I have worked all day today to try to build upon the scans posted earlier to create one that will identify stocks whose 8 EMA is rising and is within 2% of crossing its 21 EMA from below, and vice versa. I took some code from before and came up with this:

def a = ExpAverage(close, 8);

def b = ExpAverage(close, 21);

def d = a - b;

plot p = (d / b) * 100;

input center_line = 0;

plot CenterLine = center_line;

input upper_line = .2;

plot UpperLine = upper_line;

input lower_line = -.2;

plot LowerLine = lower_line;

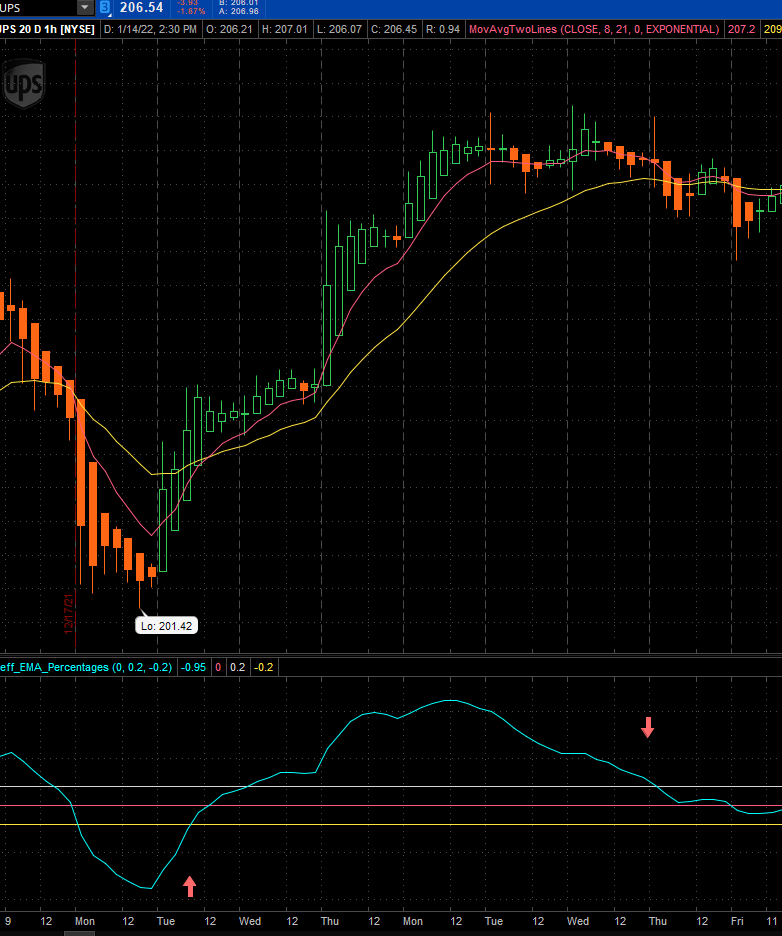

That generates this study, with arrows pointing at the points in the price action where I would like my scan to I.D. the stocks having that characteristic (in two separate scans, one going up and v.v.).

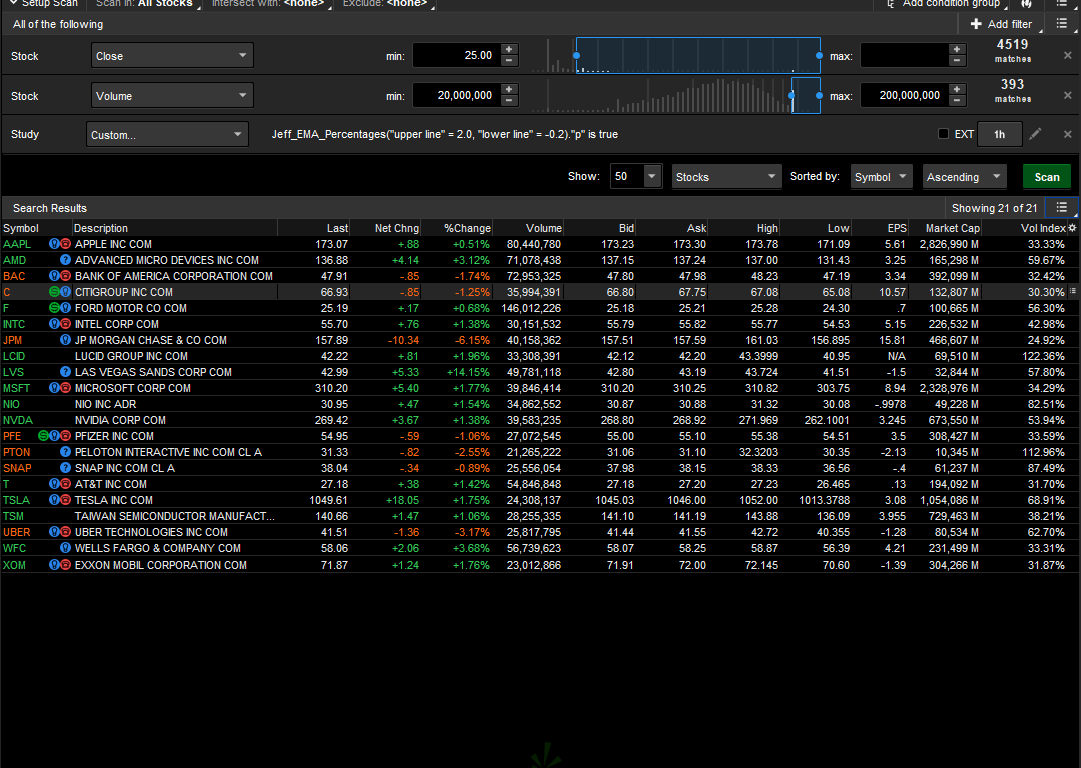

My intent is to get a jump on the time when the 8 EMA is about to cross the 21 EMA from either direction, depending on the scan I'm using. I just can't figure out after struggling for about six hours how to code it. Another way to describe it is I would like the scan to pick up on what stocks have the blue line crossing the yellow -2% line from below or the blue line crossing the white +2% line from above. The red line is where the 8 and the 21 cross. I put the study into a scan and got this, but I'm not sure if it is working how I want.

def a = ExpAverage(close, 8);

def b = ExpAverage(close, 21);

def d = a - b;

plot p = (d / b) * 100;

input center_line = 0;

plot CenterLine = center_line;

input upper_line = .2;

plot UpperLine = upper_line;

input lower_line = -.2;

plot LowerLine = lower_line;

That generates this study, with arrows pointing at the points in the price action where I would like my scan to I.D. the stocks having that characteristic (in two separate scans, one going up and v.v.).

My intent is to get a jump on the time when the 8 EMA is about to cross the 21 EMA from either direction, depending on the scan I'm using. I just can't figure out after struggling for about six hours how to code it. Another way to describe it is I would like the scan to pick up on what stocks have the blue line crossing the yellow -2% line from below or the blue line crossing the white +2% line from above. The red line is where the 8 and the 21 cross. I put the study into a scan and got this, but I'm not sure if it is working how I want.