rockster195

New member

I was browsing through research articles and came upon this article pertaining to the MACD.

Volume 2018 | Article ID 9280590 | https://doi.org/10.1155/2018/9280590

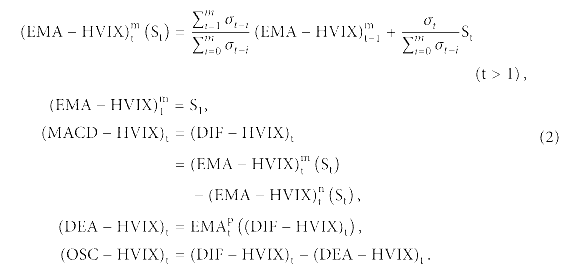

To provide a summary, the professors explain that the MACD, while reliable and widely used by traders, and focuses solely on price points to measure momentum and trend, it is prone to false signals and has a lagging sense that could make entering a trade a little late or provide a false opportunity. To combat this, the professors believe that by adding Historical Volatility to the MACD, it will provide faster responses, as well as less fluctuations (therefore less false signals). The professors even provided their own backtesting on the proposed HVIX-MACD and has provided a better win rate from buying and selling the next day, selling after the 5th day, and selling after the 10th day. They also provided comparisons to the default MACD to support their claims.

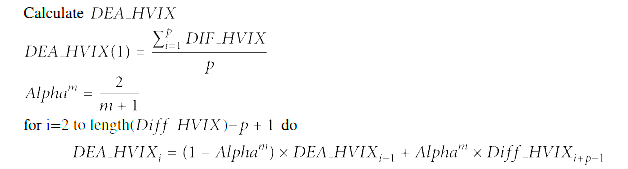

On the lower end of the article, the professors provided the formula for the default MACD as well as providing their algorithm for their proposed MACD_HVIX.

(An expanded and detailed walkthrough is also provided via this link: "https://www.hindawi.com/journals/mpe/2018/9280590/alg1/").

Unfortunately, my flaw is that I find it difficult to decipher math language into codeable language; let alone thinkscript language, but I wasn't backing on something that has been proven well.

Below is the result from my attempt:

Shareable code link: https://tos.mx/8z6yicn

To see the differences in action, I provided a couple of screenshots from the MACD, and MACD_HVIX to let you be the judge.

On the first image is the $QQQ and I've highlighted the major differences. On the left side, we see the MACD telling the user that the Average (cyan color) crossed below the zero line and the stock is in a potential downtrend. BUT, the MACD_HVIX tells a different story, telling the user that not only did it drop, it never crossed below the zero line to dictate a downtrend, and if you look closely, it hasn't provided a signal crossover (buy signal) until the indicator showed it's breakout above.

On the right side of the first image, we see the MACD having difficulty keeping the downward trend and providing false reverse signals, unlike MACD_HVIX that does it's best into holding on to the trend while providing minimal false positives.

I'm also including an extra screenshot for more comparisons.

$TSLA

An issue

For my first attempt of deciphering math language, I feel like I did a pretty good job, unfortunately, I left out a piece of code due to it being difficult for me to understand, maybe some of you guys can look into a solution for this, and if you know how to decipher math language to thinkscript, I would love it greatly for you to review my code and make any adjustments to make this code reliable for the community as it is also lagging by two bars when it comes to reversals. Thank you for looking at my code.

NOTE: Due to the complexity of the indicator, there may be times where the indicator doesn't show. I find it that if you run MACD, the indicator tends to show up.

Volume 2018 | Article ID 9280590 | https://doi.org/10.1155/2018/9280590

To provide a summary, the professors explain that the MACD, while reliable and widely used by traders, and focuses solely on price points to measure momentum and trend, it is prone to false signals and has a lagging sense that could make entering a trade a little late or provide a false opportunity. To combat this, the professors believe that by adding Historical Volatility to the MACD, it will provide faster responses, as well as less fluctuations (therefore less false signals). The professors even provided their own backtesting on the proposed HVIX-MACD and has provided a better win rate from buying and selling the next day, selling after the 5th day, and selling after the 10th day. They also provided comparisons to the default MACD to support their claims.

On the lower end of the article, the professors provided the formula for the default MACD as well as providing their algorithm for their proposed MACD_HVIX.

(An expanded and detailed walkthrough is also provided via this link: "https://www.hindawi.com/journals/mpe/2018/9280590/alg1/").

Unfortunately, my flaw is that I find it difficult to decipher math language into codeable language; let alone thinkscript language, but I wasn't backing on something that has been proven well.

Below is the result from my attempt:

Code:

declare lower;

#Credit goes to the researchers at https://doi.org/10.1155/2018/9280590

script EMA_HVIX {

input length = 12;

def R = Sum((Log(close[1]) / Log(close)), length); #Generates logarithmic returns from the previous close

def R_mean = R / (length - 1); #Returns the mean average from "length" - 1 days.

def sumVariance = Sum(Power((R - R_mean), 2), length-2); #Sums the variance in the past "length" - 1 days.

def deviation = Sqrt(sumVariance / length - 2); #Calculating the standard deviation in the past "length" - 2 days.

def sumonedeviation = Sum(deviation, length - 1); #

def sumtwodeviation = Sum(deviation, length - 2); #Sums up both deviation in alternating days.

def alphahvix = 1 - (sumtwodeviation/sumonedeviation); #Returns the ALPHA_VIX

def ema_hvix = (1 - alphahvix[1])*ema_hvix[1] + Alphahvix[1]*close;

plot data = ema_hvix; #plots the EMA with Historical Volatility;

}

input fastLength = 12; # According to the paper, this is classified as "m"

input slowLength = 26; # Default settings for MACD; "n"

input MACDLength = 9; # "p"

def alpha = 2 / fastlength + 1;

plot dif = EMA_HVIX(fastLength) - EMA_HVIX(SlowLength);

def dea_hvix = (Sum(dif, macdlength) / macdlength); #Sum(dif, macdlength) / macdlength; #Starting Gun

def de = dea_hvix; #(1 - Power(Alpha, fastlength)) * de[1] + Power(Alpha, fastLength) * dif[1];

plot dea = de ;

plot osc = dif - dea; #Osc is Histogram

plot ZeroLine = 0;

dif.SetDefaultColor(Color.CYAN);

dea.SetDefaultColor(Color.RED);

osc.SetDefaultColor(GetColor(5));

osc.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

osc.SetLineWeight(3);

osc.DefineColor("Positive and Up", Color.GREEN);

osc.DefineColor("Positive and Down", Color.DARK_GREEN);

osc.DefineColor("Negative and Down", Color.RED);

osc.DefineColor("Negative and Up", Color.DARK_RED);

osc.AssignValueColor(if osc >= 0 then if osc > osc[1] then osc.Color("Positive and Up") else osc.Color("Positive and Down") else if osc < osc[1] then osc.Color("Negative and Down") else osc.Color("Negative and Up"));

ZeroLine.SetDefaultColor(GetColor(0));Shareable code link: https://tos.mx/8z6yicn

To see the differences in action, I provided a couple of screenshots from the MACD, and MACD_HVIX to let you be the judge.

On the first image is the $QQQ and I've highlighted the major differences. On the left side, we see the MACD telling the user that the Average (cyan color) crossed below the zero line and the stock is in a potential downtrend. BUT, the MACD_HVIX tells a different story, telling the user that not only did it drop, it never crossed below the zero line to dictate a downtrend, and if you look closely, it hasn't provided a signal crossover (buy signal) until the indicator showed it's breakout above.

On the right side of the first image, we see the MACD having difficulty keeping the downward trend and providing false reverse signals, unlike MACD_HVIX that does it's best into holding on to the trend while providing minimal false positives.

I'm also including an extra screenshot for more comparisons.

$TSLA

An issue

For my first attempt of deciphering math language, I feel like I did a pretty good job, unfortunately, I left out a piece of code due to it being difficult for me to understand, maybe some of you guys can look into a solution for this, and if you know how to decipher math language to thinkscript, I would love it greatly for you to review my code and make any adjustments to make this code reliable for the community as it is also lagging by two bars when it comes to reversals. Thank you for looking at my code.

NOTE: Due to the complexity of the indicator, there may be times where the indicator doesn't show. I find it that if you run MACD, the indicator tends to show up.