oldyoungguy

Member

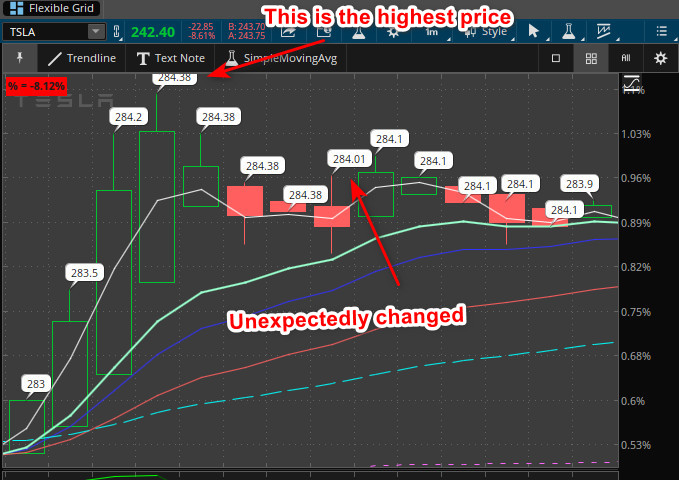

I am using Heikin Ashi bar chart. I am trying to record the highest price during a period. ThinkScript doesn't allow me to use the def variable to compare with other value. I cannot get it works correctly. Please help.

I expect all the bubbles on the right side should display the value of 284.38.

My code :

I expect all the bubbles on the right side should display the value of 284.38.

My code :

Code:

def emaLen9 = 9;

def emaLen3dot5 = 3.5;

def priceType = FundamentalType.CLOSE;

def averageType = AverageType.EXPONENTIAL;

def baseTF = GetAggregationPeriod();

def baseTF_mve9 = MovingAverage(averageType, Fundamental(priceType, period = baseTF), emaLen9);

def baseTF_mve3dot5 = MovingAverage(averageType, Fundamental(priceType, period = baseTF), emaLen3dot5);

def baseTF_O = open(period = baseTF);

def baseTF_h = high(period = baseTF);

def baseTF_l = low(period = baseTF);

def baseTF_c = close(period = baseTF);

def baseTF_HAclose = (baseTF_O + baseTF_h + baseTF_l + baseTF_c) / 4;

def baseTF_HAopen = CompoundValue(1, (baseTF_HAopen[1] + baseTF_HAclose[1]) / 2, baseTF_HAclose);

def baseTF_HAhigh = Max(Max(baseTF_h, baseTF_HAopen), baseTF_HAclose);

def baseTF_HAlow = Min(Min(baseTF_l, baseTF_HAopen), baseTF_HAclose);

def baseTF_isCrossedAbove = baseTF_mve3dot5 crosses above baseTF_mve9;

def baseTF_isCrossBelow = baseTF_mve3dot5 crosses below baseTF_mve9;

def baseTF_isCrossBelowBefore;

def baseTF_isCrossAboveBefore;

if(baseTF_isCrossBelow)

{

baseTF_isCrossBelowBefore = yes;

baseTF_isCrossAboveBefore = no;

}

else if(baseTF_isCrossedAbove)

{

baseTF_isCrossBelowBefore = no;

baseTF_isCrossAboveBefore = yes;

}

else

{

baseTF_isCrossBelowBefore = baseTF_isCrossBelowBefore[1];

baseTF_isCrossAboveBefore = baseTF_isCrossAboveBefore[1];

}

def rangeHighest ;

if(baseTF_isCrossAboveBefore)

{

#if(baseTF_HAhigh > rangeHighest ) #-- shold be like this, but thinkScript doesn't like this, syntex error

#if(baseTF_HAhigh > baseTF_HAhigh[1] && baseTF_HAhigh > rangeHighest ) #-- no syntex error but nothing show up

if(baseTF_HAhigh > baseTF_HAhigh[1]) #-- the result is NOT fully correct

{

rangeHighest = baseTF_HAhigh;

}

else

{

rangeHighest = rangeHighest[1];

}

}

else

{

rangeHighest = rangeHighest[1];

}

AddChartBubble(yes, high, rangeHighest , Color.WHITE, yes);