Author Message:

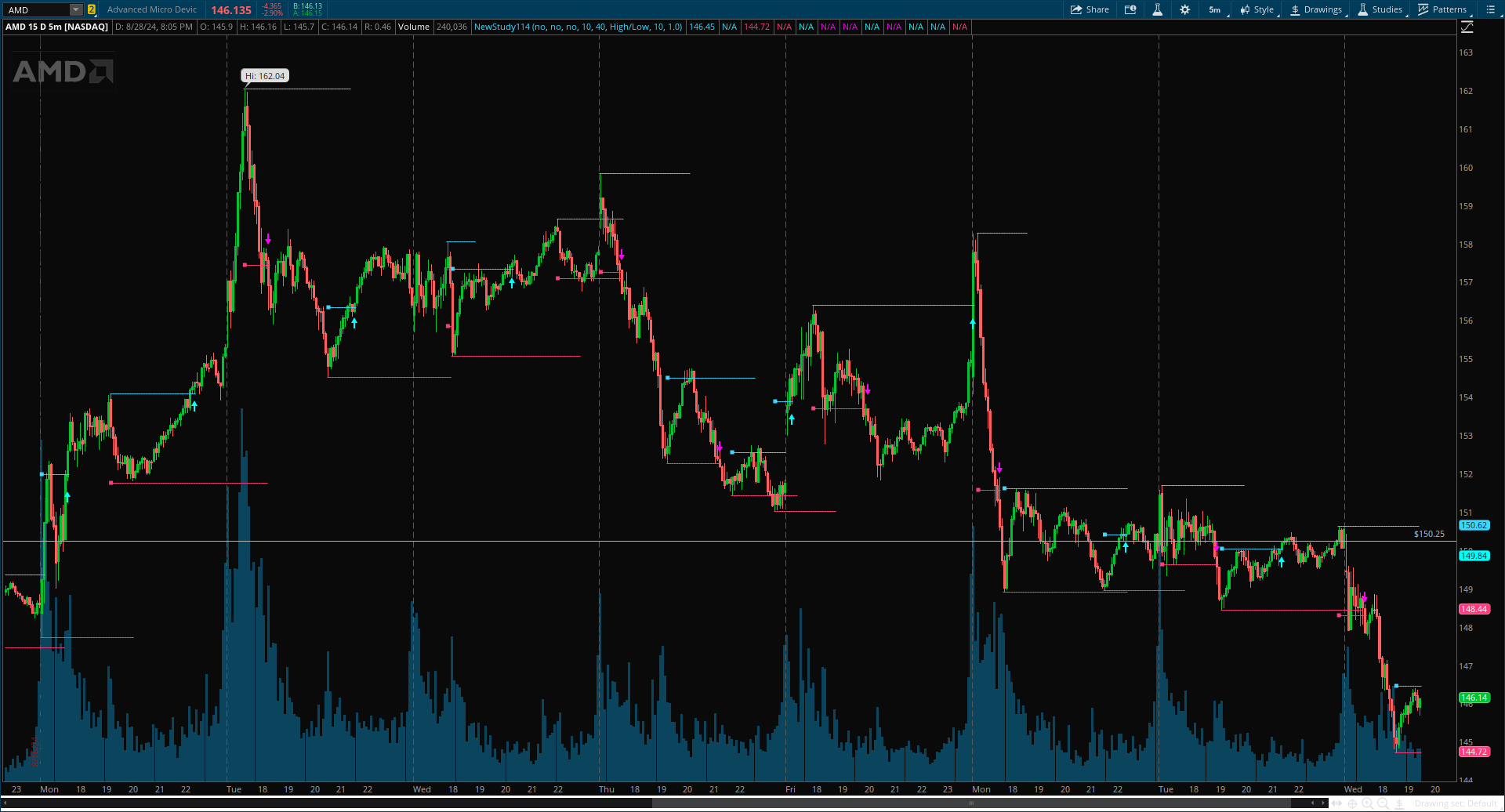

The Pivot Channel Break indicator identifies key pivot points and creates a dynamic channel based on these pivots. It detects breakouts from this channel, providing potential entry and exit signals for traders.

CODE:

CSS:

# Indicator for TOS

#// © BigBeluga

#indicator("Pivot Channel Breaks [BigBeluga]", overlay = true, max_lines_count = 20)

# Converted by Sam4Cok@Samer800 - 08/2024

input barColor = no; #(false, "Bar Color")

input showRetest = no; #, "Support & Resistance Signals")

input showPivotsLabels = no;

input pivot_right = 10;

input pivot_left = 40;

input trueRangeCalc = {Default "High/Low", "ATR"};

input trueRangeLength = 10;

input ChannelWidth = 1.0; #, "Channel Withd", step = 0.1)

def na = Double.NaN;

def last = IsNaN(close);

def HiLo = trueRangeCalc==trueRangeCalc."High/Low";

#-- Colors

DefineGlobalColor("up", CreateColor(58, 216, 255));

DefineGlobalColor("dn", CreateColor(255, 60, 124));

DefineGlobalColor("dup", CreateColor(26, 123, 130));

DefineGlobalColor("ddn", CreateColor(129, 27, 70));

#-- func

script Pivot {

input series = close;

input leftBars = 10;

input rightBars = 10;

input isHigh = yes;

def na = Double.NaN;

def HH = series == Highest(series, leftBars + 1);

def LL = series == Lowest(series, leftBars + 1);

def pivotRange = (leftBars + rightBars + 1);

def leftEdgeValue = if series[pivotRange] == 0 then na else series[pivotRange];

def pvtCond = !IsNaN(series) and leftBars > 0 and rightBars > 0 and !IsNaN(leftEdgeValue);

def barIndexH = if pvtCond then

fold i = 1 to rightBars + 1 with p=1 while p do

series > GetValue(series, - i) else na;

def barIndexL = if pvtCond then

fold j = 1 to rightBars + 1 with q=1 while q do

series < GetValue(series, - j) else na;

def PivotPoint;

if isHigh {

PivotPoint = if HH and barIndexH then series else na;

} else {

PivotPoint = if LL and barIndexL then series else na;

}

plot pvt = PivotPoint;

}

#//# Calculations

#// Detect pivot points

def ph = pivot(high[pivot_right], pivot_left, pivot_right, yes);

def pl = pivot(low[pivot_right], pivot_left, pivot_right, no);

def p_h = !IsNaN(ph);

def p_l = !IsNaN(pl);

#// Calculate channel bands

def basis = Average(close, trueRangeLength);

def tr = if HiLo then (high - low) else TrueRange(high, close, low);

def uppper_dev = basis + WildersAverage(tr, trueRangeLength) * ChannelWidth;

def lower_dev = basis - WildersAverage(tr, trueRangeLength) * ChannelWidth;

#// Set channel points based on pivot highs and lows

def point_l;

def point_h;

if p_h {

point_l = lower_dev;

point_h = high[pivot_right];

} else if p_l {

point_l = low[pivot_right];

point_h = uppper_dev;

} else {

point_l = point_l[1];

point_h = point_h[1];

}

#// Draw channel lines and labels

def cond = p_h[-pivot_right] or p_l[-pivot_right];

def StateL1 = {default "ini", "1"};

def line1;

def line11;

def cnt1;

Switch (StateL1[1]) {

Case "1" :

StateL1 = StateL1[1];

if cond {

cnt1 = 0;

line11 = line1[1];

line1 = point_h[-pivot_right];

} else {

cnt1 = cnt1[1] + 1;

line1 = if low > line1[1] then na else line1[1];

line11 = if low > line11[1] then na else if cnt1 >= pivot_right then na else line11[1];

}

Default :

cnt1 = 0;

StateL1 = StateL1."1";

line1 = na;

line11 = na;

}

#-- Pvt Low Lines

def StateL2 = {default "ini", "1"};

def line2;

def line22;

def cnt2;

Switch (StateL2[1]) {

Case "1" :

StateL2 = StateL2[1];

if cond {

cnt2 = 0;

line22 = line2[1];

line2 = point_l[-pivot_right];

} else {

cnt2 = cnt2[1] + 1;

line22 = if high < line22[1] then na else if cnt2 >= pivot_right then na else line22[1];

line2 = if high < line2[1] then na else line2[1];

}

Default :

cnt2 = 0;

StateL2 = StateL2."1";

line22 = na;

line2 = na;

}

#// Detect breakouts

def break_up = (low Crosses Above point_h[-pivot_right]);

def break_dn = (high crosses below point_l[-pivot_right]);

def breakUp = (low Crosses Above point_h);

def breakDn = (high crosses below point_l);

#// Set trend color based on breakouts

def trend_col;

if breakUp {

trend_col = 1;

} else if breakDn {

trend_col = -1;

} else {

trend_col = trend_col[1];

}

#// Detect and plot support and resistance signals

def resist = (high crosses below line1) and !break_dn and !p_h[-pivot_right+1] and showRetest;

def support = (low crosses above line2) and !break_up and !p_l[-pivot_right+1] and showRetest;

def resist1 = (high crosses below line11) and !break_dn and !p_h[-pivot_right+1] and showRetest;

def support1 = (low crosses above line22) and !break_up and !p_l[-pivot_right+1] and showRetest;

#-- plot

plot pvtHiLine = if line1 then line1 else na;

plot pvtHiLine1 = if line11 then line11 else na;

plot pvtLoLine = if line2 then line2 else na;

plot pvtLoLine1 = if line22 then line22 else na;

pvtHiLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtLoLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtHiLine1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtLoLine1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtHiLine.SetDefaultColor(GlobalColor("up"));

pvtHiLine1.SetDefaultColor(GlobalColor("up"));

pvtLoLine.SetDefaultColor(GlobalColor("dn"));

pvtLoLine1.SetDefaultColor(GlobalColor("dn"));

# // Plot breakout signals

plot breakRes = if break_up[-1] then line1-atr(14)/2 else na;

plot breakSup = if break_dn[-1] then line2+atr(14)/2 else na;

breakRes.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

breakSup.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

breakRes.SetDefaultColor(Color.CYAN);

breakSup.SetDefaultColor(Color.MAGENTA);

#/ Plot pivot high and low points

plot resSig = if resist[-1] then high else na;

plot supSig = if support[-1] then low else na;

plot resSig1 = if resist1[-1] then high else na;

plot supSig1 = if support1[-1] then low else na;

resSig.SetLineWeight(2);

resSig.SetDefaultColor(Color.MAGENTA);

resSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

supSig.SetLineWeight(2);

supSig.SetDefaultColor(Color.CYAN);

supSig.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

resSig1.SetLineWeight(2);

resSig1.SetDefaultColor(Color.MAGENTA);

resSig1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

supSig1.SetLineWeight(2);

supSig1.SetDefaultColor(Color.CYAN);

supSig1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

#// Plot channel points

plot dtUp = if p_l[-pivot_right] then point_h[-pivot_right] else na;

plot dtDn = if p_h[-pivot_right] then point_l[-pivot_right] else na;

dtUp.SetLineWeight(2);

dtDn.SetLineWeight(2);

dtUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

dtDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

dtUp.SetDefaultColor(GlobalColor("up"));

dtDn.SetDefaultColor(GlobalColor("dn"));

#-- Bubbles

def ph_1 = if p_h then ph else ph_1[1];

def pl_1 = if p_l then pl else pl_1[1];

def hh = if p_h and ph > ph_1[1] then ph else na;

def ll = if p_l and pl < pl_1[1] then pl else na;

def hl = if pl_1 > pl_1[1] then pl_1 else na;

def lh = if ph_1 < ph_1[1] then ph_1 else na;

AddChartBubble(showPivotsLabels and hh[-pivot_right], hh[-pivot_right] , "HH", Color.GREEN);

AddChartBubble(showPivotsLabels and ll[-pivot_right], ll[-pivot_right] , "LL", Color.RED, no);

AddChartBubble(showPivotsLabels and lh[-pivot_right], lh[-pivot_right] , "LH", Color.DARK_GREEN);

AddChartBubble(showPivotsLabels and hl[-pivot_right], hl[-pivot_right] , "HL", Color.DARK_RED, no);

#-- bar color

AssignPriceColor( if !barColor then Color.CURRENT else

if trend_col > 0 then GlobalColor("dup") else

if trend_col < 0 then GlobalColor("ddn") else Color.DARK_GRAY);

#-- END of CODE