Last February, @mashume was kind enough to write a program that let me do averaging of RSI's. I was trying to use that as a template and do the same thing with MACD's. I don't code , so it's cut and paste and I have not been able to get it to work. Any help is appreciated.

Here is the original from Mashume.

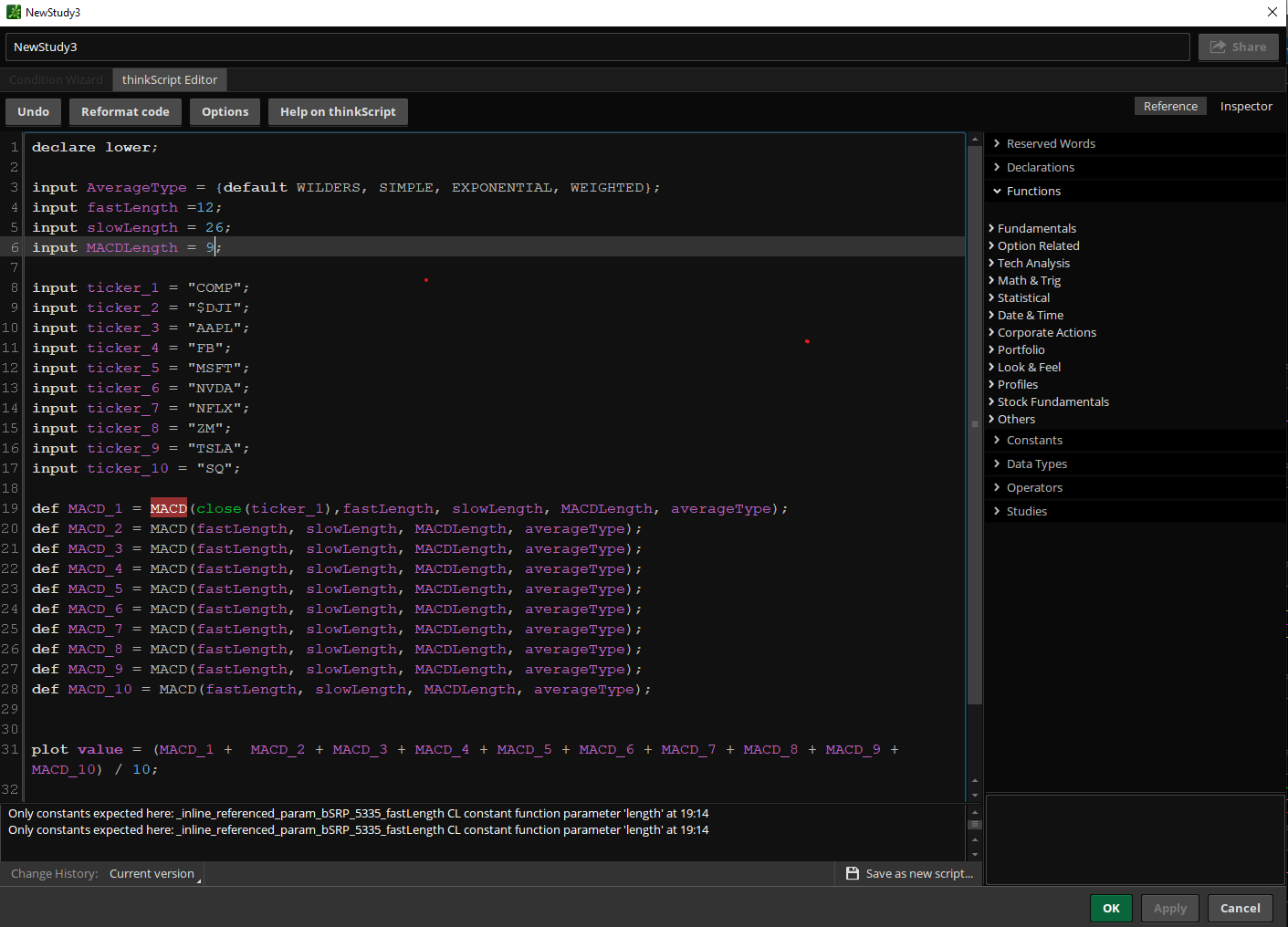

Here's the code I'm having trouble with:

Here is the original from Mashume.

Code:

# AVERAGE of RSIs FOR GROUP OF STOCKS

#

# useThinkScript

# 2020-02-26

# [USER=153]@mashume[/USER]

declare lower;

input RSI_TYPE = {default WILDERS, SIMPLE, EXPONENTIAL};

input RSI_LENGTH = 14;

input OS = 40;

input OB = 60;

input ticker_1 = "SBUX";

input ticker_2 = "MSFT";

input ticker_3 = "AMZN";

input ticker_4 = "COST";

input ticker_5 = "FFIV";

input ticker_6 = "DAIO";

input ticker_7 = "MRNA";

def RSI_1 = RSI(price = close(ticker_1), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_2 = RSI(price = close(ticker_2), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_3 = RSI(price = close(ticker_3), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_4 = RSI(price = close(ticker_4), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_5 = RSI(price = close(ticker_5), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_6 = RSI(price = close(ticker_6), "average type" = RSI_TYPE, length = RSI_LENGTH);

def RSI_7 = RSI(price = close(ticker_7), "average type" = RSI_TYPE, length = RSI_LENGTH);

plot data = (RSI_1 + RSI_2 + RSI_3 + RSI_4 + RSI_5 + RSI_6 + RSI_7) / 7;

plot midline = 50;

midline.SetDefaultColor(Color.GRAY);

# plot rsi = rsi(price = data);

data.SetDefaultColor(Color.CYAN);

data.SetLineWeight(2);

plot oversold = OS;

oversold.SetDefaultColor(Color.RED);

plot overbought = OB;

overbought.SetDefaultColor(Color.GREEN);Here's the code I'm having trouble with:

Code:

declare lower;

input AverageType = {default WILDERS, SIMPLE, EXPONENTIAL, WEIGHTED};

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input ticker_1 = "COMP";

input ticker_2 = "$DJI";

input ticker_3 = "AAPL";

input ticker_4 = "FB";

input ticker_5 = "MSFT";

input ticker_6 = "NVDA";

input ticker_7 = "NFLX";

input ticker_8 = "ZM";

input ticker_9 = "TSLA";

input ticker_10 = "SQ";

def MACD_1 = MACD(Value = close(ticker_1), fastLength, slowLength, MACDLength, averageType);

def MACD_2 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_3 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_4 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_5 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_6 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_7 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_8 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_9 = MACD(fastLength, slowLength, MACDLength, averageType);

def MACD_10 = MACD(fastLength, slowLength, MACDLength, averageType);

plot value = (MACD_1 + MACD_2 + MACD_3 + MACD_4 + MACD_5 + MACD_6 + MACD_7 + MACD_8 + MACD_9 + MACD_10) / 10;