Hello All,

Identify the High, Low, and Close values of a one-hour candle formed between 16:00 and 17:00 (EST)

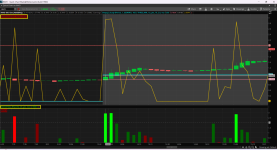

I am looking for a ThinkScript code that can identify the high, low, and close values of a one-hour candle formed between 16:00 and 17:00 (EST) and plot them as horizontal lines. I also intend to utilize this script for scanning purposes with a one-hour aggregation period, enabling it to scan stocks where the closing price has crossed below the low of the 16:00–17:00 candle. Please help.

Thank you very much

Bumping up the post again for attention

Identify the High, Low, and Close values of a one-hour candle formed between 16:00 and 17:00 (EST)

I am looking for a ThinkScript code that can identify the high, low, and close values of a one-hour candle formed between 16:00 and 17:00 (EST) and plot them as horizontal lines. I also intend to utilize this script for scanning purposes with a one-hour aggregation period, enabling it to scan stocks where the closing price has crossed below the low of the 16:00–17:00 candle. Please help.

Thank you very much

Bumping up the post again for attention

Last edited by a moderator: