Big thanks to you guys. Ive learned so much and improved my day trading

My biggest loses occur when Im not actively watching the stock whether it is because night time and Im sleeping when a tweet gets posted that adds volatility to the market

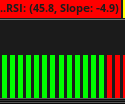

I wrote a ahk Auto hot key script that uses atr and rsi to exit positions for me if Im not actively watching.

It acts like a trailing stop but it works 24hrs a day. The problem I have is that during the evening, when market is running flat, the ema or atr gets closer and closer to the price action and a change of only a few cents can trigger it.

The good thing about using ahk versus a trailing stop is that I can adjust the time delay seeing the price action so that momentary blips down dont take me out of trade prematurely by using 2000ms of seeing sell signal continuously before triggering the sell.

I tried searching usethinkscript, but perhaps I wasn't using the correct search

My question is this...

Is there an indicator now or can one be created that looks at the high of price action statically (not a moving average ) and triggers a label of say 10cents if the price action is moving up, then reverses? For night time, it would be especially helpful for exiting positions.

My biggest loses occur when Im not actively watching the stock whether it is because night time and Im sleeping when a tweet gets posted that adds volatility to the market

I wrote a ahk Auto hot key script that uses atr and rsi to exit positions for me if Im not actively watching.

It acts like a trailing stop but it works 24hrs a day. The problem I have is that during the evening, when market is running flat, the ema or atr gets closer and closer to the price action and a change of only a few cents can trigger it.

The good thing about using ahk versus a trailing stop is that I can adjust the time delay seeing the price action so that momentary blips down dont take me out of trade prematurely by using 2000ms of seeing sell signal continuously before triggering the sell.

I tried searching usethinkscript, but perhaps I wasn't using the correct search

My question is this...

Is there an indicator now or can one be created that looks at the high of price action statically (not a moving average ) and triggers a label of say 10cents if the price action is moving up, then reverses? For night time, it would be especially helpful for exiting positions.

Last edited: