Author Message:

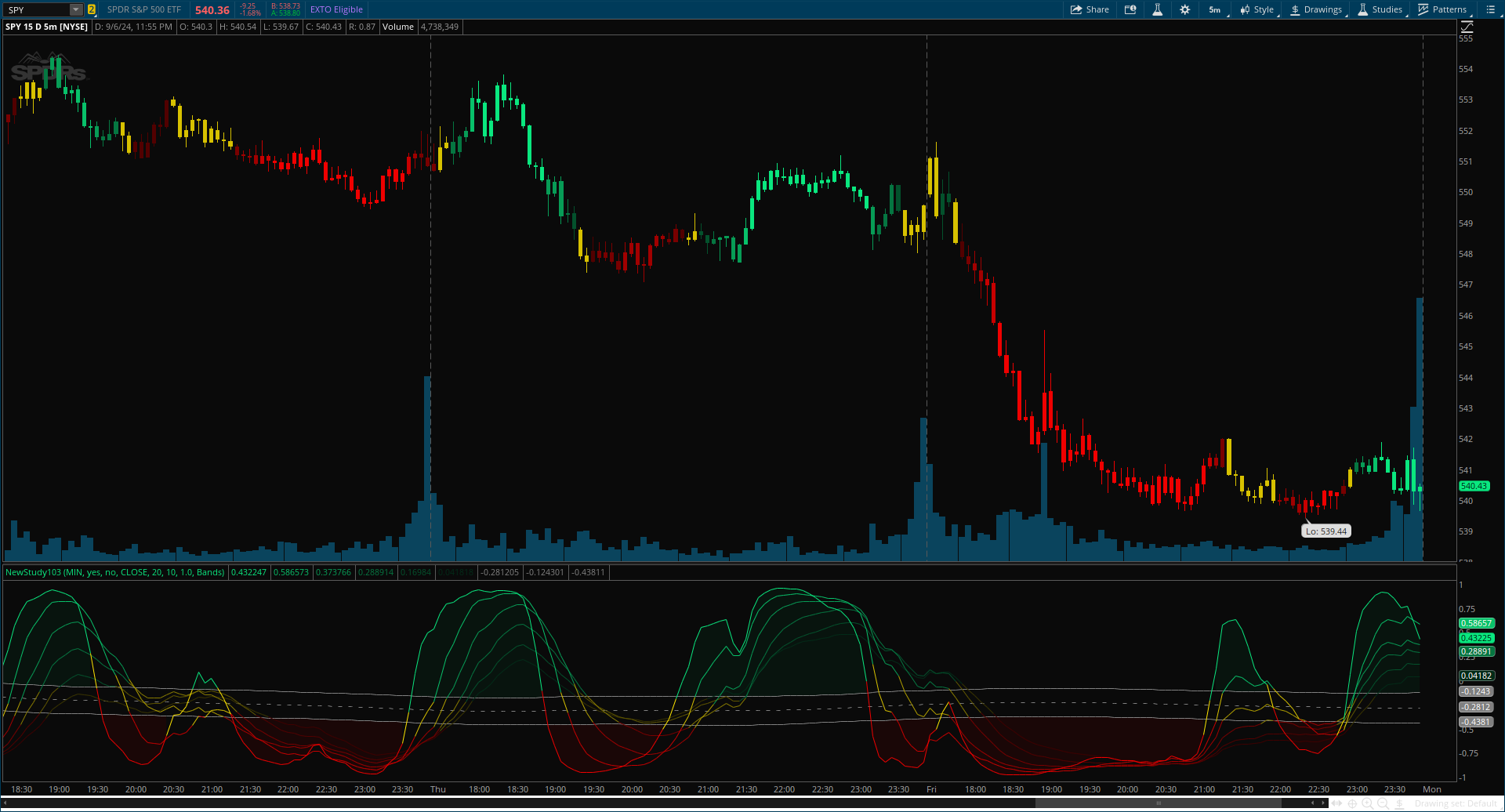

The Inverse Fisher Oscillator is a powerful tool for identifying market trends and potential reversal points by applying the Inverse Fisher Transform to normalized price data. This indicator plots multiple smoothed oscillators, each color-coded to signify their relation to dynamic volatility bands. Additionally, the Butterworth filter is incorporated to further refine trend signals.

CODE:

CSS:

#// Indicator for TOS

#// © BigBeluga

#indicator("Inverse Fisher Oscillator [BigBeluga]")

# Converted by Sam4Cok@Samer800 - 09/2024

declare lower;

input timeframe = AggregationPeriod.MIN;

input colorBars = yes;

input showLabel = no;

input source = FundamentalType.CLOSE;

input Length = 20; #, "Length") // Input for the length of the normalization period

input Smooth = 10; #, "Smooth") // Input for the smoothing period

input multi = 1.0; #, "Bands Multiplier") // Multiplier for the volatility bands

input MidLineType = {default "Bands", "Simple"}; # "Mid Line Type:"

def na = Double.NaN;

def last = IsNaN(close);

def current = GetAggregationPeriod();

def tf = Max(current, timeframe);

def src = Fundamental(FundamentalType = source, Period = tf);

#-- colors

DefineGlobalColor("band", Color.GRAY);

DefineGlobalColor("top1", CreateColor(10, 231, 127));

DefineGlobalColor("top2", CreateColor(8, 193, 106));

DefineGlobalColor("top3", CreateColor(7, 156, 86));

DefineGlobalColor("top4", CreateColor(5, 118, 65));

DefineGlobalColor("top5", CreateColor(3, 81, 44));

DefineGlobalColor("top6", CreateColor(2, 43, 24));

DefineGlobalColor("mid1", CreateColor(254, 228, 0));

DefineGlobalColor("mid2", CreateColor(215, 193, 0));

DefineGlobalColor("mid3", CreateColor(176, 158, 0));

DefineGlobalColor("mid4", CreateColor(136, 123, 0));

DefineGlobalColor("mid5", CreateColor(97, 87, 0));

DefineGlobalColor("mid6", CreateColor(58, 52, 0));

DefineGlobalColor("btm1", CreateColor(239, 0, 0));

DefineGlobalColor("btm2", CreateColor(200, 0, 0));

DefineGlobalColor("btm3", CreateColor(161, 0, 0));

DefineGlobalColor("btm4", CreateColor(121, 0, 0));

DefineGlobalColor("btm5", CreateColor(82, 0, 0));

DefineGlobalColor("btm6", CreateColor(62, 0, 0));

#// Method to calculate the inverse Fisher transform

script inverse_fisher {

input src = close;

input Length = 20;

input Smooth = 10;

def avg = Sum(src, Length) / Length;

def norm_price = (src - avg) / StDev(src, Length);

def smWMA = WMA(norm_price, Smooth);

def norm = (Exp(2 * smWMA) - 1) ;

def dnor = (Exp(2 * smWMA) + 1);

def inverse_fisher = norm / dnor;

plot out = inverse_fisher;

}

#// Calculate the inverse Fisher Oscillator for different smoothed price series

def ifish0 = inverse_fisher(src, Length, Smooth * 1);

def ifish1 = inverse_fisher(src, Length, Smooth * 2);

def ifish2 = inverse_fisher(src, Length, Smooth * 3);

def ifish3 = inverse_fisher(src, Length, Smooth * 4);

def ifish4 = inverse_fisher(src, Length, Smooth * 5);

def ifish5 = inverse_fisher(src, Length, Smooth * 6);

#// Calculate constants for the Butterworth filter

def pi = Double.Pi;

def mid_len = 500;

def piPrd = pi / mid_len;

def g = Sqrt(2);

def a1 = Exp(-g * piPrd);

def b1 = 2 * a1 * Cos(g * piPrd);

def coef2 = b1;

def coef3 = -a1 * a1;

def coef1 = (1 - b1 + a1 * a1) / 4;

#// Previous source and butter filter values

def butter;

#// Handle null values using the nz function

def avg = Sum(src, Length) / Length;

def norm_price = (src - avg) / StDev(src, Length);

def smWMA = WMA(norm_price, Smooth);

def prevB1 = if butter[1] then butter[1] else ifish0;

def prevB2 = if butter[2] then butter[2] else prevB1;

def srcB1 = if ifish0[1] then ifish0[1] else ifish0;

def srcB2 = if ifish0[2] then ifish0[2] else srcB1;

#// Calculate the Butterworth filter value

switch (MidLineType) {

case "Simple" :

butter = 0;

default :

butter = coef1 * (ifish0 + (2 * srcB1) + srcB2) + (coef2 * prevB1) + (coef3 * prevB2);

}

#// Calculate volatility as the SMA of the absolute difference between the current and previous inverse Fisher values

def volatility = Average(AbsValue(ifish0 - srcB2), 400) * multi;

#// Calculate upper and lower volatility bands

def upper_band = (volatility + butter) * (if butter == 0 then 0 else 1);

def lower_band = (butter - volatility) * (if butter == 0 then 0 else 1);

#// Assign colors to each inverse Fisher Oscillator based on its relation to the volatility bands

def color1 = if ifish0 > upper_band then 1 else if ifish0 < lower_band then -1 else 0;

def color2 = if ifish1 > upper_band then 1 else if ifish1 < lower_band then -1 else 0;

def color3 = if ifish2 > upper_band then 1 else if ifish2 < lower_band then -1 else 0;

def color4 = if ifish3 > upper_band then 1 else if ifish3 < lower_band then -1 else 0;

def color5 = if ifish4 > upper_band then 1 else if ifish4 < lower_band then -1 else 0;

def color6 = if ifish5 > upper_band then 1 else if ifish5 < lower_band then -1 else 0;

#// Plot the inverse Fisher Oscillator lines with corresponding colors

plot f1 = ifish0;

plot f2 = ifish1;

plot f3 = ifish2;

plot f4 = ifish3;

plot f5 = ifish4;

plot f6 = ifish5;

f1.AssignValueColor(if color1>0 then GlobalColor("top1") else

if color1<0 then GlobalColor("btm1") else GlobalColor("mid1"));

f2.AssignValueColor(if color2>0 then GlobalColor("top2") else

if color2<0 then GlobalColor("btm2") else GlobalColor("mid2"));

f3.AssignValueColor(if color3>0 then GlobalColor("top3") else

if color3<0 then GlobalColor("btm3") else GlobalColor("mid3"));

f4.AssignValueColor(if color4>0 then GlobalColor("top4") else

if color4<0 then GlobalColor("btm4") else GlobalColor("mid4"));

f5.AssignValueColor(if color5>0 then GlobalColor("top5") else

if color5<0 then GlobalColor("btm5") else GlobalColor("mid5"));

f6.AssignValueColor(if color6>0 then GlobalColor("top6") else

if color6<0 then GlobalColor("btm6") else GlobalColor("mid6"));

#// Plot the Butterworth filter and volatility bands

plot mid = if last then na else butter; # Plot the Butterworth filter

plot upBand = if upper_band then upper_band else na;

plot dnBand = if lower_band then lower_band else na;

mid.SetStyle(Curve.SHORT_DASH);

mid.SetDefaultColor(GlobalColor("band"));

upBand.SetDefaultColor(GlobalColor("band"));

dnBand.SetDefaultColor(GlobalColor("band"));

#-- Cloud

AddCloud(if ifish0>upper_band then ifish0 else na, upper_band, GlobalColor("top6"));

AddCloud(if ifish0<lower_band then lower_band else na, ifish0, GlobalColor("btm6"));

#-- color Bars

def col = color1 + color2 + color3 + color4 + color5 + color6;

AssignPriceColor(if !colorBars then Color.CURRENT else

if col > 5 then GlobalColor("top1") else

if col > 4 then GlobalColor("top2") else

if col > 3 then GlobalColor("top3") else

if col > 2 then GlobalColor("top4") else

if col > 1 then GlobalColor("top5") else

if col < -5 then GlobalColor("btm1") else

if col < -4 then GlobalColor("btm2") else

if col < -3 then GlobalColor("btm3") else

if col < -2 then GlobalColor("btm4") else

if col < -1 then GlobalColor("btm5") else GlobalColor("mid2"));

#-- LAbel

AddLabel(showLabel, "Trend Strength (" + AsPercent(col / 6) + ")",

if col > 5 then GlobalColor("top1") else

if col > 4 then GlobalColor("top2") else

if col > 3 then GlobalColor("top3") else

if col > 2 then GlobalColor("top4") else

if col > 1 then GlobalColor("top5") else

if col < -5 then GlobalColor("btm1") else

if col < -4 then GlobalColor("btm2") else

if col < -3 then GlobalColor("btm3") else

if col < -2 then GlobalColor("btm4") else

if col < -1 then GlobalColor("btm5") else GlobalColor("mid2"));

#-- END of CODE