Author Message:

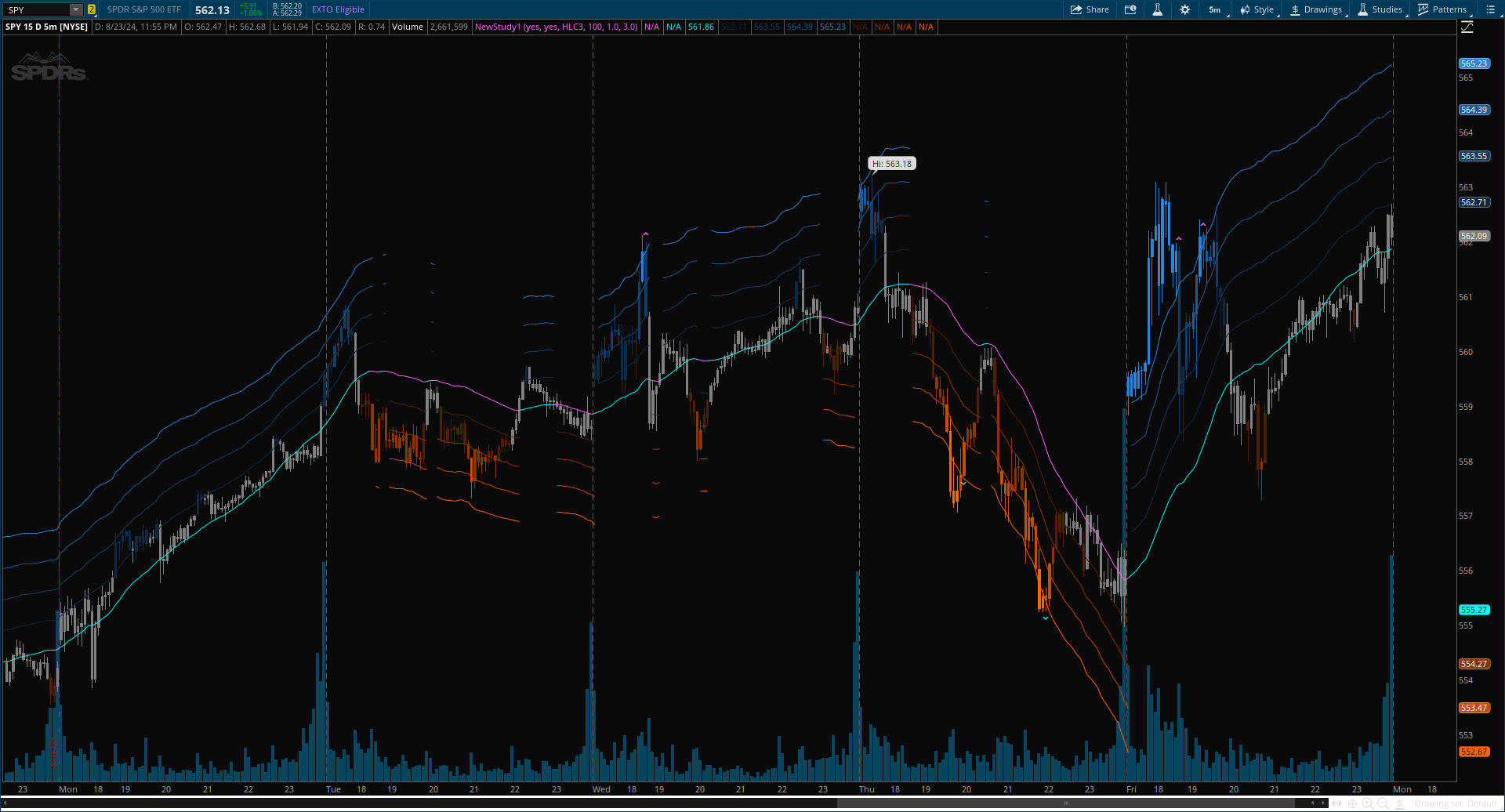

The Polynomial Regression Keltner Channel indicator is an advanced technical analysis tool that combines polynomial regression with dynamic Keltner Channels. This indicator provides traders with a sophisticated method for trend analysis, volatility assessment, and identifying potential overbought and oversold conditions.

CODE:

CSS:

#// Indicator for TOS

#//@ChartPrime

#indicator("Polynomial Regression Keltner Channel [ChartPrime]", "PR Keltner Channel [ChartPrime]"

# Converted by Sam4Cok@Samer800 - 08/2024

input colorBars = yes;

input showChannel = yes;

input Source = FundamentalType.HLC3; # "Source"

input higherTimeframe = AggregationPeriod.MIN;

input length = 100; # "Length"

input channelSensitivity = 1.0;

input baseAtrMultiplier = 3.0; # "Base ATR Multiplier"

def na = Double.NaN;

def multi = baseATRMultiplier / 10;

def current = GetAggregationPeriod();

def tf = Max(current, higherTimeframe);

def src = Fundamental(FundamentalType = Source, Period = tf);

#--Color

DefineGlobalColor("up4", CreateColor(46, 131,211));

DefineGlobalColor("up3", CreateColor(31, 91, 147));

DefineGlobalColor("up2", CreateColor(21, 61, 99));

DefineGlobalColor("up1", CreateColor(14, 41, 66));

DefineGlobalColor("dn4", CreateColor(255,102,0));

DefineGlobalColor("dn3", CreateColor(196,78, 0));

DefineGlobalColor("dn2", CreateColor(137,55, 0));

DefineGlobalColor("dn1", CreateColor(78, 31, 0));

#//@function Calculates polynomial regression

Script polynomial_regression {

input src = hlc3;

input length = 100;

def sumY = sum(src, length);

def sumX = fold i = 0 to length with x do

x + i;

def sumXY = fold i1 = 0 to length with xy do

xy + i1 * src[i1];

def sumX2 = fold i2 = 0 to length with x2 do

x2 + i2 * i2;

def sumX3 = fold i3 = 0 to length with x3 do

x3 + i3 * i3 * i3;

def sumX4 = fold i4 = 0 to length with x4 do

x4 + i4 * i4 * i4 * i4;

def sumX2Y = fold i5 = 0 to length with x2y do

x2y + i5 * i5 * src[i5];

def slope = (length * sumXY - sumX * sumY) / (length * sumX2 - sumX * sumX);

def intercept = (sumY - slope * sumX) / length;

def polynomial_regression = slope + intercept;

plot out = polynomial_regression;

}

#// Calculate basis using polynomial regression

def basis = polynomial_regression(src, length);

#// Calculate ATR and its SMA

def tr = TrueRange(high(Period = tf), close(Period = tf), low(Period = tf));

def atr = WildersAverage(tr, length);

def atr_sma = Average(atr, 10);

#// Calculate Keltner Channel Bands

def dynamicMultiplier = (1 + (atr / atr_sma)) * multi;

def volatility_basis = (1 + (atr / atr_sma)) * dynamicMultiplier * atr;

#// Set values for upper and lower bands

# // 4 bands above and below basis

def m0 = channelSensitivity;

def m1 = m0 + channelSensitivity;

def m2 = m1 + channelSensitivity;

def m3 = m2 + channelSensitivity;

def upper0 = basis + volatility_basis * m0;

def lower0 = basis - volatility_basis * m0;

def upper1 = basis + volatility_basis * m1;

def lower1 = basis - volatility_basis * m1;

def upper2 = basis + volatility_basis * m2;

def lower2 = basis - volatility_basis * m2;

def upper3 = basis + volatility_basis * m3;

def lower3 = basis - volatility_basis * m3;

#// Calculate Overbought/Oversold

def ob_os = (src - basis)/(upper3 - lower3);

def avgOBOS = Average(ob_os, 10);

#// Signal Conditions

def trend = basis > basis[2];

def crossUp = (close Crosses Above lower3);

def crossDn = (close Crosses Below upper3);

def col = if src > upper3 then 4 else

if src > upper2 then 3 else

if src > upper1 then 2 else

if src > upper0 then 1 else

if src < lower3 then -4 else

if src < lower2 then -3 else

if src < lower1 then -2 else

if src < lower0 then -1 else 0;

AssignPriceColor(if !colorBars then Color.CURRENT else

if col== 4 then GlobalColor("up4") else

if col== 3 then GlobalColor("up3") else

if col== 2 then GlobalColor("up2") else

if col== 1 then GlobalColor("up1") else

if col==-4 then GlobalColor("dn4") else

if col==-3 then GlobalColor("dn3") else

if col==-2 then GlobalColor("dn2") else

if col==-1 then GlobalColor("dn1") else color.GRAY);

#// 𝙑𝙄𝙎𝙐𝘼𝙇𝙄𝙕𝘼𝙏𝙄𝙊𝙉

plot obSig = if crossDn then high else na;

plot osSig = if crossUp then low else na;

plot basisLine = if basis then basis else na;

obSig.SetDefaultColor(GetColor(0));

osSig.SetDefaultColor(GetColor(1));

obSig.setPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

osSig.setPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

basisLine.AssignValueColor(if trend then GetColor(1) else GetColor(0));

#// Plot upper and lower bands

plot up1 = if showChannel and trend then upper0 else na;

plot up2 = if showChannel and trend then upper1 else na;

plot up3 = if showChannel and trend then upper2 else na;

plot up4 = if showChannel and trend then upper3 else na;

plot lo1 = if !showChannel or trend then na else lower0;

plot lo2 = if !showChannel or trend then na else lower1;

plot lo3 = if !showChannel or trend then na else lower2;

plot lo4 = if !showChannel or trend then na else lower3;

up1.SetDefaultColor(GlobalColor("up1"));

up2.SetDefaultColor(GlobalColor("up2"));

up3.SetDefaultColor(GlobalColor("up3"));

up4.SetDefaultColor(GlobalColor("up4"));

lo1.SetDefaultColor(GlobalColor("dn1"));

lo2.SetDefaultColor(GlobalColor("dn2"));

lo3.SetDefaultColor(GlobalColor("dn3"));

lo4.SetDefaultColor(GlobalColor("dn4"));

#-- END of CODE