hectorgasm

Member

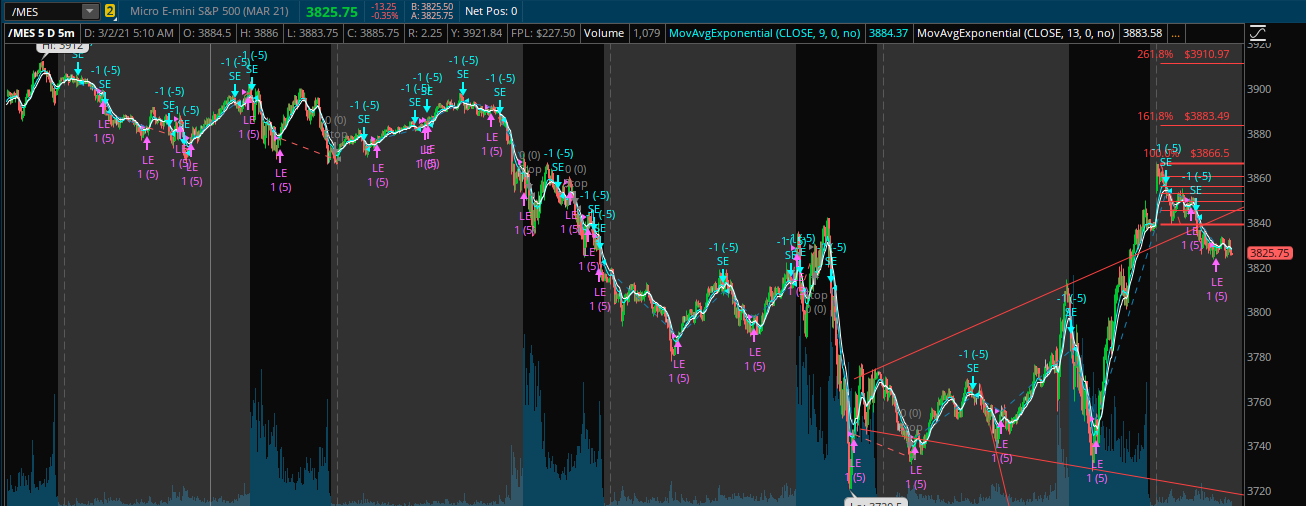

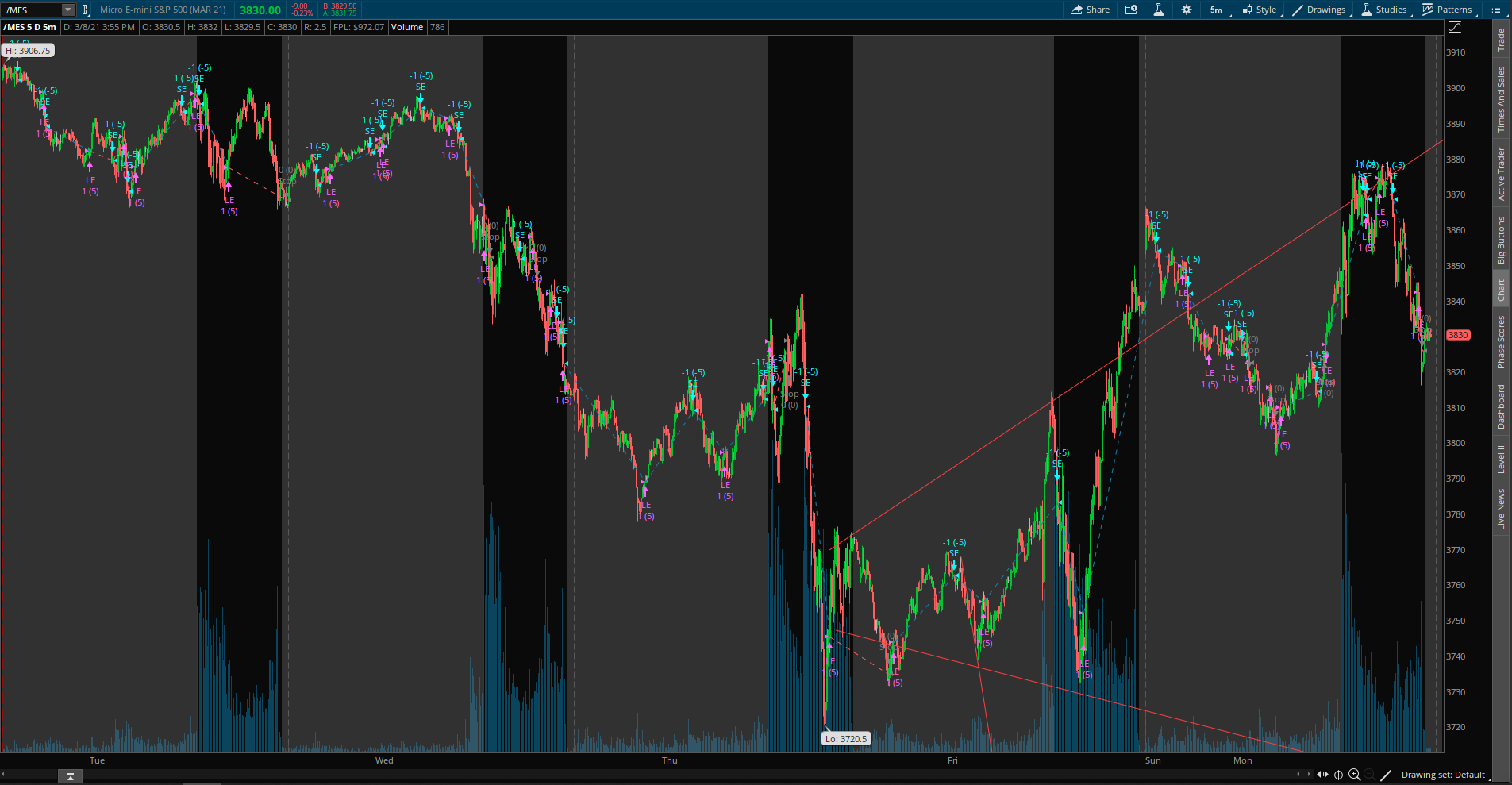

This is intended to use on a 5 minute graph

-Please feel free to comment or suggest further enhancements

http://tos.mx/HaokTj2

Code:

##CREATED BY GASMOS ;)

######################## PLOTTING THE SLOWRSI #####################################

input emaLength = 5;

input rsiLength = 10;

input over_bought = 80;

input over_sold = 20;

#breakout signals of SLOWRSI

input averageType = AverageType.WILDERS;

input showBreakoutSignals = no;

def ema = ExpAverage(close, emaLength);

def netChgAvg = WildersAverage(close - ema, rsiLength);

def totChgAvg = WildersAverage(AbsValue(close - ema), rsiLength);

def chgRatio = if totChgAvg != 0 then netChgAvg / totChgAvg else 0;

def SlowRSI = 50 * (chgRatio + 1);

def OverBought = over_bought;

def MiddleLine = 50;

def OverSold = over_sold;

#plot breakout signals of SLOWRSI

def UpSignal = if SlowRSI crosses above OverSold then OverSold else Double.NaN;

def DownSignal = if SlowRSI crosses below OverBought then OverBought else Double.NaN;

#Moving Averages of SLOWRSI

input MALength = 9;

input AverageType1 = AverageType.WEIGHTED;

input MALength2 = 26;

input AverageType2 = AverageType.SIMPLE;

input MALength3 = 57;

input AverageType3 = AverageType.SIMPLE;

input MALength4 = 200;

input AverageType4 = AverageType.HULL;

# plot the Moving Averages of SLOWRSI

def MA = MovingAverage(AverageType1, SlowRSI, MALength);

def pMA = MA;

def MA2 = MovingAverage(AverageType2, SlowRSI, MALength2);

def pMA2 = MA2;

def MA3 = MovingAverage (AverageType3, SlowRSI, MALength3);

def pMA3 = MA3;

def MA4 = MovingAverage(AverageType4, SlowRSI, MALength4);

def pMA4 = MA4;

################################ Plotting the MomentumSMA ###############################

input price = close;

input momentumLength = 26;

input smaLength = 26;

input AverageType11 = AverageType.SIMPLE;

input smaLength2 = 100;

input AverageType22 = AverageType.SIMPLE;

#Momentum

Assert(momentumLength > 0, "'momentum length' must be positive: " + momentumLength);

def Momentum = price - price[momentumLength];

#MomentumSMA Moving averages

def MA11 = MovingAverage(AverageType11, Momentum, smaLength);

def pMA11 = MA11;

def MA22 = MovingAverage(AverageType22, Momentum, smaLength2);

def pMA22 = MA22;

def ZeroLine = 0;

#plotting the arrows of Momentum SMA

def UpSignal1 = if Momentum crosses above pMA11 then pMA11 else Double.NaN;

def DownSignal2 = if Momentum crosses below pMA11 then pMA11 else Double.NaN;

####################### PLOTTING Z SCORE #####################################

def Data = close;

#Computes and plots the Zscore

#Provided courtesy of ThetaTrend.com

#Feel free to share the indicator, but please provide a link back to ThetaTrend.com

input length = 20;

input ZavgLength = 26;

#Initialize values

def oneSD = StDev(price, length);

def avgClose = SimpleMovingAvg(price, length);

def ofoneSD = oneSD * price[1];

def Zscorevalue = ((price - avgClose) / oneSD);

def avgZv = Average(Zscorevalue, 20);

#Compute and plot Z-Score

def Zscore = ((price - avgClose) / oneSD);

def avgZscore = Average(Zscorevalue, ZavgLength);

#This is an optional plot that will display the momentum of the Z-Score average

#plot momZAvg = (avgZv-avgZv[5]);

#Plot zero line and extreme bands

def zero = 0;

def two = 2;

def one = 1;

def negone = -1;

def negtwo = -2;

############# Plotting DEMANDIndex #################

input lengthDI = 20;

def wClose = (high + low + 2 * close) * 0.25;

def wCRatio = (wClose - wClose[1]) / Min(wClose, wClose[1]);

def closeRatio = 3 * wClose / Average(Highest(high, 2) - Lowest(low, 2), lengthDI) * AbsValue(wCRatio);

def volumeRatio = volume / Average(volume, lengthDI);

def volumePerClose = volumeRatio / Exp(Min(88, closeRatio));

def buyP;

def sellP;

if (wCRatio > 0) {

buyP = volumeRatio;

sellP = volumePerClose;

} else {

buyP = volumePerClose;

sellP = volumeRatio;

}

def buyPres = if IsNaN(buyPres[1]) then 0 else ((buyPres[1] * (lengthDI - 1)) + buyP) / lengthDI;

def sellPres = if IsNaN(sellPres[1]) then 0 else ((sellPres[1] * (lengthDI - 1)) + sellP) / lengthDI;

def tempDI;

if ((((sellPres[1] * (lengthDI - 1)) + sellP) / length - ((buyPres[1] * (lengthDI - 1)) + buyP) / lengthDI) > 0) {

tempDI = - if (sellPres != 0) then buyPres / sellPres else 1;

} else {

tempDI = if (buyPres != 0) then sellPres / buyPres else 1;

}

def DMIndx = if IsNaN(close) then Double.NaN else if tempDI < 0 then -1 - tempDI else 1 - tempDI;

def ZeroLineDI = 0;

#Demand Index Moving Averages

input DMIndxMALength = 8;

input DMIndxAverageType = AverageType.SIMPLE;

input DMIndxMALength2 = 26;

input DMIndxAverageType2 = AverageType.WEIGHTED;

input DMIndxMALength3 = 40;

input DMIndxAverageType3 = AverageType.SIMPLE;

input DMIndxMALength4 = 50;

input DMIndxAverageType4 = AverageType.SIMPLE;

def DMIndxMA = MovingAverage(DMIndxAverageType, DMIndx, DMIndxMALength);

def pDMIndxMA = DMIndxMA;

def DMIndxMA2 = MovingAverage(DMIndxAverageType2, DMIndx, DMIndxMALength2);

def pDMIndxMA2 = DMIndxMA2;

def DMIndxMA3 = MovingAverage(DMIndxAverageType3, DMIndx, DMIndxMALength3);

def pDMIndxMA3 = DMIndxMA3;

def DMIndxMA4 = MovingAverage(DMIndxAverageType4, DMIndx, DMIndxMALength4);

def pDMIndxMA4 = DMIndxMA4;

##########USE THIS STRATEGY FOR CONSISTENT RESULTS

AddOrder(OrderType.BUY_auto, SlowRSI crosses above pMA2 and Zscore > -1 and SlowRSI < MiddleLine and SLOWRSI > Oversold and dMIndx > pDMIndxMA2 and (Momentum > pMA11 or Momentum > Zeroline), tickcolor = GetColor(0), arrowcolor = GetColor(0), name = "LE");

AddOrder(OrderType.SELL_auto, SlowRSI crosses below pMA2 and Zscore < -1 and SLOWRSI > Oversold and (dMIndx < pDMIndxMA2), tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "SE");

AddOrder(OrderType.SELL_auto, SlowRSI crosses below pMA2 and Zscore < 1 and SlowRSI > MiddleLine and SLOWRSI < Overbought and dMIndx < pDMIndxMA2 and (Momentum < pMA11 or Momentum < Zeroline), tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "SE");

AddOrder(OrderType.BUY_auto, SlowRSI crosses above pMA2 and Zscore > -1 and SLOWRSI > Oversold and (dMIndx > pDMIndxMA2), tickcolor = GetColor(0), arrowcolor = GetColor(0), name = "LE");

#STOP LOSS ATR

input stop_mult = 2.5;

def stopb = EntryPrice() - ATR() * stop_mult;

AddOrder(OrderType.SELL_to_close, CLOSE <= stopb, tickcolor = Color.GRAY, arrowcolor = Color.GRAY, name = "Stop", price = stopb);

def stops = EntryPrice() + ATR() * stop_mult;

AddOrder(OrderType.BUY_to_close, CLOSE >= stops, tickcolor = Color.GRAY, arrowcolor = Color.GRAY, name = "Stop", price = stops);

Last edited: