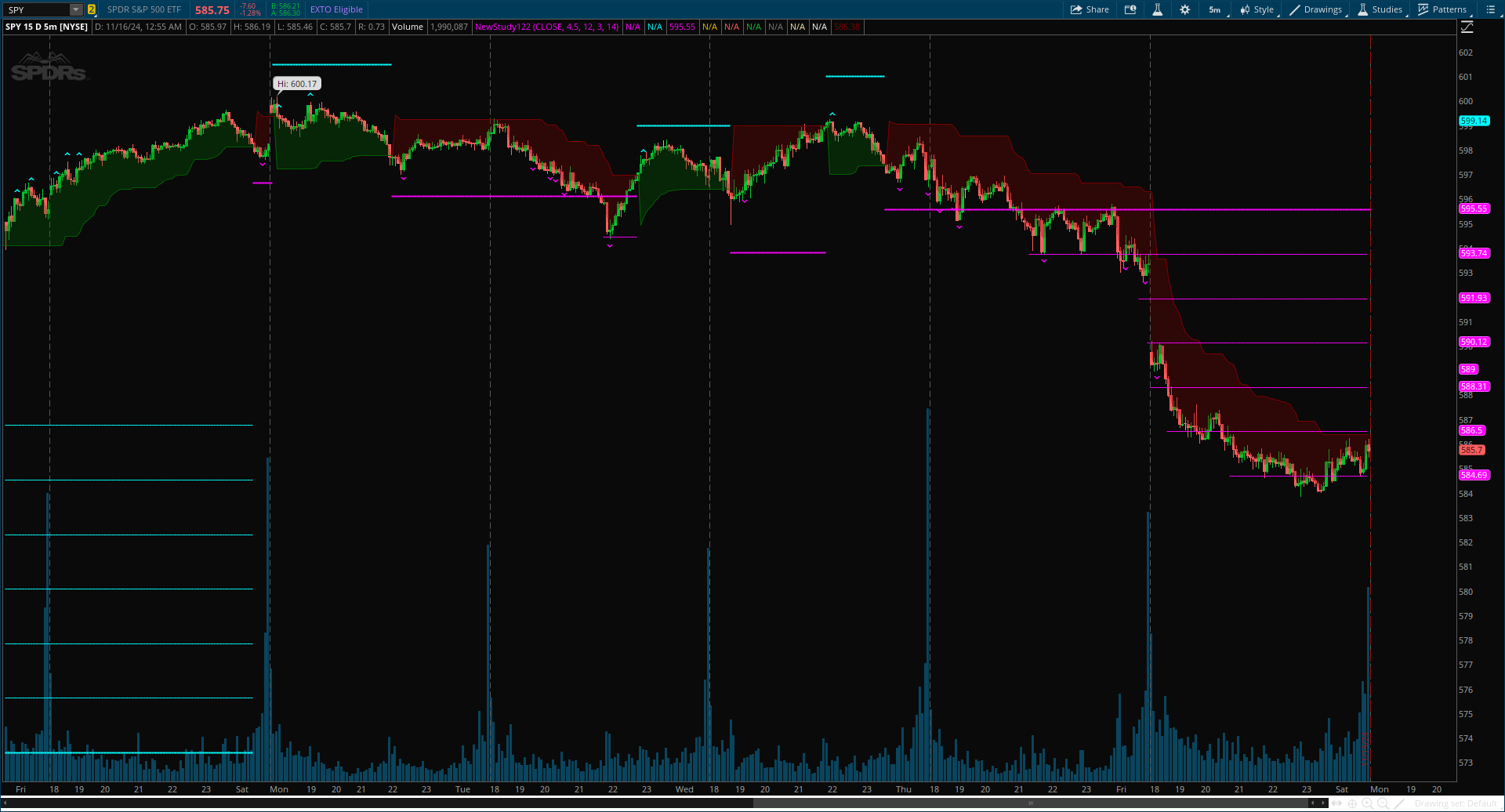

Power Root SuperTrend by AlgoAlpha, an advanced trading indicator that enhances the traditional SuperTrend by incorporating Root-Mean-Square (RMS) calculations for a more responsive and adaptive trend detection. This innovative tool is designed to help traders identify trend directions, potential take-profit levels, and optimize entry and exit points with greater accuracy, making it an excellent addition to your trading arsenal.

CODE:

CSS:

# // Indicator for TOS

#// © AlgoAlpha

#indicator("Power Root SuperTrend [AlgoAlpha]", "AlgoAlpha - Power Root", true, max_lines_count = 500)

# Conveted by Sam4Cok@Samer800 - 11/2024

input src = close;

input atrFactor = 4.5; # "Factor"

input atrLength = 12; # "ATR Length"

input RootMeanSquareLength = 3; # "Root-Mean-Square Length"

input rsiTakeProfitLength = 14; # "RSI Take-Profit Length"

def na = Double.NaN;

def last = IsNaN(close);

def mid = (open + close) / 2;

#// SuperTrend Function

script superTrendCalc {

input multiplier = 4.5;

input atrLength = 12;

input source = hl2;

def lowerLevel;

def upperLevel;

def atrValue1 = ATR(Length = atrLength);

def upper = source + multiplier * atrValue1;

def lower = source - multiplier * atrValue1;

def previousLowerLevel = CompoundValue(1, lowerLevel[1], 0);

def previousUpperLevel = CompoundValue(1, upperLevel[1], 0);

lowerLevel = if lower > previousLowerLevel or source[1] < previousLowerLevel then lower else previousLowerLevel;

upperLevel = if upper < previousUpperLevel or source[1] > previousUpperLevel then upper else previousUpperLevel;

def trendDirection;

def trendValue;

def previousTrend = CompoundValue(1, trendValue[1], 0);

if (!atrValue1[1]) {

trendDirection = 1;

} else if previousTrend == previousUpperLevel {

trendDirection = if source > upperLevel then -1 else 1;

} else {

trendDirection = if source < lowerLevel then 1 else -1;

}

trendValue = if trendDirection == -1 then lowerLevel else upperLevel;

plot st = trendValue;

plot dir = trendDirection;

}

def sumSrc = sum(Sqr(src), RootMeanSquareLength);

def rms = Sqrt(sumSrc / RootMeanSquareLength);

def superTrendValue = superTrendCalc(atrFactor, atrLength, rms). st;

def trendDirection = superTrendCalc(atrFactor, atrLength, rms).dir;

def dist = AbsValue(src - superTrendValue);

def cross = trendDirection Crosses 0;

def col1 = if trendDirection[-1] > 0 then -1 else 1;

def col = if isNaN(col1) then col[1] else if col1 then col1 else col[1];

def chg; # = 0.0

def tp1; # = 0.0

def tp2; # = 0.0

def tp3; # = 0.0

def tp4; # = 0.0

def tp5; # = 0.0

def tp6; # = 0.0

def tp7; # = 0.0

def printedtp2; # = 0

def printedtp3; # = 0

def printedtp4; # = 0

def printedtp5; # = 0

def printedtp6; # = 0

def printedtp7; # = 0

def printedtp22; # = 0

def printedtp33; # = 0

def printedtp44; # = 0

def printedtp55; # = 0

def printedtp66; # = 0

def printedtp77; # = 0

if cross {

printedtp2 = 0;

printedtp3 = 0;

printedtp4 = 0;

printedtp5 = 0;

printedtp6 = 0;

printedtp7 = 0;

chg = AbsValue(superTrendValue - superTrendValue[1]);

tp1 = superTrendValue[1] + (if trendDirection > 0 then -chg else chg);

tp2 = superTrendValue[1] + (if trendDirection > 0 then -chg * 2 else chg * 2);

tp3 = superTrendValue[1] + (if trendDirection > 0 then -chg * 3 else chg * 3);

tp4 = superTrendValue[1] + (if trendDirection > 0 then -chg * 4 else chg * 4);

tp5 = superTrendValue[1] + (if trendDirection > 0 then -chg * 5 else chg * 5);

tp6 = superTrendValue[1] + (if trendDirection > 0 then -chg * 6 else chg * 6);

tp7 = superTrendValue[1] + (if trendDirection > 0 then -chg * 7 else chg * 7);

} else {

printedtp2 = printedtp22[1];

printedtp3 = printedtp33[1];

printedtp4 = printedtp44[1];

printedtp5 = printedtp55[1];

printedtp6 = printedtp66[1];

printedtp7 = printedtp77[1];

chg = chg[1];

tp1 = tp1[1];

tp2 = tp2[1];

tp3 = tp3[1];

tp4 = tp4[1];

tp5 = tp5[1];

tp6 = tp6[1];

tp7 = tp7[1];

}

def nRSI = rsi(Price = dist, Length = rsiTakeProfitLength);

def tp = nRSI Crosses Below 60;

def extreme = if trendDirection > 0 then low else high;

def extreme_tp1_dist = AbsValue(extreme - tp1);

def extreme_tp2_dist = AbsValue(extreme - tp2);

def extreme_tp3_dist = AbsValue(extreme - tp3);

def extreme_tp4_dist = AbsValue(extreme - tp4);

def extreme_tp5_dist = AbsValue(extreme - tp5);

def extreme_tp6_dist = AbsValue(extreme - tp6);

def extreme_tp7_dist = AbsValue(extreme - tp7);

printedtp22 = if printedtp2 == 0 and extreme_tp2_dist < extreme_tp1_dist then 1 else printedtp2;

printedtp33 = if printedtp3 == 0 and extreme_tp3_dist < extreme_tp2_dist then 1 else printedtp3;

printedtp44 = if printedtp4 == 0 and extreme_tp4_dist < extreme_tp3_dist then 1 else printedtp4;

printedtp55 = if printedtp5 == 0 and extreme_tp5_dist < extreme_tp4_dist then 1 else printedtp5;

printedtp66 = if printedtp6 == 0 and extreme_tp6_dist < extreme_tp5_dist then 1 else printedtp6;

printedtp77 = if printedtp7 == 0 and extreme_tp7_dist < extreme_tp6_dist then 1 else printedtp7;

plot sTP = if tp and trendDirection > 0 then low else na; # "RSI-Based Shorts TP"

plot lTP = if tp and trendDirection < 0 then high else na; # "RSI-Based Longs TP"

sTP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

lTP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

sTP.SetDefaultColor(Color.MAGENTA);

lTP.SetDefaultColor(Color.CYAN);

#-- TP Lines

plot tpl1 = if !last and tp1[-1] then tp1[-1] else na;

plot tpl2= if !last and printedtp22[-1] then tp2[-1] else na;

plot tpl3= if !last and printedtp33[-1] then tp3[-1] else na;

plot tpl4= if !last and printedtp44[-1] then tp4[-1] else na;

plot tpl5= if !last and printedtp55[-1] then tp5[-1] else na;

plot tpl6= if !last and printedtp66[-1] then tp6[-1] else na;

plot tpl7= if !last and printedtp77[-1] then tp7[-1] else na;

plot stLine = if superTrendValue then superTrendValue else na;

AddCloud(stLine, mid, Color.DARK_RED, Color.DARK_GREEN);

stLine.AssignValueColor(if trendDirection > 0 then Color.DARK_RED else Color.DARK_GREEN);

tpl1.SetLineWeight(2);

tpl1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl6.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl7.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpl1.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl2.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl3.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl4.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl5.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl6.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

tpl7.AssignValueColor(if col>0 then Color.CYAN else Color.MAGENTA);

#-- END of CODE